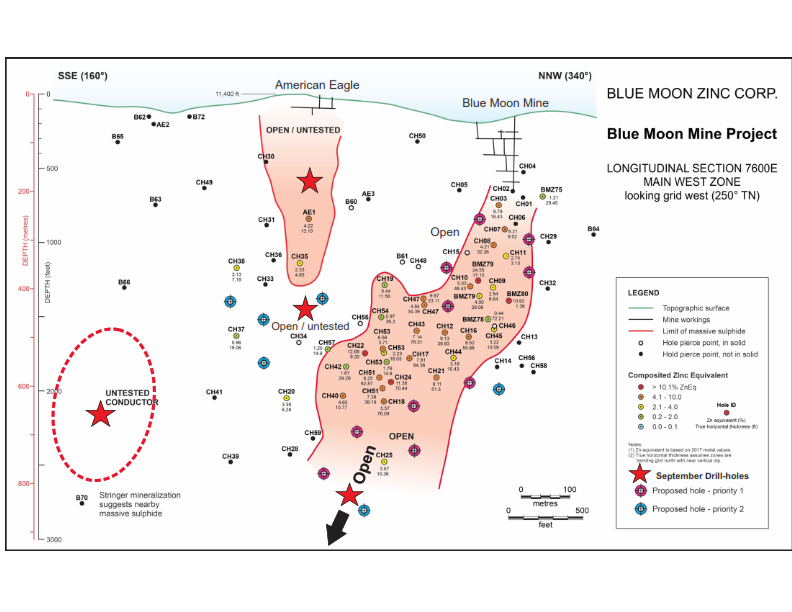

Blue Moon Metals Inc.(TSXV:MOON; OTCQB:BMOOF) (the " Company ") is pleased to announce the commencement of its drilling program to explore and expand the Blue Moon polymetallic volcanic massive sulphide ("VMS") deposit. The initial program consists of 3-4 step-out holes totalling up to 2,400 metres. The holes will test a number of high-impact targets shown on the below long section

Patrick McGrath, Chief Executive officer, stated, "We are excited to announce the resumption of drilling for resource expansion as well as high impact exploration targets in search of new VMS lenses. Since the successful program in early 2020, we have spent considerable resources reviewing the historical data and identified multiple exploration and development drilling opportunities as outlined below, all of which could dramatically change the upside potential size of the Blue Moon deposit. This is an exploration program our Company has been anxiously awaiting. It is well known that VMS deposits are found in clusters or pods and the potential to find additional massive sulphide lenses is very promising. Blue Moon has a 43-101 Inferred Mineral Resource dated November 14, 2018 consisting of 10 million ounces silver, 771 million pounds of zinc, 71 million pounds of copper, and 300,000 ounces of gold."

A comprehensive review of the historical and recent drill data identified several priority drill targets with potential for both new lenses and/or expansion of current lenses, including:

- The West and Main zones remain open down plunge;

- An off hole electromagnetic (EM) conductor to the south of the deposit lies above a long interval of stringer mineralization cut in hole B70 that is interpreted to be a feeder zone to a nearby massive sulphide lens. The EM target remains untested and may be caused by the massive sulphide lens suggested by the stringer mineralization in hole B70;

- The area between the American Eagle workings and hole AE1 remains untested with potential to add near surface mineralization; and

- The down plunge extension of the American Eagle mineralization also remains largely untested.

Blue Moon Long Section

About Blue Moon Metals

Blue Moon Metals (TSX.V: MOON; OTCQB: BMOOF) is currently advancing its Blue Moon polymetallic deposit which contains zinc, gold, silver and copper. The property is well located with existing local infrastructures including paved highways three miles from site; a hydroelectric power generation facility a few miles from site, three-hour drive to the Oakland port and a four-hour drive to service centre of Reno. The deposit is open at depth and along strike. The Blue Moon 43-101 Mineral Resource includes 7.8 million inferred tons at 8.07% zinc equivalent (4.95% zinc, 0.04 oz/t gold, 0.46% copper, 1.33 oz/t silver), containing 771 million pounds of zinc, 300,000 ounces of gold, 71 million pounds of copper, and 10 million ounces of silver. The 43-101 Mineral Resource report dated November 14, 2018 was authored by Gary Giroux, P. Eng., and Lawrence O'Connor, a QP, and entitled "Resource Estimate for the Blue Moon Massive Sulphide Occurrence". The 43-101 and related press release with details on the resource are available on the company's website and were filed on www.sedar.com on November 20, 2018. The Company also holds 100% of the Yava polymetallic project in Nunavut that is in the same volcanic lithologies and south of Glencore's Hackett River deposit. More information is available on the company's website ( www.bluemoonmetals.com ).

Qualified Persons

John McClintock, P. Eng, a Director of the Company, is a qualified person as defined by NI 43-101, has reviewed the scientific and technical information that forms the basis for this press release.

For more information please contact:

Patrick McGrath, CEO

+1-832-499-6009

pmcgrath@bluemoonmining.com

Investor Contact:

Kevin Shum

Investor Relations

+1-647-725-3888 ext702

kevin@jeminicapital.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Resource estimates included in this news release are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions set forth in the relevant technical report and otherwise, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices for commodities, the results of future exploration, uncertainties related to the ability to obtain necessary permits, licenses and titles, changes in government policies regarding mining, continued availability of capital and financing, drilling results and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Readers are cautioned not to place undue reliance on this forward-looking information, which is given as of the date it is expressed in this press release, and the Company undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

SOURCE: Blue Moon Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/663152/Blue-Moon-Metals-Announces-Commencement-of-Drilling-and-Exploration-Targets