Canada Nickel Company Inc. ("Canada Nickel" or the "Company") (TSXV: CNC) (OTCQB: CNIKF), has filed a Preliminary Economic Assessment ("PEA") for its wholly-owned Crawford Nickel Sulphide Project ("Crawford") located in Timmins, Ontario, Canada . The PEA is available on www.sedar.com and on www.canadanickel.com .

The PEA, titled "Crawford Nickel Sulphide Project NI 43-101 Technical Report and Preliminary Economic Assessment" was independently prepared by Ausenco Engineering Canada Inc., in accordance with National Instrument 43-101 ("NI 43-101"), as previously announced in a news release dated May 25, 2021 . Canada Nickel is advancing the project to a feasibility study, which is expected to be completed by mid-2022.

Highlights of the PEA

The PEA indicates a 25-year mine plan based on a phased 120,000 tonnes per day open pit mine and processing operation using conventional nickel sulphide concentrator, producing nickel concentrates and magnetite concentrate.

Over the 25-year mine life Crawford is expected to produce 842,000 tonnes of nickel, 21 million tonnes of iron and 1.5 million tonnes of chrome valued at $24 billion using long-term price assumptions. Annual average nickel production of 75 million pounds (34,000 tonnes) with peak period annual average of 93 million pounds (42,000 tonnes), with significant iron and chrome by-products of 860,000 tonnes per annum and 59,000 tonnes per annum, respectively.

- After-tax, $1.2 billion NPV 8% and 16% IRR at long-term price assumptions (Note 1)

- Large scale, low cost, long-life

- Significant iron and chrome by-products of 860,000 tonnes per annum and 59,000 tonnes per annum, respectively

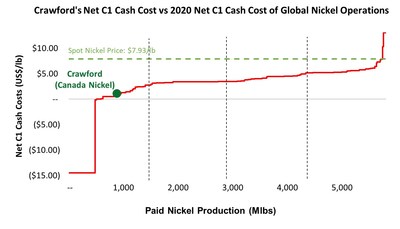

- Life-of-mine net C1 cash cost of $1.09 /lb and net AISC of $1.94 /lb on a by-product basis (1st quartile) (Notes 2 and 3)

- Life-of-mine production of 25 years with 842,000 tonnes of nickel, 21 million tonnes of iron and 1.5 million tonnes of chrome valued at $24 billion using long-term price assumptions (Note 1)

- Significant earnings and free cash flow generation. Annual EBITDA of $439 million and annual free cash flow of $274 million (Notes 1 and 3)

- Minimization of carbon footprint through use of autonomous trolley trucks and electric shovels, which reduces diesel use by 40%. Optimization of the carbon sequestration potential of tailings and waste rock.

Notes and Assumptions

- All dollar figures are in United States ("US") dollars. US metal prices used in the PEA were $7.75 /lb nickel, $1.04 /lb chromium, and $290 /tonne iron. A US dollar exchange rate of 0.75 was applied.

- Source for 1 st quartile costs – Wood Mackenzie and S&P Capital IQ; Priced as of May 20, 2021 .

- C1 cash cost, AISC, EBITDA and cash flow data are non-IFRS measures. Refer to Non-IFRS measures .

- A full copy of the Technical Report and PEA, including material assumptions, notices and cautions, can be found on the Company's profile at www.sedar.com .

Considering the positive outcome of the PEA, the Company is advancing the Crawford Project through additional studies including exploration programs aimed at in-fill drilling to upgrade current resources to the measured category; additional metallurgical studies and a feasibility study.

The PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the results of the PEA will be realized.

Qualified Person and Data Verification

Stephen J. Balch P.Geo . (ON), VP Exploration of Canada Nickel and a "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero Nickel TM , NetZero Cobalt TM , NetZero Iron TM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel Sulphide Project in the heart of the prolific Timmins - Cochrane mining camp. For more information, please visit www.canadanickel.com .

Non-IFRS Measures

The Company has included certain non-IFRS measures in this press release. The Company believes that these measures provide investors an improved ability to evaluate the underlying performance of the project. The non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

Net C1 cash costs are the sum of operating costs (including all expenses related to stripping), net of by-product credits from chromium and iron ore per pound of payable nickel. Net AISC (all in sustaining costs) are C1 cash costs plus royalties plus sustaining capital per pound of payable nickel.

EBITDA is earnings before interest, taxes and depreciation, which comprise net smelter returns less royalties and operating costs and for the purpose of the economic analysis assume all stripping costs are expensed. Free cash flow represents operating cash flow less capital expenditures.

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, the results of Crawford's PEA, including statements relating to net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs, timing for permitting and environmental assessments, realization of mineral resource estimates, capital and operating cost estimates, project and life of mine estimates, ability to obtain permitting by the time targeted, size and ranking of project upon achieving production, economic return estimates, the timing and amount of estimated future production and capital, operating and exploration expenditures and potential upside and alternatives. Readers should not place undue reliance on forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Canada Nickel to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The PEA results are estimates only and are based on a number of assumptions, any of which, if incorrect, could materially change the projected outcome. There are no assurances that Crawford will be placed into production. Factors that could affect the outcome include, among others: the actual results of development activities; project delays; inability to raise the funds necessary to complete development; general business, economic, competitive, political and social uncertainties; future prices of metals or project costs could differ substantially and make any commercialization uneconomic; availability of alternative nickel sources or substitutes; actual nickel recovery; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; accidents, labour disputes, the availability and productivity of skilled labour and other risks of the mining industry; political instability, terrorism, insurrection or war; delays in obtaining governmental approvals, necessary permitting or in the completion of development or construction activities; mineral resource estimates relating to Crawford could prove to be inaccurate for any reason whatsoever; additional but currently unforeseen work may be required to advance to the feasibility stage; and even if Crawford goes into production, there is no assurance that operations will be profitable.

Although Canada Nickel has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Canada Nickel disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-files-preliminary-economic-assessment-for-crawford-nickel-sulphide-project-301331409.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-files-preliminary-economic-assessment-for-crawford-nickel-sulphide-project-301331409.html

SOURCE Canada Nickel Company Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/July2021/12/c3207.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/July2021/12/c3207.html