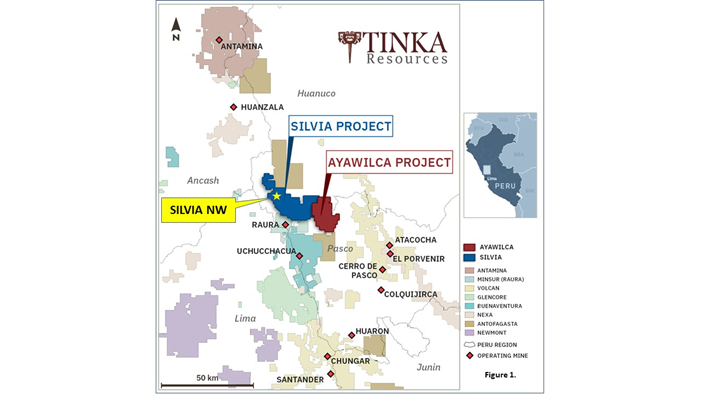

Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTCQB:TKRFF) is pleased to announce high-grade gold and copper trench results from Silvia NW, one of several prospective targets at the Company's 100%-owned Silvia Project located 30 km from the Company's flagship Ayawilca zinc-silver project. Tinka owns 460 km2 of contiguous mining concessions in the prolific mining region of central Peru - Figure 1

HIGHLIGHTS:

- New trench results: 46 metres at 1.9 g/t gold & 0.8% copper (2.2% CuEQ or 2.9 g/t AuEQ), including

- 6 metres at 12.8 g/t gold & 2.7% copper (12.3% CuEQ or 16.4 g/t AuEQ), including

- 2 metres at 22.5 g/t gold & 2.5% copper (19.4% CuEQ or 25.8 g/t AuEQ);

- Mineralization associated with chalcopyrite-bearing skarn, open in all directions beneath shallow scree cover;

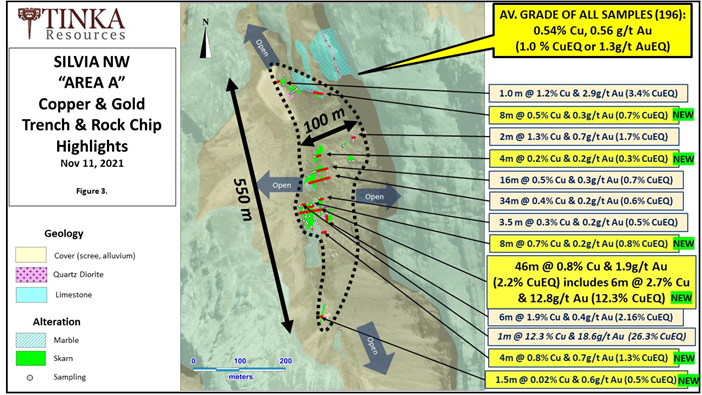

- Strike length of the skarn now extended to 550 m (N-S), up to 100 m wide (E-W);

- Gold-copper mineralization is hosted by garnet-magnetite skarn associated with dikes of quartz feldspar porphyry (QFP) intruding limestone - there is a strong positive correlation between copper and gold;

- 550 m x 100 m area at Area A -

- Average grade of all 196 rock samples: 0.5% copper & 0.6 g/t gold (1.0 % CuEQ* or 1.3 g/t AuEQ);

- Copper ranges between 0.01% to 12.3% Cu, and gold ranges between 0.01 g/t to 22.5 g/t Au;

- Rock samples are representative, non-selective, continuous trench or rock chip samples (each 1-2m in width) of various rock types including skarn, QFP and limestone;

- Exploration is continuing at Areas A and B along the 3 km prospective trend at Silvia NW - Figure 2.

* Copper Equivalent (CuEQ) is calculated assuming 100% recovery of copper and gold using a Gold Conversion Factor of 0.751, calculated from a nominal copper price of US$3.30/lb and a gold price of US$1,700/oz. Gold Equivalent (AuEQ) is calculated assuming 100% recovery of copper and gold using a Copper Conversion Factor of 1.33.

Dr. Graham Carman, Tinka's President and CEO, stated: "The new trench sampling results from Silvia NW highlight the exciting potential of the high-grade gold and copper skarn discovery at Sylvia NW, first reported in our news release on October 7, 2021. These latest results are some of the highest gold-copper grades in outcrop from a grassroots project in Peru reported in recent times. The Silvia NW area has not been previously drilled or systematically explored before."

"The surface footprint of the high-grade copper-gold skarn has been extended a further 150 metres to the south, now covering an overall strike length of 550 metres. We believe the mineralization at Area A could extend over a larger area under shallow cover. Further trenching and soil sampling is planned to confirm this."

"The Silvia copper-gold project is a great addition to our exploration portfolio in central Peru, and provides excellent synergies with our flagship Ayawilca zinc-silver project which lies immediately adjacent. At Ayawilca, we recently announced a PEA for the Zinc Zone deposit, which highlights the potential for Ayawilca to become a Top-10 global zinc producer. The project has strong economics as well as significant upside for further expansion and optimization (PEA news release dated October 14, 2021). We plan to continue to advance Ayawilca into 2022, while at the same time carry on with aggressive exploration programs over the coming weeks at our gold-copper skarn zone at Silvia and advancing permitting for an eventual drill program."

Geology and Sampling Results at Silvia NW

Tinka's exploration activities have been focused on the mapping and sampling of copper-gold skarn at Area A (Figure 2), which exposes the deepest portion of the exposed skarn system along the 3 km trend at Silvia NW. Skarns are hosted either by limestone ("exoskarn") or in QFP intrusions ("endoskarn") and consist of green garnet, magnetite, diopside, chlorite accompanied by sulphides consisting mostly of chalcopyrite and pyrite.

Cretaceous-age Jumasha Formation is the host of the copper-gold mineralization. Jumasha Formation is a thick (> 2km) sequence of platform limestones forming a major part of the fold and thrust belt in central Peru, and is host to several large skarn deposits (including Antamina). Quartz feldspar porphyry (QFP) intrusive dikes are common, and orientated either northeast-southwest or north-south.

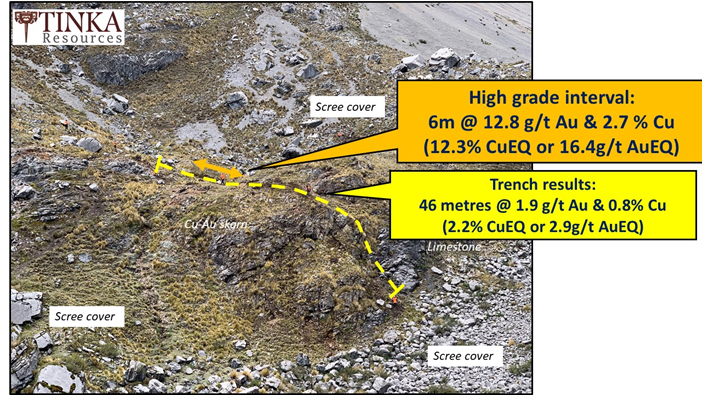

Figure 4 shows the location of the high-grade copper-gold trench sample location (6 m @ 12.8 g/t Au and 2.7% Cu).

Copper in the skarn occurs predominantly as chalcopyrite, with minor chalcocite and covellite (and copper oxides). At Area A, skarn occurs over an apparently continuous area of approximately 550 metres x 100 metres (Figure 3). There is widespread scree cover in-between outcrops of skarn. Tinka geologists believes that the skarn mineralization could continue over a larger area underneath the scree.

Table 1 highlights the new copper-gold trench sampling results. Table 2 summarizes all surface rock samples by type.

Table 1. New surface sampling results from Area A in this release

Sample type | No. of Samples | Length m | Cu% | Au g/t | **CuEQ% | **AuEQ g/t | As ppm | Zn% |

| Trench | 23 | 46.0 | 0.8 | 1.9 | 2.2 | 2.9 | 240 | 0.4 |

incl. | 3 | 6.0 | 2.7 | 12.8 | 12.3 | 16.4 | 1345 | 1.3 |

incl. | 1 | 2 | 2.5 | 22.5 | 19.4 | 25.8 | 288 | 0.6 |

| Trench | 4 | 8.0 | 0.7 | 0.2 | 0.8 | 1.1 | 64 | 0.1 |

| Trench | 2 | 4.0 | 0.8 | 0.7 | 1.3 | 1.8 | 118 | 0.3 |

| Trench | 2 | 4.0 | 0.2 | 0.2 | 0.3 | 0.5 | 92 | 0.2 |

| Trench | 4 | 8.0 | 0.5 | 0.3 | 0.7 | 0.9 | 42 | 0.4 |

| Chip* | 1 | 1.5 | 0.02 | 0.64 | 0.5 | 0.7 | 640 | 0.2 |

Table 2. All rock samples from Area A, by rock type

| Zone A - Rock type | No. of Samples | Cu% | Au g/t | **CuEQ% | **AuEQ g/t | As ppm | Zn% | |

| Endo Skarn | 96 | 0.9 | 1.0 | 1.6 | 2.2 | 118 | 0.5 | |

| Exo Skarn | 35 | 0.6 | 0.4 | 0.9 | 1.2 | 83 | 1.0 | |

| Limestone | 26 | 0.0 | 0.0 | 0.0 | 0.0 | 14 | 0.1 | |

| QFP intrusive | 39 | 0.0 | 0.0 | 0.0 | 0.0 | 17 | 0.0 | |

| Average values | 196 | 0.5 | 0.6 | 1.0 | 1.0 | 66 | 0.7 | |

** Copper Equivalent (CuEQ) is calculated assuming 100% recovery of copper and gold using a Gold Conversion Factor of 0.751, calculated from a nominal copper price of US$3.30/lb and a gold price of US$1,700/oz. Gold Equivalent (AuEQ) is calculated assuming 100% recovery of copper and gold using a Copper Conversion Factor of 1.33.

* 100 m south extension, continuous chip sample

Figure 1 - Location of Silvia NW and Ayawilca Projects in central Peru

Figure 2 - Simplified geological map of Silvia NW Areas A, B & C

Figure 3 - Highlights of copper-gold trenching and rock chip results at Area A

Figure 4 - Outcrops of high grade copper-gold skarn and trenching at Area A - viewing southeast

Notes on sampling and assaying

Trenches were dug up to a depth of 1 metre, where possible, across areas of outcrop (partially weathered) to test the grade of skarn and adjacent limestones and intrusions. Trench samples are continuous samples collected with hammer and chisel over 1 to 2 metre intervals. In areas of sporadic outcrop, samples are taken as semi-continuous rock chips. Tinka believes that the samples are representative of the outcrop and non-selective. Samples were bagged and labelled in the field. Samples were sent to Certimin laboratory in Lima where samples were dried, crushed to 90% passing 2mm, then 1 kg pulverized to 85% passing 75 microns. Gold was analysed by fire assay on 30 g (method G0108) and multi-element analysis by ICP using multi-acid digestion (method G0176). Gold assays above 10 g/t Au were re-assayed by a high grade fire assay method and a gravimetric finish (method G0014). Copper assays over 1% Cu were re-assayed by atomic absorption (method G0039). Standards and blanks were not inserted by Tinka but were inserted at the laboratory.

The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

On behalf of the Board,

"Graham Carman"

Dr. Graham Carman, President & CEO

Further Information:

www.tinkaresources.com

Mariana Bermudez 1.604.685.9316

info@tinkaresources.com

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru. The Zinc Zone deposit has an estimated Indicated Mineral Resource of 19.0 Mt @ 7.15% Zn, 16.8 g/t Ag & 0.2% Pb and Inferred Mineral Resource of 47.9 Mt @ 5.4% Zn, 20.0 g/t Ag & 0.4% Pb (dated August 30, 2021 - see news release). The Ayawilca Tin Zone has an estimated Inferred Mineral Resource of 8.4 Mt grading 1.02% Sn. Tinka holds 46,000 hectares of mining claims in central Peru, one of the largest holders of mining claims in the belt. Tinka is actively exploring for copper-gold skarn mineral deposits at its 100%-owned Silvia project.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/672050/Tinka-Samples-6-Metres-128-GramsTonne-Gold-and-27-Copper-at-Silvia