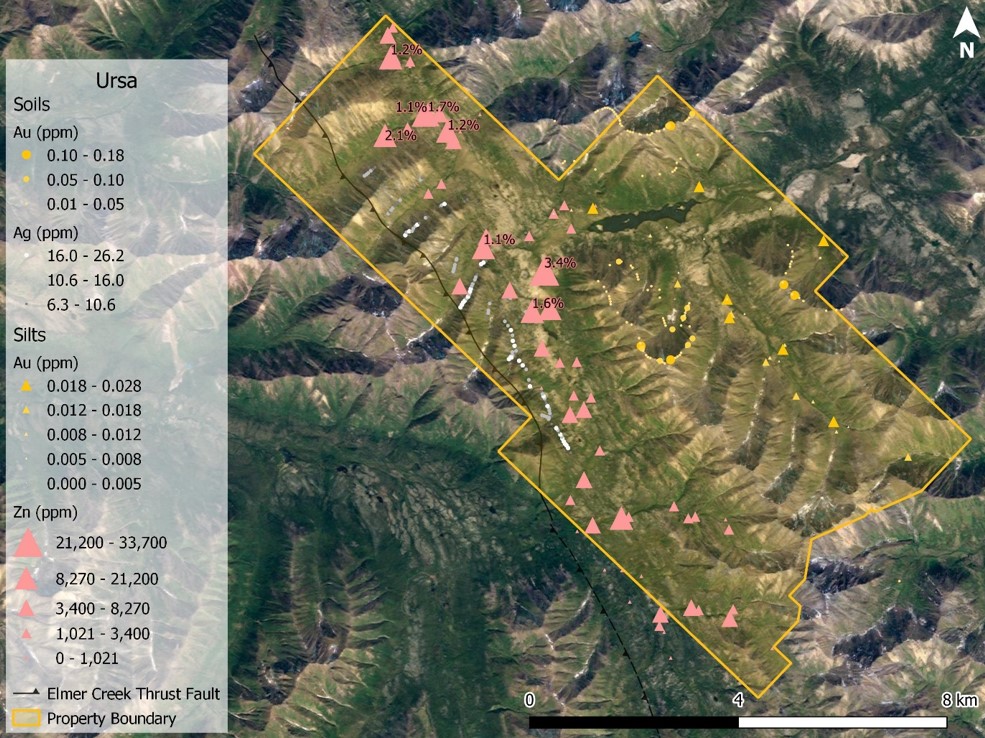

- 9 kilometre trend of elevated to anomalous gold geochemistry associated with pyrite in black shales

- Geologic setting analogous to Sukhoi Log (67 Moz Au) gold deposit

- Separate, 14 kilometre multi-element silver and base metal trend with stream sediments to 3.4% Zn

Snowline Gold Corp. (CSE:SGD)(OTC PINK:SNWGF) (the "Company" or "Snowline") is pleased to introduce its 100% owned, 7,755 hectare Ursa gold and base metals project in the Selwyn Basin, Yukon Territory. Ursa covers two distinct geochemical trends: a 9 km trend of elevated to anomalous gold in stream sediment and soil samples, and a roughly parallel 14 km trend of elevated to highly anomalous zinc accompanied by elevated silver, copper, molybdenum, nickel and vanadium. The Selwyn Basin is home to world-class base metal districts such as Howard's Pass (423 Mt @ 4.8% Zn, 1.6% Pb1) and the Anvil district (120 Mt @ 5.6% Zn, 3.7% Pb, 45 gt Ag2), both in similar stratigraphy to that of Ursa, and it is an important host to several types of gold deposit

"Ursa adds a new dimension to Snowline's exploration story," said Scott Berdahl, Director and Chief Operating Officer at Snowline Gold. "The project covers two unique new target types in our prospective corner of the Selwyn Basin, each demonstrating a very large-scale mineralizing system. Although they are early stage, the proximity of Ursa to our flagship Rogue and Einarson exploration programs affords us an opportunity to efficiently test the potential of these big, blue-sky concepts."

Gold Target

The east side of the Ursa property covers a 9-kilometer trend of elevated gold in stream sediments and soils in a sequence of heavily folded carbonaceous black shales and cherts. Gold was discovered in black shale hosted pyrite nodules by a previous operator searching for Carlin-style targets. No major carbonate units were encountered, but subsequent analysis of field data by Snowline's technical team determined that Ursa's geological setting is similar to Russia's Sukhoi Log deposit (67 Moz Au at 1.9 g/t3), in which gold is hosted in pyritic nodules and masses. The carbonaceous, passive margin shales in both areas have been compressed into a tight anticlinorium and later intruded in their vicinities by felsic plutons. At Ursa, these plutons are members of the Tombstone plutonic suite that drive the intrusion-related gold targets at Rogue. There has been very little, if any, previous exploration for this deposit type in the Selwyn Basin.

Base Metal Target

The west side of the Ursa property covers a 14-kilometer trend of elevated to highly anomalous zinc, silver, copper, molybdenum, nickel and vanadium thought to be associated with Devonian age enriched black shales. Of 45 historic stream sediment samples draining the length of the trend, 44 returned concentrations exceeding 0.1% Zn, with 8 of these samples exceeding 1% Zn to a maximum of 3.4% Zn. Concentrations of up to 0.48% Ni, up to 0.18% Cu and up to 118.5 ppm Mo were also returned by this stream sediment sampling along the trend. Historic, first-pass contour soil sampling along a subsection of the trend revealed a zone 500 m to 1,500 m wide along the length of the 6.7-kilometer subsection wherein soils consistently exceed 5 g/t Ag. A 2.7 kilometer-long, 43-sample contour soil line within this subsection had a median concentration of 14.8 g/t (0.43 oz/ton) silver.

2021 Exploration

Ursa's proximity to Snowline's flagship Rogue and Einarson projects allows for efficent exploration during the 2021 field season. Geochemical sampling, prospecting and mapping are planned to better understand the sources of the gold and base metal anomalies. Based on these results, geophysical surveying, surface trenching and initial drill testing may be conducted later in the season.

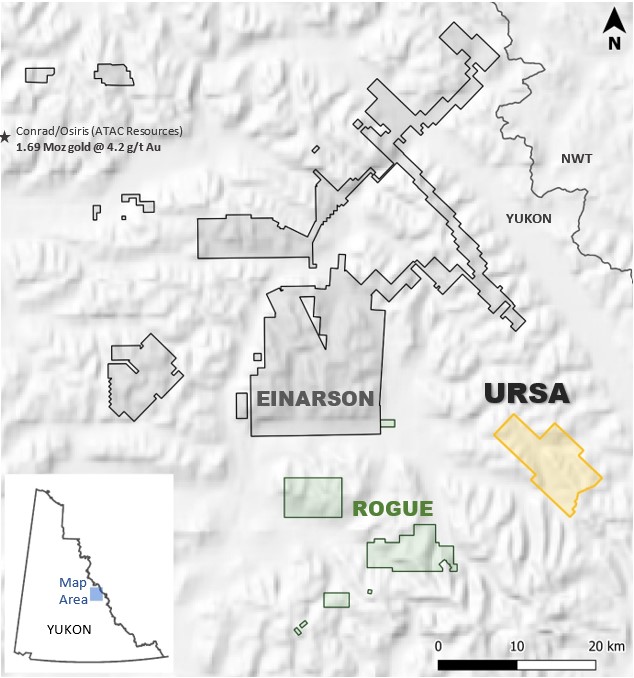

Figure 1: The 100%-owned Ursa project covers roughly 7,755 hectares in the Selwyn Basin and is within 20 kilometers of exploration targets on Snowline's adjacent Rogue and Einarson properties.

Figure 2: The northeast half of the Ursa project covers a broad zone of elevated to anomalous gold in historic stream sediment samples (gold triangles) and soil samples (gold circles) following a tightly folded anticlinorium along 9 km. The southwest half of Ursa covers a pronounced multi-element silver and base metal anomaly in a synclinorium in the footwall of the regional Elmer Creek thrust fault across 14 km. Zinc concentrations in historic stream sediments (pink triangles) consistently exceed 0.1% Zn along the trend, with 8 sites exceeding 1% Zn to a maximum of 3.4% Zn. Historic, first pass soil sampling confirmed the multi-element anomaly and returned silver concentrations (white/grey circles) commonly in excess of 5 g/t Ag, to a maximum of 26 g/t Ag, along nearly 7 km of the trend and across a 500 m to 1,500 m width. Historic data in the figure are partitioned to show gold values in the northeast and zinc/silver values in the southwest.

1 Source: Yukon Minfile 105I 068, combined indicated and inferred global resource.

2 Source: Porter Geoscience Database Faro - Anvil, Vangorda, Grum, DY, Swim, combined global resource based on figures from relevant Yukon Minfiles.

3 Source: Polyus website, measured, indicated and inferred resources for Sukhoi Log.

Resource figures presented are based on publicly available information and have not been verified by Snowline. They should not be interpreted as direct evidence that similar deposits exist on the Ursa property.

Qualified Person

Information in this release has been reviewed and approved by Scott Berdahl, P. Geo., Chief Operating Officer of Snowline and a Qualified Person for the purpose of NI 43-101. Berdahl oversaw soil sampling on the western side of the current Ursa property in 2013 and conducted a small prospecting program on the eastern side in 2008 which identified gold-bearing pyrite nodules. While he has not directly verified additional geochemical results, they appear to have been collected following industry best practices and are thus likely reliable as a general indicator of geochemical anomalism for early-stage exploration.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a 7-project portfolio covering over 90,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the prospective yet underexplored Selwyn Basin, with drilling expected to commence in mid-2021. Snowline's projects all lie in the prolific Tintina Gold Province that hosts multiple million-ounce-plus gold mines and deposits, from Kinross' Fort Knox mine to Newmont's Coffee deposit. Snowline's first mover claim position represents a unique opportunity to explore and expand a new greenfield, district-scale gold system.

ON BEHALF OF THE BOARD

Nikolas Matysek, B.Sc. (Geol)

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1-778-228-3020

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/647122/Snowline-Gold-Introduces-100-Owned-Ursa-Gold-Silver-and-Base-Metals-Project