- Acquisition of five claim blocks from arm's length vendors increases Snowline's targeted Yukon Territory land position by 18%

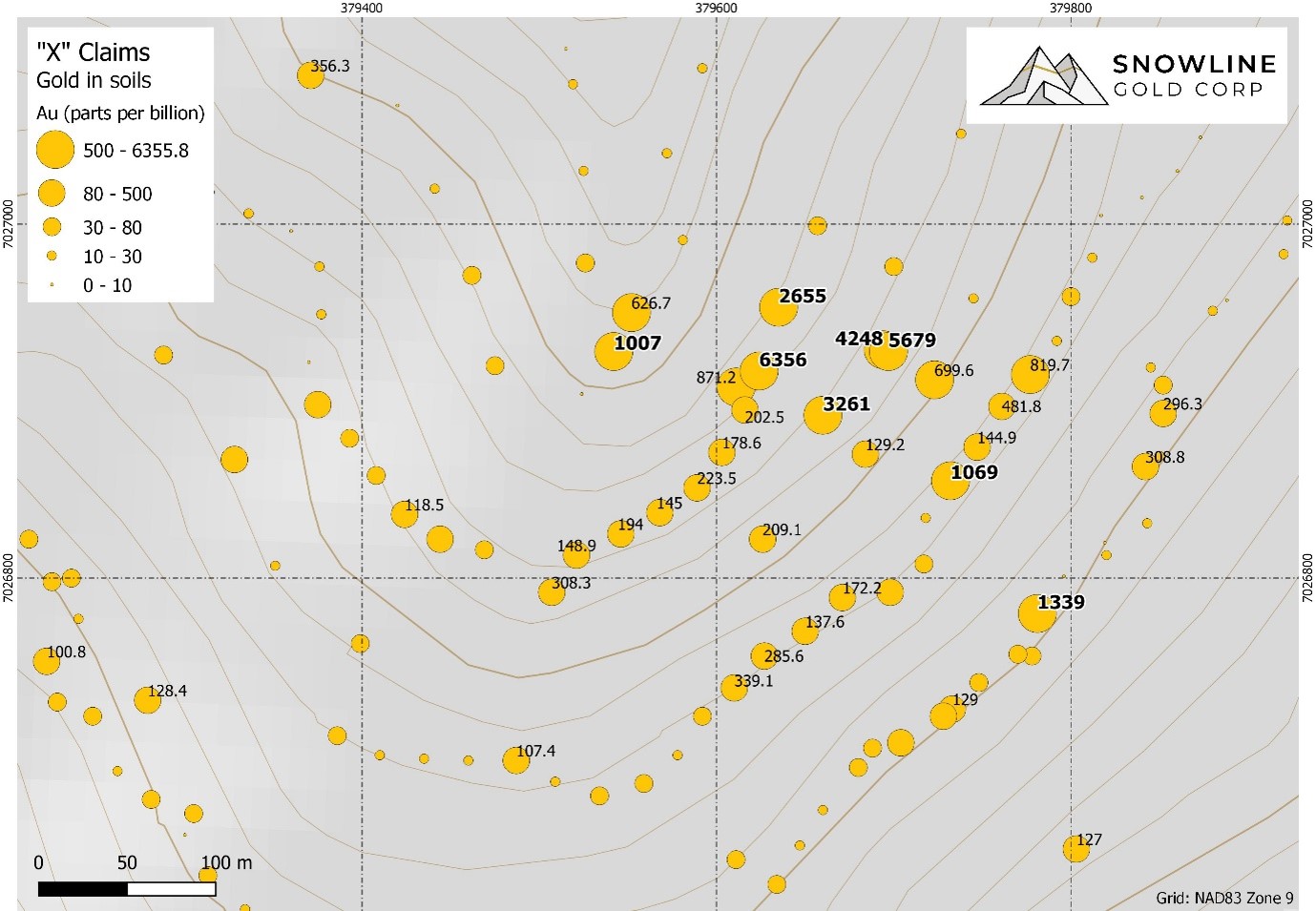

- Extensive historical dataset includes a 350 x 200 m zone of highly anomalous gold in soils with eight soil samples >1 g/t Au, up to 6.4 g/t Au, within a broader 3.5 x 1.0 km gold-in-soil trend

- New land position triples coverage of Snowline's "Ursa" trend to > 30 km of prospective strike length.

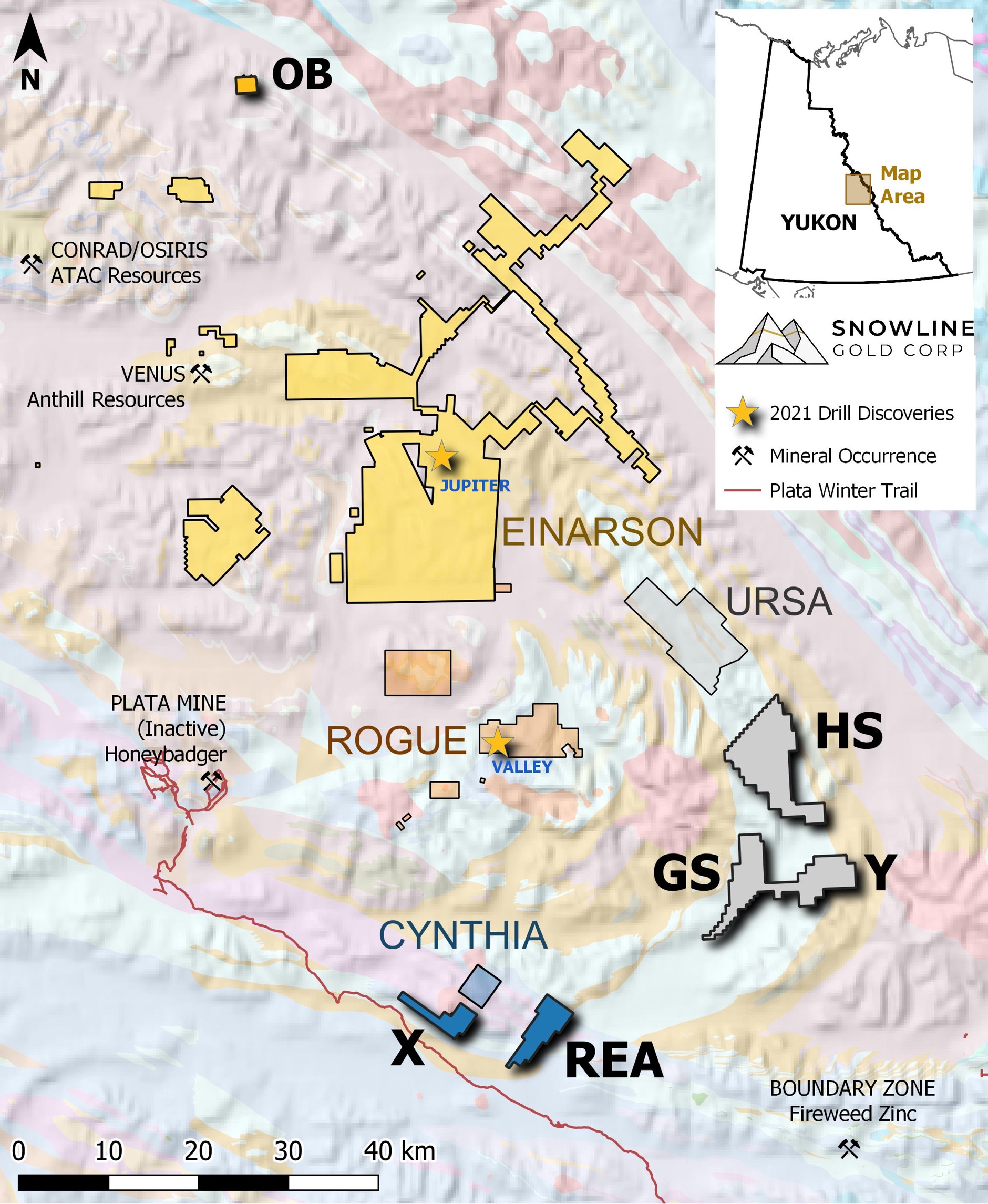

Snowline Gold Corp. (CSE:SGD) (OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce that it has entered into a property option agreement with Epica Gold Inc. and Carlin Gold Corporation (together the "Optionors") dated September 9, 2021 (the "Agreement"), pursuant to which the Company has acquired the option (the "Option") to purchase a 100% interest in 812 mining claims in five blocks collectively covering approximately 16,500 hectares (the "Properties"). The Properties are located in the Mayo mining district, Yukon Territory, where they supplement Snowline's existing claim position across a regional geological feature considered by the company to be highly prospective for gold and base metal mineralization. Snowline's mineral holdings now comprise some 106,500 hectares and are focused within the Selwyn Basin

Under the terms of the Agreement, Snowline can acquire the Properties in exchange for payments to the Optionors of $100,000, ($50,000 on signing and $50,000 on the first anniversary), and issuing 1,000,000 common shares to the Optionors, (500,000 common shares issued on signing and 500,000 on the first anniversary). All payments made by the company are divided 50/50 amongst the Optionors. The agreement is subject to a 2% net smelter returns royalty, with a 1% buy-back provision for $2,000,000.

All securities issued pursuant to the Agreement will be subject to a four‐month and one day hold period in accordance with applicable Canadian securities laws.

"This claim package has been on Snowline's radar from a long time," said Scott Berdahl, CEO and Director of Snowline. "With our promising results this season, we are excited to further solidify our cornerstone position in an area with demonstrated and increasing potential to become a significant new gold and base metals district. Each acquired property bolsters an existing Snowline project. We further benefit from the previous operators' extensive geochemical work, which identified multiple promising targets for follow-up. As with our Jupiter zone at Einarson and Valley zone at Rogue, this option provides Snowline and its shareholders low-cost entry to high-quality targets at the drill discovery stage."

THE "X" & "REA" BLOCKS - CYNTHIA

The X claims lie within 1 km of the southern boundary of Snowline's Cynthia project, south of Rogue and Einarson. Historical soil sampling conducted by the previous operator on the X claims revealed multiple gold-in-soil anomalies, including a 3.5 x 1.0 km area with generally elevated (>10 ppb Au) to highly anomalous (up to 6,355 ppb Au) gold in soils. Within this area is a 300 x 250 m zone of consistently anomalous soils, with 8 of 52 soil samples assaying above 1,000 ppb (1 g/t) Au (Figure 2). These anomalies are hosted in deformed Devonian age black shales intruded by a Mayo suite Cretaceous intrusion nearby, making for what the Company believes to be a highly prospective environment for several styles of gold deposit. Additional high gold values were encountered in historical soil sampling along strike, some 4 km from the anomaly.

Figure 1 - Map of the newly acquired claims in relation to Snowline's existing properties in the district. New acquisitions are labelled in bold and highlighted by shadow and are colour-coded to match the projects that they complement. While notable mineral occurrences like the past-producing Plata silver mine and newer discoveries like Conrad, Venus and Boundary flank Snowline's project portfolio, Snowline's project areas have seen very limited mineral exploration efforts to date.

The REA claims cover a zone of gold and base metal anomalism in soil and rocks near a zone of complex structural intersection and along strike of the X claims.

An inactive winter haul road formerly used to service the Plata silver mine comes within 1.5 km of the X claims and within 2.8 km of the REA claims (Figure 1).

Figure 2 - "X" claims soil anomaly, as delineated by previous operators in 2011. These historical soil values grade up to 6.356 g/t Au, with eight samples assaying >1 g/t Au (>1000 ppb Au) over a 300 m area. The anomaly appears to be hosted in black, organic-rich Devonian shales in the hanging-wall of a major regional thrust, within 1 km of a Cretaceous-aged Mayo suite intrusion that exhibits a strong gold signature in regional stream geochemical data.

THE "HS" AND "GS-Y" BLOCKS - URSA

The claim blocks comprising the HS, GS and Y claims extend coverage along the same belt of prospective Ordovician to Devonian rocks that host the strong, extensive, multi-element base metal anomalism identified in stream sediment and soil samples on the Company's Ursa project. This effectively triples the strike length of prospective rocks controlled by Snowline along this belt to over 30 km (non-contiguous). While Ursa appears to cover the strongest signal from this anomalous trend, historical stream sediment and soil sampling on the newly acquired blocks returned up to 1.84% zinc in stream sediment samples and 1.1% zinc in soils.

The Selwyn Basin is among the world's richest sources of zinc, with three major districts recognized to date: the Anvil District, Howards Pass, and Macmillan Pass. The rocks underlying Ursa and the newly acquired claims are similar in age and provenance to units at both Howards Pass and Macmillan Pass.

While Snowline's focus remains on its flagship gold projects, this expanded land position over prospective ground strengthens the opportunity for joint-venture, spin-out or sale if significant base metal mineralization is encountered on the Ursa project.

THE "OB" BLOCK - EINARSON

The OB claims are located north of the Einarson property along the same regional geological feature as a prominent anomalous geochemical trend on Einarson. Historical soil sampling conducted by the previous operator on the OB claims returned generally elevated (>10 ppb Au) to anomalous (up to 522 ppb Au) soils along a 2.3 km strike length, with 16 of 79 samples (20%) returning >100 ppb Au. Follow-up rock sampling targeted carbonate and clastic units and did not identify the source of the anomaly, though nearby quartz veining was mentioned in sample notes. Given Snowline's quartz-vein associated discoveries at Jupiter and Avalanche Creek, exploration targeting of an epizonal orogenic model may prove more successful in identifying the source of the anomaly.

QA/QC

Historical results relating to the newly acquired claim blocks reported herein have not been directly verified by Snowline as such data was prepared and compiled by third parties prior to Snowline's involvement with the Properties. Collection procedures, assay techniques and documentation of the data appear to follow industry best practices, and the Company believes the data to be reliable as a first-pass indicator of high prospectivity that identifies promising targets for follow-up.

QUALIFIED PERSON

The scientific and technical information in this news release has been prepared and approved by Scott Berdahl, P. Geo., Chief Executive Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seven-project portfolio covering nearly 106,500 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. Snowline's first-mover land position provides a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

ON BEHALF OF THE BOARD

Scott Berdahl, MSc, MBA, PGeo

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1-778-650-5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the exercise of the Option and the payments and share issuances related thereto, the Company's belief the Properties will be a highly prospective environment for several styles of gold deposit and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things, risks associated with executing the Company's plans and intentions. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/663989/Snowline-Gold-Enters-Into-Property-Option-Agreement