Sarama Resources Ltd. ("Sarama" or the "Company") (TSX-V:SWA) is pleased to announce that the Government of Burkina Faso has issued the Company a new Exploration Permit (the "Permit") covering the underexplored Gbingue 2 Property ("Gbingue 2" or the "Property") in south-western Burkina Faso. This follows the recent re-issue of the Djarkadougou ll Permit (refer news release dated August 12, 2021) which hosts the high-grade Bondi Deposit

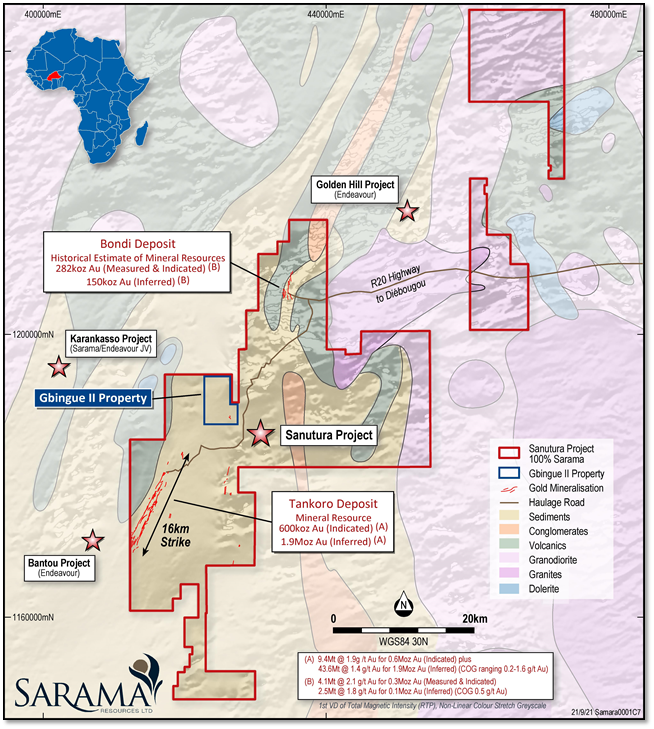

The Property is part of the Company's 100%-ownedSanutura Project (the "Project") which covers approximately 1,500km² and is located within the prolific Houndé Belt in south-western Burkina Faso (refer Figure 1). The Project hosts the Tankoro Deposit, which has a mineral resource of 0.6Moz Au (indicated) and 1.9Moz Au (inferred)(1,5), and the Bondi Deposit, which has a historical estimate of mineral resources of 0.3Moz Au (measured and indicated) and 0.1Moz Au (inferred)(3). These deposits contain a substantial amount(2) of high-grade and free-milling material which has the potential to support a low capital intensity, staged mine development.

The new Permit is effectively a re-issue of the previously expired Gbingue Exploration Permit and covers an area of approximately 28km². The Permit is valid for an initial term of 3 years and is renewable for a further two 3-year terms, subject to satisfaction of routine conditions regarding execution of work programs and minimum expenditure thresholds.

Exploration work undertaken by Sarama to date on Gbingue 2 has been minimal and the Property remains prospective for gold. Several zones of mineralisation have been modelled from reconnaissance drilling and the Company has identified additional targets which will be pursued in upcoming exploration programs.

Corporate Activities

Sarama remains fully engaged with leading Australian resources broker, Euroz Hartleys, for its proposed dual listing on the Australian Securities Exchange (" ASX "). Given the recent progress on the re-issue of key Exploration Permits in Burkina Faso, the Company has recommenced the ASX listing process which remains well advanced and prerequisite documentation is largely complete.

Proceeds raised pursuant to the dual listing on the ASX will primarily be used to expedite an extensive drilling campaign totalling approximately 50,000m at the Sanutura Project. The planned drill programs aim to augment and upgrade the currently defined oxide and free-milling mineral resources, to test high-priority targets identified through previous grassroots exploration that have the potential to significantly impact project growth and to evaluate early-stage targets.

Sarama's President and CEO, Andrew Dinning commented:

"We are pleased to have the new Gbingue 2 Exploration Permit issued. This follows the recent issuance of the Djarkadougou 2 Exploration Permit which hosts the Bondi Deposit and is a key component of the Sanutura Project. We look forward to re-commencing exploration programs at the Project, which will focus on the many oxide and free-milling targets that we have generated."

For further information on the Company's activities, please contact:

Andrew Dinning or Paul Schmiede

e: info@saramaresources.com t: +61 (0) 8 9363 7600

Figure 1 - Sanutura Project & Gbingue 2 Property Location

ABOUT SARAMA RESOURCES LTD

Sarama Resources Ltd ( TSX-V: SWA ) is a West African focused gold explorer and developer with substantial landholdings in south-west Burkina Faso. Sarama is focused on maximising the value of its strategic assets and advancing its key projects towards development.

Sarama's 100%-owned Sanutura Project is principally located within the prolific Houndé Greenstone Belt in south-west Burkina Faso and is the exploration and development focus of the Company. The project hosts the Tankoro Deposit which has a mineral resource of 0.6Moz gold (indicated) and 1.9Moz gold (inferred) (1,5) and also the Bondi Deposit which has a historical estimate of mineral resources of 0.3Moz Au (measured and indicated) and 0.1Moz Au (inferred) (3) .

Together, the deposits present a potential mine development opportunity featuring an initial, long-life CIL project which may be established and paid for by the significant oxide mineral resource base.

Sarama has built further optionality into its portfolio including a 600km² exploration position in the highly prospective Banfora Belt in south-western Burkina Faso. The Koumandara Project hosts several regional-scale structural features and trends of gold-in-soil anomalism extending for over 40km along strike.

Sarama also holds an approximate 18% participating interest in the Karankasso Project Joint Venture (" JV ") which is situated adjacent to the Company's Sanutura Project in Burkina Faso and is a JV between Sarama and Endeavour Mining Corp (" Endeavour ") in which Endeavour is the operator of the JV. In February 2020, an updated mineral resource estimate of 709koz gold (4) was declared for the Karankasso Project JV.

The Company's Board and management team have a proven track record in Africa and a strong history in the discovery and development of large-scale gold deposits. Sarama is well positioned to build on its current success with a sound strategy to surface and maximise the value of its property portfolio.

FOOTNOTES

- Sanutura Project, Tankoro Deposit - mineral resource estimate - 9.4Mt @ 1.9g/t Au for 0.6Moz Au (indicated) plus 43.6Mt @ 1.4g/t Au for 1.9Moz (inferred), reported at cut-off grades ranging 0.2-1.6g/t Au, reflecting the mining methods and processing flowsheets assumed to assess the likelihood of the mineral resources to have reasonable prospects for eventual economic extraction. The effective date of the Company's inferred mineral resource estimate is September 8, 2020. For further information regarding the mineral resource estimate please refer to the technical report titled "NI 43-101 Technical Report, Sanutura Project, South-West Burkina Faso", dated October 20, 2020 (effective date: September 8, 2020) and prepared by Paul Schmiede, Adrian Shepherd & Fred Kock. The technical report is available under Sarama's profile on SEDAR at www.sedar.com .

- Sanutura Project, Tankoro Deposit - oxide & transition component of the mineral resource - 3.2Mt @ 1.6g/t Au for 0.2Moz Au (indicated) plus 20.1Mt @ 1.0g/t Au for 0.7Moz Au (inferred), reported above cut-off grades of 0.2g/t Au and 0.3g/t Au for oxide and transition material respectively.

- Sanutura Project, Bondi Deposit - historical estimate of mineral resources - 4.1Mt @ 2.1g/t Au for 282,000oz Au (measured and indicated) plus 2.5Mt @ 1.8g/t Au for 149,700oz Au (inferred), reported at a 0.5 g/t Au cut-off.

- The historical estimate of the Bondi Deposit reflects a mineral resource estimate compiled by Orezone Gold Corporation (" Orezone ") and has an effective date of February 20, 2009. The historical estimate is contained in a technical report titled "Technical Report on the Mineral Resource of the Bondigui Gold Project", dated February 20, 2009 and prepared by Yves Buro (the " Bondi Technical Report "). Yves Buro is an employee of Met-Chem Canada Inc and is independent of Orezone and Sarama. The technical report is available under Orezone's profile on SEDAR at www.sedar.com

- Sarama believes that the historical estimate is relevant to investors' understanding of the property, as it reflects the most recent and substantive technical work undertaken in respect of the Bondi Deposit.

- The historical estimate was informed by 886 drillholes, assayed for gold by cyanidation methods, which were used to interpret mineralised envelopes and geological zones over the area of the historical estimate. Gold grade interpolation was undertaken using ID² methodology based on input parameters derived from geostatistical and geological analyses assessments. Field measurements and geological logging of drillholes were used to determine weathering boundaries and bulk densities for modelled blocks.

- The historical estimate uses the mineral resource reporting categories required under National Instrument 43-101.

- No more recent estimates of the mineral resource or other data are available.

- Sarama is currently undertaking the necessary verification work in the field and on the desktop that may support the future reclassification of the historical estimate to a mineral resource.

- A qualified person engaged by Sarama has not undertaken sufficient work to verify the historical estimate as a current mineral resource and Sarama is therefore not treating the historical estimate as a current mineral resource.

- Karankasso Project current mineral resource estimate - the current mineral resource estimate for the Karankasso Project of 12.74Mt @ 1.73g/t Au for 709koz Au (effective date of December 31, 2019) was disclosed on February 24, 2020 by Semafo Inc (" Semafo ", since acquired by Endeavour Mining Corp. " Endeavour "). For further information regarding that mineral resource estimate, refer to the news release "Semafo: Bantou Project Inferred Resources Increase to 2.2Moz" dated February 24, 2020 and Semafo: Bantou Project NI43-101 Technical Report - Mineral Resource Estimate" dated April 3, 2020 (effective date: December 31, 2020). The news release and technical report are available under Semafo's and Endeavour's profile on SEDAR at www.sedar.com . The mineral resource estimate was fully prepared by, or under the supervision of Semafo. Sarama has not independently verified Semafo's mineral resource estimate and takes no responsibility for its accuracy. Semafo, and now Endeavour, is the operator of the Karankasso Project JV and Sarama is relying on their Qualified Persons' assurance of the validity of the mineral resource estimate. Additional technical work has been undertaken on the Karankasso Project since the effective date but Sarama is not in a position to quantify the impact of this additional work on the mineral resource estimate referred to above.

- The Tankoro Exploration Permit, which hosts the Tankoro Deposit, is going through a process with the Government of Burkina Faso where it is required it be re-issued as a new full-term exploration permit and the Company continues to work with the relevant government departments to progress the re-issue of the exploration permit. The Company remains optimistic of a satisfactory outcome, however timeframe for the permit re-issue is indeterminate. Sarama has previously had a number of exploration permits re-issued, however there is no assurance of the timing and prospects for the re-issuance of the exploration permit. As a matter of practice, the application for re-issue is typically granted providing work done by the holder is significant and the application is submitted in a timely manner, with both conditions being satisfied by Sarama.

CAUTION REGARDING FORWARD LOOKING INFORMATION

Information in this news release that is not a statement of historical fact constitutes forward-looking information. Such forward-looking information includes, but is not limited to, the potential for the Gbingue 2 Property and the Sanutura Project to host economic mineralisation, statements regarding the Company's future exploration and development plans, statements regarding the Company's planned listing on the ASX and the Company's planned use of any proceeds raised in connection with that listing, statements regarding the potential for mine development at the Sanutura Project, the potential for the Koumandara and Karankasso Projects to host economic mineralisation, the reliability of the historical estimate of mineral resources at the Bondi Deposit, the potential for the receipt of regulatory approvals and the timing and prospects for the re-issuance of the Tankoro Exploration Permit by the Government of Burkina Faso. Actual results, performance or achievements of the Company may vary from the results suggested by such forward-looking statements due to known and unknown risks, uncertainties and other factors. Such factors include, among others, that the business of exploration for gold and other precious minerals involves a high degree of risk and is highly speculative in nature; mineral resources are not mineral reserves, they do not have demonstrated economic viability, and there is no certainty that they can be upgraded to mineral reserves through continued exploration; few properties that are explored are ultimately developed into producing mines; geological factors; the actual results of current and future exploration; changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents.

There can be no assurance that any mineralisation that is discovered will be proven to be economic, or that future re-issuance of Exploration Permits and required regulatory licensing or approvals will be obtained. However, the Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the re-issuance of Exploration Permits, the Company's ability to carry on its exploration activities, the sufficiency of funding, the timely receipt of required approvals, the price of gold and other precious metals, that the Company will not be affected by adverse political events, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain further financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information.

Sarama does not undertake to update any forward-looking information, except as required by applicable laws.

QUALIFIED PERSONS' STATEMENT

Scientific or technical information in this disclosure that relates to the preparation of the Company's mineral resource estimate for the Tankoro Deposit within the Sanutura Project is based on information compiled or approved by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this news release of the information, in the form and context in which it appears.

Scientific or technical information in this disclosure, in respect of the Bondi Deposit relating to mineral resource and exploration information drawn from the Technical Report prepared for Orezone on that deposit has been approved by Guy Scherrer. Guy Scherrer is an employee of Sarama Resources Ltd and is a member in good standing of the Ordre des Géologues du Québec and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Guy Scherrer consents to the inclusion in this disclosure of the information, in the form and context in which it appears.

Scientific or technical information in this disclosure that relates to the quotation of the Karankasso Project's mineral resource estimate and exploration activities is based on information compiled by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this disclosure of the information, in the form and context in which it appears. Paul Schmiede and Sarama have not independently verified Semafo's (now Endeavour's) mineral resource estimate and take no responsibility for its accuracy.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Sarama Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/665111/Sarama-Resources-Issued-the-Gbingue-2-Exploration-Permit-in-Burkina-Faso