(CSE : OZ, OTCQB: OZBKF, FSE: S600)

Outback Goldfields Corp . (the " Company " or "Outback") (CSE: OZ) is pleased to report that it has applied for an additional exploration license, central and contiguous to its Yeungroon property, Victorian Goldfields.

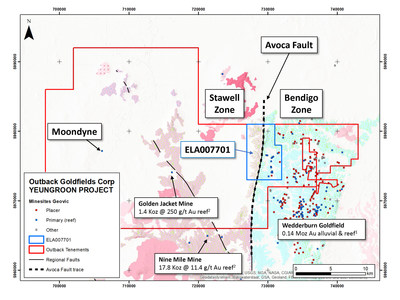

"This newly available Exploration Licence is strategically centered on an eight kilometer corridor along the prospective Avoca Fault system and is contiguous with our existing Yeungroon licenses. This corridor contains numerous historic workings centered on gold-bearing quartz-reefs. These documented gold occurrences are hosted in prospective rocks of the Bendigo zone. Once granted, the new Exploration Licence will be systematically evaluated," commented Chris Donaldson , CEO.

Exploration Licence Application

- Exploration licence (EL007701) comprises 3,700 hectares centered on the regionally prospective Avoca Fault system.

- EL007701 covers numerous reef-hosted gold occurrences over a 3 km north-south trend.

- Once granted, a thorough geological mapping, prospecting and soil sampling program will commence.

Based on a review of all property and regional geological and geophysical data, numerous target areas were defined across the property (see OZ news release dated June 28 th , 2021). Many of these key targets are proximal to- and associated with the Avoca Fault system and associated splays (e.g., Golden Jacket; Figure 1). The area underlying EL0077001 was highlighted as it covers a significant section of the Avoca Fault system with numerous, reef-hosted gold occurrences hosted in Bendigo Zone rocks (Figure 1). Once granted, all occurrences will be systematically evaluated, and the entire Exploration Licence will be the focus of a geological mapping and geochemical sampling program. The application has been registered with the Earth Resources branch of the Victorian state government.

Figure 1. Map of the existing Yeungroon tenements and the location of EL0077001 in relation to existing target areas; Golden Jacket and Wedderburn. Note: Au production values are historic estimates (see references below).

Yeungroon Property

The 698 km 2 Yeungroon property is transected by the north-trending, crustal-scale Avoca fault, which separates the western Stawell zone from the Eastern Bendigo zone. The western side of the Yeungroon property contains the historic Golden Jacket hard-rock reef mine associated with the regional-scale, northwest-trending Golden Jacket fault. Historic mining records indicate the Golden Jacket mine produced quartz-rich ore with grades of up to 250 grams per tonne gold (Bibby and More, 1998) however, the vertical and lateral extent of mineralization has yet to be tested by drilling.

The eastern side of the project is underlain by Ordovician rocks of the Castlemaine group and comprises the northern extent of the Wedderburn Goldfield, where numerous small-scale, historic alluvial and hard-rock mines are located (Figure 1).

Community Engagement

Outback recognises the importance of open and honest community engagement in all our exploration activities. We approach all our exploration activities in a sustainable manner and ensure our activities comply with the Victorian Code of Practice for Mineral Exploration. As such, community consultation with local landowners has commenced.

References

- Edwards, J., Moore, D.H., Bibby, L.M., and Lynn, S.F., 2001, Wedderburn 1:100,000 map area geological report, Geological Survey of Victoria Report 122, 118 p.

- Bibby, L.M., and Moore, D.H., 1998, Charlton 1:100,000 map area geological report, Geological Survey of Victoria Report 116, 95 p.

Data Verification and National Instrument 43-101 Disclosure

Some data disclosed in this news release is historical in nature. Neither the Company nor a Qualified Person, as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects (" NI 43-101 "), have verified the data, and, therefore, investors should not place undue reliance on such data. In some cases, the data may be unverifiable. Mineralization hosted on adjacent and/or nearby and/or geologically similar properties is not necessarily indicative of mineralization hosted on the company's property. The technical information disclosed in this news release has been reviewed and approved by Christopher Leslie , P.Geo., a Qualified Person as defined by NI 43-101.

About Outback Goldfields Corp.

Outback Goldfields Corp. is a well financed exploration mining company holding a package of four highly prospective gold projects located proximate and adjacent to the Fosterville Gold Mine in Victoria, Australia . The initial Phase 1 exploration program is now underway on three of the four company properties. The Goldfields of Victoria, Australia is in the midst of a modern-day gold rush and is home to some of the highest grade and lowest cost mining in the world.

~signed

Chris Donaldson , CEO and Director

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the development of the Company's mineral projects, including drilling programs and mobilization of drill rigs; and future mineral exploration and development.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Outback, future growth potential for Outback and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Outback's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Outback's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and Outback has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mining activities in Australia ; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in Outback's management discussion and analysis. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although Outback has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Outback does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE Outback Goldfields Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/July2021/27/c7843.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/July2021/27/c7843.html