NV Gold Corporation (TSXV:NVX)(OTCQB:NVGLF)(FSE:8NV) (" NV Gold " or the " Company ") is pleased to announce that the Company has received all assays from its expanded reverse circulation ("RC") drill program at its 100% owned Sandy Gold Project ("Sandy"), located within the Walker Lane, Lyon County, Nevada, USA. The expanded program was comprised of 17 RC drill holes totaling 3,811 m (12,505 ft). This project was generated through a historical data review in 2020. A Phase 1 Maiden Drill Program was undertaken in early 2021 to test near surface targets with rock chip assays of better than 1 gram gold and to broadly evaluate the property for a potentially economic gold system

"2021 will be one of NV Gold's busiest exploration seasons in our corporate history, with multiple drill-ready gold projects being planned for potential drill programs, including the Sandy Gold Project. I look forward to the next Phase of the Sandy exploration program later this year after we review data gathered from the upcoming IP survey and additional mapping," commented Peter A. Ball, President and CEO of NV Gold. "With over $4.5M in our treasury, we are well funded for 2021 and beyond."

Key Highlights from Phase 1 Drill Program at Sandy Gold Project

- RC drilling encountered a large epithermal gold system defined by extensive argillic to propylitic alteration with intervals of moderate to intense quartz and pyrite veining (refer to Figure 1 and 2). The mineralized vein system is hosted by a thick andesite volcanic package. Some underlying shaly basement rocks also showed visual evidence of veining and hydrothermal fluid flow. The alteration footprint at the surface has a strike length of 2.4 kms and a width of approximately 500 meters.

- The best intercept from this program returned 22.9 meters @ 0.65 g/t Au from 29 meters to 51.9 meters (including 6.1 meters of 1.58 g/t Au at 38.1 meters) in hole SD-4. All 17 RC holes intercepted anomalous gold and strong trace element geochemistry (refer to Figure 3 and 4). Twelve holes displayed grades above a threshold of >3 meters @ >0.1 g/t Au. These gold results and associated trace element geochemistry confirm the presence of a large epithermal gold system.

- Much of the property remains undrilled. The system stays open at depth and under late volcanic cover. With multiple targets remaining including in the mineralized volcanics underlying shaly basement rocks, a potential Phase 2 Drilling Campaign is under review and will be guided by future Leapfrog modelling and the results of IP survey.

- NV Gold plans to conduct an IP (Induced Polarization) survey and conduct additional soil sampling to identify new prospective targets. Detailed mapping of the property is currently underway.

Results:

| Hole No. | From (m) | To (m) | Interval (m) | Au (g//t) |

|

|

|

| |

SD-1 | 13.7 | 24.4 | 10.7 | 0.27 |

SD-2 | 99.1 | 112.8 | 13.7 | 0.29 |

176.9 | 193.7 | 16.8 | 0.14 | |

225.7 | 233.3 | 7.6 | 0.15 | |

SD-3 | 228.8 | 230.3 | 1.5 | 1.73 |

SD-4 | 29.0 | 51.9 | 22.9 | 0.65 |

incl. | 38.1 | 44.2 | 6.1 | 1.58 |

86.9 | 90.0 | 3.1 | 0.35 | |

SD-5 | 79.3 | 85.4 | 6.1 | 0.29 |

SD-6 | 48.8 | 79.3 | 30.5 | 0.15 |

SD-7 | 204.3 | 207.4 | 3.1 | 0.13 |

SD-8 | 65.6 | 93 | 27.4 | 0.22 |

106.8 | 123.5 | 16.7 | 0.20 | |

SD-9 | anomalous gold values | |||

SD-10 | anomalous gold values | |||

SD-11 | 61.0 | 65.8 | 4.8 | 0.34 |

102.2 | 109.8 | 7.6 | 0.14 | |

135.7 | 141.8 | 6.1 | 0.15 | |

167.8 | 175.4 | 7.6 | 0.12 | |

SD-12 | anomalous gold values | |||

SD-13 | anomalous gold values | |||

SD-14 | 47.3 | 70.1 | 22.8 | 0.13 |

152.5 | 158.6 | 6.1 | 0.20 | |

228.8 | 233.3 | 4.5 | 0.27 | |

SD-15 | 4.6 | 10.7 | 6.1 | 0.34 |

50.3 | 54.9 | 4.6 | 0.15 | |

SD-16 | anomalous gold values | |||

SD-17 | 129.6 | 132.7 | 3.1 | 0.49 |

"During my first field review of Sandy in early 2021, I was impressed by the two kilometer plus strike-length of alteration and the presence of high-grade gold within the area at up 18.1 g/t Au from rock chips. Our Phase 1 Drilling Program was designed to initially collect data and to test as much of the property as possible. Expectations went high after drilling into numerous quartz veins and also when two RC holes encountered the underlying and mineralized shaly basement rocks. In conclusion, even though we did not hit any economic grades immediately, these are encouraging results, and better gold grades are anticipated with zones of silicification/quartz veining yet to be determined. I look forward to seeing the results of the proposed IP survey and additional mapping to guide a potential Phase 2 Drilling Campaign in the early fall of 2021," stated Thomas Klein, VP Exploration, NV Gold.

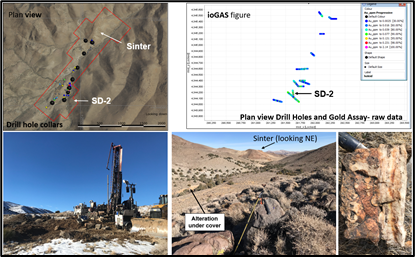

Figure 1: Sandy Gold Project - Drill Sites and subcropping quartz vein material (To view the full sized image, please click here)

Figure 2: Sandy quartz and pyrite veining (To view the full sized image, please click here)

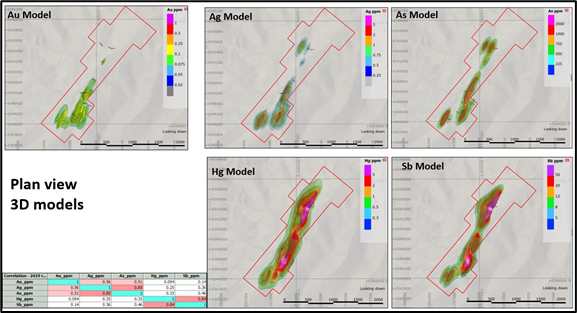

Figure 3: Gold-in-drill holes and multi-elements distribution in plan view (To view the full sized image, please click here)

Figure 4: Gold-in-drill holes from Main Gold Zone in cross sections (note potentially open mineralization at depth) (To view the full sized image, please click here)

Quinton Hennigh (Ph.D., P.Geo.) is a Qualified Person pursuant to National Instrument 43-101 and has reviewed and approved the technical information contained in this news release. Dr. Hennigh is a director of NV Gold and is not independent and is also the President, Chairman and a Director of Novo Resources Corp.

About NV Gold Corporation

NV Gold ( TSXV:NVX)(OTCQB:NVGLF)(FSE:8NV) is a well-financed exploration company based in Vancouver, British Columbia, and Reno, Nevada and is focused on delivering value through mineral discoveries in Nevada, USA. Leveraging its expansive property portfolio, its highly experienced in-house technical team, and its extensive geological data library, 2021 will be NV Gold's busiest exploration year in its corporate history.

On behalf of the Board of Directors,

Peter A. Ball

President & CEO

For further information, visit the Company's website at www.nvgoldcorp.com or contact:

Peter A. Ball, President & CEO

Phone: 1-888-363-9883

Email: peter@nvgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's planned exploration activities, the Phase 2 exploration program at Sandy and locating the feeder structures at depth, the potential for a discovery at its properties are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include regulatory issues, market prices, availability of capital and financing, general economic, market or business conditions, timeliness of government or regulatory approvals, the extent to which mineralized structures extend on to the Company's Projects and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by applicable securities legislation.

SOURCE: NV Gold Corporation

View source version on accesswire.com:

https://www.accesswire.com/652786/NV-Gold-Identifies-Large-Epithermal-Gold-System-at-the-Sandy-Gold-Project-in-Nevada