(TheNewswire)

VANCOUVER, BRITISH COLUMBIA TheNewswire - October 6, 2021 (TSXV:NRG ) US (OTC :NRGOF ) ( Frankfurt:X6C) Newrange Gold Corp. (" Newrange " or the " Company ") is pleased to provide an update to the ongoing exploration on its Pamlico Project in Nevada where recent diamond drilling, mapping and sampling programs are outlining a large-scale, multi-phase, polymetallic mineralizing system .

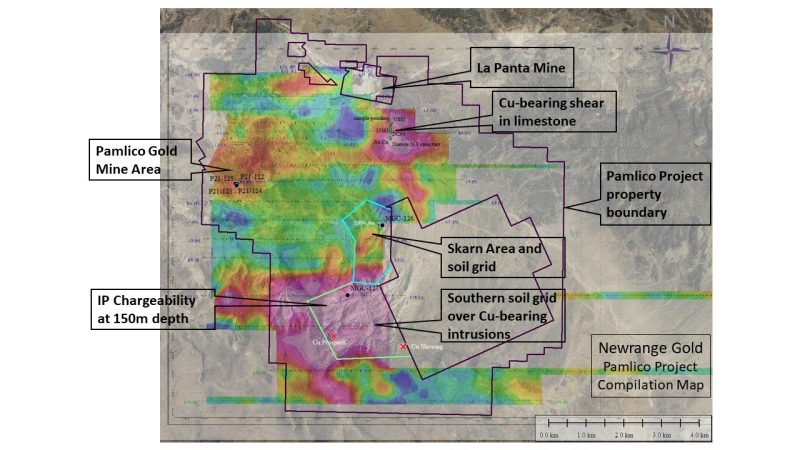

"The recognition of metal zonation at Pamlico is a significant step forward in the exploration of the project," stated Robert Archer, Newrange CEO. "The structural complexity of the gold mineralization has made it challenging to trace out mineralized zones and this gives us a new tool to improve the odds of success. Ongoing mapping, rock and soil sampling, in conjunction with the expanded IP survey, are demonstrating strong intrusive activity in the southern part of the newly enlarged property, with widespread copper, zinc, silver and gold mineralization that was previously unrecognized. It now appears that we are dealing with more than one phase of mineralizing activity spread over more than 25 square kilometers and the Pamlico Mine area may be just one portion of this."

Diamond Drilling Program

A six-hole, 1,123 meter diamond drilling program was conducted in May to August but was terminated prematurely due to poor productivity, low core recoveries, and cost over-runs. Longer than usual turn around times were experienced in assaying but all results have now been received. As previously reported (Newrange news release July 6, 2021), four core holes, P21-122 to 125, inclusive, were drilled around reverse circulation (RC) hole P21-115, just east of the Merritt Zone and north of the historic Pamlico Mine. All core holes were drilled at -60° on an azimuth of 070°, the same as hole P21-115, and collared within 25-30 meters of that hole (see plan view here ). Significantly, all four holes displayed concentric metal zonation starting with a broad halo of zinc, followed by internal halos of lead, copper, arsenic and silver, usually in that order, with higher gold values in discrete structures near the center. This program marks the first time that multi-element geochemistry has been used on drill samples. As the structural geology of the Pamlico area is highly complex and there is no sulphide mineralization due to intense oxidation, the ability to use certain geochemical patterns as pathfinders will be important in future drill targeting. A program of re-assaying pulps and rejects from previous drill samples for multi-element geochemistry has been initiated.

The first core hole, P21-122, intersected a zone of brecciated quartz with secondary copper minerals, including abundant chrysocolla and lesser amounts of azurite and malachite that assayed 2.54 grams per tonne gold (g/t Au), 1,291 g/t silver (Ag), 1.1% copper (Cu) and 1.52% lead (Pb) over 1.52 meters. A similar vein on the 5428 level of the historic Pamlico Mine assayed 5.62 g/t Au, 63.2 g/t Ag and 0.98% Cu over 0.48 meters. Another zone of silver enrichment was intersected in hole 122, with 35.1 g/t over 17.22 meters. This zone also included anomalous gold (0.22 g/t over 3.96 meters), copper, lead and zinc. Just beyond this, at a downhole depth of 123.14-123.44 meters, a zone of fractured rhyolite returned 10.2 g/t Au over 0.3 meters within a broader zone of 0.58 g/t Au over 12.34 meters.

Core hole P21-123, drilled ‘behind' P21-115, intersected a broad zone of anomalous zinc and lead with more discrete gold intercepts such as 6.54 g/t Au over 1.2 meters and several others in the 1-2 g/t Au range, including 1.82 g/t Au, 32.3 g/t Ag and 1.75% Pb over 1.50 meters. Hole P21-124 displayed a moderate zinc and lead content but no significant gold values, while hole P21-125 returned 3.66 g/t Au over 0.61 meters within a broader zone of 0.82 g/t Au over 7.92 meters and a separate zone of 20.2 g/t Ag over 7.01 meters.

Hole MGC21-126 was drilled to test a previously identified multi-element soil anomaly over skarn altered limestone and calcareous shale that is coincident with favorable magnetic and IP geophysical anomalies on the Skarn Zone in the McGill Canyon Area. The hole was drilled approximately 100 meters from the exposed contact of limestone with a mineralized rhyolite porphyry that assayed 2.994 g/t Au (see Newrange news release June 14, 2021). The hole intersected a strongly faulted and altered contact zone between rhyolite and limestone, from 80.18 to 92.38 meters, containing 1.40% Zn over 1.52 meters and 1.51% Zn over 1.52 meters. Other elements such as copper and silver were enriched over the entire 12.20 meter interval but gold values were low, implying a similar metal zonation as seen in holes P21-122 to 125.

Hole MGC21-127, drilled to test a near-surface IP anomaly, intersected 22.86 meters of hornfels skarn within a sedimentary package with anomalous copper, before passing into a pyritic mudstone. Although the latter would have contributed to the IP anomaly in this area, the skarn alteration is indicative of intrusive activity at depth. The zone displayed weakly anomalous copper but no other significant values.

Mapping & Sampling Programs

Property-wide mapping and rock sampling is ongoing, a 750 sample soil grid was completed over the Skarn Zone and a second 2 by 2 kilometer soil grid is being initiated over the large IP anomaly in the southern part of the property (see map below and here ). In the Skarn Zone, 46 grab samples showed widespread polymetallic mineralization, with seven samples assaying greater than 0.5 g/t Au (three of these more than 1.0 g/t Au), three greater than 100 g/t Ag, four more than 1% Cu, one more than 1% Pb and four greater than 1% Zn.

Immediately to the south of the Skarn Area several intrusive bodies have been recognized and are being mapped out in more detail. Importantly, shears and contact zones within this area contain copper and zinc mineralization and skarn alteration is widespread within the host sedimentary rocks.

Pamlico Project Compilation Map

In the eastern part of the property south of the historic La Panta Mine, a north-south copper-bearing shear has been identified that shows a strong spatial association with a similarly-trending IP anomaly. Grab samples along the structure have returned 5.59%, 1.36%, 2.43% and 1.63% Cu over a strike length of approximately 250 meters.

The widespread polymetallic mineralization associated with skarn alteration and shearing coupled with a greater abundance of intrusive rocks than previously known all point to a large, multi-phase, intrusive related mineralizing system. The current program will allow the Company to better interpret the geological environment and develop new targets prior to mounting another drill campaign. At that time, it will be decided whether to attempt diamond drilling again with a different contractor or return to RC drilling.

Quality Assurance/Quality Control

Mr. Robert G. Carrington, P. Geo, a Qualified Person as defined by National Instrument 43-101, the President and Chairman of the Company, has reviewed, verified and approved for disclosure the technical information contained in this news release. All reverse circulation drilling was conducted using a five-inch diameter center return bit. All drilling was supervised by professional geologists. Samples were collected on 1.5 meter (5 foot) intervals. Drill cuttings were captured in a vacuum augmented, closed system cyclone, then riffle split in a three-tiered Jones-type splitter. All core reported in this release is PQ or HQ diameter core, drilled with "triple tube" split shells. Core is logged and marked by professional geologists for sampling. Core is then saw-cut along the marked sample lines with diamond saws. Sludge from each identified sample interval is collected separately, flocculated, dried and split. One half of the sludge is then combined with the one half of the core for assay, the other half of sludge is placed in a paper envelope and kept with the one half reference core for future work. Samples are securely stored and delivered to Paragon Geochemical Laboratories in Sparks, Nevada for preparation and analysis. Samples are dried then stage crushed to 80% passing 10 mesh. A 300 gram sub-sample is then split out and pulverized to 90% passing 140 mesh from which 1 Assay Ton, approximately 30 gram samples are split for analysis by fire assay (FA) with an OES finish. Samples assaying in excess of 5 g/t Au are re-assayed by fire assay with a gravimetric finish. Silver was determined by fire assay with an atomic absorption finish. In addition to the QA – QC conducted by the laboratory, the Company inserts blanks, duplicates, standards and certified reference material (CRM) at a rate of not less than 1 in 20.

About Newrange Gold Corp.

Newrange is focused on district-scale exploration for precious metals in favorable jurisdictions including Nevada, Ontario and Colorado. With locally high-grade, near surface oxide gold mineralization, the Company's flagship Pamlico Project is poised to become a significant new Nevada discovery, while the North Birch Project offers additional blue-sky potential in the prolific Red Lake District. Focused on developing shareholder value through exploration and development of key projects, the Company is committed to building sustainable value for all stakeholders. Further information can be found on our website at www.newrangegold.com .

Signed: "Robert Archer"

CEO & Director

For further information contact :

Sharon Fleming

Corporate Communications

Phone: 760-898-9129

Email: info@newrangegold.com

Dave Cross

Chief Financial Officer and Corporate Secretary

Phone: 604-669-0868

Email: dcross@crossdavis.com

Website: www.newrangegold.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release .

Forward-Looking Statement:

Some of the statements in this news release contain forward-looking information that involves inherent risk and uncertainty affecting the business of Newrange Gold Corp. Actual results may differ materially from those currently anticipated in such statements.

Copyright (c) 2021 TheNewswire - All rights reserved.