Marvel Discovery Corp. (TSXV:MARV)(Frankfurt:O4T1)(OTCQB:MARVF); (the "Company") is pleased to announce it has entered into an assignment and assumption agreement the ("Assignment Agreement") with District 1 Exploration Corp. ("District 1") pursuant to which District 1 has assigned all of its rights and obligations with respect to a property option agreement dated October 30, 2018, as amended November 23, 2020 (the "Option Agreement") whereby District 1 was granted sole and exclusive right and option to acquire a 100% interest (the "Option") in the Highway North Property in the Athabasca region of Saskatchewan (the "Property

The Property is located 70km southwest of the former producing Key Lake Uranium Mine. Aptly named for its location along Highway 914, the Property consists of five contiguous claims totaling 2,573 hectares. The Key Lake Deposit, which is northeast of the Property, consisted of two mineralized zones which historically produced a total of 4.2 million tonnes of product at an average grade of 2.1% U3O8 (Harvey, 1999). Only 21 drill holes have been drilled on the Property thus far totaling 3,527m, between 1980 and 2008. Surface exploration and drilling have verified the presence of uranium mineralization along the Highway Zone, with grades up to 2.31% U3O8 over 0.29 m in KLR15-086.

The Company is not treating these historical results as current and has not completed sufficient work to verify such historical results. Further, the historical production from the Key Lake Deposit has not been verified independently by the Company. While the Company is not treating these historical results and numbers as accurate, it does believe the numbers to be reliable and may be of assistance to readers.

Regional Geology and Mineralization

The deposit model for exploration on the Highway North Property has been a basement-type unconformity-related uranium deposit, such as those found at the Eagle Point, Millennium, and the Gaertner and Deilmann (Key Lake). This deposit type belongs to the class of uranium deposits where mineralization is spatially associated with unconformities that separate Proterozoic conglomeratic sandstone basins and metamorphosed basement rocks (Jefferson et al., 2007). Although rocks of the Athabasca Group and the basal unconformity do not outcrop on the Property, they likely once overlaid the basement gneisses and metapelites which now do, as the current erosional edge of the Athabasca Basin, and potential outliers, is about 50 km north of the Property.

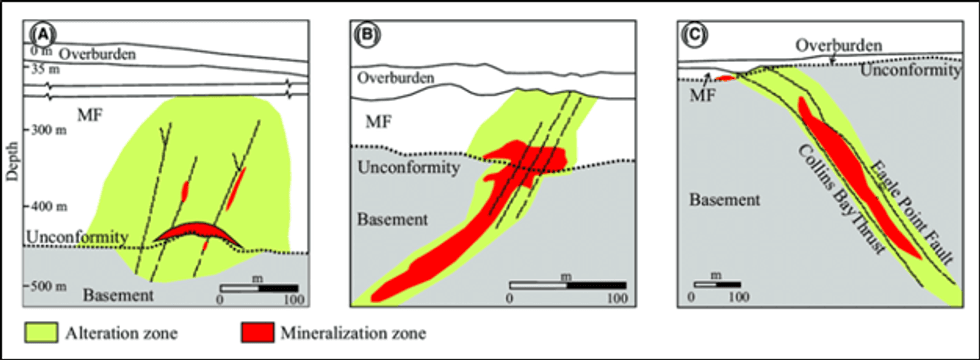

In Saskatchewan, uranium deposits have been discovered at, above, and up to 300 m below, the Athabasca Group unconformity within basement rocks. Mineralization can occur hundreds of meters into the basement or can be up to 100 m above, in Athabasca Group sandstone. Typically, uranium is present as uraninite/pitchblende that occurs as veins and semi-massive to massive replacement bodies. Mineralization is also spatially associated with steeply-dipping, graphitic basement structures and may have been remobilized during successive structural reactivation events. Such structures can be important fluid pathways as well as structural or chemical traps for mineralization as reactivation events have likely introduced further uranium into mineralized zones and provided a means for remobilization (Jefferson, et al. 2007) (Figure 1).

Figure 1. Representative sections of three well-known unconformity-related uranium deposits of the eastern Athabasca Basin showing the strong spatial association of the deposits with the intersection of basement-rooted fault zones and the unconformity surface. (A) Cigar Lake deposit, consisting of predominantly unconformity ore and perched ore in the overlying sandstone. (B) Deilmann pit, Key Lake deposit, including both basement hosted and unconformity ore, controlled by the Key Lake fault. (C) Eagle Point deposit, mostly basement-hosted ore, controlled by the Collins Bay thrust and Eagle Point fault.

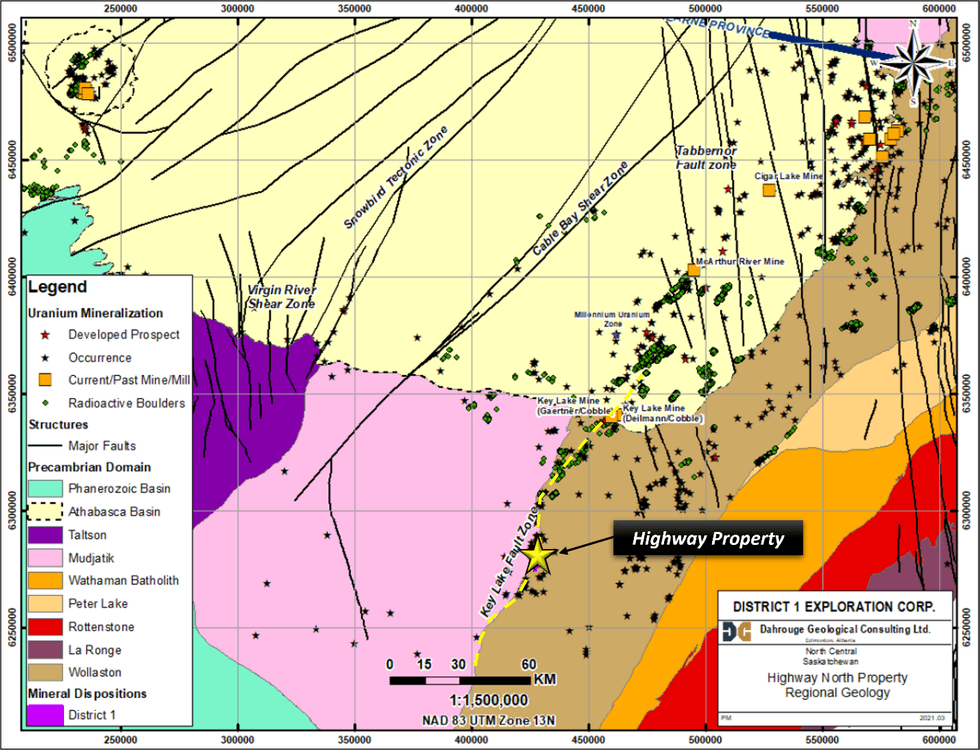

The Highway Property straddles the Key Lake Fault Zone, an important corridor for structurally controlled Athabasca Basin type uranium deposits. Critical criteria on the Property for these type of uranium deposits include the presence of graphitic EM conductors within metasedimentary packages, major re-activated northeast-trending fault systems that have been disrupted by obliquely cross-cutting subsidiary structures and the presence of uranium-enriched source rocks (Figure 2). Exploration to date on the Property has been limited.

Figure 2: Regional geological and structural location of the Highway Property.

Commentary

Mr. Karim Rayani, President and Chief Executive Officer commented, "We are entirely pleased to have acquired the option on such a prominent land package on an important structural corridor in the Athabasca Uranium producing region of Saskatchewan. The Highway North Project is perfectly situated along the Key Lake Shear Zone with power, water, and road accessibility. The geological setting is perspective for structurally controlled basement hosted Uranium deposits such as the Millennium Zone and Key Lake deposits of Cameco. Marvel continues to present stakeholders a rare opportunity having exposure to multi commodity - critical element opportunities under one umbrella."

The Transaction

As consideration for the Option, the Company has agreed to issue 4,600,000 common shares to District 1 (the "Consideration Shares") at a price of $0.09 per share. The Company will assume all obligations of District 1 under the Option Agreement to acquire the Property including, issuing a total of 1,250,000 Shares to the owner of the Property (the "Optionor"), paying a total of $115,000, and incur a total of $650,000 of expenditures on the Property, over time. It is expected that the Company and the Optionor will negotiate an amendment to the Option Agreement to better align with the business and operations of the Company rather than District 1. In addition, the Optionor will retain a 1 % (NSR) net smelter royalty.

Closing of the transaction is subject to conditions, including, but not limited to, (i) the Company conducting a private placement to raise minimum gross proceeds of $300,000, (ii) approval of the transaction by the TSX Venture Exchange, and (iii) approval of the transaction by the shareholders of District 1.

The transaction between the Company and District 1 can be considered as non-arm's length, in that the companies share a common director.

Further details regarding the geology of the Property and the terms of fund raising will be disclosed as available.

Qualified Person

The technical content of this news release has been reviewed and approved by Mike Kilbourne, P.Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects. The QP has not completed sufficient work to verify the historic information on the properties comprising the Highway Property, particularly regarding historical exploration, neighbouring companies, and government geological work. The information provides an indication of the exploration potential of the Property but may not be representative of expected results.

Reference

Harvey, S.E. (1999): Structural geology of the Deilmann Orebody, Key Lake, Saskatchewan; in

Summary of Investigations 1999, Volume 2, Saskatchewan Geological Survey, Sask. Energy Mines,

Misc. Rep. 99-4.2.

About Marvel Discovery Corp.

Marvel, listed on the TSX Venture Exchange for over 25 years, is a Canadian based emerging resource company. The Company is systematically exploring its extensive property positions in:

- Newfoundland (Slip, Gander North, Gander South, Victoria Lake, Baie Verte, and Hope Brook - Au Prospects)

- Atikokan, Ontario (BlackFly - Au Prospect)

- Elliot Lake, Ontario (East Bull - Ni-Cu-PGE Prospect)

- Quebec (Duhamel - Ni-Cu-Co prospect & Titanium, Vanadium, and Chromium Prospect)

- Prince George, British Columbia (Wicheeda North - Rare Earth Elements Prospect)

The Company's website is: https://marveldiscovery.ca/

ON BEHALF OF THE BOARD

Marvel Discovery Corp.

"Karim Rayani"

Karim Rayani

President/Chief Executive Officer, Director

Tel: 604 716 0551 email: k@r7.capital

Disclaimer for Forward-Looking Information:

Certain statements in this release are forward-looking statements which reflect the expectations of management. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward-looking statements in this press release relate to, among other things: completion of the proposed Arrangement. Actual future results may differ materially. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. There is no assurance any of the conditions for closing will be met. Forward-looking statements reflect the beliefs, opinions, and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times. Except as required by law, the Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Marvel Discovery Corp.

View source version on accesswire.com:

https://www.accesswire.com/674096/Marvel-Acquires-Option-to-Purchase-Uranium-Property--Key-Lake-Athabasca-Basin-Saskatchewan