Idaho Champion Gold Mines Canada Inc. (CSE:ITKO)(OTCQB:GLDRF)(FSE:1QB1)("Idaho Champion" or the "Company") is pleased to report the results from its 2020 diamond core ("Core") drilling campaign at its 100% controlled Champagne Gold Project ("Champagne") near the city of Arco, Butte County, Idaho

2020 Champagne Drilling Highlights:

- Drill hole DDH-CC-20-02 intersected 1.04 g/t gold equivalent ("AuEq") for the interval 123.14-166.12 m (42.98 m core length), including 1.22 g/t AuEq for the interval 123.14-157.06 m (31.93 m core length).

- Drill hole DDH-CC-20-02 was collared at Mine Hill in the approximate center of the unmined 300 m interval between the North and South Pits (Bema Gold c. 1989-90).

- This mineralized interval is associated with shallow induced polarization anomalies in chargeability and resistivity as reported in the Idaho Champion press release dated Feb 2, 2021.

"Core drilling and results of our IP survey have provided data to better formulate a conceptual geologic model for the Champagne District," stated President and CEO, Jonathan Buick. "The promising mineralization from the program demonstrates there is gold in the system below the historic mined pits where we are confident that we can identify additional resources. Our evolving geologic model indicates that the base, or roots, of a larger system that may have been the feeder for all mining in this district, lies off to the west. This large body of anomalous chargeability will be drill tested in 2021."

Champagne Drilling Technical Summary

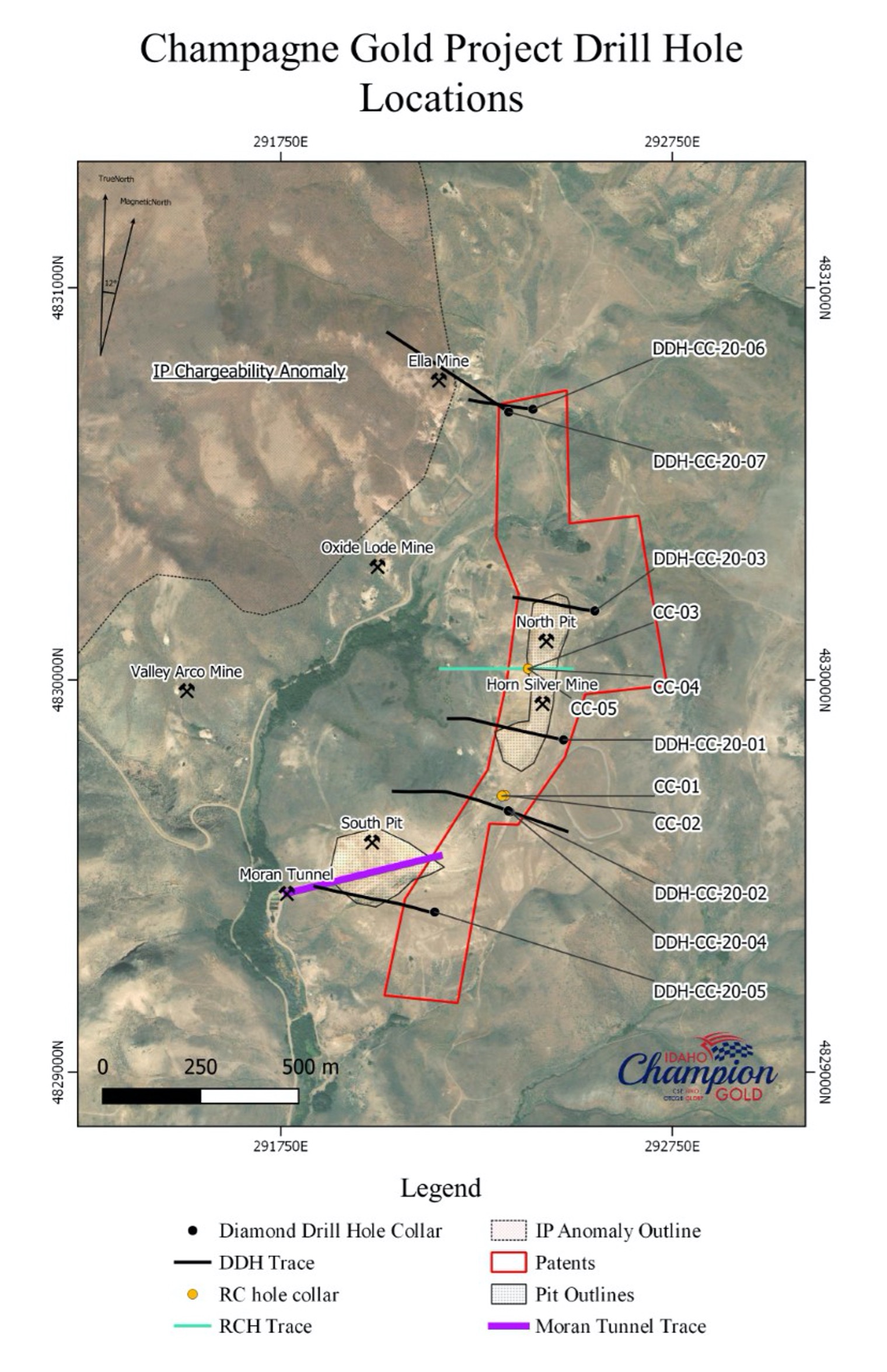

The 2020 core drilling program consisted of seven (7) diamond drill holes totaling 2,818 Metres (Fig. 1). Five core holes (DDH-CC-20-01 through DDH-CC-20-05) were positioned on Mine Hill in the vicinity of the North and South Pits and two core holes (DDH-CC-20-06 and DDH-CC-20-07) were located further north near the Ella Mine breccia vein.

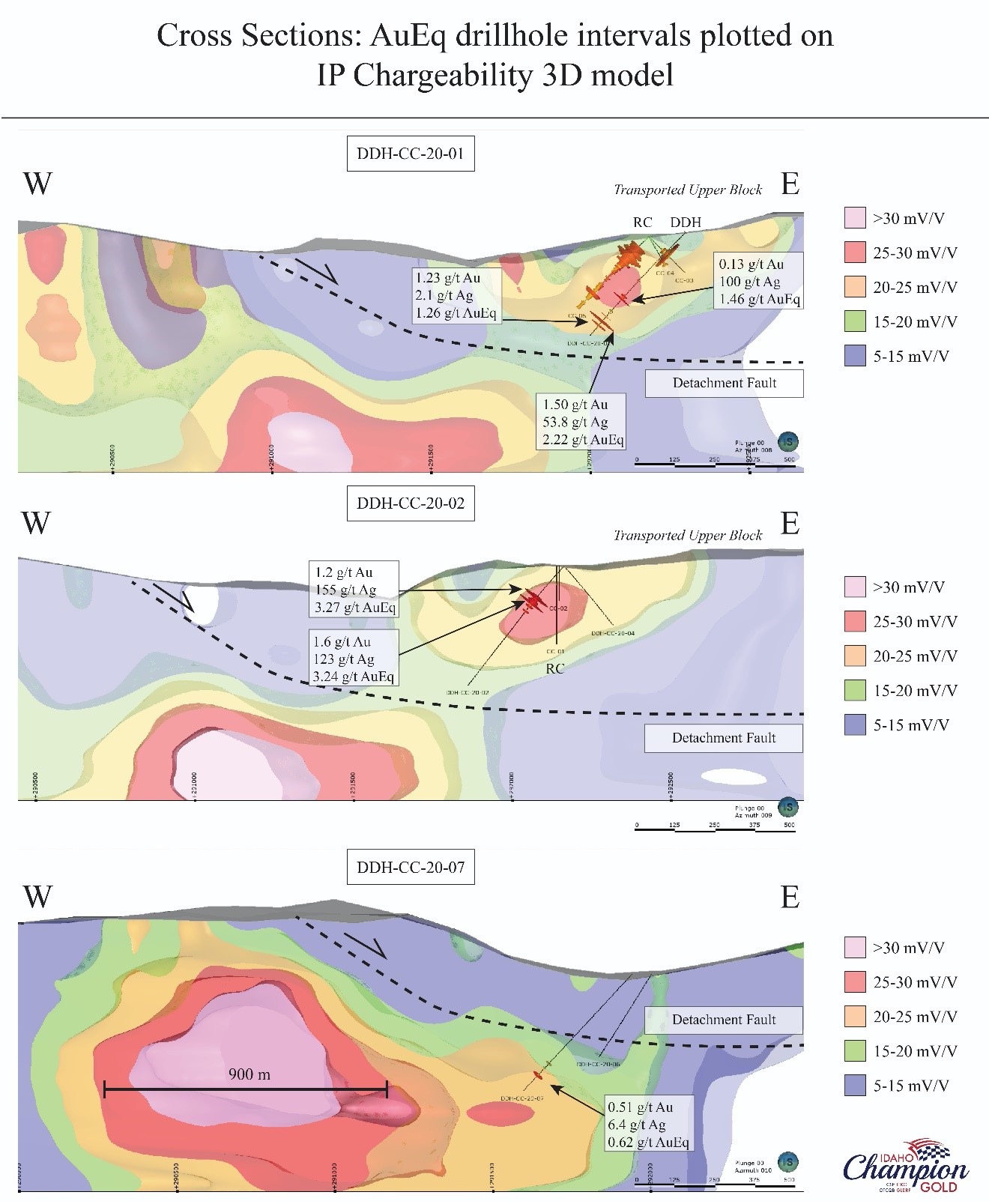

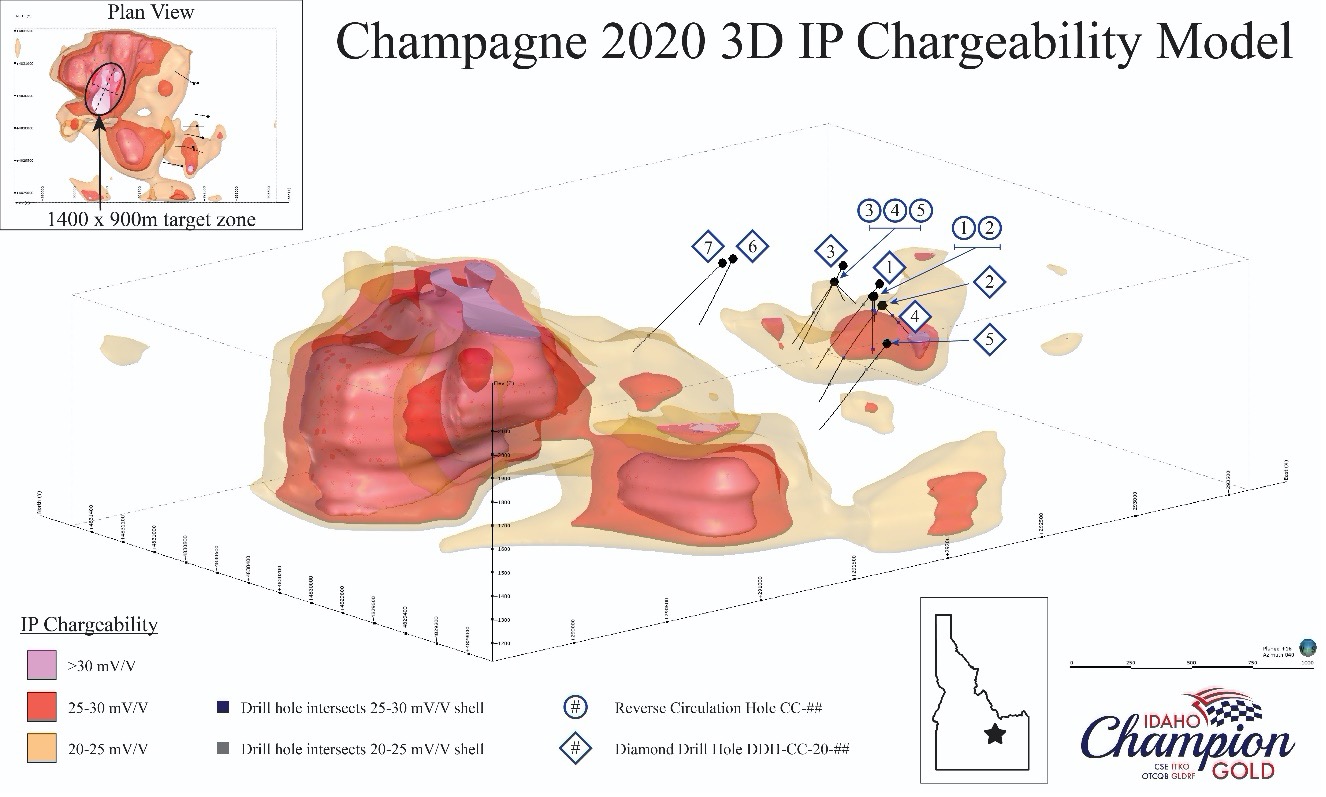

Three holes (DDH-CC-20-01, -02, -07) intersected promising precious metals mineralization, with the strongest presence of gold and silver intersected in DDH-CC-20-02. The spatial relationships of these three holes to results of the recently completed induced polarization (IP) survey are represented in Figs. 2-3 (see also Idaho Champion press release of February 2, 2021). An inferred low-angle detachment fault represented in Fig. 2 is interpreted to have displaced the shallow IP anomaly at Mine Hill from a larger and deeper anomaly 800 m west of Mine Hill.

Table 1: 2020 Champagne Core Drill Program - Significant Au and Ag Intercepts for All Holes (DDH-CC-20-01 - DDH-CC-20-07)

Drill Hole | From (m) | To (m) | Length (m)1 | Au (g/t) | Ag (g/t) | AuEq (g/t)2 | |

DDH-CC-20-01 | 379.97 | 381.00 | 1.03 | 1.03 | 30.79 | 1.44 | |

395.94 | 398.98 | 3.04 | 0.78 | - | 1.01 | ||

DDH-CC-20-02 | 123.14 | 166.12 | 42.98 | 0.67 | 27.87 | 1.04 | |

Including | |||||||

123.14 | 157.06 | 31.93 | 0.75 | 34.73 | 1.22 | ||

AND | |||||||

157.58 | 166.12 | 8.54 | 0.52 | 10.07 | 0.65 | ||

DDH-CC-20-03 | No significant Au or Ag intercepts | ||||||

DDH-CC-20-04 | No significant Au or Ag intercepts | ||||||

DDH-CC-20-05 | No significant Au or Ag intercepts | ||||||

DDH-CC-20-06 | No significant Au or Ag intercepts | ||||||

DDH-CC-20-07 | 440.44 | 452.63 | 12.19 | 0.03 | 9.98 | 0.17 | |

Including | |||||||

440.44 | 447.79 | 7.35 | 0.04 | 8.88 | 0.16 | ||

| 1 - Reported intervals are down-hole lengths and not true thickness. 2 -AuEq calculated using a gold/silver ratio of 75:1. AuEq (g/t) = Au (g/t) + [ Ag (g/t) / 75] (based on $1,200 Au and $15 Ag pricing) Length-weighted average grades are calculated with un-capped gold assays. | |||||||

Figure 1: Champagne Gold Project 2020 Exploration Drill Hole Locations

Figure 2: Cross sections showing downhole AuEq intervals (red disks) plotted on 3D IP chargeability model. High AuEq values are associated with chargeability highs. The large, buried IP chargeability high is currently interpreted to be the center of the mineralizing system. Details about the recently competed IP survey at Champagne can be found in Idaho Champion's news release dated 2 February 2021.

Figure 3: 2020 Idaho Champion Core and Reverse Circulation Drill Holes and 2020 3D IP Chargeability Model

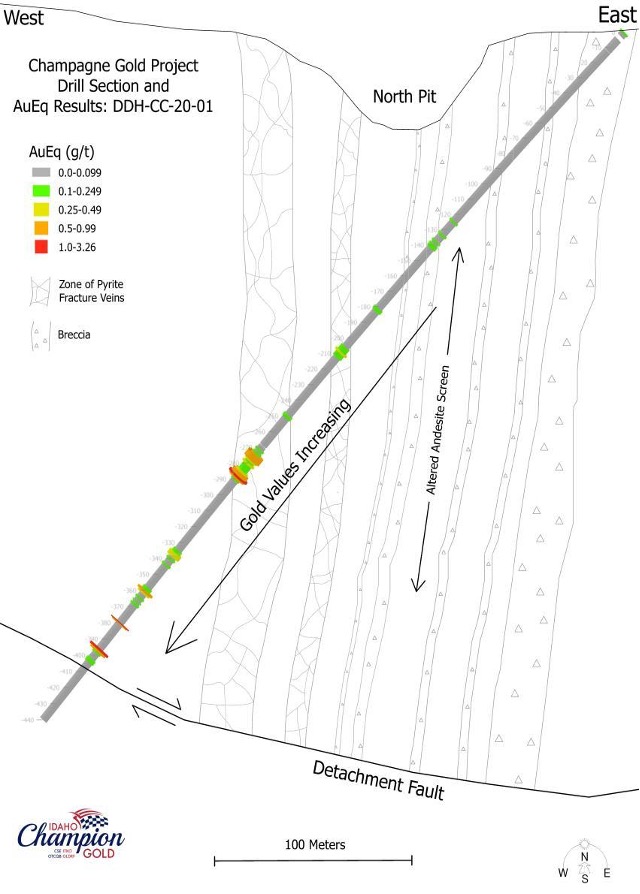

DDH-CC-20-01 (Fig. 4) was inclined westward beneath the central part of the North Pit across a series of mineralized and altered breccia and fractured intervals. The intervals represent a sheeted pyritiferous breccia zone, the upper oxidized portion of which was mined for gold and silver in the North Pit. Below the pit floor, the breccia intervals in the intercept were found to be separated by intervals of less-altered andesite. DDH-CC-20-01 is interpreted to have progressed from the very top of the hydrothermal mineralizing system down into increasingly gold-bearing parts of the system. This gradient of increasing gold with depth also correlates to intervals of increased levels of anomalous pathfinder metals (principally As, Hg, Sb, and Bi).

Figure 4: Champagne Gold Project Drill Section and AuEq Results: DDH-CC-20-01

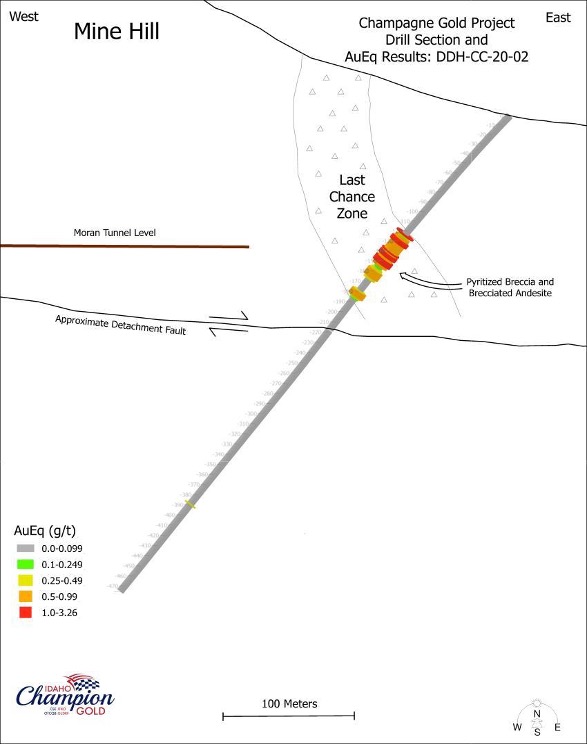

DDH-CC-20-02 (Fig. 5) was sited to test the projected trace of the Last Chance Zone, which had historically been exploited for oxide-silver (Horn Silver Mine) and deeper lead-zinc-silver sulfide mineralization. The reported common occurrence of accessory famatinite (copper-antimony sulfosalt) and aikinite (copper-bismuth sulfosalt) with the sulfide ore is also of exploration interest. The Last Chance Zone was intersected between drilling depths of 123.14 to 166.12 Metres and is comprised of strongly pyritized breccia and brecciated andesite with sulfide intervals approaching semi-massive character.

The results show that the zinc and lead values appear to be tapering off down hole, but anomalous gold content continues to depth, as does silver and copper. The pathfinder metal mercury reaches very high levels with scattered intervals of strong arsenic and scattered intervals of anomalous antimony and bismuth. A fault that is interpreted as a low-angle detachment structure was encountered below the intersection of the Last Chance Zone.

Figure 5. Drill Section and AuEq Results: DDH-CC-20-02

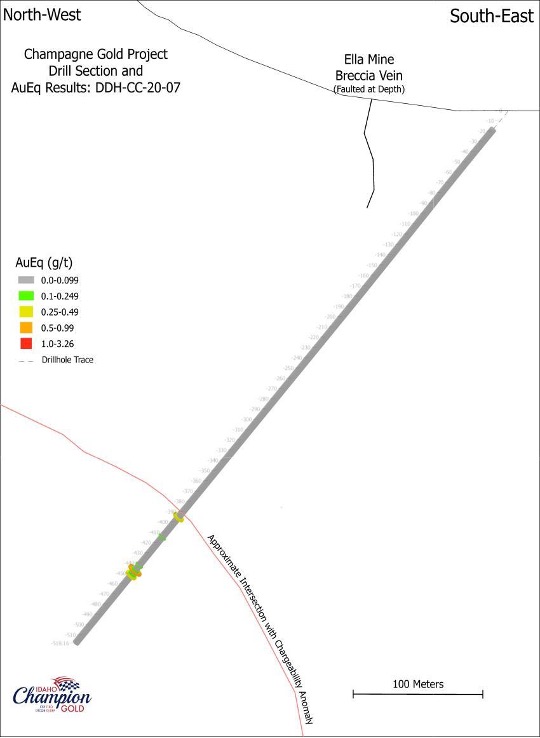

DH-CC-20-07 (Fig. 6) was designed to test the Ella Mine breccia vein but is interpreted to have instead pierced the detachment fault at shallow depth. The hole was advanced through propylitically altered footwall ash-fall and crystal tuff units in an effort to penetrate the eastern edge of the IP anomaly on Lines 4 and 5. Strong sericite-silica alteration and well-developed mosaic brecciation was intersected beginning at a depth of 340 m. The pyrite content increased to 3 - 8% with the sericite and silica alteration and is accompanied by anomalous silver, zinc, lead and arsenic (as well as weakly anomalous gold values). At depths of 441.96 to 452.63 Metres, anomalous silver (up to 42.3 g/t), copper (up to 0.22%), and anomalous gold (up to 0.107 g/t) occur within a brecciated interval. Zinc, lead, and arsenic are also anomalous within this interval. At a depth of 475 m, the hole returned to dominantly propylitic alteration with diminished pyrite content. The direction and angle of the hole suggests that only the outer-most edge of the IP anomaly was intersected.

Figure 6. Drill Section and AuEq Results: DDH-CC-20-07

Quality Assurance/Quality Control Procedure

Idaho Champion Gold adheres strictly to a regimented drill core handling and processing procedure. Core from the drill rig(s) is logged for lithology, mineralization, structure, alteration, and veining. During the logging process 1 to 2 metre samples are delineated by company geologists. Core is then photographed and sawn in half. Following sawing, individual samples are extracted from core boxes and inserted into individual sacks with a unique waterproof sample number tag and sealed. The remaining half-core is left in core boxes for post-cut photographing and storage. Sacks containing samples are kept indoors on site until they are transported to the assay lab.

Quality control (QC) samples are inserted into the sample stream such that there is one QC sample for every ten drill core samples. These QC samples consist of certified standards (known metallic content) and blanks (known barren of metals). Two styles of blank material were used: a coarse blank and a pulverized blank. QC sample insertions alternate between standard and blank.

The first sample shipment was delivered to ALS Geochemistry's facility in Elko, NV. All subsequent sample shipments were delivered to American Assay Labs (AAL) in Sparks, NV. ALS and AAL conform to ISO 17025 requirements. All drill samples and coarse blanks are crushed to 70% passing 2mm at the assay lab, and 1 kg material is split and pulverized to 85% passing 75 micron. All samples are processed by 30 gram fire assay- Inductively coupled plasma optical emission spectrometry (ICP-OES). Samples are additionally analyzed for 35, 36, or 61 multi-element analysis by ICP-OES and/or inductively coupled plasma mass spectrometry (ICP-MS). Samples containing Au or Ag above detection limits by ICP-OES analysis are automatically re-analyzed by fire assay with a gravimetric finish.

All drill intervals reported in this release are calculated using a 0.10 g/t gold cut off grade and a maximum of 3 Metres consecutive waste.

About the Champagne Project

The Champagne Mine* was operated by Bema Gold as a heap leach operation on an epithermal gold-silver system that occurs in volcanic rocks. Bema Gold drilled 72 shallow reverse circulation holes on the project, which complement drilling and trenching from other previous operators. The property has had no deep drilling or significant modern exploration since the mine closure in early 1992.

The Champagne Deposit contains epigenetic style gold and silver mineralization that occurs in strongly altered Tertiary volcanic tuffs and flows of acid to intermediate composition. Champagne has a near surface cap of gold-silver mineralization emplaced by deep-seated structures that acted as conduits for precious metal rich hydrothermal fluids. Higher grade zones in the Champagne Deposit appear to be related to such feeder zones.

* The Company cautions that the information about the past-producing mine may not be indicative of mineralization on Champion's property, and if mineralization does occur, that it will occur in sufficient quantity or grade that would result in an economic extraction scenario. The historic data were simply used to evaluate the prospective nature of the property. The Company has not yet conducted sufficient exploration to ascertain if a mineral resource is present on the property.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its 100%-owned highly prospective mineral properties located in Idaho, United States. The Company's shares trade on the CSE under the trading symbol "ITKO", on the OTCQB under the trading symbol "GLDRF", and on the Frankfurt Stock Exchange under the symbol "1QB1". Idaho Champion is vested in Idaho with the Baner Project in Idaho County, the Champagne Project located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. Idaho Champion strives to be a responsible environmental steward, stakeholder and a contributing citizen to the local communities where it operates. Idaho Champion takes its social license seriously, employing local community members and service providers at its operations whenever possible.

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 477- 7771 ext. 205

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company, including suggested strike extension. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/629895/Idaho-Champion-Reports-Results-of-2020-Core-Drilling-at-Champagne-Project-Idaho-including-104-gt-Gold-Equivalent-over-4298-Metres