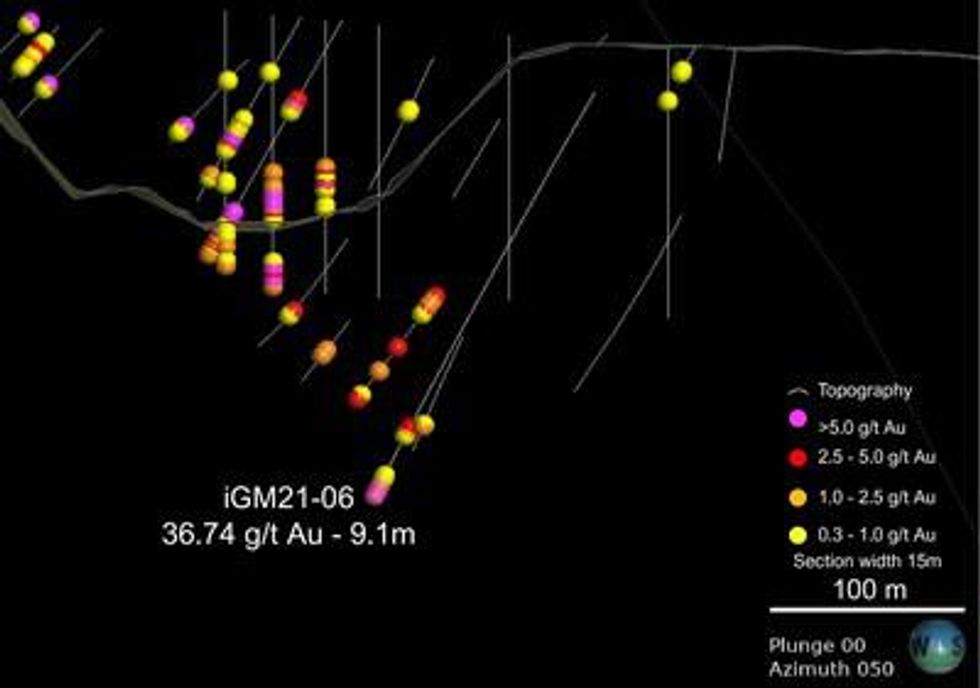

New results include 36.74 g/t Au over 9.1 Metres

i-80 Gold Corp. (TSX: IAU) (OTCQX: IAUCF) ("i-80", or the "Company") is pleased to announce that assay results for the first phase of drilling at the Company's Granite Creek Mine ("Granite Creek" or "the Property") Property, for geotechnical and metallurgical purposes associated with the planned open pit project, have been received and confirm the high-grade open pit opportunity.

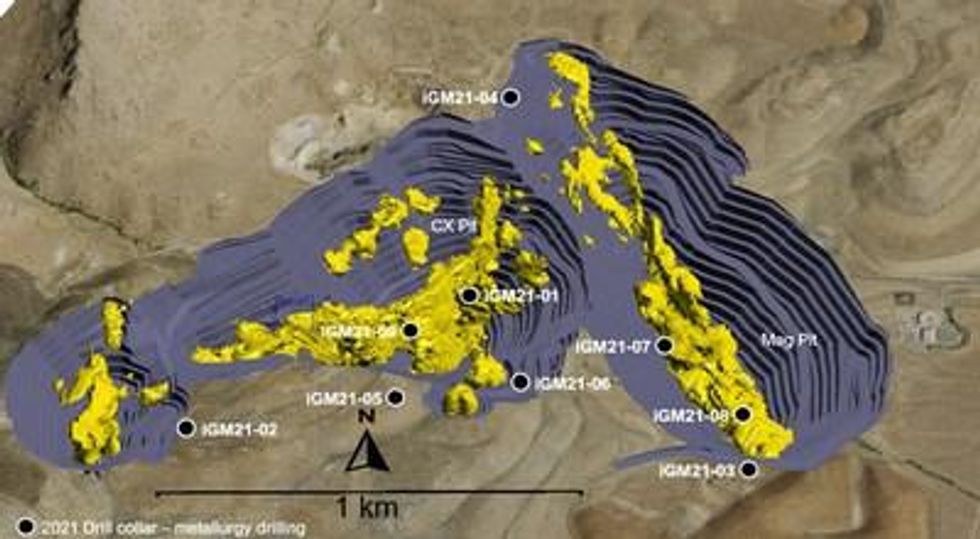

Several holes were drilled into the mineralized structures for metallurgical purposes including iGM21-01, 03, 08 and 09. Drilling in the CX-Pit area intersected higher than anticipated grades and additional drilling will likely be completed. Full results from the open pit drilling are set out in Table 1 below . The open pit program was completed for geotechnical and metallurgical purposes in advance of initiating permitting for an open pit mine with on-site processing. The balance of the ongoing drill program is primarily targeting mineralization to advance underground mining on the Property.

| | Table 1 – Highlight Assay Results from Open Pit Drilling | | |||||

| | New 2021 Drill Results from Granite Creek | | |||||

| Drillhole ID | Type | From (m) | To (m) | Length (m) | Au (g/t) | Estimated | |

| iGM21-01* | Core | 83.7 | 134.8 | 51.1 | 6.80 | 10 – 30% | |

| iGM21-02 | Core | 26.8 | 73.5 | 46.6 | 0.34 | 80 – 90% | |

| iGM21-03 | Core | 106.0 | 117.2 | 11.2 | 0.96 | 10 – 30% | |

| iGM21-03 | Core | 232.5 | 254.1 | 21.6 | 0.97 | 10 – 30% | |

| iGM21-06 | Core | 246.9 | 252.1 | 5.2 | 2.45 | 70 – 90% | |

| iGM21-06 | Core | 283.5 | 292.6 | 9.1 | 36.74 | 70 – 90% | |

| iGM21-08 | Core | 32.0 | 157.3 | 125.3 | 2.25 | 10 – 30% | |

| iGM21-08 | Core | 169.0 | 186.2 | 17.2 | 2.90 | 10 – 30% | |

| iGM21-08 | Core | 193.0 | 210.9 | 17.9 | 0.96 | 10 – 30% | |

| iGM21-09 | Core | 14.8 | 63.4 | 48.6 | 7.54 | 10 – 20% | |

| | | | | | | | |

| * | Previously released 08/30/2021 |

| Table 1a Collar Coordinates | ||||||

| UTM | Drillhole ID | East m | North m | Elevation m | Azimuth | Dip |

| NAD83 Zone 11 | iGM21-01 | 478255 | 4553917 | 1452 | 145 | -56 |

| iGM21-02 | 477494 | 4553225 | 1632 | 270 | -60 | |

| iGM21-03 | 478827 | 4553408 | 1503 | 020 | -56 | |

| iGM21-04* | 478351 | 4554172 | 1557 | 090 | -45 | |

| iGM21-05* | 478238 | 4553586 | 1543 | 310 | -63 | |

| iGM21-06 | 478369 | 4553708 | 1533 | 330 | -57 | |

| iGM21-07* | 478672 | 4553694 | 1434 | 000 | -45 | |

| iGM21-08 | 478810 | 4553573 | 1434 | 028 | -60 | |

| iGM21-09 | 478095 | 4553737 | 1445 | 145 | -54 | |

| * | Holes drilled for geotechnical purposes and thus do not contain significant intercepts |

The majority of the ongoing program, expected to consist of more than 20,000 metres of drilling that will extend well into 2022, is focused on defining and expanding mineralization within several high-grade target areas proximal to existing underground mine workings at Granite Creek. This program has yielded numerous successes including the identification of an extensive high-grade structure to the north of the underground mine workings that is the focus of surface expansion drilling.

i-80 has completed initial rehabilitation of the underground mine workings and the Company is also completing a major underground drilling program as part of an aggressive plan to re-commence mining. A test mining program is ramping up and a Preliminary Economic Assessment for Granite Creek was recently released, demonstrating robust economics associated with underground and open pit mining at the Property (See press release dated November 9, 2021 ).

"We continue to realize substantial success in numerous areas at Granite Creek, including the completion of open pit drilling in advance of permit applications", stated Matt Gili , President and Chief Operating Officer of i-80. "These successes bode well for the planned ramp-up of underground mining, planned for H1-2022 and the long-term future of this exciting property."

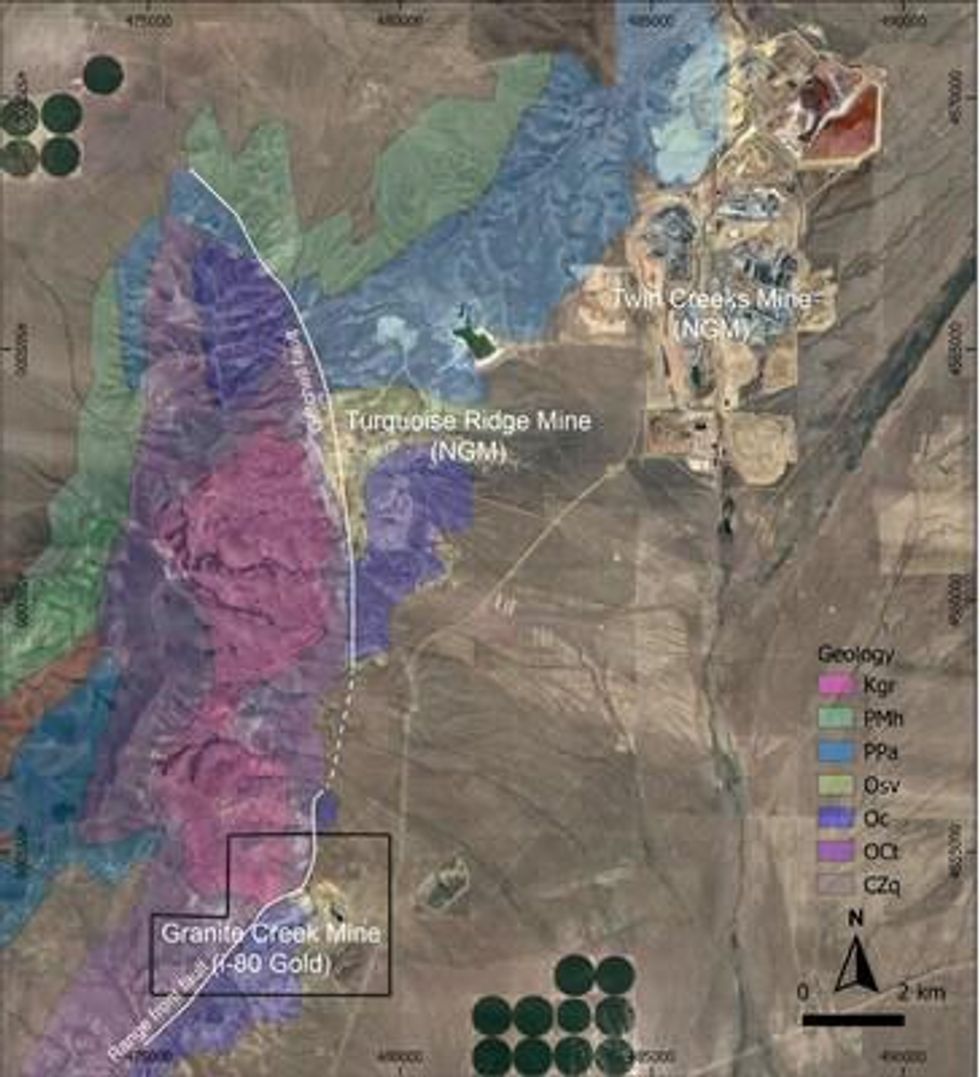

Granite Creek is strategically located immediately south of to Nevada Gold Mines' Turquoise Ridge and Twin Creeks mines at the north end of the Battle Mountain-Eureka Trend, at its intersection with the Getchell gold belt in Nevada (see Figure 3 below). i-80 recently entered into an interim processing agreement with Nevada Gold Mines that will provide for the processing of material from Granite Creek at the nearby Twin Creeks (Sage) plant.

QAQC Procedures

All samples were submitted to Paragon Geochemical Assay Laboratories (PAL) of Sparks, NV , which is an ISO 9001 and 17025 certified and accredited laboratory, independent of the Company. Samples submitted through PAL are run through standard prep methods and analysed using FA-Pb30-ICP (Au; 30g fire assay) and 48MA-MS (48 element Suite; 0.5g 4-acid digestion/ICP-MS) methods. PAL also undertake their own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. i-80 Gold Corp's QA/QC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results.

Qualified Person

Tim George, PE, is the Qualified Person for the information contained in this press release and is a Qualified Person within the meaning of National Instrument 43-101.

About i-80 Gold Corp.

i-80 Gold Corp. is a well-financed, Nevada-focused, mining company with a goal of achieving mid-tier gold producer status through the development of multiple deposits within the Company's advanced-stage property portfolio to complement existing gold production from the Ruby Hill open pit.

______________________________________________

| Certain statements in this release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws, including but not limited to, commencement of trading of i-80 Gold on the Toronto Stock Exchange and completion of the acquisition of the Getchell Project. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the Company's current expectations regarding future events, performance and results and speak only as of the date of this release. |

| |

| Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations. |

SOURCE i-80 Gold Corp