Graycliff Exploration Limited (the "Company" or "Graycliff") (CSE:GRAY)(OTCQB:GRYCF)(FSE:GE0) is pleased to announce expanded (full) assay results on the previously announced first drill hole of its over 2,000 metre ("m") phase two core drilling program on the Company's Shakespeare Gold Project located on the prolific Canadian Shield near Sudbury, Ontario

Drill Hole J-8-21 intersected a mineralized interval of 16.37 g/t gold ("Au") over 16.0 metres including the previously announced interval of 67.10 g/t Au over 3.0 m (see Press Release dated May 19, 2021), as detailed below:

Drill Hole | From (m) | To (m) | Width (m)1 | Au (g/t) 2 |

J-8-21 | 89.0 | 105.0 | 16.00 | 16.37 |

including | ||||

90.5 | 102.0 | 10.52 | 6.50 | |

also including | ||||

102.0 | 105.0 | 3.00 | 67.10 | |

as well as | ||||

102.3 | 103.0 | 0.70 | 90.10 | |

and | ||||

104.0 | 105.0 | 1.00 | 137.00 | |

| 1 - Reported intervals are down-hole lengths and not true thicknesses. True width of the mineralization cannot be determined due to the early-stage nature of the current program. 2 - Length-weighted average grades are calculated using un-capped gold assay data. | ||||

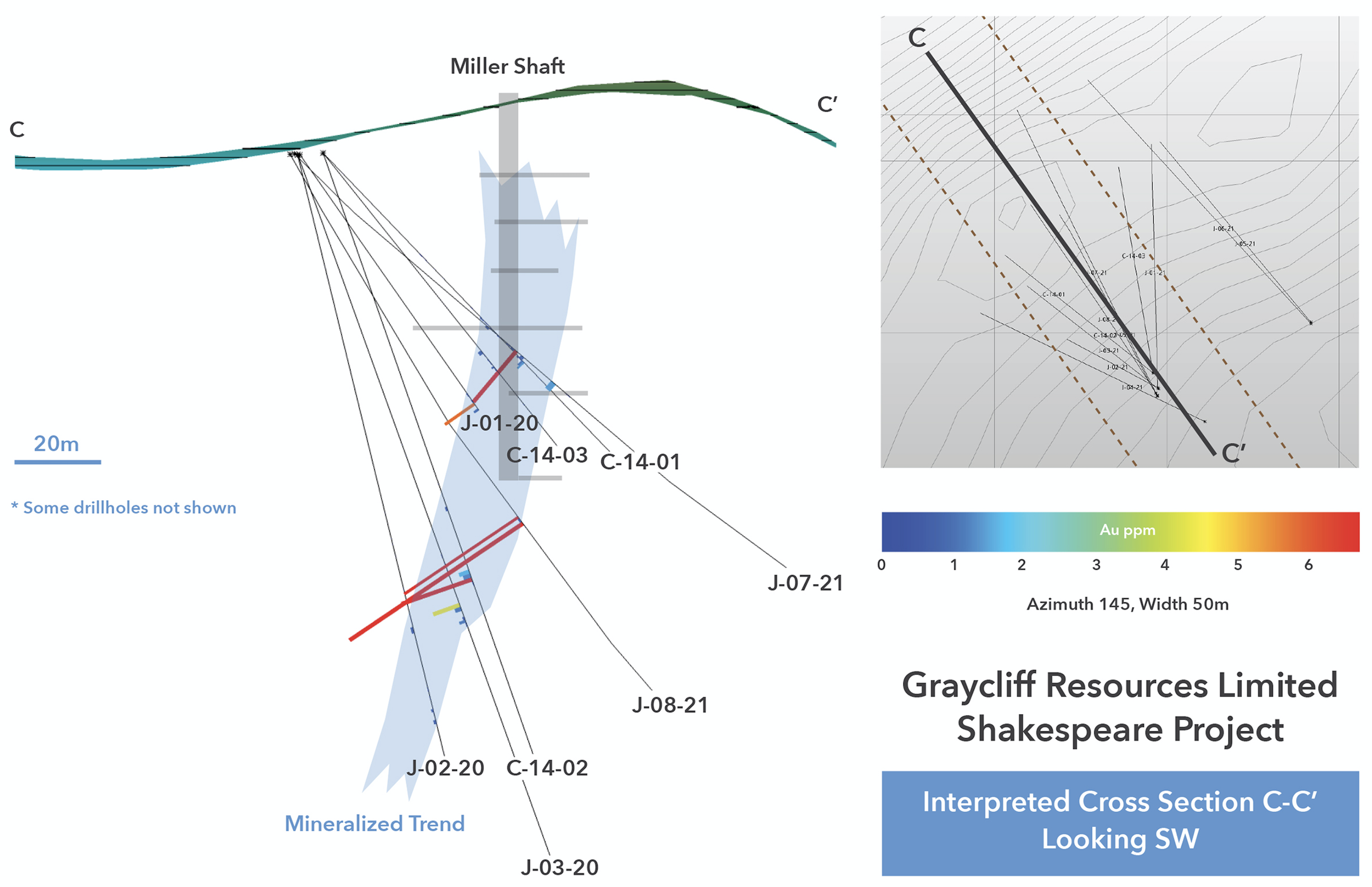

"Based on our analysis of the drill hole J-8-21, our first hole from the phase two drilling, in combination with prior results, we now believe that there is one larger zone of mineralization, not two narrower parallel zones as shown in earlier press releases. This broad 16 metre section with two distinct high-grade intervals is located approximately 30 metres down-dip of the mineralization that we reported from drill hole J-7-20. We expect to able to release additional assay results from the phase two drilling in the coming weeks," stated President and CEO, James Macintosh.

Phase Three drilling continues in the vicinity of the Miller shaft, along strike and down-dip of the high-grade intersection in hole J-8-21. A number of batches of samples have been delivered to the analytical lab in Sudbury and assay results are expected in September for several holes.

Figure 1 - Hole J-8-21 Location and Cross Section

Qualified Person

Bruce Durham, P.Geo, is a Qualified Person, as that term is defined by Canadian regulatory guidelines under NI 43-101, and has read and approved the technical information contained in this press release.

About Graycliff Exploration Limited

Graycliff Exploration is a mineral exploration company focused on its 1,025 hectares of prospective ground, located roughly 80 kilometres west of Sudbury on the prolific Canadian Shield. The Company's Shakespeare Project consists of one crown patented lease, two crown leases and 40 claims on a property associated with the historic Shakespeare Gold Mine, which operated from 1903 to 1907. Graycliff's Baldwin Project is adjacent to the east and is comprised of 68 claims covering 1,500 hectares.

QA/QC Protocol: https://graycliffexploration.com/wp-content/uploads/2021/06/graycliffexploration-qa-qc-protocols-june-2021.pdf

For more information, contact investor relations at investors@graycliffexploration.com

On Behalf of the Board of Directors,

James Macintosh

President and CEO

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release.

This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable

SOURCE: Graycliff Exploration Ltd.

View source version on accesswire.com:

https://www.accesswire.com/659404/Graycliff-Exploration-Expands-Near-Surface-High-Grade-Interval-in-Hole-8-to-1637gt-Gold-Over-160-Metres