(TheNewswire)

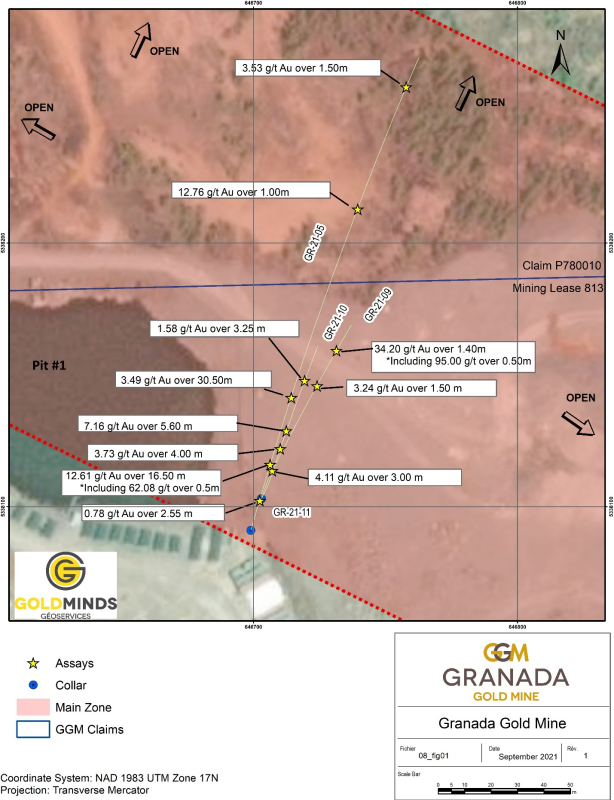

These new intercepts verify the continuity of gold mineralization along the main vein structure East of Pit #1 and support the extent of high-grade gold.

Granada Gold Mine Inc. (TSXV:GGM) (OTC:GBBFF) (Frankfurt:B6D) (the "Company" or "Granada") is pleased to announce additional drill results from its on-going drill program at its Granada Gold project with multiple new assays from its 200-Series drill holes with grades of up to 7.16 gt Au over 5.60m and 95.00 gt Au over 0.50m

Drilling Highlights

- The 200-Series drill holes (GR-21-05, GR-21-09, GR-21-10, and GR-21-11) were designed to determine the variability of gold mineralization of the main vein zone within the eastern extension of Pit #1 by drilling down the dip of the structure.

- These assay results confirm the significant extent of localized high-grade gold mineralization within the structure as well as prove the continuity of the mineralization over much broader intervals up to 263m down-dip of the main zone below Pit #1.

- Previously released results from GR-21-05 graded 3.49 g/t over 30.50m (including 66.54 g/t over 0.50m (Press release June 21, 2021), and 12.61 g/t over 16.50m (including 62.06 g/t over 0.50m), with new results grading 12.76 g/t over 1.00m, and 3.53 g/t over 1.50m.

- GR-21-09 intersected 4.11 g/t over 3.00m, 3.24 g/t over 1.50m, 34.20 g/t over 1.40m including 95.00 g/t over 0.50m.

- GR-21-10 intersected 3.73 g/t over 4.00m, 7.16 g/t over 5.60m, and 1.58 g/t over 3.25m.

- GR-21-11 intersected 2.65 g/t over 3.0m.

"The assay results in these drill holes proved the continuity along the main structure and confirmed the extent to depth of high-grade gold mineralization. This supports the view that our gold grades and occurrences are continuous and have substantial thickness to the zone." said Frank J. Basa, P.Eng., President and CEO.

The mineralized zone beneath the eastern extension of Pit #1 contains a collection of multiple veins with sulfide mineralized halos. The zone contains 3 distinct sub-parallel mineralized veins which connect with the former Pit #1 to the west. The true thickness of these mineralized structures varies between 2m and 11 m. The main zone of these 3 structures is what was tested with the 200-Series drill holes.

Figure 1: Plan Map Showing Drill Hole and Assay Locations just East of Pit #1

Table 1: Sample Details

| Hole ID | Target Location | From (m) | To (m) | Length (m) | Au (g/t) |

| GR-21-05 | Main Zone Pit #1 | 37.5 | 54.00 | 16.50 | 12.61 |

| Including | Main Zone Pit #1 | 39.75 | 40.50 | 0.75 | 23.52 |

| Including | Main Zone Pit #1 | 43.00 | 43.50 | 0.50 | 62.08 |

| Including | Main Zone Pit #1 | 44.50 | 45.00 | 0.50 | 23.64 |

| Including | Main Zone Pit #1 | 46.50 | 47.00 | 0.50 | 31.26 |

| Including | Main Zone Pit #1 | 51.00 | 51.50 | 0.50 | 27.86 |

| GR-21-05 | Main Zone Pit #1 | 79.00 | 109.50 | 30.50 | 3.49 |

| Including | Main Zone Pit #1 | 109.00 | 109.50 | 0.50 | 66.54 |

| GR-21-05 | Main Zone Pit #1 | 188.50 | 189.50 | 1.00 | 12.76 |

| GR-21-05 | Main Zone Pit #1 | 261.00 | 262.50 | 1.50 | 3.53 |

| GR-21-09 | Main Zone Pit #1 | 21.00 | 24.00 | 3.0 | 4.11 |

| GR-21-09 | Main Zone Pit #1 | 87.00 | 88.50 | 1.50 | 3.24 |

| GR-21-09 | Main Zone Pit #1 | 115.60 | 117.00 | 1.40 | 34.20 |

| Including | Main Zone Pit #1 | 116.10 | 117.00 | 0.50 | 95.00 |

| GR-21-10 | Main Zone Pit #1 | 42.50 | 46.50 | 4.00 | 3.73 |

| Including | Main Zone Pit #1 | 46.00 | 46.50 | 0.50 | 22.80 |

| GR-21-10 | Main Zone Pit #1 | 60.00 | 65.60 | 5.60 | 7.16 |

| GR-21-10 | Main Zone Pit #1 | 109.00 | 112.25 | 3.25 | 1.58 |

| GR-21-11 | Main Zone Pit #1 | 23.50 | 26.05 | 2.55 | 0.78 |

The 200-Series holes were designed with an azimuth of 10-30 degrees to the north attempting to drill down the vein structures as opposed to obliquely. Normally, the drill holes are aimed southward which are designed to intersect the structures at a high angle, with an azimuth in the general range of 170-190 degrees. Previous intercepts into this structure have returned 6.95 g/t gold over 3.50 meters ( true thickness) in hole GR-11-380 (Press release September 18, 2012), and 11.45 g/t gold over 33.00 meters in hole GR-19-A (Press Release January 9, 2020). The grades we see in the 200-Series drill holes validate the grades encountered previously in other drill programs and confirm the continuity of the gold mineralization. It also demonstrates that the system is a multi-vein system (as opposed to a single discrete vein). This is why the true thickness of the gold mineralization at Granada varies significantly from small high-grade intervals, such as 95.00 g/t over 0.50m, to even 0.31 g/t over 301m (Press Release September 18, 2012) depending on the location within the property and cut-off grade used for the calculation.

Location

The Granada Gold project is located near Rouyn-Noranda adjacent to the prolific Cadillac Break shear zone, which is hosted in Pontiac metasedimentary rocks, granites, and younger syenite sills along the Granada shear zone (LONG Bars Zone). The project is located on the same side of the Cadillac Fault as the Canadian Malartic mine property, which has historically produced 12.7 million Ounces of gold from 1935 to 2010 with an additional 5 million ounces as of June 18, 2020 (Canadian Malartic Technical Report of March 25, 2021 & Le Citoyen June 19, 2020).

Qualified person

The technical information in this news release has been reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc., a member of the Québec Order of Engineers, and is a qualified person in accordance with the National Instrument 43- 101 standards.

Quality Control and Reporting Protocols

All NQ core assays reported for Wedges of 2020 holes were obtained by either 1-kilogram screen metallic fire assay or standard 50-gram fire assay (with either atomic absorption or gravimetric finish). This was completed at the SGS Laboratory in Vancouver, British Columbia with the sample preparation completed in Val d'Or, Québec. The 2021 assay results are from ALS laboratory in Val d'Or. The screen metallic fire assay method is pre-selected by the geologist or geological engineer when samples contain visible gold. The drill program, quality assurance, quality control (QAQC), and interpretation of results is performed by qualified persons employing procedures consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QAQC purposes for this program in addition to the lab QAQC.

Mineral Resource Estimate

On March 15, 2021 the Company released an updated NI 43-101 resource estimate for the Granada Gold project (Please see January 29, 2021 news release) with a combined total of 713,000 gold ounces of measured, indicated, and inferred. This estimate contains 351,000 gold ounces of combined measured, indicated, and inferred for the open pit and 362,000 gold ounces of combined measured, indicated, and inferred for the underground. Please see Table 2 below for full details. Report reference: Granada Gold Project Mineral Resource Estimate Update, Rouyn-Noranda, Quebec, Canada authored by Yann Camus, P.Eng. and Maxime Dupéré, B.Sc, P.Geo., SGS Canada Inc. with an effective date of December 15, 2020 and signature date of March 15, 2021.

Table 2: Mineral Resource Estimate Showing Tonnes, Average Grade, and Gold Ounces

| Type | Category | Tonnes | Avg Grade Au (g/t) | Gold Ounces |

| Open Pit | Measured | 3,756,000 | 1.89 | 228,000 |

| Indicated | 1,357,000 | 2.55 | 111,000 | |

| Measured + Indicated | 5,113,000 | 2.06 | 339,000 | |

| Inferred | 34,000 | 11.29 | 12,000 | |

| Underground | Measured | 37,000 | 4.22 | 5,000 |

| Indicated | 807,000 | 4.02 | 104,000 | |

| Measured + Indicated | 844,000 | 4.03 | 109,000 | |

| Inferred | 1,244,000 | 6.33 | 253,000 |

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop and explore its 100% owned Granada Gold Property near Rouyn-Noranda, Quebec, and is adjacent to the prolific Cadillac Break. The Company owns 14.73 square kilometers of land in a combination of mining leases and claims. The company is currently undergoing a large drill program with 30,000m out of 120,000m complete. The drills are currently paused to provide the technical team with the necessary time to evaluate and assimilate existing data.

The Granada Shear Zone and the South Shear Zone contain, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and a half kilometers. Three of these structures were mined historically from four shafts and three open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 m and 498 m with open pit grades from 3.5 to 5 grams per tonne gold.

The property includes the former Granada Gold underground mine which produced more than 50,000 ounces of gold at 10 grams per tonne gold in the 1930's from two shafts before a fire destroyed the surface buildings. In the 1990's, Granada Resources extracted a bulk sample (Pit #1) of 87,311 tonnes grading 5.17 g/t Au. They also extracted a bulk sample (Pit # 2) of 22,095 tonnes grading 3.46 g/t Au.

"Frank J. Basa"

Frank J. Basa, P. Eng.

Chief Executive Officer

For further information, Contact:

Frank J. Basa, P.Eng.

Chief Executive Officer

P: 416-625-2342

Or:

Wayne Cheveldayoff,

Corporate Communications

P: 416-710-2410

E: waynecheveldayoff@gmail.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Copyright (c) 2021 TheNewswire - All rights reserved.