(TheNewswire)

Vancouver, BC TheNewswire - July 15, 2021 Alianza Minerals Ltd. (TSXV:ANZ ) ( OTC:TARSF) ("Alianza") and Cloudbreak Discovery PLC (LSE:CDL) ("Cloudbreak") announce the acquisition of the first project generated from their newly formed Strategic Alliance (the "Alliance"). The Klondike Property, located in Colorado, consists of 72 Bureau of Land Management (BLM) claims and a State of Colorado Exploration Permit with an exclusive right to a State Lease.

This Alliance will focus on the identification, acquisition and advancement of copper projects in the southwestern US states of Arizona, Colorado, New Mexico and Utah. The two companies anticipate this to be the first of many projects and will continue to identify new copper exploration opportunities to acquire and advance with the intent of finding strong partners to move the projects forward.

Klondike Project Highlights:

-

- Road accessible 843 hectare property covering Paradox basin sedimentary package in San Miguel County, Colorado

- Favourable stratigraphy known to host sediment-hosted copper deposits in the emerging Paradox Copper Belt

- No copper exploration since the 1960s in the area

- Exploring for additional deposits similar to the operating Lisbon Valley Mine, 50 km to the northwest

Jason Weber, President and CEO of Alianza , noted that, "The Klondike property is the first example of the ideas generated out of this alliance and demonstrates the potential we see for additional, bona fide copper prospects in this under-explored region."

Kyler Hardy, President and CEO of Cloudbreak , reflected on Klondike, stating, "We are very excited to investigate the high-grade potential demonstrated by the historical work. We know these rocks are prospective for copper mineralization as evidenced by other deposits in the belt and the active Lisbon Valley Copper Mine".

About the Klondike Project

The Klondike project is located approximately 25 km south of Naturita, Colorado. This property lies within the Paradox Copper Belt, which includes the producing Lisbon Valley Copper Mine. There are numerous historical copper occurrences that have been identified throughout the district, however, many of these have not been explored using modern exploration techniques.

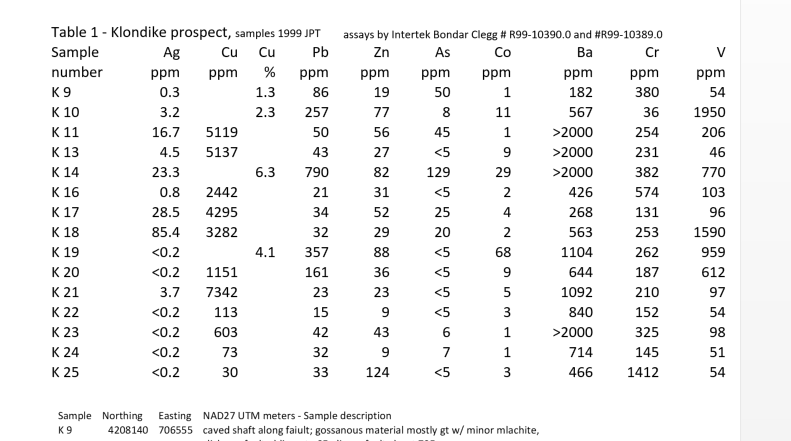

At Klondike, documented copper exploration ceased in the 1960s with subsequent exploration targeting uranium during the 1970s. Previous workers reported high-grade copper mineralization highlighted by results of 6.3% copper and 23.3 g/t silver in outcrop. In addition to its high-grade potential, disseminated copper-silver mineralization has been observed which may be amenable to modern open pit mining with Solvent Extraction Electro Winning (SXEW) processing similar to the Lisbon Valley Mine. Sedimentary-hosted copper deposits are an important contributor to world copper production, accounting for more than 20% of the world's copper supply annually.

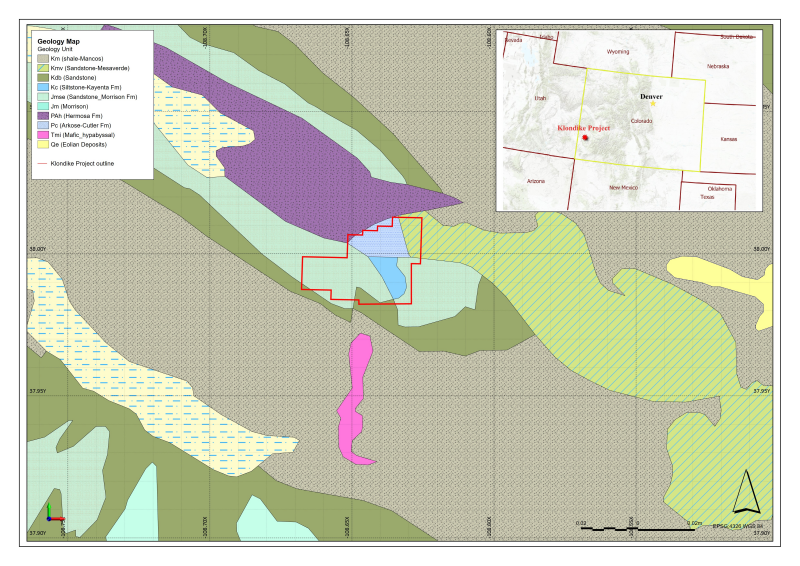

Figure 1. Klondike Property Location Map

Klondike is located at the southeast end of a gypsum salt anticline in a similar structural setting as Lisbon Valley. Copper mineralization occurs in bleached and altered, porous and permeable, sandstone units adjacent to small graben-bounding normal faults. Copper mineralization in outcrop includes malachite, azurite, chalcocite and black copper oxides.

Surface sampling of mineralized outcrops along the graben faults has yielded assay results up to 6.3% copper and 23.3 g/t silver. Eleven of 15 samples reported from a limited historical prospecting and mapping program returned assays ranging from 0.12 to 6.3% copper and below detection to 85.4 g/t silver. Additionally, disseminated copper-silver mineralization has also been identified in outcropping sandstones of Jurassic and Permian age. Both styles of mineralization will be investigated in upcoming work programs with the goal of refining drill targets in these units. Initial work will include detailed geological mapping, soil and rock sampling, and geophysics.

Under the terms of the Alliance, either company can introduce projects to the Strategic Alliance. Projects accepted into the alliance will be held 50/50 but funding of the initial acquisition and any preliminary work programs will be funded 40% by the introducing partner and 60% by the other party. Project expenditures are determined by committee, consisting of two senior management personnel from each party. Alianza is the operator of alliance projects unless the Alliance steering committee determines, on a case-by-case basis, that Cloudbreak would be a more suitable operator. The initial term of the Alliance is two years and may be extended for an additional two years.

Alianza and Cloudbreak expect to commence exploring on the property imminently.

About Alianza Minerals Ltd.

Alianza employs a hybrid business model of joint venture funding and self-funded projects to maximize opportunity for exploration success. The Company currently has gold, silver and base metal projects in Yukon Territory, British Columbia, Colorado, Nevada and Peru. Alianza currently has one project (Tim, Yukon Territory) optioned out to Coeur Mining, Inc. and a copper exploration alliance in the southwestern United States with Cloudbreak Discovery PLC. Alianza also is seeking partners on other projects. The Company is listed on the TSX Venture Exchange under the symbol "ANZ" and trades on the OTCQB market in the US under the symbol "TARSF".

Mr. Jason Weber, P.Geo., President and CEO of Alianza Minerals Ltd. is a Qualified Person as defined by National Instrument 43-101. Mr. Weber supervised the preparation of the technical information contained in this release.

About Cloudbreak Discovery PLC

Cloudbreak Discovery PLC is a leading natural resource project generator, working across a wide array of mineral assets that are being developed and managed by an experienced team with a proven track record. Value accretion within the projects being developed by Cloudbreak's generative model enables a multi-asset approach to investing. Diversification within the mining sector and amongst resource classes is key to withstanding the cycles of natural resource investing.

For further information, contact:

Jason Weber, President and CEO

Sandrine Lam, Shareholder Communications

Tel: (604) 807-7217

Fax: (888) 889-4874

Renmark Financial Communications Inc.

Melanie Barbeau

mbarbeau@renmarkfinancial.com

Tel: (416) 644-2020 or (514) 939-3989

To learn more visit: www.alianzaminerals.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. STATEMENTS IN THIS NEWS RELEASE, OTHER THAN PURELY HISTORICAL INFORMATION, INCLUDING STATEMENTS RELATING TO THE COMPANY'S FUTURE PLANS AND OBJECTIVES OR EXPECTED RESULTS, MAY INCLUDE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS ARE BASED ON NUMEROUS ASSUMPTIONS AND ARE SUBJECT TO ALL OF THE RISKS AND UNCERTAINTIES INHERENT IN RESOURCE EXPLORATION AND DEVELOPMENT. AS A RESULT, ACTUAL RESULTS MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS.

Copyright (c) 2021 TheNewswire - All rights reserved.