Xplore Resources Corp. (TSXV: XPLR) ("Xplore" or the "Company"), has identified and prioritized targets at its Upper Red Lake Project ("Upper Red Lake"), located in the Red Lake Mining Division, Ontario.

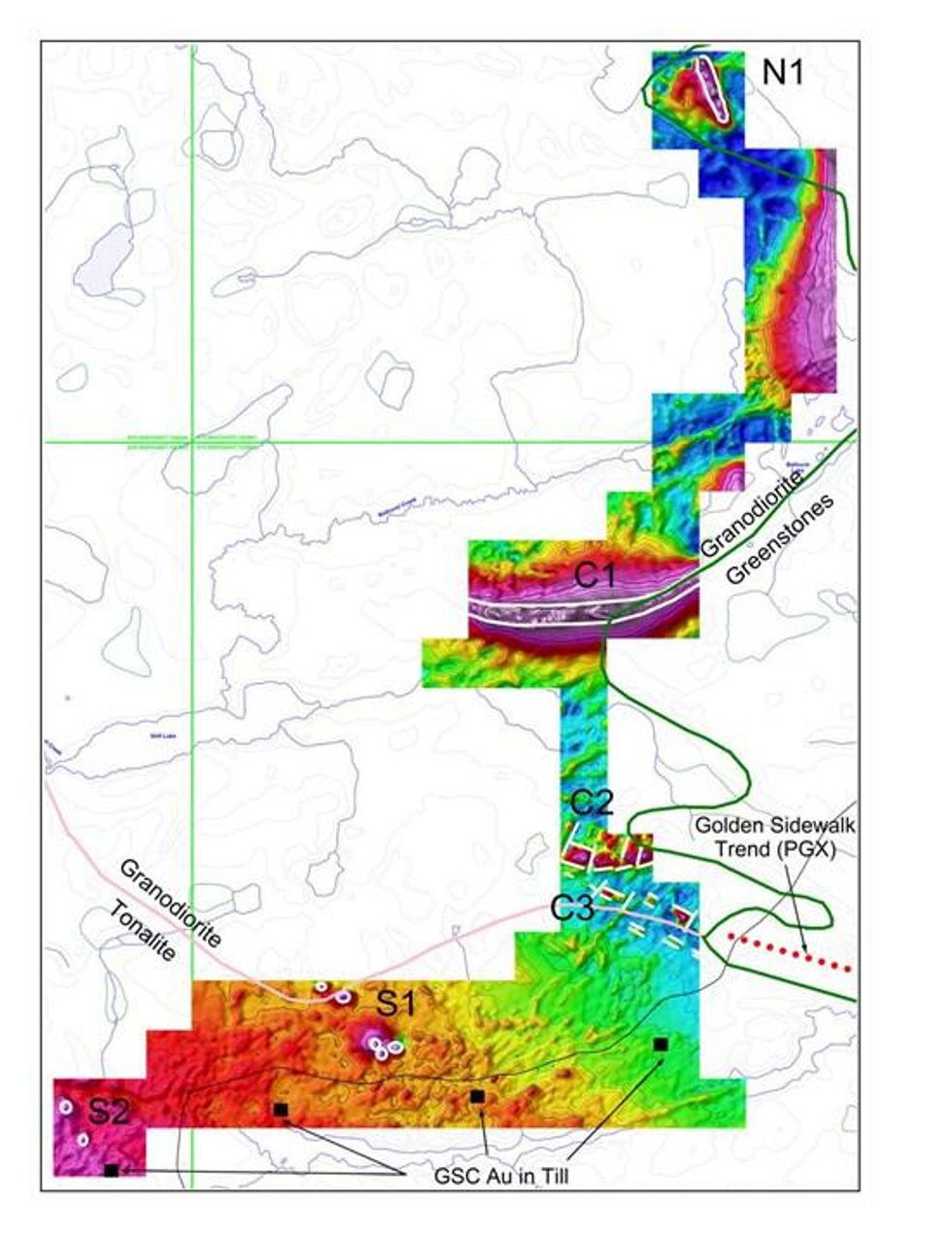

Jeremy S. Brett, M.Sc., P.Geo., Senior Consulting Geophysicist, Jeremy S. Brett International Consulting Ltd., has reviewed the airborne magnetic data for the Upper Red Lake property, identifying six priority anomalies for field follow-up (Ref. Figure 1.0). A brief overview of each target follows:

C1 An E-W MAG high, the C1 target, traceable over 2,200 metres within mapped granodiorites, interpreted to represent possible ultramafic volcanic rocks emplaced along and wrapping around the granodiorite-greenstone contact.

C2 A second E-W MAG high response with multiple interpreted structural offsets that parallels the C1 target but is more broken up. C2 occurs along the interpreted trendline of Prosper Gold Corp's Golden Sidewalk Project to the east.

C3 A WNW structural trend, the C3 target is interpreted to represent the western continuation of Prosper Gold Corp's Golden Sidewalk trend.

N1 A NNW striking MAG high, the N1 target, traceable over 700 metres lying entirely within mapped greenstones in the northern most part of the claim block, and potentially another ultramafic intrusive emplaced along the granodiorite-greenstone contact.

S1 Five, semi-circular MAG high signatures, the S1 targets, that may reflect potential kimberlites or small diameter untramafic intrusives oriented along a NW trend entirely within mapped tonalites.

S2 Two semi-circular MAG highs oriented along a NW trend within the mapped tonalite, identified as the S2 targets.

Waldo Sciences Inc. ("Waldo") Vernon, B.C., completed preliminary reconnaissance mapping, prospecting, till and rock sampling of the C1, 2 and 3 target areas in October 2021. Waldo's work identified several meta-volcanic outcrops with disseminated sulphide mineralization at Targets C2 and C3 which lie along strike of Prosper Gold's Golden Sidewalk target. Waldo collected samples from outcrop and completed reconnaissance scale gold in till sampling of the C2 and C3 target areas. Results are anticipated in Q1, 2022.

Wes Hanson, P.Geo., President and CEO of Xplore, notes, "The objective of the airborne survey was to prioritize targets for follow-up mapping, sampling and, if warranted, drilling. We were fortunate that Waldo was able to access the site and prospect the C1,2 and 3 target areas prior to the onset of winter. We expect the results of the reconnaissance samples collected by Waldo in Q1, 2022. The Red Lake - Birch Uchi greenstone belt is seeing a significant surge in interest following the success of Great Bear Resources at their Dixie Project which has led to a takeover bid by Kinross Gold, valued at C$ 1.8 billion, and First Mining Gold Corp's decision to develop the Springpole deposit. In addition, Barrick Gold has announced two separate transactions to earn into the Red Lake camp, further evidence that Red Lake is a compelling exploration district."

Mr. Hanson also notes, "The anomalous gold in till results identified by the Geological Survey of Canada lie entirely within a large tonalite and are well south and down ice of the projected trend of Prosper Gold Corp's Golden Sidewalk project volcanic host rocks. The GSC results indicate grades of up to 1,200 ppb Au with numerous, pristine gold grains observed in the four samples spread across a 4,000 metre strike extent. These anomalous gold in till results currently remain unexplained."

About Xplore Resources (TSXV: XPLR)

Xplore Resources is a Toronto based mining exploration company listed on the TSX Venture Exchange under symbol XPLR and is focused on the acquisition and development of copper and gold projects in the Americas. The Company is led by a highly experienced management team and is comprised of industry experts with executive and senior management experience.

Qualified Persons

Mr. Wes Hanson, P. Geo., President & CEO of Xplore and registered in the Provinces of Ontario is the "Qualified Person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and is responsible for the technical contents of this news release and has approved the disclosure of the technical information contained herein.

ON BEHALF OF THE BOARD

"Wesley C. Hanson"

President & CEO

For further information, please contact:

Phone: +1 647-362-9675

Email: info@xploreresources.com

Figure 1.0 - Upper Red Lake - Total Magnetic Intensity with Priority Targets

To view an enhanced version of Figure 1.0, please visit:

https://orders.newsfilecorp.com/files/7519/107553_5ac9e49914a49be5_002full.jpg.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

ANY SECURITIES REFERRED TO HEREIN WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT"), AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES OR TO A U.S. PERSON IN THE ABSENCE OF SUCH REGISTRATION OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE 1933 ACT.

THE TSX VENTURE EXCHANGE INC. HAS IN NO WAY PASSED UPON THE MERITS OF THE PROPOSED TRANSACTION AND HAS NEITHER APPROVED NOR DISAPPROVED THE CONTENTS OF THIS PRESS RELEASE.

Notice on forward-looking statements:

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Xplore cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Xplore's control. Such factors include, among other things: risks and uncertainties relating to Xplore's ability to complete the proposed Transaction; and other risks and uncertainties, including those to be described in the Filing Statement to be filed by Xplore on SEDAR.com. Accordingly, actual, and future events, conditions and results may differ materially from the estimates, beliefs, intentions, and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Xplore undertakes no obligation to publicly update or revise forward-looking information.

###

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107553