Altiplano Metals Inc. (TSXV: APN) (WKN: A2JNFG) ("Altiplano" or the "Company") is pleased to report assay results from an additional seven drill holes at its ongoing exploration drilling program at the Farellon copper-gold (Cu-Au) mine located near La Serena, Chile.

Highlights

- 18 holes have been completed at Farellon for a cumulative total of 3,261 metres of drilling.

- Assay results from 14 of the 18 holes drilled to-date have been received with 7 new holes reported as outlined in Table 1. (See news release dated 3 November 2021 for results from the initial seven holes).

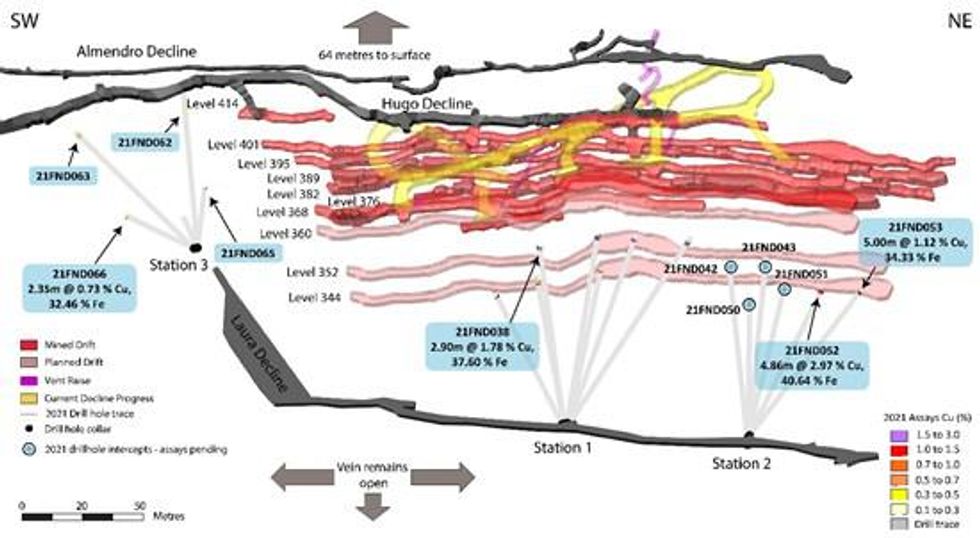

- All additional holes have intersected the mineralized vein system at depth observed up to 24 m below the 360 km operational level and along the NE-SW strike extensions. Strong results were observed from Drill Station 2 yielding 2.97% Cu over 4.86 m and 1.12% Cu over 5.00 m (Figure 1.).

- Recent drill results further demonstrate the mineralized areas observed in the core are consistent with the mineralized areas of the upper zones of Farellon vein system that were previously drilled and consistent with ongoing mining operations. Since 2018, the grade at Farellon has averaged 1.74% Cu through sales of Cu-Au material extracted from the Hugo Decline.

- Exploration holes at Drill Station 3 display elevated copper and substantial iron content, demonstrating continuity of the mineralized system thus providing additional exploration upside to the southwest of existing workings.

- Drilling results in this area delineate high iron content that has been historically discarded as waste material. The El Péñon processing facility, currently in construction, will include an iron separation unit which will provide opportunity to capture significant secondary revenue from the sale of iron in future operations. Altiplano expects to utilize lower grade copper zones in the coming quarters with additional revenue expected from iron recovery.

- In the 14 reported intervals from the ongoing drill campaign, iron content ranges from 9.2% up to 70.6%, with an average value of 24.15%.

- The drill program has 2 holes remaining at Drill Station 2 to complete the program and will be mobilized to the Maria Luisa project to begin a new drill program to support the current underground exploration program.

CEO Alastair McIntyre comments, "We are very pleased with the results of the drill program which demonstrates that the Farellon Iron-Oxide-Copper-Gold vein system continues along strike and at depth. Drilling has yielded very good assay results particularly in the NE portion of the mine and this work supports our underground expansion plans and delineates additional tonnage for extraction. We are also seeing encouraging high iron grades to the SW which will support our future mining operations as we build copper and iron processing capacity at our mill."

Figure 1. Assay Results

| DDH* | From (m) | To (m) | Width** | Fe % | Au ppm | Cu % |

| 21FND038 | 188.40 | 191.30 | 2.90 | 37.60 | 0.09 | 1.78 |

| 21FND052 | 181.75 | 186.61 | 4.86 | 40.64 | 0.09 | 2.97 |

| including | 181.75 | 185.11 | 3.36 | 47.44 | 0.13 | 4.20 |

| 21FND053 | 180.30 | 185.30 | 5.00 | 34.33 | 0.05 | 1.12 |

| including | 182.20 | 185.30 | 3.10 | 39.00 | 0.07 | 1.64 |

| 21FND062 | 107.58 | 108.08 | 0.50 | 52.00 | 0.03 | 0.65 |

| 21FND063 | 121.42 | 123.92 | 2.50 | 35.89 | 0.03 | 0.23 |

| 21FND065 | 112.80 | 113.70 | 0.90 | 53.10 | 0.08 | 0.79 |

| 21FND066 | 120.40 | 122.75 | 2.35 | 32.46 | 0.07 | 0.73 |

* Four completed drill holes have assays pending

**Intervals are core length. True width is estimated between 80-90% of the core length.

Figure 2. Mine Section and Drill Intercepts

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4303/107456_3d6e24e23457191a_001full.jpg.

The objective of the 2021 drilling program is to further delineate the iron-oxide copper-gold vein system at depth and to outline additional tonnage available to support the planned 5,000 tonnes/month extraction rate at Farellon. In addition, the drilling is expected to aid in grade control and optimize development.

Altiplano has generated over US$7,200,000 from the recovery and sale of 3.597 million pounds of copper with an average grade of 1.74% Cu (2018 Q1-2021 Q3). Altiplano will move the company-owned drill to Maria Luisa in the new year to continue exploratory drill operations and, add tonnage at Farellon for the nearly completed El Peñón mill and flotation plant. Altiplano will continue to use positive cash flow to invest in infrastructure and exploration to increase productivity and advance the Company's assets to production.

About Altiplano

Altiplano Metals is a growing gold, silver, and copper company focused on the Americas. The Company has a diversified portfolio of assets that include an operating copper/gold/iron mine, development of near-term producing gold/copper projects, and exploration land packages with district-scale potential. Altiplano is focused on creating long-term stakeholder value through developing safe and sustainable production, reinvesting into exploration, and pursuing acquisition opportunities to complement its existing portfolio. Management has a substantial record of success in capitalizing on opportunity, overcoming challenges and building shareholder value. Altiplano trades on the Toronto Venture Exchange trading under the symbol APN and the Frankfurt Exchange under the symbol A2JNFG.

John Williamson, B.Sc., P.Geol., a Qualified Person as defined by NI 43-101, has reviewed, and approved the technical contents of this document.

ON BEHALF OF THE BOARD

/s/ "John Williamson"

Chairman

For further information, please contact:

Alastair McIntyre, President and CEO

alastairm@apnmetals.com

Tel: (416) 434-3799

Jeremy Yaseniuk, Director

jeremyy@apnmetals.com

Tel: (604) 773-1467

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the (TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. A qualified person has not done sufficient work to classify any historical estimates as current mineral resources or mineral reserves and the issuer is not treating the historical estimates as current mineral resources or mineral reserves. The Farellon mine was previously in production dating back to the 1970's with a reported historical production (to a depth of 70 m) yielding approximately 300,000 tonnes at an average grade of 2.5% copper and 0.5g/t gold. This material was processed locally and sold to ENAMI. Altiplano is relying upon past production records, underground sampling and related activities and current diamond drilling to estimate grade and widths of the mineralization to reactivate production. The decision to commence production on the Farellon deposit is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and there is increased uncertainty and economic and technical risks of failure associated with any production decision. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107456