UK InstaCoin APP Promises to Open NFTs up to the Masses through Social Media

Codebase Ventures Inc. ("Codebase" or the "Company") (CSE:CODE)(FSE:C5B)(OTCQB:BKLLF) is pleased to provide an update on its recent investment in InstaCoin Technologies Ltd., a newly formed UK entity

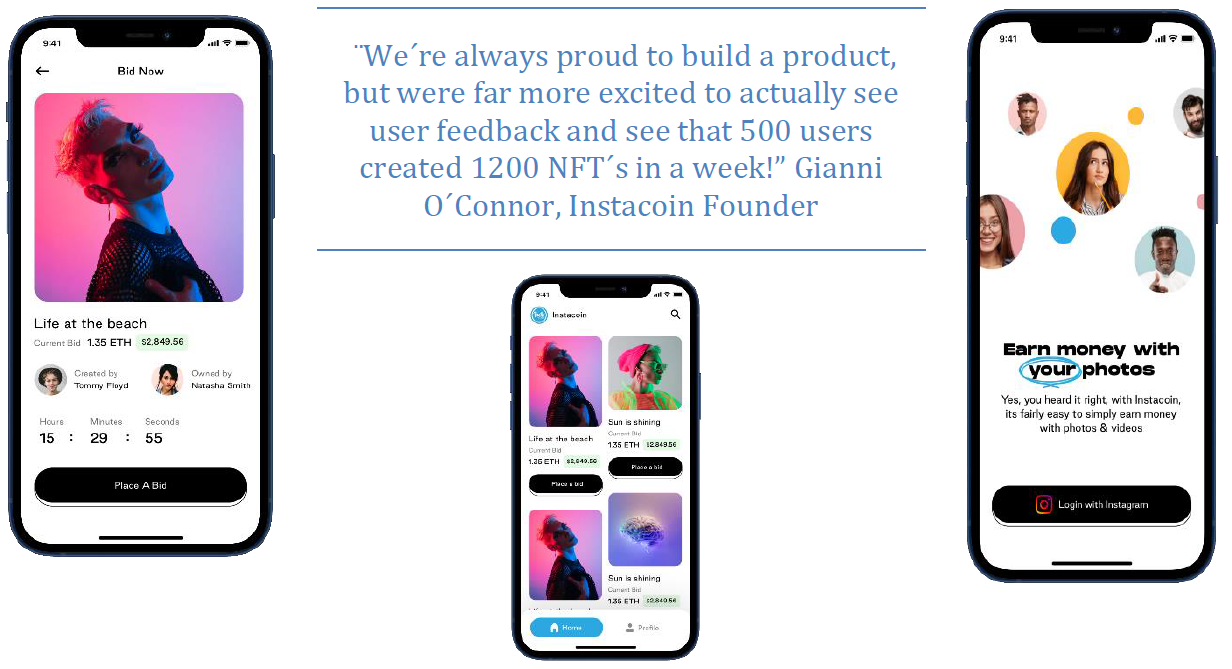

Following an extensive testing period, new NFT APP InstaCoin has announced a global submission to the Apple store platforms with imminent release. The APP which promises to simplify the creation of NFT assets from a user's social media has gone through extensive scale and blockchain testing as well as creating full language compatibility with the Chinese markets and European block.

NFTs are the new and most popular way to sell digital content across the world. Up until now the focus has been on large value sales, InstaCoin APP promises to bring the creation and auction element to the everyday person.

Code has a strong track record with the founders of InstaCoin through the Company's existing TRAD3R investment. Code is excited to expand their involvement with TRAD3R and InstaCoin, as both entities are taking an innovative approach within the blockchain ecosystem. Code has taken an early 50% equity position of InstaCoin who aims to democratize NFT's rather than focus primarily on multi-million dollar individual components.

The InstaCoin APP is positioned as the world's first self-serve social NFT platform. InstaCoin will allow users to connect their social profiles to the blockchain and create instant NFT tokens from their own content. Followers and fans connect in the open market for immediate sales.

InstaCoin Technologies Ltd., a newly formed UK entity, has no relationship with any other company or crypto exchange with similar names, including Instacoin Capital Inc.

About Codebase Ventures Inc.

Codebase Ventures Inc. seeks early-stage investments in emerging technology sectors, including the blockchain ecosystem and fintech. The Company identifies such opportunities and applies its relationships and capital to advance its interests.

For further information, please contact:

George Tsafalas - Ivy Lu

Investor Relations

Telephone: Toll-Free (877) 806-CODE (2633) or 1 (778) 806-5150

E-mail: IR@codebase.ventures

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain information set forth in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. All statements other than statements of historical fact are forward-looking statements, including, without limitation, statements regarding future financial position, business strategy, use of proceeds, corporate vision, proposed acquisitions, partnerships, joint-ventures and strategic alliances and co-operations, budgets, cost and plans and objectives of or involving the Company. Such forward-looking information reflects management's current beliefs and is based on information currently available to management. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "predicts", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. A number of known and unknown risks, uncertainties and other factors may cause the actual results or performance to materially differ from any future results or performance expressed or implied by the forward-looking information. These forward-looking statements are subject to numerous risks and uncertainties, certain of which are beyond the control of the Company including, but not limited to, the impact of general economic conditions, industry conditions and dependence upon regulatory approvals. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities laws.

SOURCE: Codebase Ventures Inc.

View source version on accesswire.com:

https://www.accesswire.com/640877/Codebase-Investee-Instacoin-NFT-App-UK-Completes-Worldwide-Testing-Phase-and-Submission-to-Apple-Store-Platforms