July 08, 2024

Multiple wide, high-grade intercepts with grades of up to 126g/t Au from final batch of in-fill and extensional assays from the first half of 2024 drilling.

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to provide an update on exploration results and development activities at its 100%-owned Dalgaranga Gold Project (“DGP”), located in the Murchison region of Western Australia.

HIGHLIGHTS

- Never Never Gold Deposit – strong in-fill drilling results strengthen deeper Resource extents:

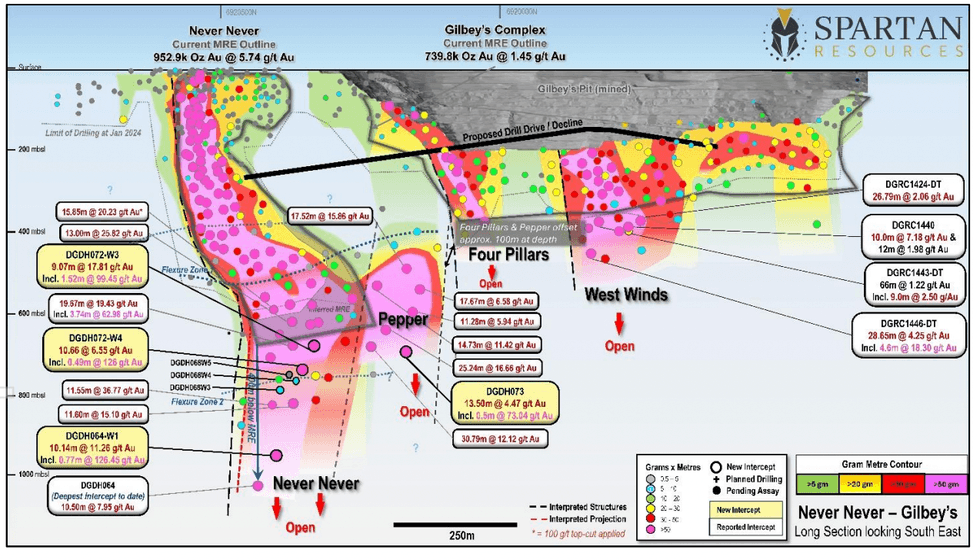

- 10.14m @ 11.26g/t gold from 966.90m down-hole, incl. 0.77m @ 126.45g/t (DGDH064-W1)

- 9.07m @ 17.81g/t gold from 760.55m down-hole, incl. 1.52m @ 99.45g/t (DGDH072-W3)

- 10.66m @ 6.55g/t gold from 798.02m down-hole, incl. 0.49m @ 126.00g/t (DGDH072-W4)

- Pepper Gold Prospect – new deepest intercept expands potential high-grade Resource extent:

- 13.50m @ 4.47g/t gold from 679.50m down-hole, incl. 0.5m @ 73.04g/t (DGDH073)

- Mineral Resource Estimate updates for the Never Never and Sly Fox Gold Deposits, as well as maiden standalone MRE’s for the Four Pillars, West Winds and Pepper Gold Prospects due for imminent release.

- Underground Exploration Drill Drive – finalisation of approvals and support activities for the underground development are well in train with development to commence in Q3 2024.

This release contains new assay results from recent surface drilling targeting the high-potential and very high-grade Pepper Gold Prospect, as well as the immediately adjacent and ever growing high-grade Never Never Gold Deposit.

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “These latest intercepts demonstrate the incredible potential of what we have found right in front of our processing plant at Dalgaranga. With the Never Never Gold Deposit we have really shown what can happen with a change in mindset and the more recent discovery of the Pepper Gold Prospect has demonstrated that we are really onto something very special in this under-explored greenstone belt.

“Our drill teams are taking a well-earned rest at the moment while we catch up on the frantic pace of drilling and discovery. Our geology team is now finalising the new Mineral Resource Estimate to collate our drilling efforts in the first half of this calendar year and update the Spartan value proposition. While we take a brief drilling hiatus, we are planning and prioritising our second half exploration program so that we increase our momentum and keep driving the Spartan juggernaut forward!”

Click here for the full ASX Release

This article includes content from Spartan Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

15h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00