NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWS WIRES

Nevada Silver Corporation ("NSC" or the "Company") (TSXV: NSC) is pleased to provide an update on assay results from the 2021 diamond drill program at its 100% owned Corcoran Silver-Gold project ("Corcoran" or the "Project") in Nevada, USA

NSC has received analytical results from two diamond drill holes (CC21-04 and CC21-05) of the company's maiden drill campaign. Highlights include:

CC21-04

- 142.15 meters from 29.85 meters @ 42g/t AgEq (13g/t Ag, 0.38g/t Au)

- Including:

- 14.65 meters @51g/t AgEq (4g/t Ag, 0.62g/t Au)

- 16.00 meters @63g/t AgEq (16g/t Ag, 0.63g/t Au)

- 16.50 meters @88g/t AgEq (57g/t Ag, 0.41g/t Au)

CC21-05

- 34.5 meters from 57.00 meters @101g/t AgEq (86g/t Ag, 0.20g/t Au)

- Including:

- 1.50 meters @1137g/t AgEq (1120g/t Ag, 0.23g/t Au)

Mineralized intervals from the first hole (CC21-01) were reported on 10th November 2021 and include:

- 96 meters from surface @ 35g/t AgEq (19g/t Ag, 0.21g/t Au),

- 2.67 meters from 233.7 meters @ 1336g/t AgEq ((1219g/t Ag, 1.82g/t Au including 1.33 meters @ 2466g/t AgEq (2310g/t Ag, 2.6g/t Au))

- 6.09 meters from 245.7m @ 277g/t AgEq (253g/t Ag, 0.38g/t Au).

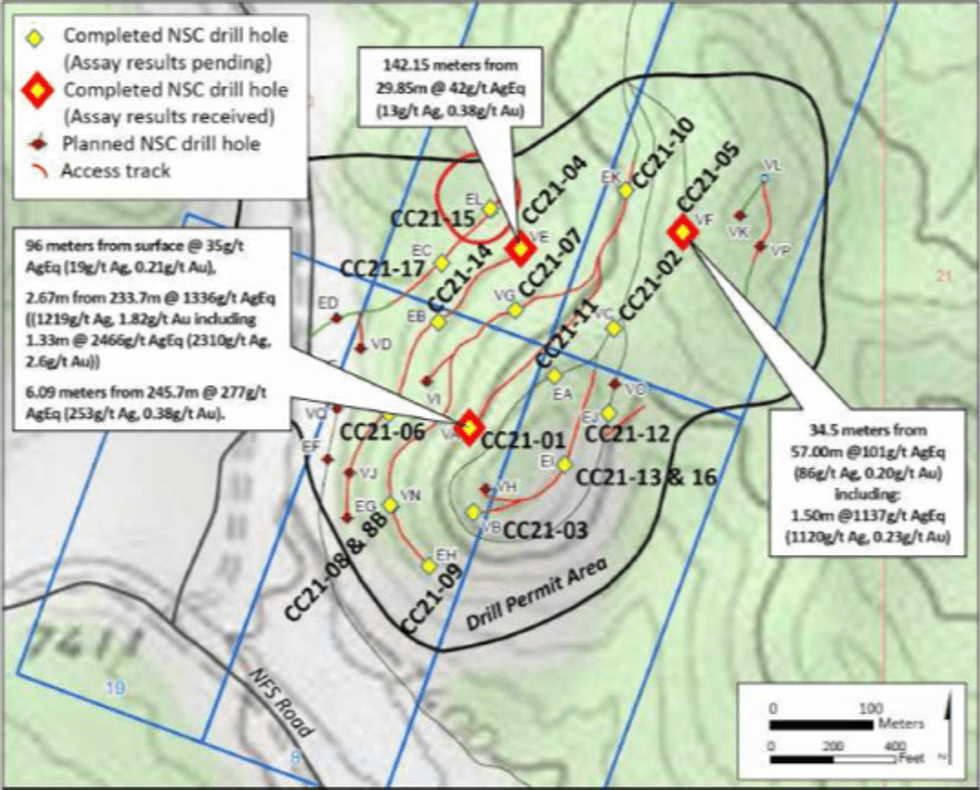

Drill holes CC21-01, 04 and 05 are the first three holes released in NSC's recently completed 3,040-meter drilling program at the outcropping epithermal Corcoran Silver-Gold deposit (Figure 1).

The collar of drill hole CC21-04 is located 200 meters north of CC21-01 and the hole was drilled towards the south east at a 47.5 degree dip. The 142 meter Ag-Au intersection in CC21-04 confirms the considerable extent and thickness of the Corcoran deposit and consistently elevated gold grades indicate that gold to silver ratios are variable within the deposit.

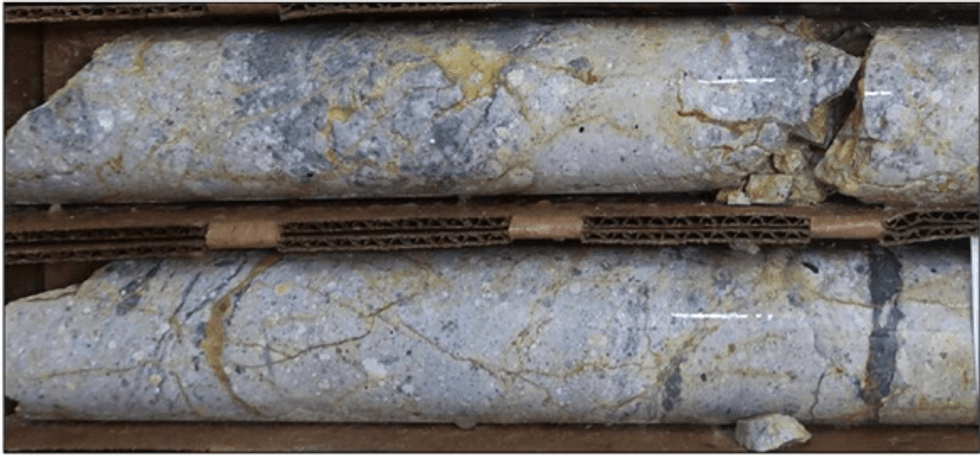

CC21-05 is located 300 meters north east of CC21-01. Like CC21-01, this vertical hole intersected narrow zones of high grade silver (e.g. 1120g/t Ag between 70.00-71.50 meters). Partial oxidation extends to considerable depth in both CC21-04 and CC21-05 and this is typically prominent in structural zones, fractures and veinlets (Figure 2).

Assay results for the remaining 14 holes (CC21-02, 03, 06-17) are expected during coming weeks.

Figure 1. Drill hole location map of the Corcoran Ag-Au deposit showing completed NSC drill holes.

Assay highlights are summarized in Table 1 and drill hole location details are listed in Table 2.

NSC CEO Gary Lewis commented, "CC21-04 and 5 have both intersected thick zones of near-surface silver and gold representing the potential for a very large deposit. The high-grade silver intersections in both CC21-01 and CC21-05 are particularly encouraging because these holes are 300 meters apart and there appears to be continuity of high grades along this trend. Importantly, the CC21-05 results show that Corcoran is likely to extend further to the north east, beyond the current drill program."

Figure 2. CC21-05 drill core of fractured and partially oxidized rhyolite breccia in between 80.0-80.9 meters (67g/t Ag).

Table 1. Significant mineralized intervals in drill hole CC21-01, CC21-04 and CC21-05.

| Hole ID | From | To | Interval | Ag | Au | Ag grade x width | AgEq† |

Meters | Meters | Meters | g/t | g/t | g/m | g/t | |

| CC21-01 | 0 | 96 | 96.00 | 19 | 0.21 | 1824 | 35 |

| including | 81.10 | 91.70 | 10.60 | 82 | 0.4 | 869 | 111 |

| including | 86.07 | 88.70 | 2.63 | 187 | 0.48 | 492 | 220 |

| CC21-01 | 233.7 | 236.37 | 2.67 | 1219 | 1.82 | 3255 | 1336 |

| including | 233.7 | 235.03 | 1.33 | 2310 | 2.6 | 3072 | 2466 |

| CC21-01 | 245.67 | 251.76 | 6.09 | 253 | 0.38 | 1541 | 277 |

|

|

|

|

|

|

| |

CC21-04 | 29.85 | 172 | 142.15 | 13 | 0.38 | 1848 | 42 |

including | 29.85 | 44.5 | 14.65 | 4 | 0.62 | 59 | 51 |

including | 89.42 | 112.08 | 22.66 | 16 | 0.63 | 363 | 64 |

including | 132.5 | 149 | 16.5 | 57 | 0.41 | 941 | 87 |

|

|

|

|

|

|

|

|

CC21-05 | 57 | 91.5 | 34.5 | 86 | 0.2 | 2967 | 100 |

including | 70 | 71.5 | 1.5 | 1120 | 0.23 | 1680 | 1117 |

| Intervals are core length. True width of mineralization is unknown until more drill data is available. | |||||||

| Drill location, altitude, azimuth and dip of drill holes are provided in Table 2. | |||||||

| Quality control, Assay laboratory and analytical methods are detailed in the text of this report. | |||||||

| A cut-off grade of 20g/t silver equivalent (AgEq) has been applied to calculate the length-weighted intercepts. | |||||||

| Numbers are rounded. | |||||||

| † Silver equivalent values (AgEq) - Metal prices follow the NI 43-101 Resource report on the Corcoran Canyon Project by Mosher and Smith (October, 2020) which used USD1460/ounce gold and USD17/ounce silver as well as a cut-off grade of 20g/t AgEq which has been applied to these results. Precious metal recoveries off 98.2% Ag and 88.6% Au were determined by laboratory tests by ALS (USA) in December 2018 (reference RE18305962), the most recent metal recovery data available. AgEq has been calculated as follows: AgEq = (gold price/silver price) x (gold assay x 0.886) + (silver assay x 0.982). | |||||||

Table 2. Drill hole details for CC21-01, CC21-04 and CC21-05.

Drill hole | Drill collar location | Azimuth | Dip | Collar Elevation | Final Depth | Start Date | Finish Date | |

WGS84 E | WGS84 N | degrees | degrees | meters | meters | |||

CC21-01 | 515611 | 4282554 | 0 | -90 | 2319 | 354.16 | 9/4/2021 | 9/10/2021 |

CC21- 04 | 515659 | 4282725 | 110 | -47.5 | 2295 | 217.62 | 9/19/21 | 9/25/21 |

CC21-05 | 515816 | 4282741 | 0 | -90 | 2343 | 166.72 | 9/26/21 | 9/30/21 |

Quality Assurance, Sampling and Assay Determinations

The diamond drilling was undertaken by Falcon Drilling, Inc, Nevada, using industry standard equipment and procedures. All drill core was HQ size. Drilling supervision and drill core logging and sampling was carried out by Ethos Geological, Inc under the direction of Mr Scott Close (President and Chief Geologist, Ethos Geological).

Drill hole orientation, down-hole survey data and collar coordinates were routinely gathered and drill core was logged (geological and geotechnical) and photographed prior to sampling. Drill core samples were collected at variable lengths (averaging 1 meter) and saw-sampled on-site prior to storage in a secure compound.

Collected intervals including quality control samples (duplicates, blanks and international standards) were forwarded by secure freight to ALS Chemex Labs, Inc in Reno, NV. Analytical procedures used four acid ICP-AES (code ME-ICP61) for silver and 32 elements and additional assays for ore-grade samples (Ag-OG62, ME-OG62). High silver grades (over 1500g/t Ag) were determined using fire assay method Ag-GRA21.

Market Stabilization and Liquidity Services

The Company has signed a letter agreement with Red Cloud Securities Inc. ("Red Cloud") to provide market stabilization and liquidity services, in accordance with the policies of the TSX Venture Exchange (the "TSXV") and applicable laws. Red Cloud will trade the securities of the Company on the TSXV for the purposes of maintaining an orderly market. None of Red Cloud nor its affiliates or associates has any interest directly or indirectly in the Company or its securities, or any right or intent to acquire such an interest. In consideration of the services provided by Red Cloud, the Company will pay a monthly cash fee of $5,000 for a minimum term of three months, which will automatically extend for successive one-month terms unless terminated by either party on thirty days' prior notice. The services provided by Red Cloud will commence today, December 14, 2021. Red Cloud will not receive shares or other securities as compensation. The capital used for market making will be provided by Red Cloud.

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Ian James Pringle PhD, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further Information please contact:

Nevada Silver Corporation

Gary Lewis

Group CEO & Director

T: +1 (416) 941 8900

gl@nevadasilvercorp.com

About Nevada Silver Corporation

Nevada Silver Corporation (TSXV:NSC) is a US-based, multi-commodity resource company with two advanced stage exploration projects in the USA. NSC's principal asset is the Corcoran Silver-Gold Project in Nevada. In addition, NSC also owns the Emily Manganese Project in Minnesota which has been the subject of considerable technical studies with US$23 million invested to date. Both Corcoran and Emily are wholly (100%) owned by NSC.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including, without limitation, risks as a result of the Company having a limited operating history and may have a wide variance from actual results, risks concerning the ability to raise additional equity or debt capital to continue its business, uncertainty regarding the inclusion of inferred mineral resources in the mineral resource estimate which are too speculative geologically to be classified as mineral reserves, uncertainty regarding the ability to convert any part of the mineral resource into mineral reserves, uncertainty involving resource estimates and the ability to extract those resources economically, or at all, uncertainty involving exploration (including drilling) programs and the Company's ability to expand and upgrade existing resource estimates, risks involved in any future regulatory processes and actions, risks from making a production decision (if any) without any feasibility study completed on the Company's properties, risks applicable to mining exploration, development and/or operations generally, and risk as a result of the Company being subject to certain covenants with respect to its activities by creditors, as well as other risks.

Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

SOURCE: Nevada Silver Corporation

View source version on accesswire.com:

https://www.accesswire.com/677515/Nevada-Silver-Corporation-Drills-Wide-Intersections-Of-Mineralization-at-Its-Corcoran-Silver-Gold-Project-Nevada-USA