March 26, 2025

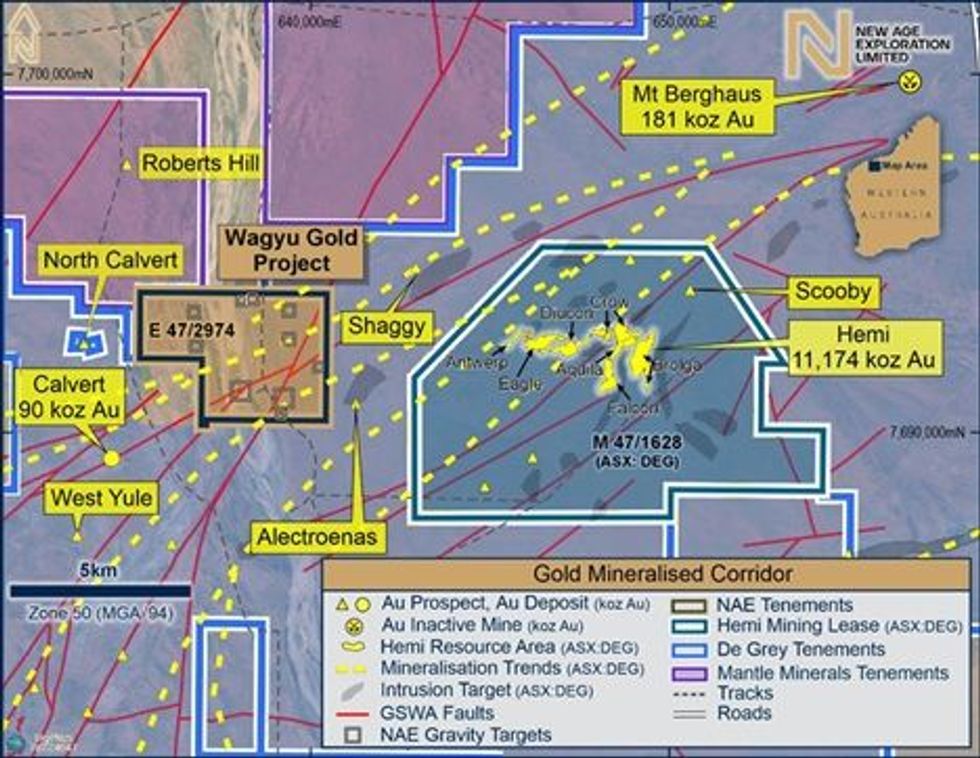

New Age Exploration (ASX: NAE) (NAE or the Company) is pleased to provide an update on its ongoing exploration activities at the Wagyu Gold Project in the Central Pilbara, WA, as well as a key leadership appointment that will enhance the Company’s technical expertise.

HIGHLIGHTS

- Drilling at the Wagyu Gold Project continues to plan, with the first six Reverse Circulation (RC) holes completed at Target 6. The drill rig will now move to Target 10 to test further mineralisation.

- NAE has successfully completed a placement for $360k, on the same terms as the previous capital raise, further strengthening the funding of the Wagyu drill program

- Peter Thompson has been appointed as Chief Geologist, taking on a strategic leadership role in directing the Company’s exploration activities during this critical phase

Drilling Update

The RC drill program at Wagyu is progressing on schedule, with the first six planned holes completed at Target 6. The RC rig has performed well, reaching target depth in all holes to date. The drill rig is now being mobilised to Target 10, another high-priority area where NAE aims to confirm further gold mineralisation extensions. These drilling efforts are a continuation of NAE’s systematic exploration strategy following promising results from previous Air Core (AC) drilling.

Share Placement

The Company is pleased to announce it has raised $360K through a placement on the same terms as the previous capital raise. This funding will underpin the continued expansion of drilling activities at Wagyu and support additional exploration work aimed at unlocking the project’s full potential.

NAE Executive Director Joshua Wellisch commented:

"We are pleased with the steady progress of our Wagyu drill program, which we are looking to continue delivering encouraging results. The strong support from investors in our latest placement reinforces confidence in the project's potential and allows us to accelerate our exploration efforts further. With drilling advancing at Target 10, we remain committed to systematically testing our highest-priority targets."

The Hemi Gold Mineral Resource was last updated by De Grey Mining on 14 November 20241. The estimate is for 264Mt @ 1.3g/t Au for 11.2Moz, which can be broken down into 13Mt @ 1.4g/t for 0.6Moz, 149Mt @ 1.3g/t Au Indicated for 6.3 Moz, and 103Mt @ 1.3g/t Au for 4.3 Moz Inferred. 14 November 2024 – ASX:DEG Hemi Gold Project Mineral Resource Estimate (MRE) 2024

NAE confirms that it is not aware of any new information or data that materially affects the information included in De Grey’s reported Mineral Resources referenced in this market announcement. To NAE’s full knowledge, all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed.

Click here for the full ASX Release

This article includes content from New Age Exploration Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

New Age Exploration

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand Keep Reading...

7h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold Corporation (NYSE:EGO,TSX:ELD) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that would create a larger, diversified gold and copper producer with two major development projects set to enter production in 2026Under the deal, Eldorado... Keep Reading...

9h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

02 February

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

02 February

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

02 February

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

Latest News

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00