June 15, 2025

Somerset Minerals Ltd (“Somerset” or the “Company”) (ASX:SMM) is pleased to announce the initial assay results from the maiden surface sampling campaign at its recently acquired Coppermine Project (the “Project”) in Canada.

- Initial assay results from maiden surface sampling program confirm wide-spread mineralisation

- Large representative rock samples were collected across Laphroaig, Jura and Oban districts

- At Laphroaig: High-grade copper over 500m strike, within a broader 2.0km trend, including:

- CMC0047: 51.96% Cu and 52.2g/t Ag

- CMC0042: 50.84% Cu and 65.3g/t Ag

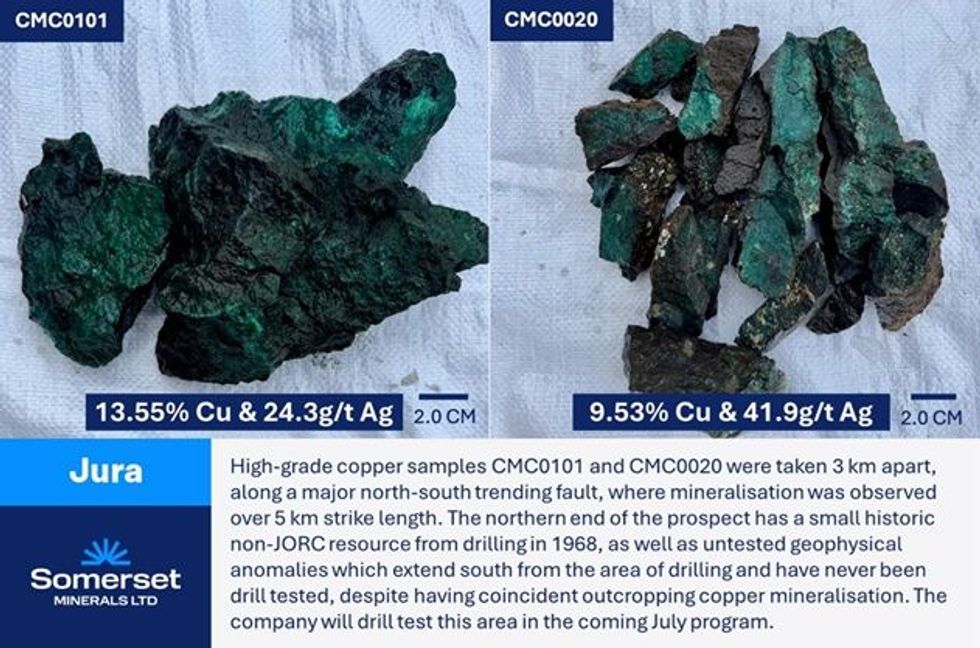

- At Jura: High-grade copper over 5.0km strike, hosted within a major N-S trending fault, including:

- CMC0021: 19.10% Cu and 21.1g/t Ag

- CMC0101: 13.55% Cu and 24.3g/t Ag

- Maiden drill campaign scheduled to commence around 5th July focusing on Coronation C Jura

- Assay results for samples containing native copper are expected to be received in the next week

- Fully funded C fully permitted for high-impact maiden exploration drill campaign

- lanning underway for larger Phase-2 exploration program, including expanded drill campaign

Managing Director, Chris Hansen, commented,

“These are truly exceptional early results that speak to the scale, quality, and untapped potential of our Coppermine Project. To return grades of over 50% copper from surface samples — and to also return high-grade results from across multiple prospects — is a rare and exciting outcome. What’s even more compelling is the continuity of mineralisation we're seeing: over 500 metres at Laphroaig and more than 5.0 kilometres at Jura. This confirms the presence of an extensive, high-grade copper system, and supports the historic information we’re building on.

We are now entering a very exciting phase for Somerset. Our fully funded, fully permitted maiden drill campaign is set to commence in just over two weeks time, with walk-up targets defined by strong geophysical signatures and outcropping copper mineralisation. At Coronation, we’re targeting several high-priority IP anomalies supported by historical drill intercepts of up to 40 metres, while Jura and Laphroaig are shaping up as large-scale, structurally controlled, high-grade copper systems with district-scale potential. These early successes are the direct result of our methodical and targeted approach to exploration.

With a dominant landholding in one of the world’s last underexplored copper frontiers, drilling set to begin imminently and assays still outstanding for native copper sampling, we believe Somerset is uniquely positioned to potentially unlock a major new copper district.”

Click here for the full ASX release

This article includes content from Somerset Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SMM:AU

The Conversation (0)

5h

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00