August 14, 2024

Moab Minerals (ASX:MOM), a uranium exploration company, presents a compelling case for investors evaluating opportunities in the rapidly growing uranium market with the high-quality Manyoni and Octavo projects in Tanzania.

Tanzania, a global leader in uranium resources, is in a good position to establish itself as a significant player in the global nuclear energy sector. Significant Tanzanian deposits include Namtumbo (Mkuju), Bahi, Galapo, Minjingu, Mbulu, Simanjiro, Lake Natron, Manyoni, Songea, Tunduru, Madaba and Nachingwea. Of these projects, Mkuju River is the largest, boasting a mineral resource of 8,500 tons U3O8 and, once operational, will be the country’s first operating uranium mine.

Moab Minerals announced the acquisition of a majority stake in Katika Resources, a Tanzanian company that holds the Manyoni and Octavo uranium projects on the 8th of July 2024. The Manyoni project was previously explored by Uranex Ltd from the early 2000s until 2013. The Octavo uranium project is adjacent to Rosatom’s world-class Nyota uranium deposit (Mkuju River project), which was formerly held by ASX-listed Mantra Resources before the AU$1.02 billion takeover in 2011.

Company Highlights

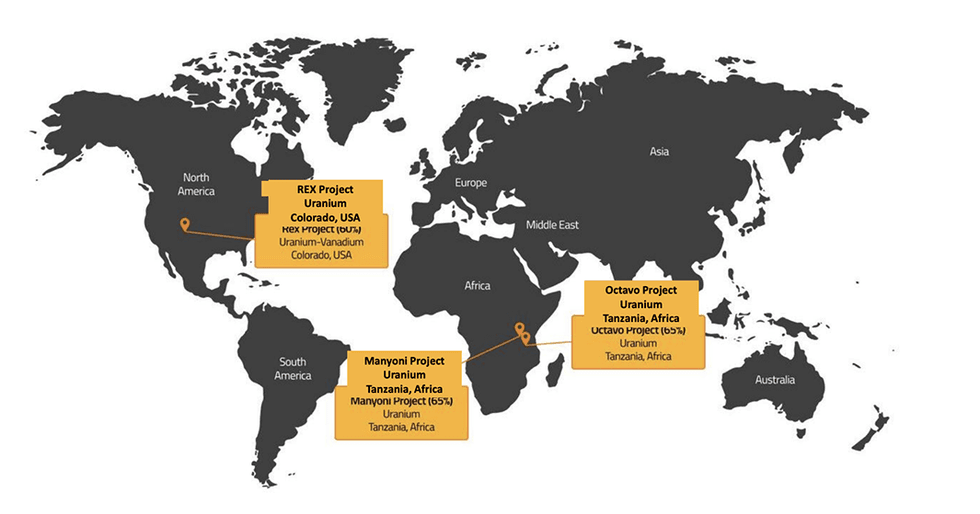

- Moab Minerals is a uranium exploration company developing its primary uranium assets in Tanzania - Manyoni and Octavo.

- Tanzania is a global leader in identified uranium resources and companies operating in the country benefit from a supportive pro-mining government.

- Positive outlook for uranium, with demand expected to increase by 28 percent in 2030, and 51 percent by 2040.

- The Company is looking to start drilling 1,500 metres in August/September to validate historical drill results from Uranex (early 2000’s-2013) and to test extensions of the known mineralization at Manyoni.

- Additional upside exists from Moab’s uranium-vanadium asset (REX project) located in Colorado and within trucking distance of the White Mesa Mill.

This Moab Minerals profile is part of a paid investor education campaign.*

Click here to connect with Moab Minerals (ASX:MOM) to receive an Investor Presentation

MOM:AU

The Conversation (0)

30 January

Quarterly Activities Report and Appendix 5B

Moab Minerals (MOM:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

27 January

Moab terminates agreement to acquire Sasare Project Zambia

Moab Minerals (MOM:AU) has announced Moab terminates agreement to acquire Sasare Project ZambiaDownload the PDF here. Keep Reading...

28 October 2025

Quarterly Activities Report and Appendix 5B

Moab Minerals (MOM:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

24 March 2025

Uranium Assay Results for Manyoni Uranium Project

Moab Minerals (MOM:AU) has announced Uranium Assay Results for Manyoni Uranium ProjectDownload the PDF here. Keep Reading...

18 February 2025

Outstanding Uranium Assay Results at Manyoni Uranium Project

Moab Minerals (MOM:AU) has announced Outstanding Uranium Assay Results at Manyoni Uranium ProjectDownload the PDF here. Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00