May 19, 2025

- New High-Grade Drilling Discovery in First Round of Shallow Drilling -

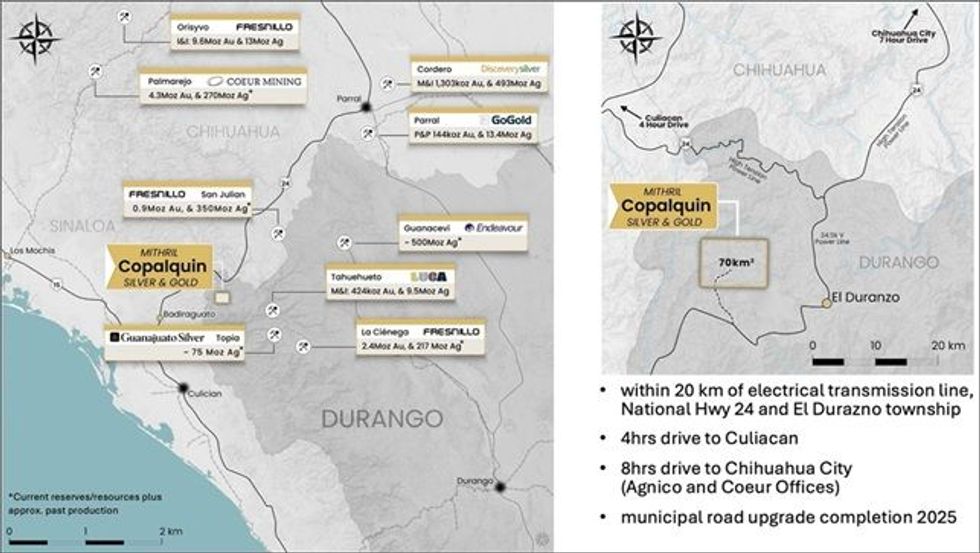

Mithril Silver and Gold Limited ("Mithril” or the "Company") (TSXV: MSG) (ASX: MTH) is pleased to provide high-grade maiden drill results for a new drill discovery at the Target 2 area in Mithril’s Copalquin silver and gold district property, Durango State, Mexico (Figure 1).

Exploration Progress Update

Drilling at Target 2 (Las Brujas) has returned excellent results, with shallow holes over a 200-metre strike length intersecting very high-grade gold and silver within a broad, near-surface structure. Hole T2DH25-006 returned 11.5m @ 8.61 g/t gold, 57.6 g/t silver from 44.5m, including 3.85m @ 25.33 g/t gold, 128 g/t silver from 46.65m including 0.85m @ 109.5 g/t gold, 325 g/t silver from 46.65m. Follow-up drilling ~80 metres down dip is planned for the next phase.

Momentum Building Across the Copalquin District – Multiple Targets Advancing (Figure 2)

- Exciting Progress at El Peru (Target 2 Extension): The first phase of drilling at El Peru, 400 m east of Las Brujas, has been completed. Multiple shallow drillholes have shown further extension of the mineralized footprint of this emerging high-grade zone (samples dispatched).

- Eastern District Activity Ramps Up: A second exploration camp has been established to support aggressive mapping and target generation at Targets 2 and 3, highlighting our commitment to unlocking the eastern potential of the district.

- High-Potential for additional Discovery at Target 5 – El Apomal: A new target has been defined at the historic El Apomal workings. A 130-metre underground adit has been dewatered, mapped, and sampled (assays pending), and a surface vein has been traced over 300 metres — a compelling new drill target developing.

- District-Scale Potential Confirmed: Over 1,000 metres of vertical relief between Target 2 and Target 5 across 5 km demonstrates the immense scale and structural complexity of the Copalquin district, underscoring its potential to host a large, multi-target mineralized system.

- Resource Expansion Underway at Target 1: Deep drilling at the El Refugio structure continues to intercept the targeted zone, with samples dispatched for assay. Drilling success here will directly contribute to an upcoming Target 1 resource update.

“We’re advancing on multiple fronts across the Copalquin district, with strong drill results at Las Brujas, exciting new potential at El Apomal, and ongoing success at our flagship Target 1 resource area,” said John Skeet, CEO and Managing Director. “The scale of this system is becoming increasingly evident, with multiple mineralized zones across the district. With drilling, mapping, and sampling all in full swing, we’re well positioned to continue building momentum and unlock significant value through discovery and resource growth.”

COPALQUIN GOLD-SILVER DISTRICT, DURANGO STATE, MEXICO

With 100 historic underground gold-silver mines and workings plus 198 surface workings/pits throughout 70km2 of mining concession area, Copalquin is an entire mining district with high-grade exploration results and a maiden JORC resource. To date there are several target areas in the district with one already hosting a high-grade gold-silver JORC mineral resource estimate (MRE) at the Target 1 area (El Refugio-La Soledad)1 and a NI 43-101 Technical Report filed on SEDAR+, supported by a conceptional underground mining study completed on the maiden resource in early 2022 (see ASX announcement 01 March 2022 and metallurgical test work (see ASX Announcement 25 February 2022). There is considerable strike and depth potential to increase the resource at El Refugio and at other target areas across the district, plus the underlying geologic system that is responsible for the widespread gold-silver mineralisation.

With the district-wide gold and silver occurrences and rapid exploration success, it is clear the Copalquin District is developing into another significant gold-silver district like the many other districts in this prolific Sierra Madre Gold-Silver Trend of Mexico.

Click here for the full ASX Release

This article includes content from Mithril Silver and Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00