Investor Insight

Rua Gold offers a compelling investment opportunity driven by its highly promising gold assets in New Zealand’s historic gold-producing regions, and supported by the government’s renewed focus on fast tracking economic growth.

Overview

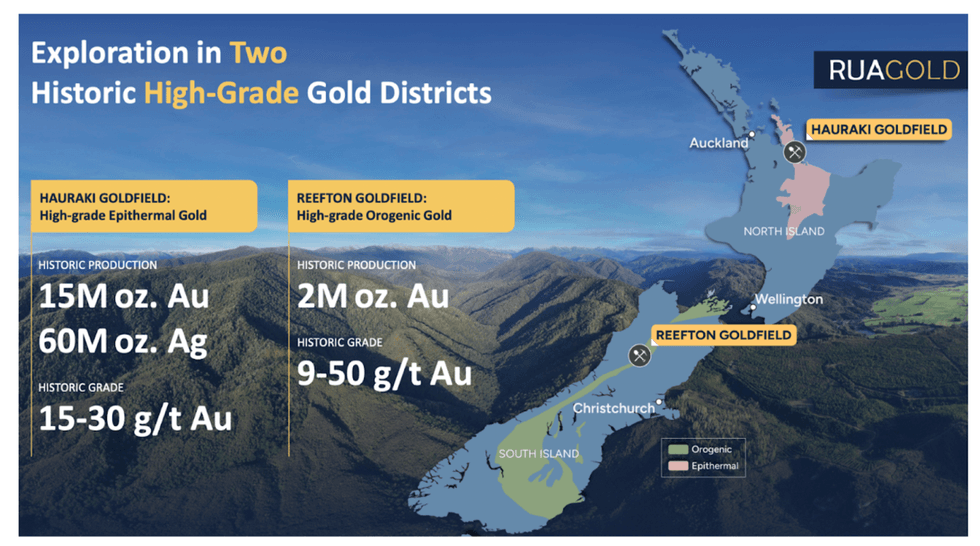

Rua Gold (TSXV:RUA,OTC:NZAUF,WKN:A4010V,OTCQB:NZAUF) is a gold exploration company focused on two prolific, historic gold-producing regions in New Zealand: Hauraki Goldfield and Reefton Goldfield. Both these regions boast of previous high-grade gold production, with more than 15 million ounces (Moz) produced in the Hauraki district and over 2 Moz in the Reefton Goldfield. New Zealand is a tier 1 mining jurisdiction with highly prospective geology, and a skilled workforce. The new government of New Zealand has committed to promoting economic growth through mining- and business-friendly policies, such as the Fast Track Approval Bill, which proposes quicker approval timelines for a range of projects, including mining.

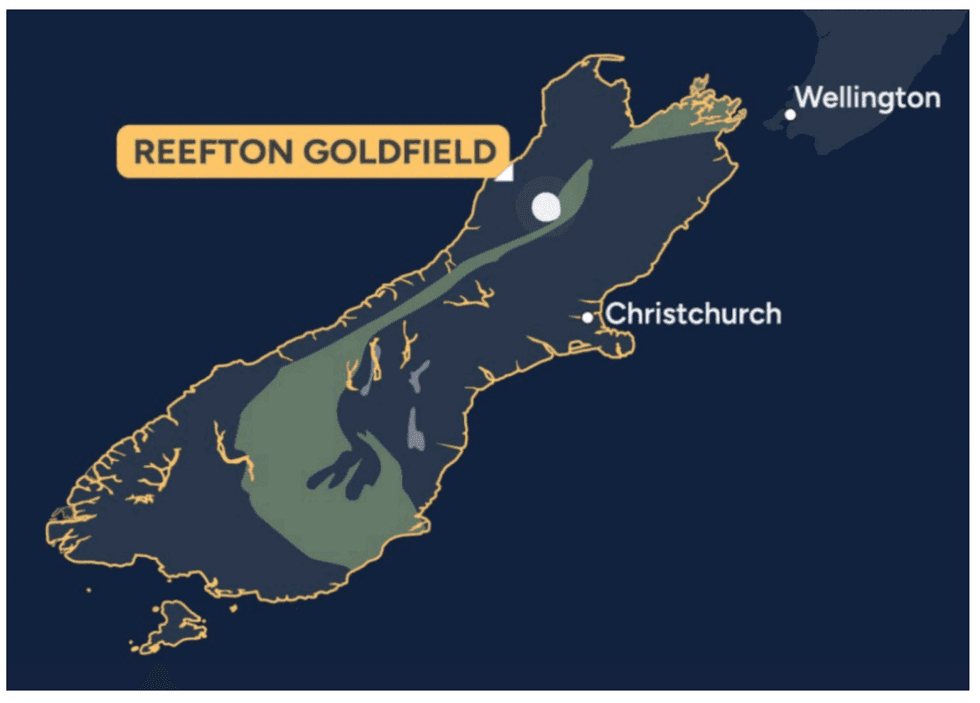

Rua Gold solidified its position as the dominant Reefton Goldfield explorer with the acquisition of Reefton Resources, a 100 percent owned subsidiary of Siren Gold (ASX:SNG). The completion of the transaction expands Rua Gold's tenement package to cover over 95 percent of the Reefton Goldfield.

New Zealand’s critical minerals list includes both gold and antimony, enhancing the significance of Rua Gold’s ongoing exploration campaign which revealed promising antimony potential. Rua Gold sits on the majority of New Zealand’s known antimony inventory, a strategic advantage that positions the Reefton Project to contribute substantial economic value while strengthening New Zealand’s critical mineral supply.

Rua Gold benefits from a team of professionals boasting extensive expertise in geology and mining. The company’s board of directors is led by Oliver Lennox-King (Fronteer, Roxgold), who has a successful track record developing projects and companies.

Company Highlights

- Rua Gold is a gold exploration company advancing two highly prospective land packages in New Zealand’s historic gold districts – the Hauraki Goldfield and the Reefton Goldfield.

- Premiere Mining Jurisdiction: New Zealand is recognized as a tier 1 mining jurisdiction, underpinned by proven high grade geology and a long history of gold production. The country hosts orogenic deposits (+9 Moz), epithermal sources (+15 Moz), and alluvial deposits (+22 Moz).

- Key Assets: The company’s portfolio includes the Reefton Goldfield on New Zealand’s South Island and the Glamorgan property on the North Island.

- Supportive Government Policy: The new government has prioritized economic growth, highlighted by the Fast Track Approval Bill, which enables mining permits to be granted in less than 6 months, the fastest permitting timeline in the world.

- High-Quality Prospects: Rua Gold’s projects feature both orogenic and epithermal gold systems with historical production grades ranging from 16 to 50 g/t gold.

- Exploration Programs: The company is fully permitted and financed, with multiple near-term catalysts. Active exploration is underway, including drilling programs at the Reefton district properties.

- Leadership Team: Rua Gold is led by a seasoned board and management team with deep regional knowledge and a strong track record of discovery success. With financing and permits secured, the company is well-positioned to unlock value and drive growth.

Key Projects

Reefton Goldfield

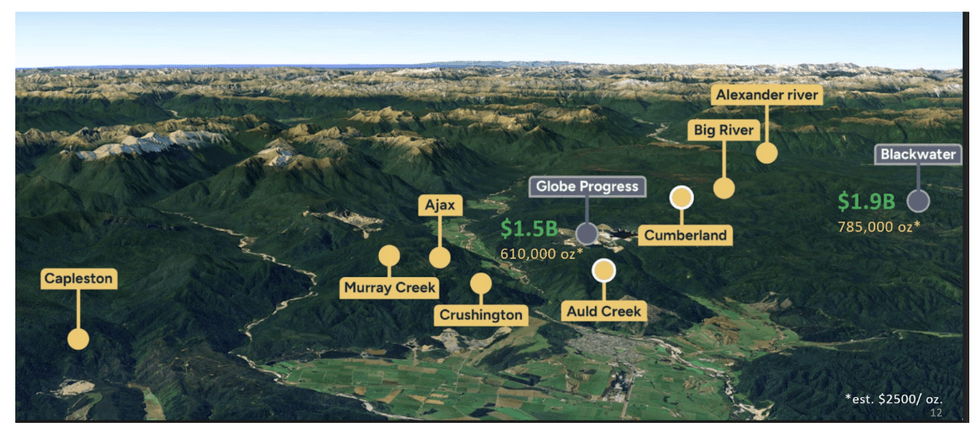

Rua Gold holds six project areas at the Reefton Goldfield: Northern, Capleston, Murray Creek, Ajax, Crushington, and Southern. The Reefton district has a rich history of gold production with over 2 Moz of gold recovered at 24.5 g/t. Among the noteworthy findings from recent years of exploration is the greenfield discovery of the Pactolus quartz vein. Assays have unveiled significant high-grade gold concentrations in this vein.

Rua Gold’s systematic exploration has highlighted the potential for the rejuvenation of this district in renewed opportunities around the historic high-grade gold deposits. Rua Gold completed an extensive assessment of the historical mines situated within the company's tenements in the Reefton Goldfield, yielding five targets in the Murray Creek area.

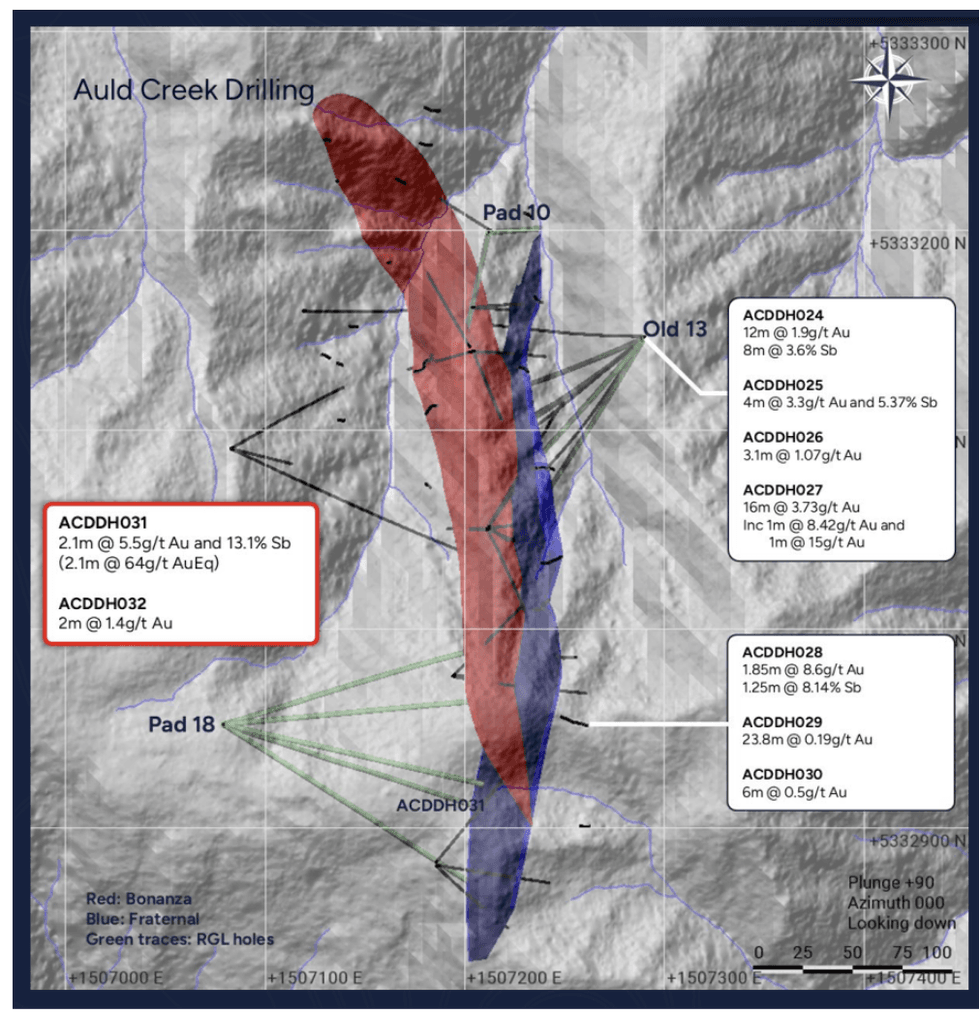

Rua Gold has expanded its Reefton exploration program with a third drill rig and a planned 4,000 m of diamond drilling at Auld Creek in the coming months. The company is targeting a resource of >300,000 oz AuEq by the end of 2025 and positioning to enter New Zealand’s proposed fast-track permitting process. At Glamorgan, access agreements are underway, with surface work scheduled for Q3 2025 and drilling expected to begin in Q4 2025. Rua Gold is fully funded to execute this growth strategy, with a cash balance of US$14 million as of June 30, 2025.

Drilling at Auld Creek has returned high-grade intercepts, including 17 m @ 9.8 g/t AuEq (with 10 m @ 15.3 g/t AuEq) and 8 m @ 8.9 g/t AuEq (with 5 m @ 11.1 g/t AuEq). These results extend the vertical extent of the Fraternal shoot from 160 m to 300 m and strike length from 350 m to 620 m, with mineralization remaining open in all directions. Surface geochemistry suggests the system may continue for more than 2.5 km, underscoring significant potential for resource growth.

Glamorgan Project

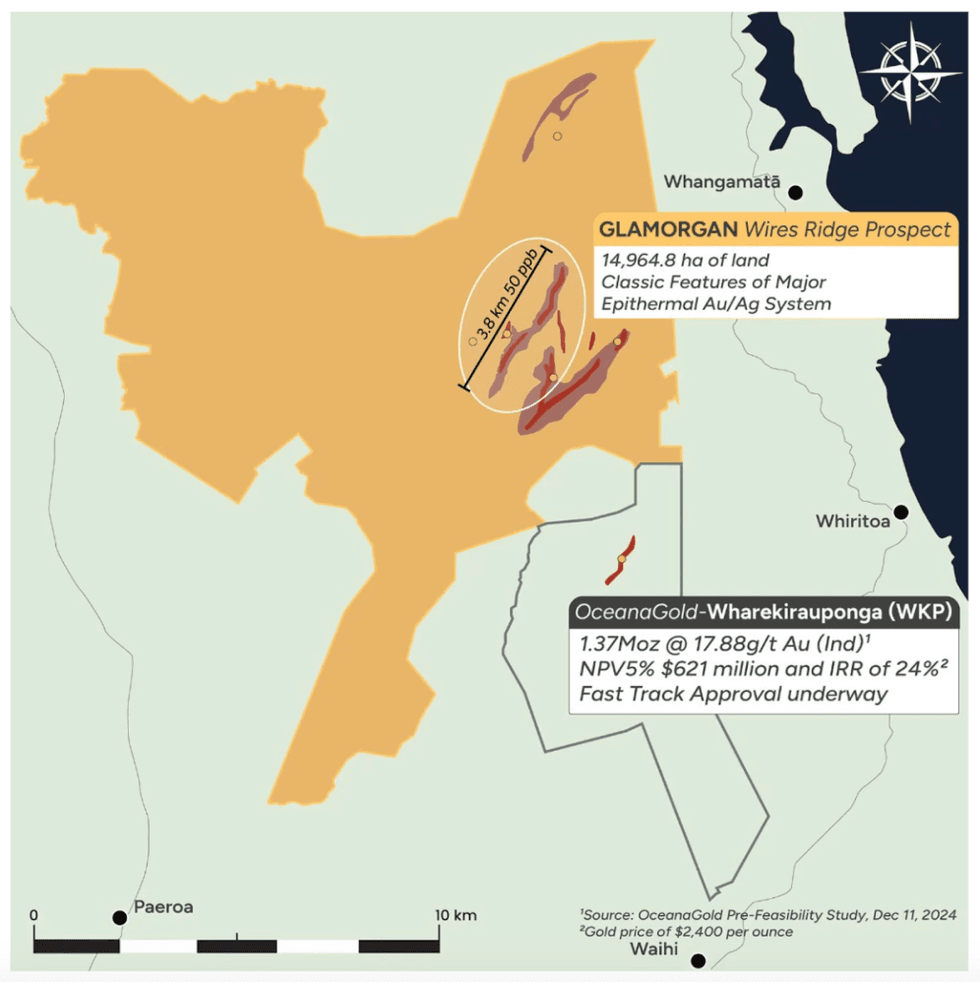

The Glamorgan project comprises over 4,600 hectares in the Hauraki district on New Zealand’s North Island. Hauraki boasts of a substantial presence of high-grade gold and silver mining, with approximately 50 epithermal deposits mined since the 1860s. These deposits have yielded over 15 Moz of gold and 60 Moz of silver. Glamorgan has a 3.8 km zone displaying indications of gold mineralization, backed by soil and rock samples, suggesting the presence of an epithermal gold mineralized system at the property.

Glamorgan is located 2.8 kms north of Oceana Gold’s recent significant discovery at Wharekirauponga. The company has applied for a minimum impact access agreement with the New Zealand Department of Conservation. Once granted, the company will commence an exploration program that includes soil sampling, magnetic and resistivity geophysical surveys, and geological mapping.

Rua Gold completed the first phase of surface exploration on its Glamorgan epithermal gold prospect which identified two significant soil anomalies over 4 kms in length. Rua Gold also completed the second phase of surface exploration at its Glamorgan Project, an epithermal gold system located in the Hauraki Goldfield on New Zealand’s North Island.

The Hauraki Goldfield is a prolific epithermal gold province that has produced more than 15 million ounces of gold from over 50 historic mines. The Glamorgan Project sits adjacent to OceanaGold’s Wharekirauponga deposit, which hosts Indicated Mineral Resources of 1.4 Moz at 17.9 g/t Au and is expected to commence construction in the second half of 2025.

Management Team

Oliver Lennox-King – Non-executive Chairman

Oliver Lennox-King boasts a distinguished and extensive career within the mineral resource sector, encompassing a broad experience in financing, research, and marketing. Since 1992, he has occupied senior executive and board roles in various junior exploration and mining enterprises. Most recently, Lennox-King was the chairman of Roxgold from 2012 until July 2021, when it was sold for $1.2 billion to Fortuna. In addition to Roxgold, he also served as chairman of other notable firms, including Pangea Goldfields, Aurora Uranium, and Fronteer Gold.

Robert Eckford – CEO and Director

Robert Eckford is a certified professional accountant with significant expertise in mergers and acquisitions, accounting, finance, and commercial management within the mining sector. Most recently, he was co-founder and head of finance for Aris Mining, and prior to that, he had worked with international mining companies, including Barrick Gold, Yamana Gold, and Leagold Mining.

Simon Henderson – COO and Director

Simon Henderson is an exploration specialist and has over 40 years of experience, most of which is in New Zealand. He was part of the discovery team for several significant gold finds in New Zealand, such as Wharekirauponga. He maintains robust connections with key local stakeholders and the country's permitting authorities.

Zeenat Lokhandwala – CFO and Corporate Secretary

Zeenat Lokhandwala brings over a decade of expertise in mergers and acquisitions, finance, accounting and taxation. She is the former CFO of Great Bear Royalties and director of finance at Great Bear Resources.

Brian Rodan - Director

Brian Rodan has more than 43 years of experience who is currently serving as Fellow of the Australian Institute of Mining and Metallurgy. Rodan is the founding director of Dacian Gold (ASX:DCN)

Mario Vetro - Director

Mario Vetro has extensive experience structuring and providing guidance to resource companies. He is the co-founder of K92 Mining and the proprietor of Commodity Partners.

Paul Criddle - Director

Paul Criddle has extensive experience constructing and overseeing gold mines in Australia and West Africa. He was formerly a chief operating officer for West Africa at Fortuna and also served as the COO for Azimuth and Perseus. He was previously the managing director at Matador Mining.

Tyron Breytenbach – Director

Tyron Breytenbach is a geologist with operational and capital markets experience. He is currently the CEO of Lithium Africa Resources. Previously, he was senior vice-president of Capital Markets at Aris Mining and served as managing director at Cormark Securities. Before transitioning to capital markets, Breytenbach spent a decade in the mining sector as a geologist, focusing on orogenic and epithermal gold deposits and specializing in resource estimation. He earned his BSc (Honours) degree from Rand Afrikaans University in South Africa and is a designated professional geologist in Ontario.

Simon Delander – Vice President, Risk, Stakeholder & Regulatory Affairs

Simon Delander brings over 25 years of experience in regulatory affairs, stakeholder engagement, and risk governance within the resource sector. Before joining Rua Gold, Delander served as vice-president at Endura Mining (formerly Federation Mining), where he successfully guided the company through the consenting process and built strong stakeholder relationships. He has also held senior positions with Evolution Mining and MMG, overseeing ESG frameworks and regulatory initiatives. Delander serves on the boards of the New Zealand Minerals Council, the New Zealand Mine Rescue Trust, and Terra Firma Mining Limited.