February 11, 2025

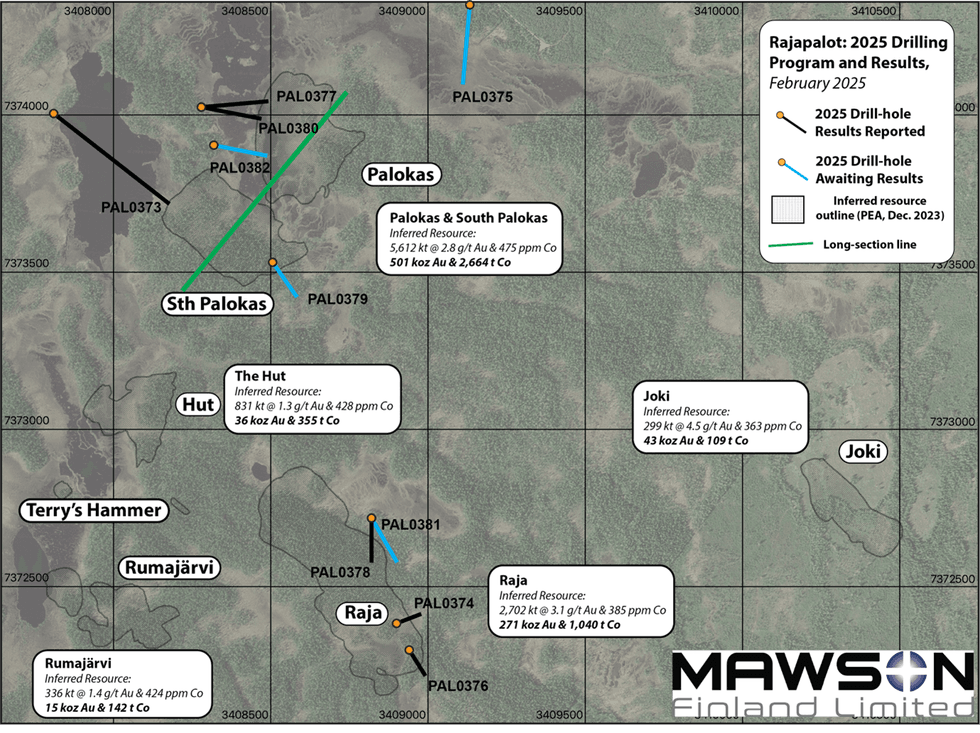

Mawson Finland Limited ("Mawson" or the "Company") (TSXV:MFL) is pleased to announce drilling results from the first 6 drillholes from the 2025 drilling season at the Company's wholly-owned Rajapalot gold-cobalt project in Finland (see Table 1, Table 2, Table 3, and Figure 1 in Schedule "A" hereto).

Highlights:

- 120 metre step-out discovery from Drillhole PAL0373 in South Palokas confirms the effectiveness of the project EM survey

- Further significant gold-bearing intercepts drilled in down-dip extensions at Palokas zone in PAL0380

- Confirmation of mineralised ‘Raja-footwall' EM conductor in drillhole PAL0378

- Additional downhole EM (DHEM) surveys confirm the presence of significant conductors at depth in potential ‘down-dip' Raja position

Ms. Noora Ahola, Mawson Finland CEO, states:"We are very pleased to present the first of our results from the 2025 drilling season at Rajapalot. Most significantly, we have demonstrated the larger potential of both the South Palokas and Palokas mineralised zones, intercepting gold-bearing mineralisation in a large 120 metre step-out down-dip of our deepest intercept at South Palokas which targeted a deep downhole-EM conductor discovered in our recent 2024 geophysics program. Significant intercepts have also been drilled in the deeper portions of the Palokas zone, while additional mineralisation is also confirmed from Raja resource extension drillholes. Additional downhole-EM geophysical surveys conducted in January 2025 have also indicated the potential of further mineralization of the projected down-dip extension of the Raja zone in which target-test drilling will be immediately undertaken. These initial successes from our 2025 drilling season demonstrate open mineralisation to depth in several of our important mineralised zones, and bodes well for our ongoing resource expansion objectives. We look forward to bringing further drilling results in the very near future."

Detailed Results

Winter Drilling

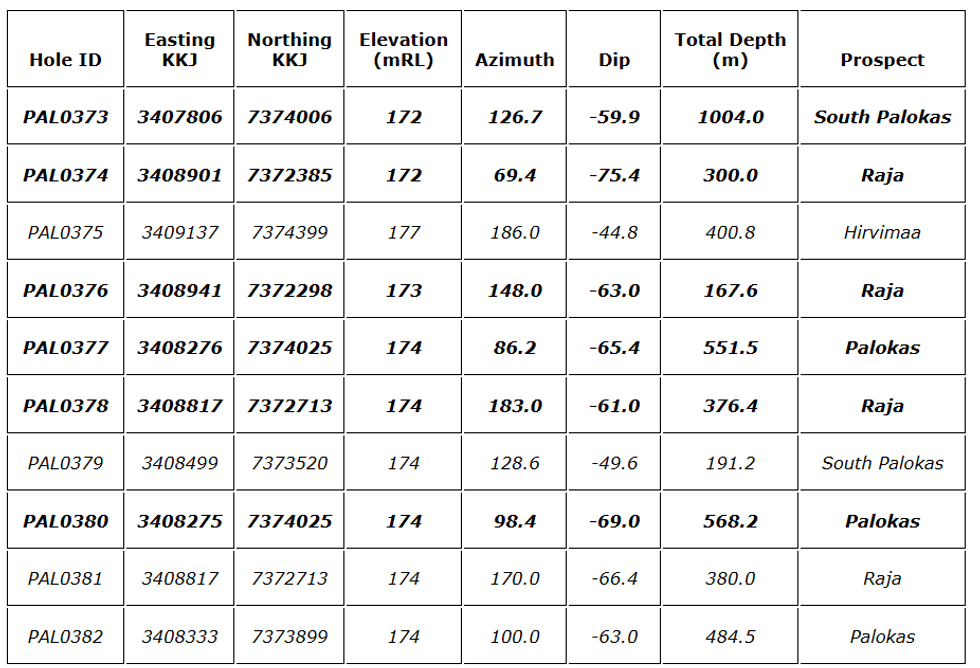

Four diamond drilling rigs are actively drilling at the Rajapalot project. Ten diamond drillholes have been completed to date, for a total of 4,424 metres at time of writing. Primary aims for this season's drilling program are to extend the limits of the currently defined envelope of the Rajapalot inferred mineral resource, while secondary aims focus on target-test drilling of geochemical and geophysical targets developed during the summer and autumn field exploration season in order to advance the ‘exploration pipeline' and define new zones of gold-cobalt mineralization. To date, gold-assay results (cobalt values to be announced) have been received for the first 6 of the 10 completed holes and presented in Table 1, 2 and 3, and Figure 1.

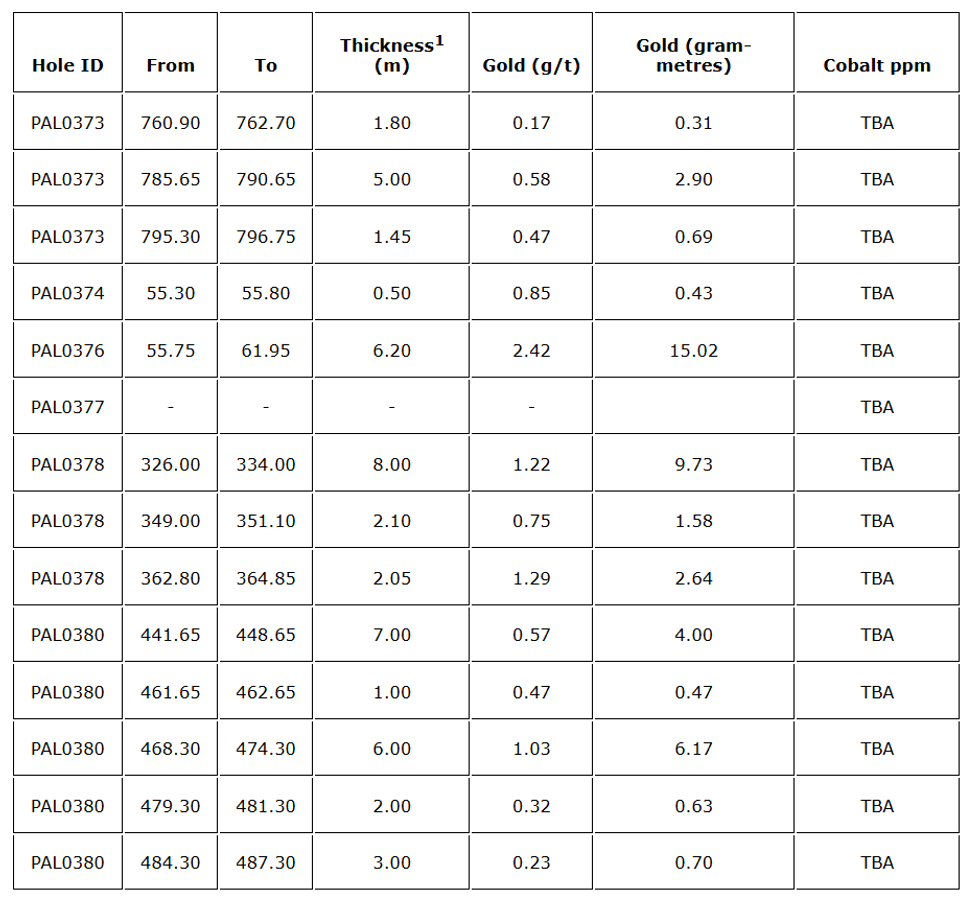

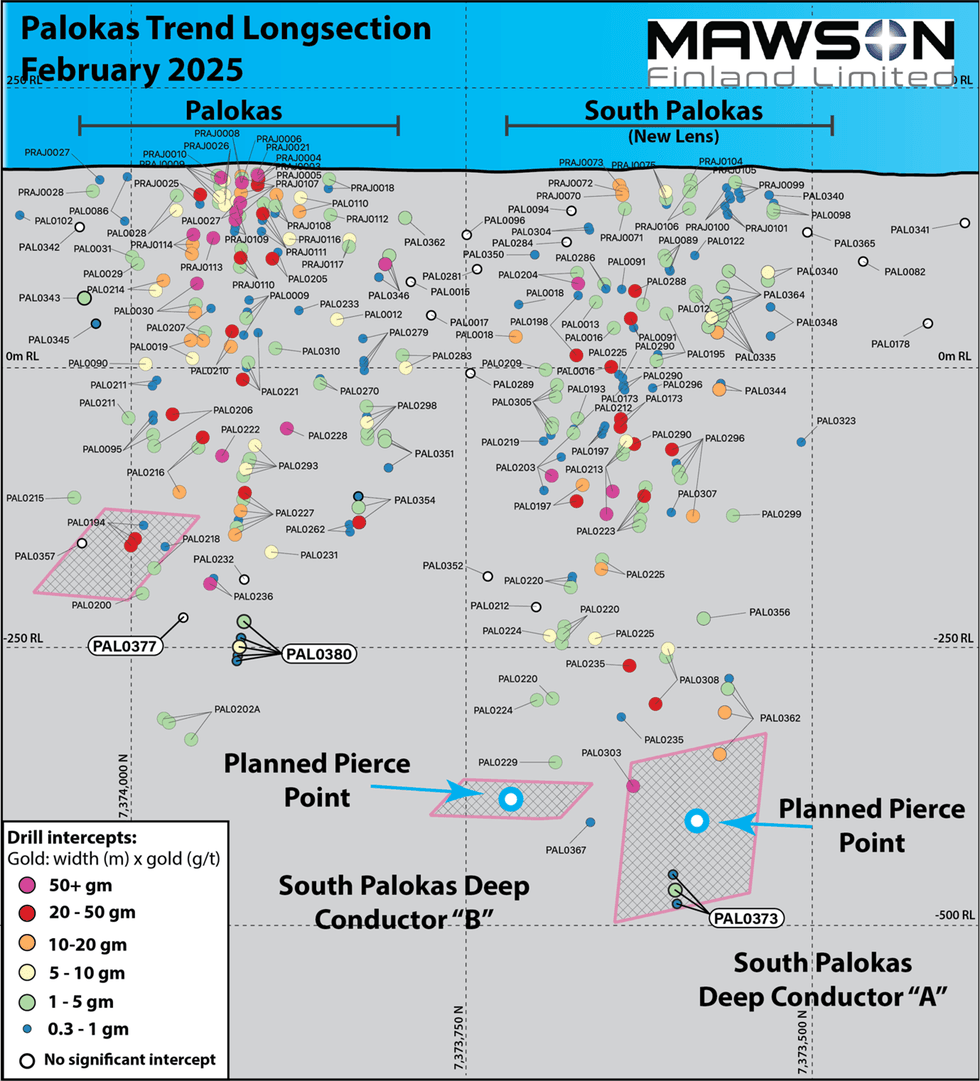

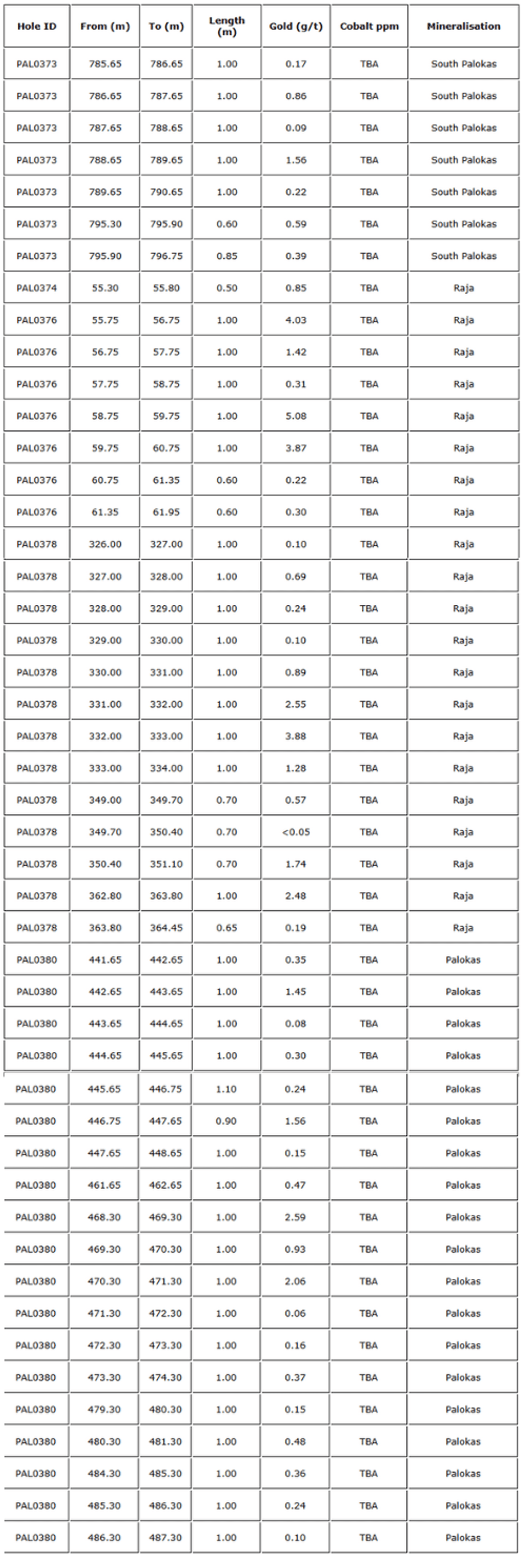

South Palokas: To date, a single 1,004 metre drillhole PAL0373 - the deepest ever drilled at Rajapalot - has been completed at South Palokas, where it successfully penetrated the modelled deep, southern conductive anomaly (South Palokas deep conductor "A"), returning a significant intercept of 5 m @ 0.58 g/t Au from 785.65 metres downhole (see Figure 2). This intercept demonstrates the steeply-dipping, depth-continuation of South Palokas, representing an approximate 120m step-out in the plane of mineralisation. Closest significant intersections are PAL0303 with 30.8 metres @ 5.1 g/t Au at 120m distance and distance of 150m PAL0361 with 6m @ 2.24 g/t Au and 5.3m 2.73 g/t Au (Reported previously). Further drilling will be carried out in order to define geometry and test for high-grade mineralisation in the core-portions of the modelled conductive zone (refer to Figure 2).

Palokas: To date, 3 drillholes have been completed at Palokas zone of gold-cobalt mineralization, of which PAL0380 has returned a dispersed mineralised zone consisting of 5 separated intercepts recording a best of 6 m @ 1.03 g/t gold, and 7 m @ 0.57 g/t gold (refer to Table 2). Drillhole PAL0377 did not record any significant intercept, and drillhole PAL0382 awaits logging, sampling and assay.

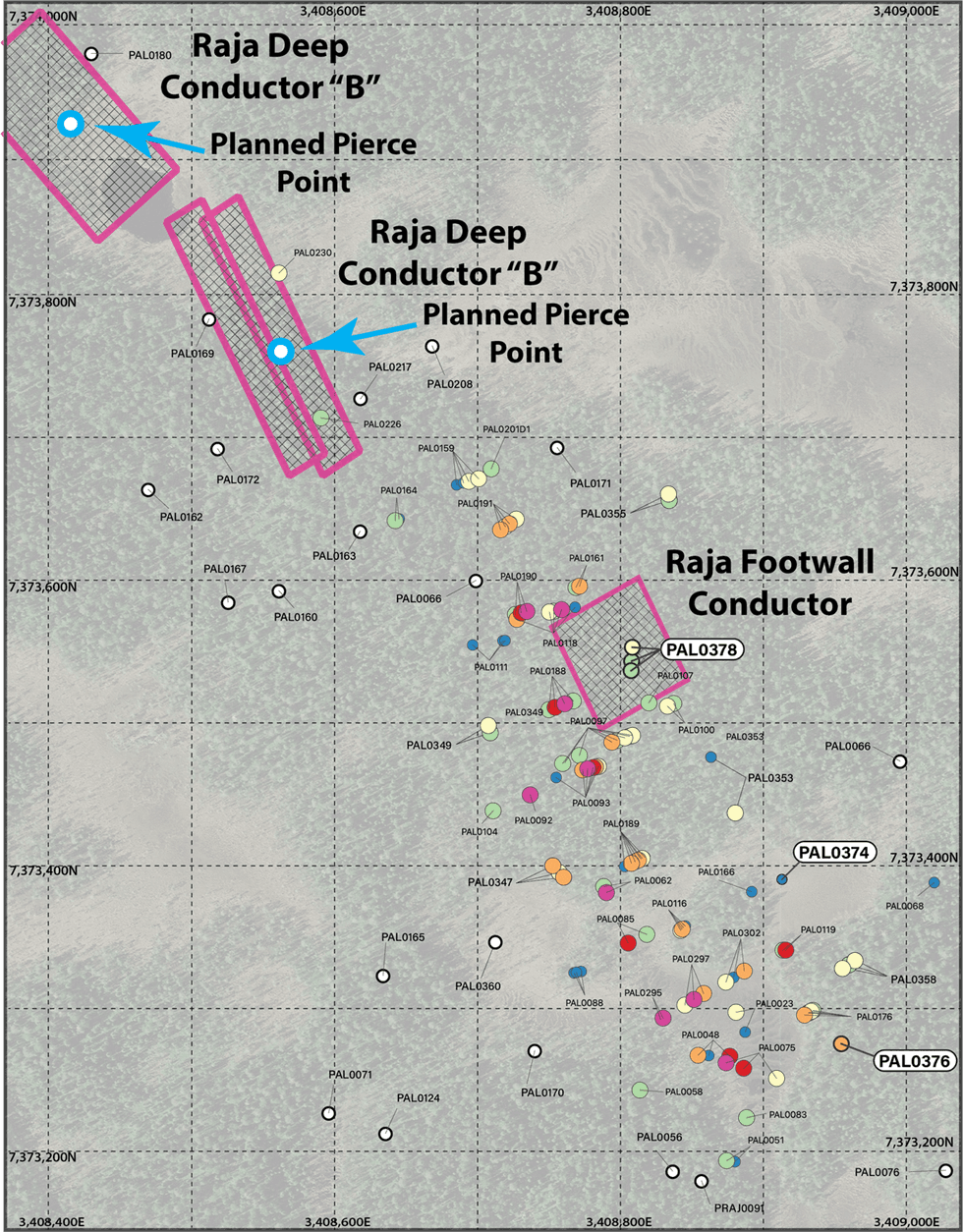

Raja: To date, 4 drillholes have been completed at Raja, with significant intercepts recorded in holes PAL0374 (0.5 m @ 0.85 g/t gold), PAL0376 (6.2 m @ 2.42 g/t gold) and PAL0378 (best intercept of 8 m @ 1.22 g/t gold; refer to Table 2 and Figure 3). Drillhole PAL0381 awaits logging, sampling and assay. Importantly, drillhole PAL0378 intercepted the modelled downhole-EM conductor situated in the footwall-zone below the main Raja lens of mineralisation, confirming gold-mineralisation in this conductive anomaly, returning a 2.05 metre thick gold-bearing interval of 1.29 g/t gold (refer to Figure 3).

Geophysics

In January 2025, a series of downhole-EM surveys were carried out in the lower portions of the Raja zone in order to search for any conductive bodies in and around the historical deeper drilling. Downhole probes were sent down drillholes PAL0180, PAL0230 and PAL169, where each detected a series of off-hole conductors. Most notably, a conductive anomaly was detected below and to the immediate south of drillhole PAL0180, with the modelled plate measuring 150 x 75 metres, dipping shallowly to the north-west, with the centre of the modelled plate located approximately 640 metres below surface (refer to Figure 3; Raja deep conductor "B"). Similarly, off-hole and overlapping conductive anomalies were recorded from drillholes PAL0230 and PAL0169, with the modelled overlapping plates measuring a combined 200 x 50 metres in area, dipping shallowly to the north-west, with centres of the modelled plates located between 508 and 520 metres below surface (refer to Figure 3; Raja deep conductor "A"). Geophysical modelling and interpretation of these conductive anomalies is ongoing and more refined findings will be presented in future news releases.

Technical Background, Data Verification and Quality Assurance and Quality Control

Four diamond drill rigs from MK Core Drilling Oy, Comadev Oy and Arctic Drilling Company Oy, all with water recirculation and drill cuttings collection systems, were used in this drill program. Core diameter is NQ2 (50.7 mm). Core recoveries are excellent and average close to 100% in fresh rock. After photographing and logging in Mawson's Rovaniemi facilities, core intervals of between 0.4 to 2 metres are taken, then half-sawn by independent contractors the Geological Survey of Finland (GTK) in Rovaniemi, Palsatech Oy in Kemi and Geopool Oy in Sodankylä. The remaining half core is retained for verification and reference purposes. Analytical samples are transported by commercial transport from site to the independent contractor CRS Minlab Oy ("CRS") facility in Kempele, Finland. Samples were prepared and analyzed for gold using the PAL1000 technique which involves grinding the sample in steel pots with abrasive media in the presence of cyanide, followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (including cobalt) are pulped at CRS, then transported by air to MSALABS in Vancouver, Canada and analyzed using four acid digest ICP-MS methods. All the foregoing laboratories are independent of the Company. The quality assurance and quality control program of Mawson consists of the systematic insertion of certified standards of known gold content, duplicate samples by quartering the core, and blanks placed within sample runs in interpreted mineralized rock. In addition, CRS inserts blanks and standards into the analytical process. In addition to the sample preparation and security measures described above, data verification procedures are well integrated into the Company's quality assurance and quality control program. Routine ongoing checking of all data is undertaken prior to being uploaded to the database. This will be followed by independent data verification audits at exploration milestones throughout the Rajapalot project's development. Dr. Fromhold (see "Qualified Person" below) has also reviewed the qualifications and analytical procedures of the above-mentioned laboratories, photographs of drill cores, and the PEA in connection with verifying the exploration information presented herein.

All maps have been created within the KKJ3/Finland Uniform Coordinate System (EPSG:2393). Tables 1-3 in Schedule "A" hereto provide collar and assay data. Due to the typically low angles of drill intercepts, the true thickness of the mineralized intervals are interpreted to be approximately 80-90% of the drilled thickness. Table 3 gives detailed individual assay data of all intervals reported in this press release. Intersections are reported with a lower cut of 0.1 g/t Au over sampled intervals, with composite data (Table 2 in Schedule "A" hereto) containing no more than 2 metres of consecutively sampled waste-rock (i.e., 2 metres @ <0.05 g/t Au). No upper-cut was applied.

Geophysical Survey Parameters

The downhole EM (DHEM) survey was conducted by Finnish geophysics provider Geovisor Oy from Rovaniemi, using a Zonge ZT-30 transmitter system. The acquisition was measured using the EMIT Smartem24 receiver system with EMIT DHEM Digiatlantis probe that measures the decaying magnetic field with three orthogonal Fluxgate magnetometer sensors producing along hole (A-component), and two perpendicular components (namely U and V- components). For each loop configuration, the base frequency was tested, and the base frequency was altered from 0.25 Hz to 1 Hz. The EM response was stacked over 32,128 EM pulses depending on the base frequency and the observed signal strength. The used time windows scheme was SMARTem standard containing 39 to 43 time channels depending on the base frequency. All the holes were measured in one piece from the collar with surveys having 10 metre reading intervals. The modelling was done using Maxwell software, using plate models. All maps have been created within the KKJ3/Finland Uniform Coordinate System (EPSG:2393).

Deposit Model

At Rajapalot, mineralization is regarded as orogenic in nature. All examples of gold-cobalt mineralisation are consistently located within highly-sheared and foliated wall-rocks adjacent to strongly hydrothermally altered, northwest to north dipping shear-zones. Mineralisation is typically encountered as disseminated to semi-massive sulfide lenses (predominantly pyrrhotite and lesser pyrite cobaltite), hosted within strongly deformed and altered, mafic volcanic and volcaniclasitic stratigraphy of the upper portions of the Paleoproterozoic-aged Kivalo Group of the Peräpohja Greenstone Belt. Prospects with high-grade gold and cobalt mineralisation at Rajapalot occur across a 3 km (east-west) by 2 km (north-south) area within the larger Rajapalot project area measuring 4 km by 4 km with multiple mineralized boulders, base-of-till (BOT). Gold-Cobalt mineralization at Rajapalot has been drilled to approximately 470 metres below surface at both South Palokas and Raja prospects, and mineralisation remains open at depth across the entire project.

Rajapalot Mineral Resource

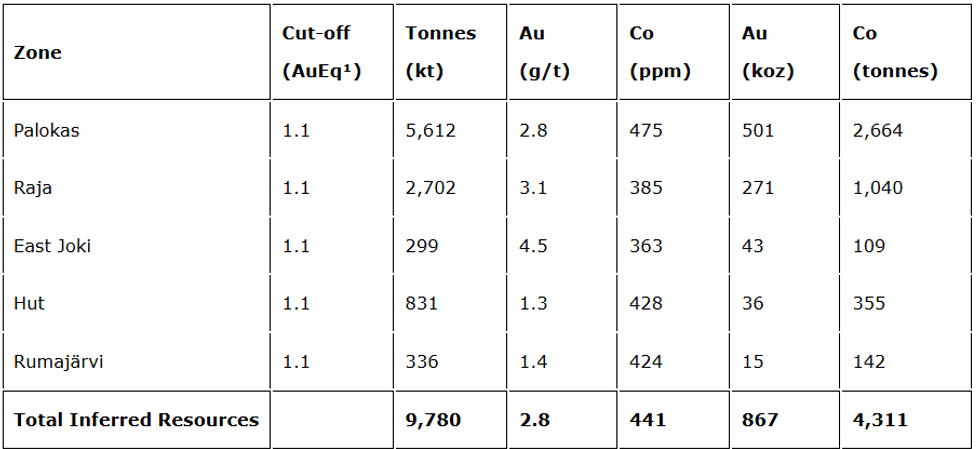

An Inferred Mineral Resource ("MRE") has been calculated for the Rajapalot project (effective date August 26, 2021), and is based on an ‘underground only' mining scenario containing 9.8 million tonnes @ 2.8 g/t gold ("Au") and 441 ppm Co, equating to 867 thousand ounces ("koz") gold and 4,311 tonnes of cobalt.

Rajapalot Inferred Mineral Resource Effective August 26, 2021

- The independent geologist and Qualified Person as defined in NI 43-101 for the mineral resource estimates is Mr. Ove Klavér (EurGeol). The effective date of the MRE remains unchanged to the Previous MRE (August 26, 2021, available on SEDAR as filed by the previous owner, Mawson), and will be restated in the PEA technical report when it is filed.

- The mineral estimate is reported for a potential underground only scenario. Inferred resources were reported at a cut-off grade of 1.1 g/t (AuEq1 Au g/t + Co ppm /1005) with a depth of 20 meters below the base of solid rock regarded as the near-surface limit of potential mining.

- Wireframe models were generated using gold and cobalt shells separately. Forty-eight separate gold and cobalt wireframes were constructed in Leapfrog Geo and grade distributions independently estimated using Ordinary Kriging in Leapfrog Edge. A gold top cut of 50 g/t Au was used for the gold domains. A cobalt top cut was not applied.

- A parent block size of 12 m x 12 m x 4 m (>20% of the drillhole spacing) was determined as suitable. Sub-blocking down to 4 m x 4 m x 0.5 m was used for geologic control on volumes, thinner and moderately dipping wireframes.

- Rounding of grades and tonnes may introduce apparent errors in averages and contained metals.

- Drilling results to 20 June 2021.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Qualified Person

The technical and scientific information in this news release was reviewed, verified and approved by Dr. Thomas Fromhold, an employee of Fromhold Geoconsult AB, and Member of The Australian Institute of Geosciences (MAIG, Membership No. 8838). Dr. Fromhold is a "qualified person" as defined under NI 43-101. Dr. Fromhold is not considered independent of the Company under NI 43-101 as he is a consultant of the Company.

About Mawson Finland Limited

Mawson Finland Limited is an exploration stage mining development company engaged in the acquisition and exploration of precious and base metal properties in Finland. The Company is primarily focused on gold and cobalt. The Corporation currently holds a 100% interest in the Rajapalot Gold-Cobalt Project located in Finland. The Rajapalot Project represents approximately 5% of the 100-square kilometre Rompas-Rajapalot Property, which is wholly owned by Mawson and consists of 11 granted exploration permits for 10,204 hectares and 2 exploration permit applications and a reservation notification area for a combined total of 40,496 hectares. In Finland, all operations are carried out through the Company's fully owned subsidiary, Mawson Oy. Mawson maintains an active local presence of Finnish staff with close ties to the communities of Rajapalot.

Additional disclosure including the Company's financial statements, technical reports, news releases and other information can be obtained at mawsonfinland.com or on SEDAR+ at www.sedarplus.ca.

Media and Investor Relations Inquiries

Please contact: Neil MacRae Executive Chairman at neil@mawsonfinland.com or +1 (778) 999-4653, or Noora Ahola Chief Executive Officer at nahola@mawson.fi or +358 (505) 213-515.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No securities regulatory authority has reviewed or approved of the contents of this news release.

Forward-looking Information

This news release includes certain "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws (collectively, "forward-looking information") which are not comprised of historical facts. Forward-looking information includes, without limitation, estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking information may be identified by such terms as "believes", "anticipates", "expects", "estimates", "aims", "may", "could", "would", "will", "must" or "plan". Since forward-looking information is based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, and management of the Company believes them to be reasonable based upon, among other information, the contents of the PEA and the exploration information disclosed in this news release, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, any expected receipt of additional assay results or other exploration results and the impact upon the Company thereof, any expected milestone independent data verification, the continuance of the Company's quality assurance and quality control program, potential mineralization whether peripheral to the existing Rajapalot resource or elsewhere, any anticipated disclosure of assay or other exploration results and the timing thereof, the estimation of mineral resources, exploration and mine development plans, including drilling, soil sampling, geophysical and geochemical work, any expected search for additional exploration targets and any results of such searches, potential acquisition by the Company of any property, the growth potential of the Rajapalot resource, all values, estimates and expectations drawn from or based upon the PEA, and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to: any change in industry or wider economic conditions which could cause the Company to adjust or cancel entirely its exploration plans, failure to identify mineral resources or any additional exploration targets, failure to convert estimated mineral resources to reserves, any failure to receive the results of completed assays or other exploration work, poor exploration results, the inability to complete a feasibility study which recommends a production decision, the preliminary and uncertain nature of the PEA, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Click here to connect with Mawson Finland Limited (TSXV:MFL) to receive an Investor Presentation

MFL:CC

The Conversation (0)

31 October 2024

Mawson Finland Limited

Gold and cobalt exploration in Tier 1 Lapland Region in Northern Finland

Gold and cobalt exploration in Tier 1 Lapland Region in Northern Finland Keep Reading...

5h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

7h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00