June 07, 2022

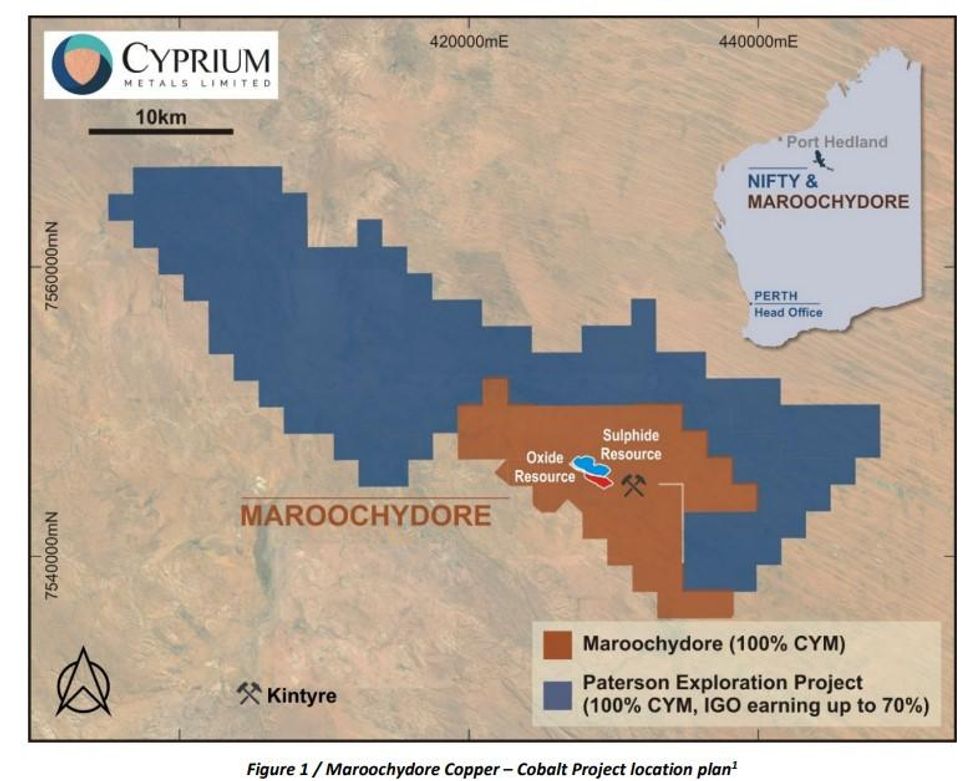

Cyprium Metals Limited (“CYM”, “Cyprium” or “the Company”) is pleased to report the remaining assay results from the initial drilling campaign which was completed in 2021 at the Maroochydore copper-cobalt project (refer to Figure 1).

HIGHLIGHTS

- Drilling extends massive Maroochydore copper-cobalt oxide resource potential

- Maroochydore is the 8th largest copper development project in Australia, ranked by contained copper metal

- Near-surface oxide copper-cobalt mineralisation extended to 3,000m long, up to 500m wide and up to 100m thick

Significant Copper results include:

- 38m @ 1.04 % Cu & 508 ppm Co from 82m in 21MDRC027 including:

- 20m @ 1.60 % Cu & 794 ppm Co from 86m

- 61m @ 0.92% Cu & 543 ppm Co from 71m in 21MDRC030 including:

- 5m @ 1.39 % Cu & 795 ppm Co from 73m

- 4m @ 1.92 % Cu & 794 ppm Co from 90m

- 13m @ 1.77 % Cu & 818 ppm Co from 96m

- 61m @ 0.35 % Cu & 203 ppm Co from 56m in 21MDRC033 including:

- 2m @ 0.45 % Cu & 146 ppm Co from 62m

- 5m @ 0.46 % Cu & 244 ppm Co from 69m

- 4m @ 1.27 % Cu & 212 ppm Co from 88m

- 6m @ 0.46 % Cu & 342 ppm Co from 102m

Significant Cobalt results include:

- 22m @ 0.19 % Cu & 529 ppm Co from 25m in 21MDRC022 including:

- 4m @ 0.16 % Cu & 1,659 ppm Co from 42m

- 35m @ 0.31 % Cu & 743 ppm Co from 39m in 21MDRC024 including:

- 7m @ 0.48 % Cu & 1,775 ppm Co from 48m

- 6m @ 0.54 % Cu & 1,186 ppm Co from 60m

Managing Director Barry Cahill commented:

“Repeated significant intersections demonstrate the robustness and size of this deposit at Maroochydore. Our initial drilling programme at Maroochydore targeted the oxide zones of the deposit and has returned better than expected results. We look forward to further developing the oxide and sulphide resource base of this large greenfield project in the next phase of drilling.”

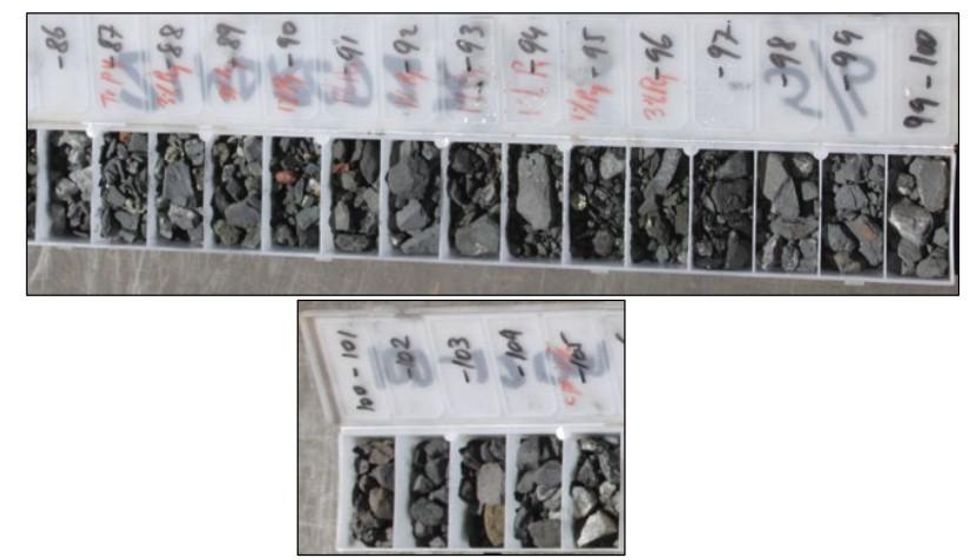

The 50 RC drillhole programme included 46 resource definition and extension holes (5,990m) and 4 water monitoring bores (228m) for a total of 6,218 metres as detailed in Figure 2, Images 1 to 5 and Table 1. The initial results from 18 resource extension drillholes and 1 water bore were the subject of the Cyprium announcement titled Maroochydore Cu-Co Project Initial RC Drilling Results released 14 February 2022.

Oxide mineralisation at Maroochydore has currently been drilled over a strike length of 3,000m, has a width up to 700m and thicknesses up to 100m, as outlined in Figure 2 and Sections 1 to 3. The 2021 RC drilling programme targeted oxide, supergene and transitional mineralisation at the project, the results of which will inform a mineral resource update for the project in the second half of 2022 to be utilised in a scoping study. Cyprium will release to the market the results of the mineral resource estimate and scoping study as and when they become available.

Click here for the full ASX Release

This article includes content from Cyprium Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CYM:AU

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 March 2025

Cyprium Metals

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth Keep Reading...

23 January

Capital Raise Presentation

Cyprium Metals (CYM:AU) has announced Capital Raise PresentationDownload the PDF here. Keep Reading...

22 January

A$41M Capital Raise via Placement & Entitlement Offer

Cyprium Metals (CYM:AU) has announced A$41M Capital Raise via Placement & Entitlement OfferDownload the PDF here. Keep Reading...

19 January

Paterson Exploration Review Update

Cyprium Metals (CYM:AU) has announced Paterson Exploration Review UpdateDownload the PDF here. Keep Reading...

19 November 2025

Cathode Restart Approved by Cyprium Board

Cyprium Metals (CYM:AU) has announced Cathode Restart Approved by Cyprium BoardDownload the PDF here. Keep Reading...

13 November 2025

Senior Loan Facility Refinanced with Nebari

Cyprium Metals (CYM:AU) has announced Senior Loan Facility Refinanced with NebariDownload the PDF here. Keep Reading...

11h

Faraday Copper Signs LOI to Acquire BHP’s San Manuel Property in Arizona

Faraday Copper (TSX:FDY,OTCQX:CPPKF) has signed a letter of intent (LOI) to acquire BHP's (ASX:BHP,NYSE:BHP,LSE:BHP) San Manuel property, which sits next to its Copper Creek project in Arizona. The company says the move will combine the two adjacent assets into a single US-focused copper... Keep Reading...

23 February

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

23 February

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00