April 26, 2022

Queensland Pacific Metals Ltd (ASX:QPM) (“QPM” or “the Company”) is pleased to present a summary of activities from the March 2022 quarter

Highlights

- Conditional finance support received from Korea Trade Insurance Corporation (“K-SURE”) for the provision of debt funding for the TECH Project, reinforcing QPM’s ties with Korea.

- Baseload ore supply contract executed with Société Le Nickel (“SLN”) and approved by New Caledonian government.

- Continuing to advance through the Definitive Feasibility Study (“DFS”), with extensive testwork being undertaken during the quarter with key vendors to ensure commercial equipment is fit for purpose and optimised.

- First High Purity Alumina (“HPA”) made from New Caledonia ore in testwork with Lava Blue.

- Regulatory approvals required to construct the TECH Project are progressing on schedule

- Residue testwork and discussions with Queensland State Government regarding use as engineered landfill have been positive – pathway to zero solids waste and reinforcement of QPM’s ESG credentials

K-SURE Funding

Ever since the investment and binding offtake agreement signed with LG Energy Solution and POSCO, QPM has targeted Korean export credit agencies as potential financiers of the project. QPM commenced discussions with K-SURE in 2021, culminating in the provision of a formal Expression of Interest letter from K-SURE to QPM.

The Expression of Interest from K-SURE is a significant milestone in their internal consideration for the provision of debt funding. K-SURE has indicated that its participation in the debt syndicate will be in line with the terms and conditions of Export Finance Australia (“EFA”), which has previously provided a letter outlining $250m of conditional financing support. The letter received from K-SURE does not constitute a commitment or an offer and any provision of debt funding will be subject to due diligence and typical terms and conditions.

The Korean and Australian governments have recently focused on formal cooperation regarding critical minerals. In December 2021, the Australian and Korean governments entered into a Memorandum of Understanding (“MOU”) regarding cooperation in Critical Minerals Supply Chains. Following this, both countries’ Export Credit Agencies (K-SURE and EFA) entered into an MOU to strengthen their capacity to work together and undertake joint financings.

QPM’s strong ties to Korea have positioned it well to access financing from both Australian and Korean export credit agencies and strong progress has been made. As the project progresses towards financial close, QPM is confident that these strong Korean-Australian ties will assist in obtaining credit approval for debt funding from these parties

Ore Supply

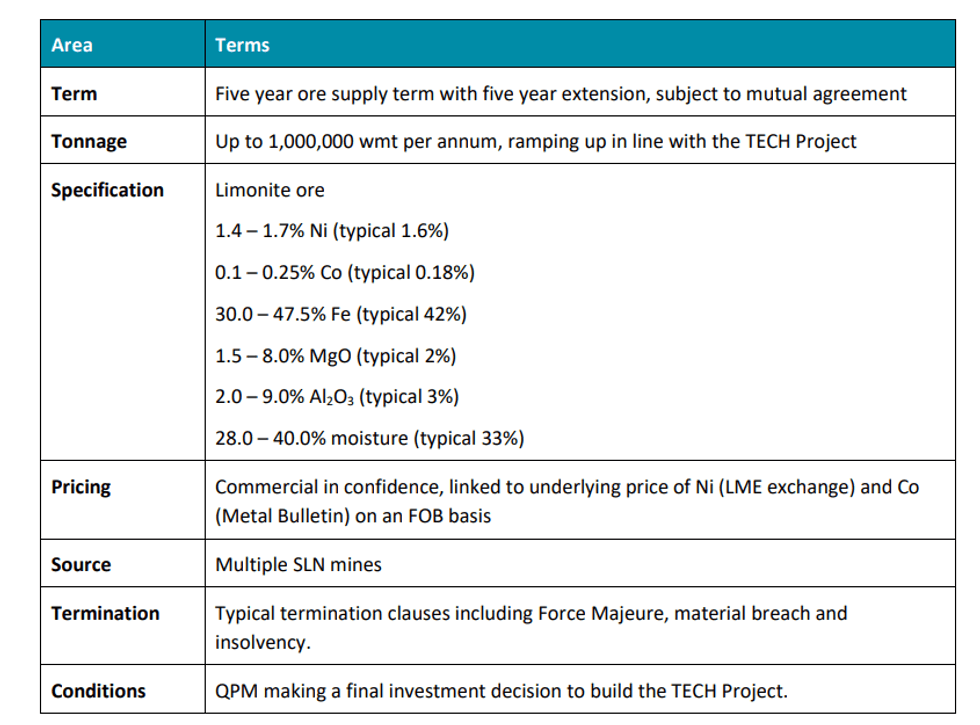

QPM and SLN have been in discussions and negotiating terms for ore supply since the execution of an MOU in April 2021. In parallel, SLN had been working with the New Caledonia government to obtain the requisite approvals it required to export ore to QPM.

In February 2022, a press conference was held by the President of New Caledonia, Louis Mapou, and SLN. At the press conference, it was announced that the Government of New Caledonia had approved an increase in the annual nickel ore export quota of SLN. This increase includes the supply of up to 1,000,000 wet metric tonnes (“wmt”) of nickel ore per annum to QPM. The approval is valid through to 2029, in line with SLN’s existing export approvals that are currently in place.

Shortly after receiving government approval, QPM and SLN executed a binding contract for up to 1,000,000 wmt of nickel ore per annum. The key terms of the agreement are set out in the table below:

The execution of this contract is a major de-risking milestone for QPM with regards to its ore supply and demonstrates the support of the project from New Caledonia and SLN.

QPM is in active discussions with other ore suppliers for the balance of its ore required at full production.

Click here for the full ASX Release

This article includes content fromQueensland Pacific Metals Ltd , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00