- WORLD EDITIONAustraliaNorth AmericaWorld

May 23, 2024

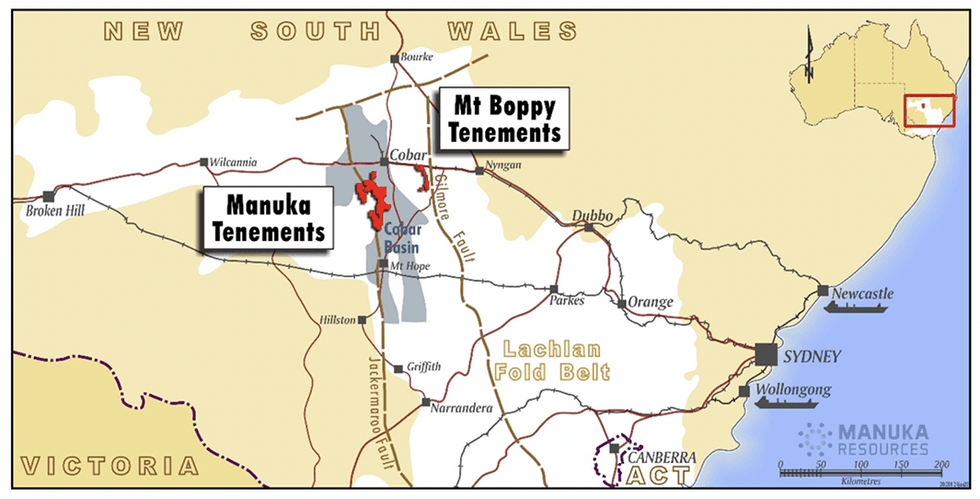

Manuka Resources Limited (ASX:MKR) is an ASX-listed mining company with gold and silver-gold projects in the Cobar Basin, one of Australia’s most prolific producers of base and precious metals.

The company focuses on its 100 percent owned fully permitted precious metals projects in the Cobar Basin - the Mt Boppy gold mine and Wonawinta silver project. Manuka Resources's development strategy includes bringing back the Mt Boppy gold mine into production and restarting mining and production at the Wonawinta silver mine.

The Mt Boppy gold mine was historically one of the richest in NSW, Australia and produced ~500,000oz gold at an average grade of 15 grams per ton (g/t) gold. Accordingly, the company is very excited about its exploration potential.

The Mt Boppy gold project comprises three mining leases, four gold leases and one exploration license, spanning an area of more than 210 sq. km. in the prolific Cobar Basin in New South Wales, Australia. The project was acquired by Manuka in 2019, and has a current mineral resource of 4.3 Mt at 1.19 g/t gold. This includes a combination of oxidized and transitional/fresh mineralization in the ground, as well as mineralized rock dumps and tailings.

Company Highlights

- Manuka Resources is an ASX-listed mining company focused on exploring and developing gold and silver assets in the Cobar Basin in New South Wales, Australia.

- The company’s two principal assets – the Mt Boppy Gold Mine and the Wonawinta Silver Mine – are both located in the prolific Cobar Basin. In addition, MKR holds a 100 percent interest in the Taranaki VTM iron sands project, located in New Zealand.

- The primary focus is on bringing the fully permitted Mt Boppy mine back into production by Q4 2024. The company aims to establish an on-site processing plant at Mt Boppy and in turn free up the Wonawinta processing plant for silver production from the Wonawinta silver mine, which was being used to process Mt Boppy ore.

- The results of the recently completed sonic drill program coupled with an updated mineral resources estimate at Mt Boppy (100 percent increase in indicated gold ounces) improve confidence in the recommencement of gold dore production at Mt Boppy.

- A dedicated processing facility at Mt Boppy will improve the project economics and also allow for an additional revenue stream by freeing up the Wonawinta processing plant to process ore from the Wonawinta silver mine (placed on care and maintenance in February 2024, and targeting release of its maiden silver reserve under Manuka ownership before the end of June 2024).

- The cash flows from the Mt Boppy mine will be used to fund the restart of the Wonawinta silver mine, which is also expected to become operational by late Q1 or early Q2 2025.

- Elevated gold and silver prices should substantially benefit Manuka Resources, resulting in improved profitability and cash flows as it brings both its gold and silver projects into production.

This Manuka Resources profile is part of a paid investor education campaign.*

Click here to connect with Manuka Resources (ASX:MKR) to receive an Investor Presentation

MKR:AU

The Conversation (0)

26 March 2025

Manuka Resources

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales Keep Reading...

05 August 2025

Results of Fully Underwritten Entitlement Offer

Manuka Resources (MKR:AU) has announced Results of Fully Underwritten Entitlement OfferDownload the PDF here. Keep Reading...

31 July 2025

June 2025 Quarter Activities and Cashflow Reports

Manuka Resources (MKR:AU) has announced June 2025 Quarter Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

29 July 2025

Maiden Mt Boppy Open Pit Ore Reserve

Manuka Resources (MKR:AU) has announced Maiden Mt Boppy Open Pit Ore ReserveDownload the PDF here. Keep Reading...

10 July 2025

Further Information to 26 June Announcement

Manuka Resources (MKR:AU) has announced Further Information to 26 June AnnouncementDownload the PDF here. Keep Reading...

08 July 2025

Reinstatement to Quotation

Manuka Resources (MKR:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

2h

Visible Gold Intersected at Roy, Sunbeam

First Class Metals PLC ("First Class Metals", "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to provide an update on the ongoing drilling programme at the Roy prospect on the... Keep Reading...

9h

Peruvian Metals Announces Private Placement

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that it has arranged a non-brokered private placement for gross proceeds of up to $750,000 which will be used to make improvements and additions for expansion to its Aguila Norte processing... Keep Reading...

14h

Additional Strong Assays Results Extend High-Grade Antimony Mineralisation at Oaky Creek

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”) a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce that it has received continued strong assay results... Keep Reading...

22h

Jeffrey Christian: Gold, Silver Prices to Rise, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

23h

Precious Metals Price Update: Gold, Silver, PGMs Volatile on Oil Spike, Fed Rates

Precious metals prices are responding to the impact of the US-Iran war, as well as inflation data.The war has weighed on the precious metals market for much of this past week. An oil price surge past US$100 per barrel increased the threat of inflation and strengthened the US dollar, softening... Keep Reading...

11 March

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00