November 18, 2024

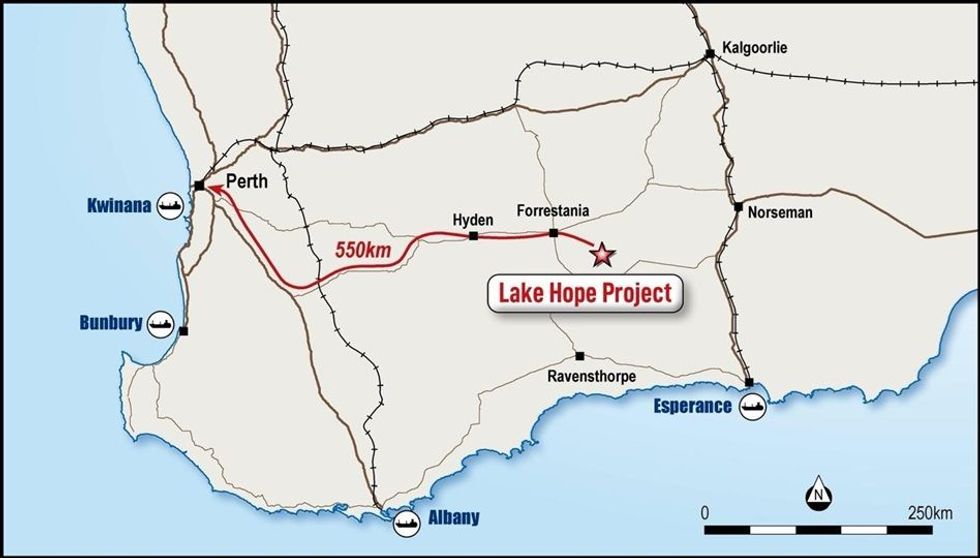

Impact Minerals Limited (ASX:IPT) is pleased to announce a substantial and high-grade maiden Measured Resource estimate for its flagship Lake Hope High Purity Alumina (HPA) Project, located about 500 km east of Perth in Western Australia. Impact has the right to earn an 80% interest in Playa One Pty Ltd, owner of the Lake Hope project, via an incorporated joint venture by completing a Pre- Feasibility Study (PFS) currently in progress (Figure 1 and ASX Release 21st March 2023).

- A maiden Measured Resource of 730,000 tonnes at 25.8% alumina (Al2O3) for a contained 189,000 tonnes of alumina has been defined at the Lake Hope HPA Project in Western Australia.

- The Measured Resource supports the first 15 years or more of proposed HPA production from Lake Hope. It will underpin a maiden Probable or Proven Reserve, subject to ongoing mining studies, test work, and economic studies to be completed as part of the Pre-Feasibility Study on Lake Hope.

- Impact aims to bring Lake Hope into production to deliver low-cost, high-margin end products to a rapidly expanding global market. Current prices for benchmark 4N HPA (99.99% Al2O3) and related products are more than US$20,000 per tonne.

- The Pre-Feasibility Study will be completed in Q1 2025 after the final reports from various contractors and consultants are received, which are expected in December and January.

- Following an agreement with the Federal government, the first monies from the recent $2.87 million grant for the CRC-P research and development project with CPC Engineering and Edith Cowan University to construct a pilot plant for Lake Hope will be received by the end of November, a few months ahead of schedule. This will accelerate the construction of the pilot plant.

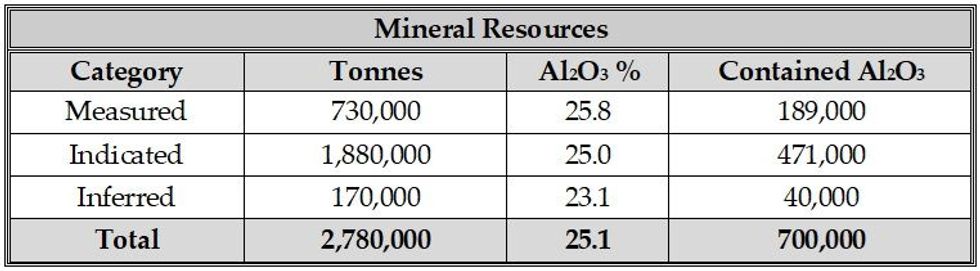

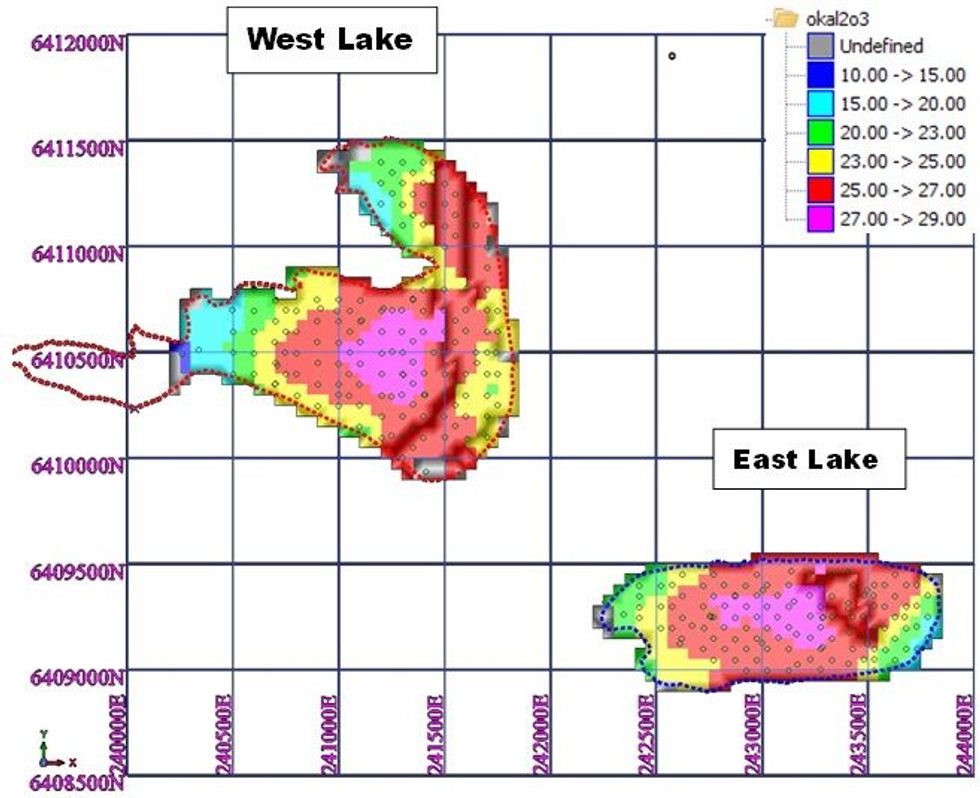

The Measured Resource comprises 730,000 tonnes of lake clay at a grade of 25.8% alumina (aluminium oxide, Al2O3) for a contained 189,000 tonnes of alumina (Table A). It is part of a much larger resource that includes Indicated and Inferred Resources within a unique deposit of high-grade alumina hosted in extremely fine-grained evaporite and clay minerals in the top two metres of two small dry salt lakes in the Lake Hope playa system (West Lake and East Lake, Figure 3 and ASX Release March 21st 2023).

The Measured Resource will underpin a maiden Probable or Proven Reserve Statement for an initial mine life of at least 15 years at the proposed benchmark production rate of 10,000 tonnes per annum of High Purity Alumina. The Reserve Statement is subject to further mining, metallurgical test work and economic studies that are part of the ongoing PFS (ASX Release October 9th 2024).

The larger resource underpins a potentially much longer mine life of at least 25 years, as reported in the Scoping Study on Lake Hope. The study showed that the project had very robust economics, with an after-tax Net Present Value (NPV8) of A$1.3 billion and one of the lowest operating costs per tonne of HPA globally (ASX Release November 9th, 2023). Impact confirms that all material assumptions underpinning the production target and forecast financial information in the Scoping Study continue to apply.

The Mineral Resource estimate is shown in Table A and is reported in accordance with the requirements of the JORC Code 2012 by resource consultants H and S Consultants Pty Ltd (HSC) of Brisbane, Queensland. All details relevant to the Resource Estimate are given below and in the JORC Tables 1, 2 and 3 at the end of this report. Drill hole information and assay data have been reported previously (ASX Release 19th June 2023).

About 60% of the Measured Resource lies within West Lake, over which Impact recently pegged a Mining Lease Application (ASX Release August 12th, 2024). When required, further low-cost push-tube sampling of the lake can significantly increase the size of the measured resource (Figure 2).

The alumina block grade distribution for the resources is shown in Figure 2. The grade increases towards the centre of the lakes, offering an opportunity for preferential mining of the higher-grade material in the early stages of any future mine development. Initial geometallurgical studies examining the variability of the mineral assemblages across the lakes have also been completed, and these are being incorporated into the mining schedules being prepared for the PFS.

The new Mineral Resource Estimate will be incorporated, as per the JORC 2012 Code, into the Pre- Feasibility Study for Lake Hope, which is nearing completion. Final reports from the engineering and design studies, mining schedules, and mining cost estimates, as well as from other contractors and consultants, are awaited. Some of these are expected in mid-December, and accordingly, the PFS is expected to be completed in Q1 2025.

Early Access to the CRC-P Research and Development Grant Funding

Impact recently announced that, in collaboration with CPC Engineering and the Mineral Recovery Research Centre (MRRC) at Edith Cowan University, it had been awarded a $2.87 million grant to commercialise its innovative process for producing High-Purity Alumina from Lake Hope (ASX Release October 22nd, 2024).

The grant is provided under the Federal Government’s Cooperative Research Centres Projects (CRC-P) program and is part of a more extensive research and development project designed to

provide Impact with the relevant information required to complete a Definitive Feasibility Study. A vital component of the grant funding will be to construct a pilot plant, which is an essential milestone for 2025, and this will provide consistent HPA samples for off-take and qualification trials.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

15h

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00