December 13, 2023

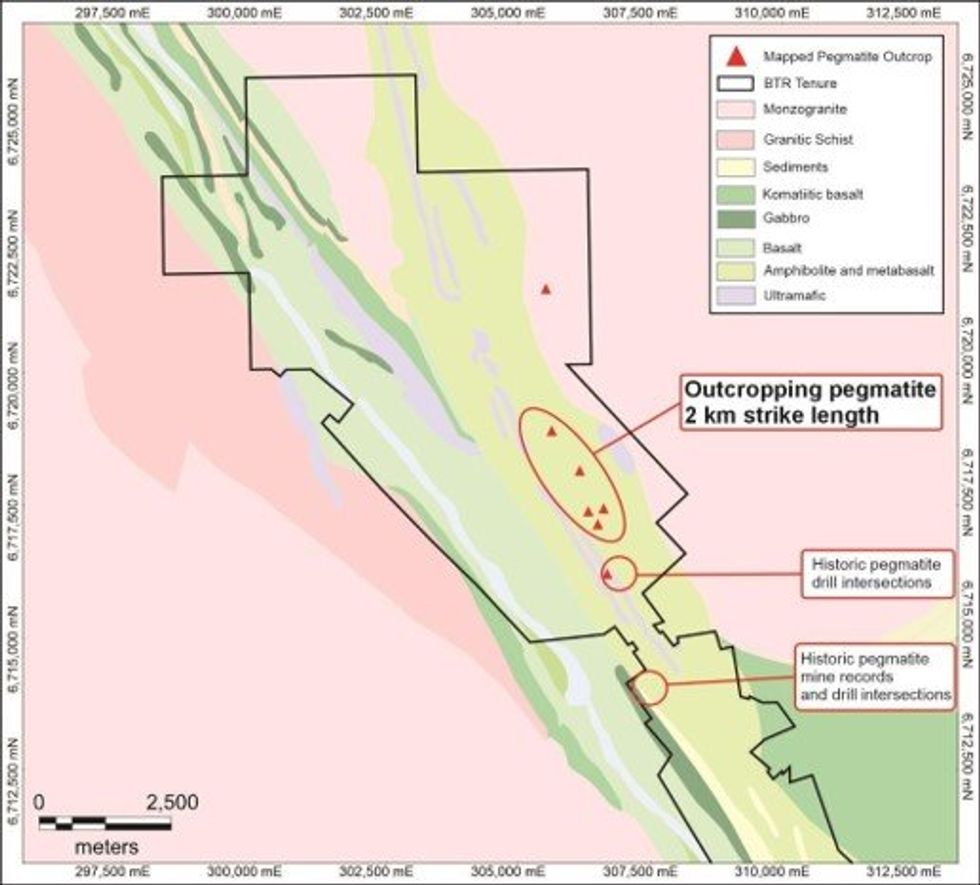

Brightstar Resources Limited (ASX: BTR) (Brightstar or the Company) is pleased to advise the completion of its first phase of lithium-focused field exploration activities at the Menzies Northern Trend (Figure 1), where early-stage exploration efforts into potential lithium mineralisation have occurred in parallel with the drilling underway at the Aspacia and Link Zone Gold Deposits in Menzies.

HIGHLIGHTS

- Field work undertaken during and after the recent heritage survey completed at Menzies has uncovered numerous outcropping pegmatites1 over +3km

- Analysis of hyperspectral imagery has identified 162 potential lithium bearing pegmatite targets within the Menzies Northern Trend

- Rock chip assays received from first pass field mapping indicate a fertile LCT-type pegmatite with significant anomalies in key indicators including Cs, Rb, Ta and Li

- A comprehensive 400m x 100m soil sampling program has been completed covering the entire Northern Trend

- Multi-element assays for the soil survey program and December rock chip sampling submitted to laboratory for analysis

Brightstar’s Managing Director, Alex Rovira, commented: “In conjunction with the recent drilling programs at Menzies and Pre-Feasibility Study workstreams underway for the restart of gold mining operations at Menzies and Laverton, Brightstar has been advancing initial greenfields exploration efforts within the Northern Trend at Menzies for potential lithium-bearing pegmatites. The structural and geological setting is ideal to host lithium-bearing LCT Pegmatites, given the greenstone terrane and proximal granitic intrusion to the north is a similar geological setting to Delta Lithium’s (ASX:DLI) Mt Ida Lithium Project located approximately 70km to the northwest.

Recent transactions from WA gold miners such as Ora Banda Mining’s (ASX:OBM) transformational $26 million Joint Venture with Wesfarmers2 and Pantoro’s (ASX:PNR) sale of Lithium and Base Metals rights for up to $60 million to Mineral Resources Ltd3 have shown that it is commercially pragmatic to conduct greenfields exploration for lithium in the greenstone belts in parallel with Brightstar’s gold drilling and study work.

Brightstar’s recently commissioned hyperspectral survey has delineated 162 potential lithium-bearing outcropping targets, with many being ground-truthed via rock chip sampling, mapping and soil sampling programs to define potential drill targets. The recent Heritage Survey with the Watarra Darlot Native Title Group has, for the first time, cleared the Northern Trend of any areas of cultural heritage significance and now affords Brightstar the opportunity to explore compelling targets. The existence of overlapping data sets and the presence of numerous outcropping pegmatites over a strike length of 3-4km is significant and warrants further considered exploration in parallel with the gold infill and extensional drilling and various workstreams within our PFS underway.”

“We eagerly await the results from the recent sampling program which will aid in generating targets for further follow-up sampling and potential drilling. The correlation between the hyperspectral targeting and the identification of pegmatites in the field is encouraging as a way to vector on-ground exploration efforts efficiently.”

REMOTE SENSING PROGRAM

Brightstar commissioned Terra Resources to analyse a remote sensing dataset and perform a hard-rock lithium pegmatite targeting exercise over the tenement package as part of a holistic targeting campaign. Both ASTER and Sentinel-2 were processed over the project area, with lithium band combinations for the different mineral species used to derive the best Li-pegmatite target for follow up ground truthing. Confirmed lithium-bearing pegmatites in the Menzies-Mt Ida District were used as controls for the algorithms, which showed strong correlations to the Sentinel-2 lithium band combination and confirmed lithium pegmatite outcrops in the district.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

01 February

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

5h

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

15h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

16h

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

25 February

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00