January 19, 2025

Red Mountain Project delivers the thickest and one of the highest-grade intersections to date, as the discovery continues to grow

Astute Metals NL (ASX: ASE) (“ASE”, “Astute” or “the Company”) is pleased to report assay results from the second of two holes from its inaugural diamond drilling campaign at the 100%-owned Red Mountain Lithium Project in Nevada, USA. Drill-hole RMDD002 has returned an outstanding thick intersection of some of the highest-grade lithium mineralisation seen to date at the Project, intersecting:

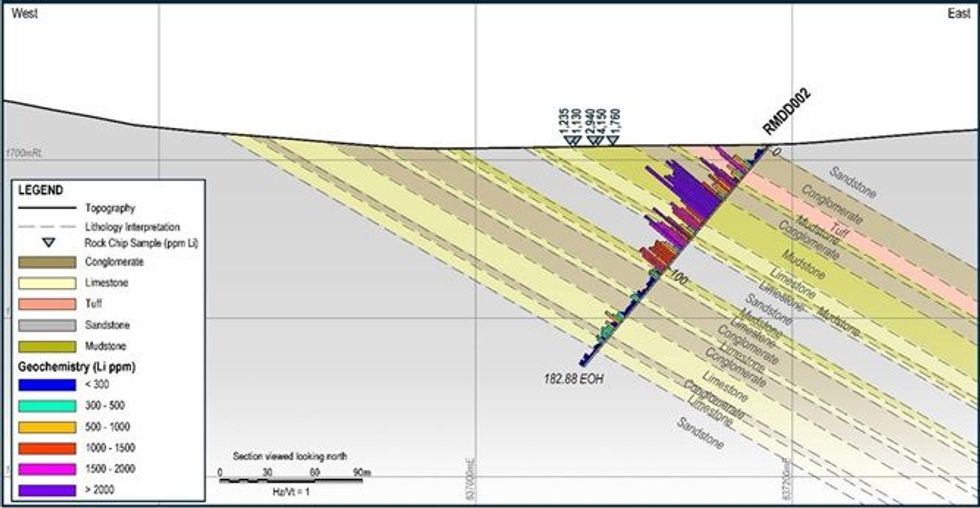

- 86.9m @ 1,470ppm Li / 0.78% Lithium Carbonate Equivalent1 (LCE) from 18.3m, including an internal high-grade zone grading 32.1m @ 2,050ppm Li / 1.09% LCE from 46.2m

Key Highlights

- Strong lithium mineralisation returned in assays for drill- hole RMDD002, which intersected:

- 86.9m @ 1,470ppm Li from 18.3m, including 32.1m of high-grade mineralisation @ 2,050ppm Li from 46.2m.

- RMDD002 marks the thickest intercept recorded to date at Red Mountain.

- Mineralisation successfully extended 375m north of previous northernmost intersections in holes RMRC002 & 003.

- Lithium mineralisation remains open down-dip to the east and along strike to the north.

- Outstanding results strenghten the foundation for a maiden Mineral Resource Estimate in 2025.

The identification of thick, lithium mineralisation in the northernmost drill-hole at Red Mountain highlights the immense scale of the project, with strong lithium mineralisation now intersected in all drill-holes now spanning a north-south strike extent of over 5km and surface sample geochemistry indicating further potential to the north, south and west of the current drilled extents7, 9 (Figure 4).

Of particular significance in hole RMDD002 is the presence of an internal 32.1m zone of very high-grade lithium mineralisation averaging 2,050ppm Li. The identification of substantially higher-grade lithium mineralisation in this hole, as well as that in the previously announced diamond drill hole RMDD001, indicates strong potential for further high-grade zones to be discovered at Red Mountain.

With all results for the recent diamond drilling now received, the Company is finalising geological mapping ahead of planning and permitting for the next round of drilling at the Project, which will be conducted at the earliest opportunity in the 2025 field season.

Astute Chairman, Tony Leibowitz, said:

“Like all great discoveries, Red Mountain continues to grow and improve the more we drill. The manifest scale and high tenor of mineralisation are testament to Red Mountain being one of the most important recent US lithium discoveries. This drill hole is the latest in a succession of thirteen, all of which intersected strong lithium mineralisation, establishing a solid foundation for a maiden mineral resource estimate to be advanced rapidly in 2025.”

Background

Located in central-eastern Nevada (Figure 5), the Red Mountain Project was staked by Astute in August 2023.

The Project area has broad mapped tertiary lacustrine (lake) sedimentary rocks known locally as the Horse Camp Formation2. Elsewhere in the state of Nevada, equivalent rocks host large lithium deposits (see Figure 5) such as Lithium Americas’ (NYSE: LAC) 62.1Mt LCE Thacker Pass Project3, American Battery Technology Corporation’s (OTCMKTS: ABML) 15.8Mt LCE Tonopah Flats deposit4 and American Lithium (TSX.V: LI) 9.79Mt LCE TLC Lithium Project5.

Astute has completed substantial surface sampling campaigns at Red Mountain, which indicate widespread lithium anomalism in soils and confirmed lithium mineralisation in bedrock with some exceptional grades of up to 4,150ppm Li2,8 (Figure 4).

The Company’s maiden drill campaign at Red Mountain comprised 11 RC drill holes for 1,518m over a 4.6km strike length. This campaign was highly successful with strong lithium mineralisation intersected in every hole drilled9. Two diamond drill holes have been drilled at the project.

Scoping leachability testwork on mineralised material from Red Mountain indicates high leachability of lithium of up to 98%, varying with temperature, acid strength and leaching duration10.

Other attractive Project characteristics include the presence of outcropping claystone host-rocks and close proximity to infrastructure, including the Project being immediately adjacent to the Grand Army of the Republic Highway (Route 6), which links the regional mining towns of Ely and Tonopah.

Results

Hole RMDD002 successfully intersected an 86.9m thick zone of lithium mineralised clay-bearing mudstone, sandstone, tuff and limestone, from 18.3m to 105.2m down-hole. The best grades were developed in the most clay-rich zones, which exhibit a desiccated and cracked appearance in drill core once dry (Figure 2). An internal very high-grade zone of 32.1m graded 2,050ppm Li, with a maximum single sample grade of 3,850ppm Li from 59.4-61.5m (195-201.7ft), which is the drill sample with the highest lithium grade achieved to date at the project.

Interpretation

The two northernmost holes drilled as part of the maiden Red Mountain RC drilling campaign, RMRC002 and RMRC003, intersected thin zones of near-surface lithium mineralisation. It was interpreted at the time that these two holes ‘clipped’ the edge of a zone of lithium bearing clay-rich rocks that was likely to thicken towards the east (see ‘open’ arrow in Figure 3)9. RMDD002 was designed to test this interpretation and, in addition, extend the mineralisation 375m further north beneath an extrapolated zone of strong rock chip sample results (Figure 1).

Click here for the full ASX Release

This article includes content from Astute Metals NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00