May 30, 2023

Li3 Lithium Corp. (TSXV: LILI) (FSE: WD9) ("Li3 Lithium" or the "Company") is pleased to announce that it has identified high-grade lithium targets from its ongoing exploration program at the Mutare Lithium Project, located in Zimbabwe. Li3 Lithium holds a 50% ownership interest in the Mutare Lithium Project, with the remaining 50% owned by Premier Africa Minerals Limited, operator of the Zulu Lithium and Tantalum Mine in Zimbabwe.

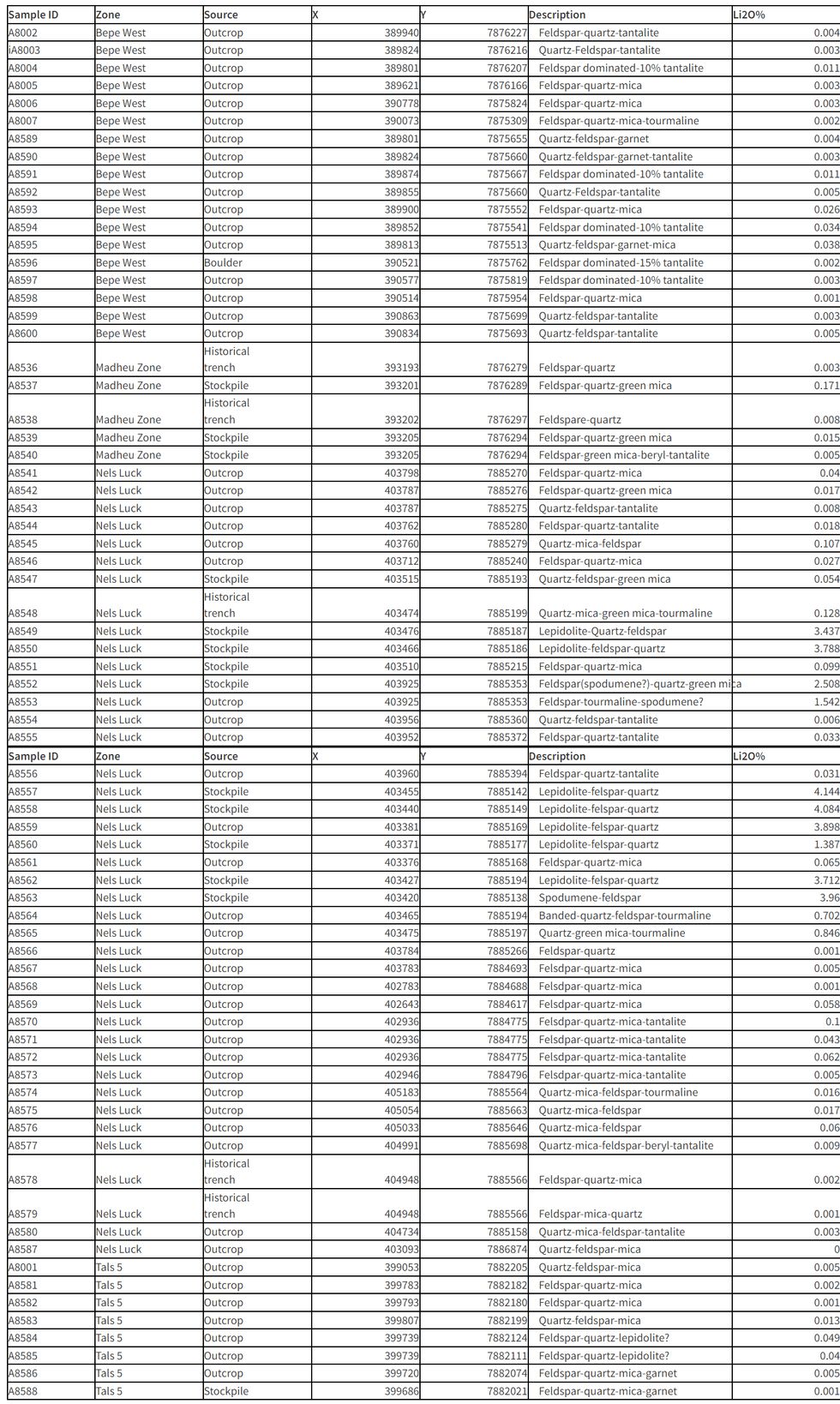

The Company, as operator of the Mutare Lithium Project, has received assay results from seventy-two grab samples collected during the initial phase of the 2023 exploration program. The exploration program includes geological mapping, and a surface rock sampling program to assist in identifying priority targets for the trenching and 5,000-meter exploration drilling program, scheduled to start in the coming weeks.

Highlights:

- 72 samples sent for analysis in April

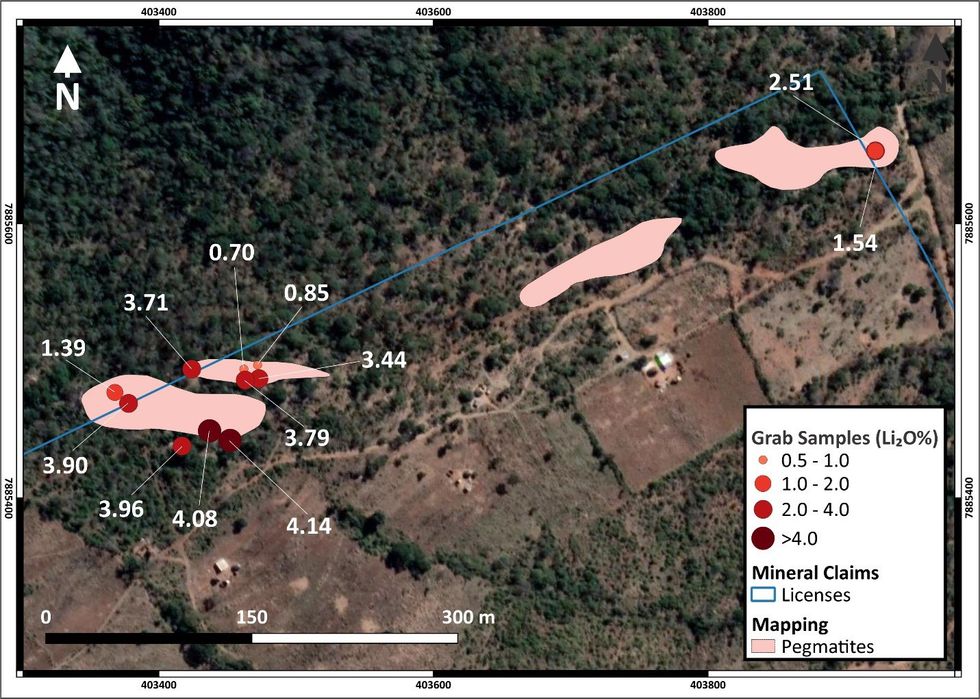

- Highest grade returned in initial phase is 4.14% Lithium Oxide ("Li2O") from the Nels Luck group of licenses

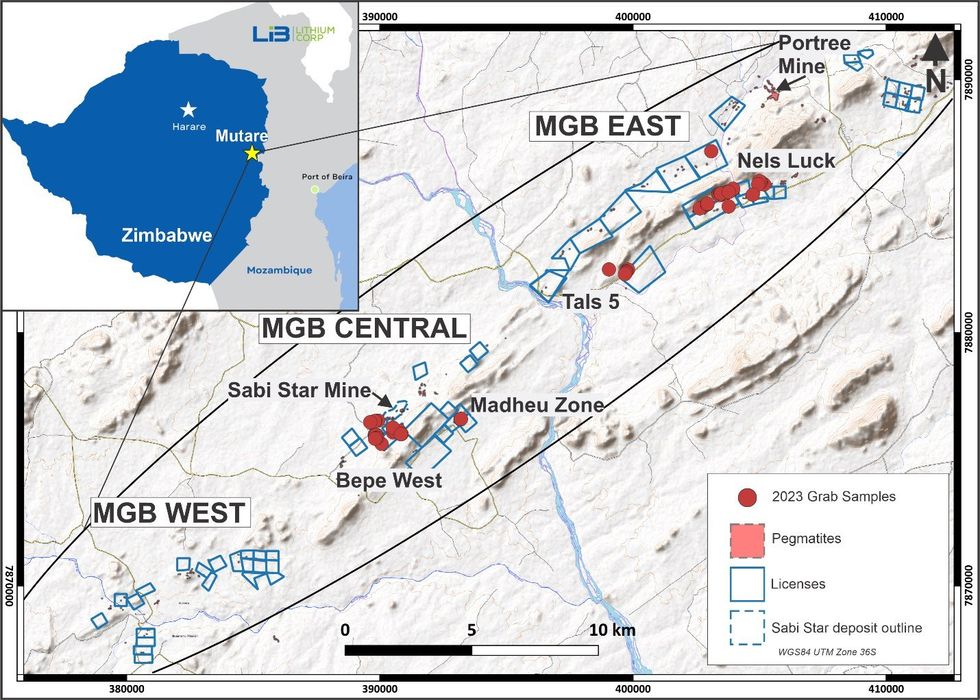

The preliminary surface rock sampling program consisted of 72 samples taken from across the Mutare Lithium Project (Table 1, Figures 1-2,). The grab samples were from the central and eastern section of property, including the Nels Luck group of licenses, situated in the Mutare Greenstone Belt ("MGB") East zone, one of many target areas within the Mutare Lithium Project, comprised of approximately 2,000 hectares of licences retained in the MGB. The Nels Luck license hosts a group of lepidolite, spodumene, and tantalite, bearing lithium-cesium-tantalum pegmatites with an approximate surface expression of 600 meters by 20 meters (up to 50m) (Figure 2). The Nels Luck group of licenses is situated about 15 km northeast in the same stratigraphic package, on the southern limb of a regional syncline, that hosts the Sabi Star Lithium Tantalum Mine.

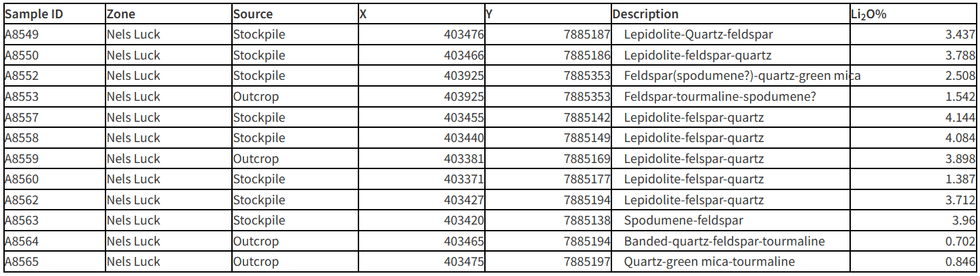

Table 1: Summary of Lithium Oxide (Li2O) results from the Nels Luck area greater than 0.500%. Values are rounded to the nearest 0.001

Figure 1: Mutare Lithium Project License and Location map, identifying the location of the initial surface samples across the Mutare Lithium Project

François Auclair, P.Geo, M.Sc., CEO and President of Li3 Lithium commented, "The initial high-grade results, up to 4.14% lithium oxide, suggest the potential for high-grade lithium oxide mineralization at surface and at depth within the Eastern section of the property. We are anxious to commence the 5,000-meter exploration drilling program across the property with emphasis on the Nels Luck group of pegmatites."

Figure 2: Summary of grab sample results at Nels Luck greater than 0.50 %

Mutare Lithium Project, Zimbabwe

The Mutare Lithium Project is located adjacent to the Sabi Star Lithium Tantalum Mine in eastern Zimbabwe's Mutare Greenstone Belt, an emerging lithium district. Li3 Lithium is evaluating the acquisition of additional prospective ground, either through staking or agreements with potential vendors. The area was deemed prospective for lithium-cesium-tantalum pegmatites based on prior target generation work. Management believes the lithium exploration potential of the MGB is analogous to that of the Pilbara Craton pegmatites in Western Australia.

Zimbabwe, which is estimated to hold Africa's largest lithium resources and the fifth largest globally, is rapidly emerging as an important player within the lithium supply chain. Over the past year and a half, major Chinese battery metals companies have committed approximately US$1.4 billion to acquire and develop lithium projects in Zimbabwe.

Technical information

Quality Assurance and Quality Control of Li3 Lithium's sampling programs are under the control of the Company's geological employees and are consistent with industry best practices. Grab samples are transported by Li3 Lithium's employees following a defined chain of custody, to Zimlabs in Harare, Zimbabwe. All samples were pulverized to produce a 30g charge and then analyzed by G706 (multi acid digestion with AAS finish). Zimlabs is a subsidiary of GNK laboratories and an internationally accredited laboratory testing provider with ISO/IEC 17025:2005 certification (Laboratory Accreditation Number: TEST-S 0010 (lSO/lEC t7025:20t7l).

The Company intends to transport the pulp of the grab samples for analysis of Niobium (Nb), Tantalum (Ta), and Caesium (Cs) at an accredited laboratory in South Africa. Grab samples are selective by nature and reported values are not necessarily indicative of mineralized zones.

Qualified Person

François Auclair, QP, M.Sc, Quebec Order of Geologists, CEO and President of Li3 Lithium, is the non-independent qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects for the technical disclosure contained in this news release. Mr. Auclair has reviewed and approved the technical disclosure contained in this news release

About Li3 Lithium Corp.

Li3 Lithium is focused on acquiring and developing hard rock spodumene lithium assets in Zimbabwe and Argentina, where the founders have significant experience and relationships. As evidenced by recent market growth, hard rock lithium deposits are forecast to continue to dominate the global supply of lithium given the scarcity, complexity and capex-intensive nature of alternative brine sources.

Contact Information:

Li3 Lithium Corp.

Francois Auclair, P.Geo, M.Sc., CEO and President

Tel: 514-889-5089

Email: info@lithium3.com

www.lithium3.com

CAUTIONARY STATEMENT:

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain "forward-looking information" within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "would", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward- looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

APPENDIX 1: Grab sample summary table, coordinates are in WGS84 UTM Zone 36S

LILI:CA

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00