November 08, 2023

Outstanding Economics show Lake Hope to potentially be the lowest-cost producer of High Purity Alumina (HPA) globally by up to 50%

Impact Minerals Limited (ASX:IPT) is pleased to announce the positive results of a Scoping Study based on realistic production and capital expenditure estimates for the company’s Lake Hope High Purity Alumina (HPA) Project, located 500 km southeast of Perth in the Tier 1 jurisdiction of Western Australia.

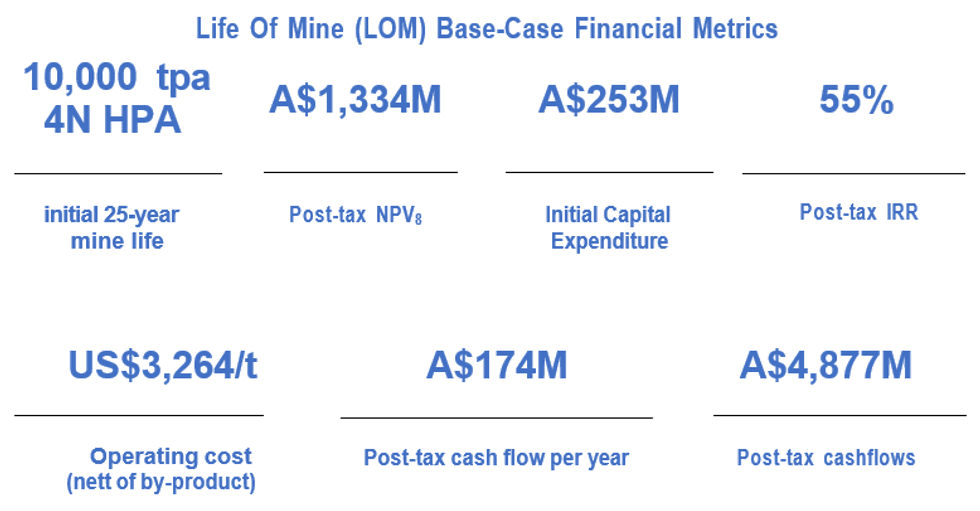

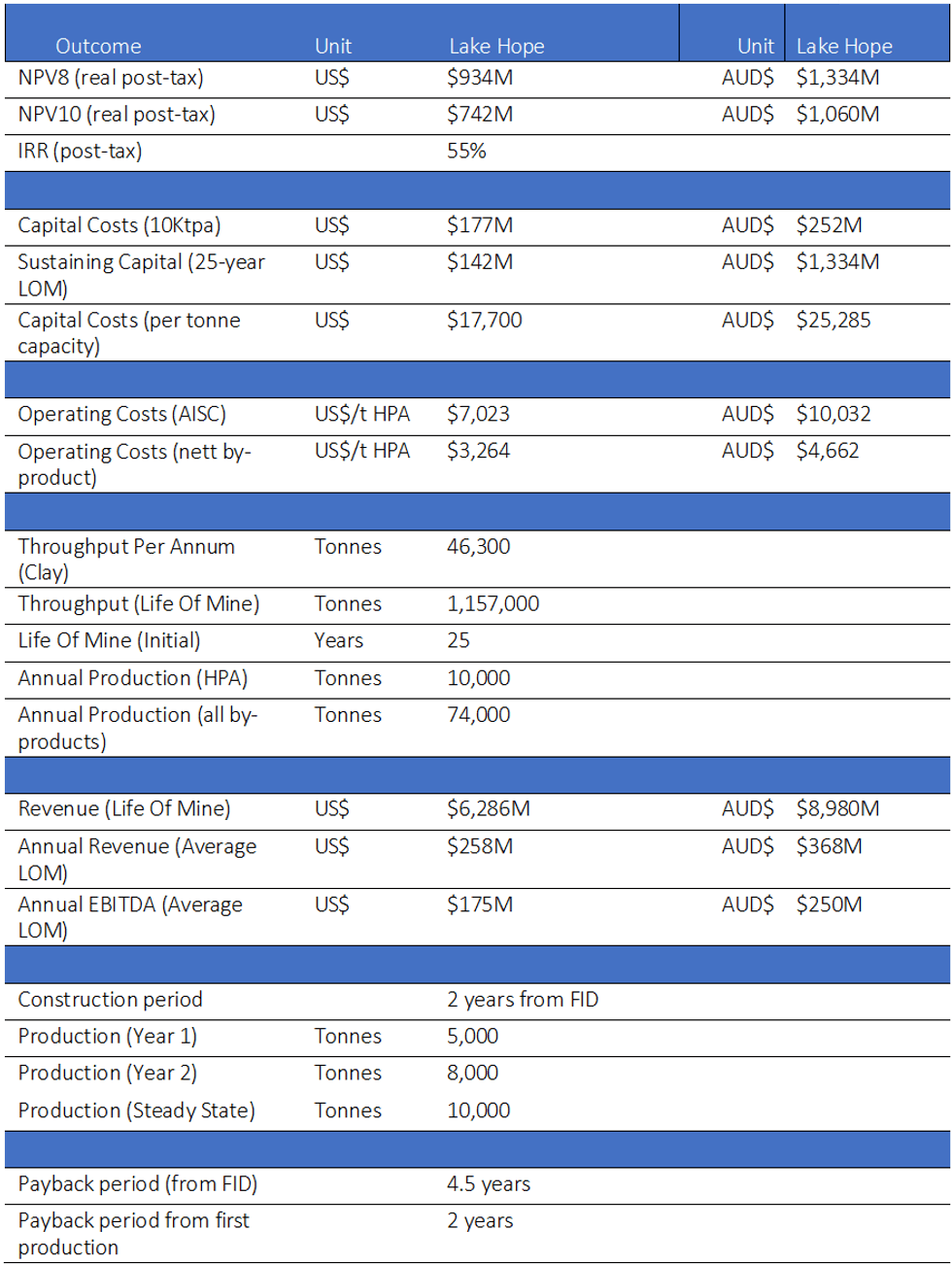

SCOPING STUDY HIGHLIGHTS

The Lake Hope project contains a significant alumina (Al2O3) resource, which could become a major global supplier of High Purity Alumina (HPA) because of the unique nature of the deposit that allows very cost-effective mining and processing.

This Scoping Study indicates that, as far as Impact can ascertain from published data, the Lake Hope project could be one of, if not the lowest-cost producer of HPA globally, possibly by a significant margin of up to 50%.

- Potential to become a significant producer of HPA with steady-state production of 10,000 tonnes per annum following a two-year ramp-up.

- Low capital costs compared to peers driven by the unique nature of the clay deposit at Lake Hope.

- Low operating cost and high margins due to the deposit size, zero strip ratio, high- grade mineralisation at surface, no on-site beneficiation required, advantageous kinetics of the metallurgical process and by-product credits.

- Natural ESG benefits include probably considerably reduced CO2 emissions compared to incumbent producers.

- Very favourable market fundamentals with HPA deemed a Critical Mineral in Australia and many other countries.

- Forecast compound annual growth rate of about 20% for the HPA and related products market over the next decade driven by expansion in the battery and LED sectors.

- The study of HPA is based on a conservative commodity price estimate of US$22,000 per tonne compared to recent forecasts of more than US$25,000 per tonne from 2025 onwards.

Impact Minerals’ Managing Director, Dr Mike Jones, said, “This Scoping Study demonstrates the world-class potential of the Lake Hope Project and supports what we first thought was possible when we came across it and the work already done by Roland Gotthard and the Playa One team”.

“If you are playing in the industrial minerals space, at least one of four things has to be true about your mine otherwise you will not make it through the market cycle: the deposit has to be either the biggest, have the highest grade, be the first to market or, preferably, be the lowest cost producer. The unique characteristics of the Lake Hope deposit, both in terms of mining and processing, look like they could possibly deliver HPA at the lowest cost globally by a significant margin”.

“Even though we are only at the Scoping Study stage, with all its inherent uncertainties, the financial model demonstrates the world-class economics of the project, which has an NPV of more than A$1 billion, very large operating margins and significant after-tax earnings of A$174 million per year. The ability to deliver sub-US$4,000 per tonne HPA is an extraordinary competitive advantage that Impact will continue to leverage in the current Preliminary Feasibility Study, due for completion in 2024.”

KEY SCOPING STUDY OUTCOMES

SUMMARY OF THE SCOPING STUDY

Impact Minerals Limited (ASX:IPT) is pleased to publish the results of a Scoping Study into a series of development options for the Lake Hope High Purity Alumina (HPA) Project located 500 km east of Perth in the Tier 1 jurisdiction of Western Australia. The Study comprises the results of preliminary metallurgical, engineering and logistical studies into the economic viability of the Lake Hope project.

HPA is now listed as a Critical Mineral in Australia, the US and Europe and is an essential mineral required for the ongoing decarbonisation of the world’s energy market.

The Scoping Study is reported in accordance with the JORC 2012 Code and ASX Listing Rules and with a level of accuracy of +/-30% commensurate with this level of study. The Study justifies the project progressing to a Preliminary Feasibility Study, which is well underway (ASX Release October 18th 2023).

The Study is based on work completed by Playa One Pty Ltd before Impact’s involvement in the project and work completed by Impact since acquiring the right to earn an 80% interest in the project earlier in 2023 (ASX Release March 21st 2023). Impact can earn its 80% interest by completing the PFS.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

10h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

15h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

17h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

17h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

18h

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00