March 04, 2025

Lahontan Gold Corp. (TSXV:LG,OTCQB:LGCXF) is dedicated to advancing its portfolio of high-quality gold and silver projects in Nevada, a top-tier mining jurisdiction. The company’s flagship Santa Fe Mine — a past-producing operation from 1988 to 1992 — yielded 356,000 ounces of gold and 784,000 ounces of silver. Lahontan is focused on unlocking the mine’s full potential by expanding resources and advancing permitting efforts to fast-track the project toward production.

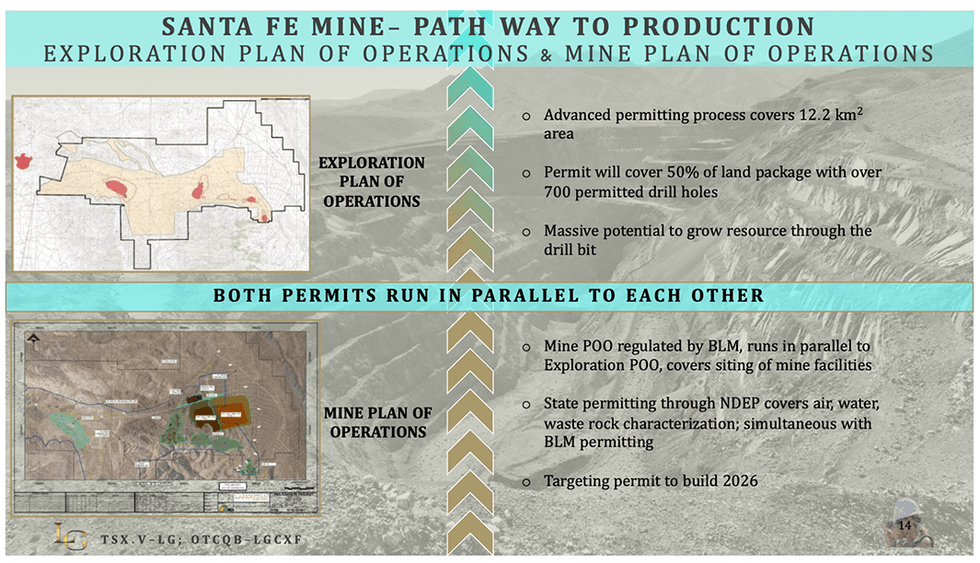

A recently completed preliminary economic Assessment (PEA) highlights a clear pathway to restarting operations, demonstrating the project’s robust economics. Permitting with the Bureau of Land Management (BLM) is underway, with the company targeting a 2026 construction start.

The Santa Fe mine, located in Mineral County, Nevada, spans 26.4 sq km and represents Lahontan Gold’s flagship development project. With an updated mineral resource estimate of 1.95 Moz gold equivalent, the project hosts multiple oxide and sulfide zones that remain open for expansion.

Company Highlights

- Flagship Santa Fe Project: 100 percent owned, past-producing open-pit heap leach mine with a current MRE of 1.95 Moz gold equivalent at a grade of ~0.9 g/t.

- Strategic Nevada Location: Situated in Walker Lane, one of the world’s best mining jurisdictions, with excellent infrastructure, water access, and a mining-friendly regulatory environment.

- Strong Resource Growth Potential: The Santa Fe Mine and its satellite projects, West Santa Fe and Moho, offer exploration upside, with further drilling planned to expand resources.

- Advancing Toward Production: With a positive Preliminary Economic Assessment (PEA) completed in late 2024, Lahontan is aggressively moving toward permitting and development.

- Experienced Leadership: The company is led by an experienced management team with a proven track record in mine development, permitting, and value creation for investors.

This Lahontan Gold profile is part of a paid investor education campaign.*

Sign up to get your FREE

TomaGold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

8h

TomaGold

Advancing a district-scale gold and base metal portfolio in Québec’s Chibougamau Mining Camp

Advancing a district-scale gold and base metal portfolio in Québec’s Chibougamau Mining Camp Keep Reading...

11h

Jaime Carrasco: Gold at US$7,000 is "Conservative," Plus Silver Outlook

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, explains what's driving gold and silver prices. "The real question here is not how high silver is going — forget about that," he said. "The right question is how high does gold have to go to... Keep Reading...

11h

Precious Metals Price Update: Another Week of Volatility for Gold, Silver, PGMs

It's been another week of strong volatility in precious metals prices.Gold, silver and platinum have posted new all-time highs in 2026, but so far February has been more choppy seas than smooth sailing. A complex web of push-and-pull factors are at play in the precious metals market. Let’s take... Keep Reading...

12h

55 North Mining: The Economic Upside of US$5,000 Gold and High-grade Project Next to Alamos Gold

With gold prices maintaining their historic trajectory toward US$5,000 per ounce, gold exploration companies with high-grade assets offer immediate economic leverage. 55 North Mining (CSE:FFF,FWB:6YF) is emerging as a primary beneficiary of this. We sat down with CEO Bruce Reid as he discussed... Keep Reading...

Latest News

Sign up to get your FREE

TomaGold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00