March 06, 2023

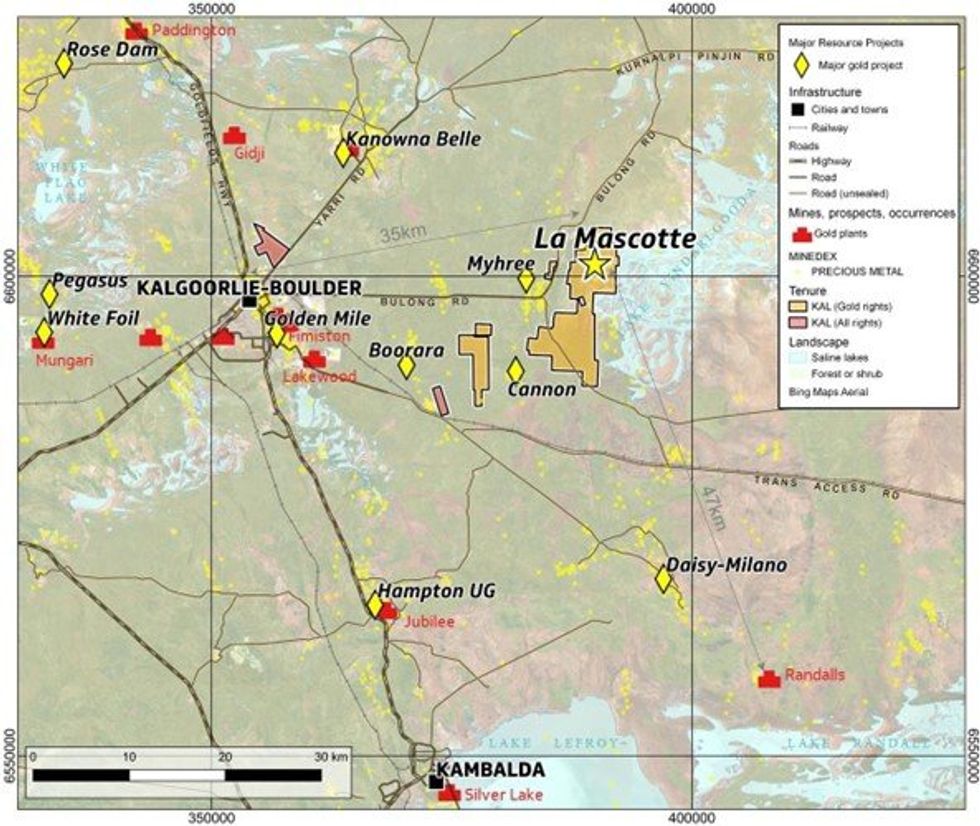

WA-focused gold explorer, Kalgoorlie Gold Mining (ASX:KAL) (‘KalGold’ or ‘the Company’), is pleased to announce the first JORC (2012) Mineral Resource at the La Mascotte gold deposit within the Bulong Taurus project, 35km to the east of Kalgoorlie-Boulder.

Highlights

- La Mascotte is one of the few outcropping gold deposits in the Eastern Goldfields

- First ever La Mascotte JORC (2012) Inferred Mineral Resource Estimate of:

- 3.61 Mt @ 1.19 g/t Au for 138,000 oz (0.6 g/t cut-off)

- Resource is estimated above the 220 mRL, or to a depth of ~140 m below surface on a granted mining lease

- Modelled resource footprint measures 700 m north-south by 500 m east-west, with multiple stacked mineralised horizons demonstrating a total sectional thickness of up to ~175 m

- Mineralisation remains open below 220 mRL at several target areas

- Potential for significant resource growth and upgrade with additional drilling

- KalGold direct expenditure cost of only ~A$5 per gold ounce (including drilling and assays)

The JORC (2012) Mineral Resource Estimate at La Mascotte has been estimated at:

3.61 Mt @ 1.19 g/t Au for 138,000 oz at a 0.6 g/t cut-off (Inferred).

This includes a higher-grade component of 1.35 Mt @ 1.92 g/t Au for 83,000 oz at a 1.0 g/t cut-off.

KalGold Managing Director and CEO Matt Painter said:

“The definition of 138,000 oz of gold from surface only 35km east of Kalgoorlie Boulder is a major milestone in KalGold’s short history. It reinforces our objective of discovering and defining gold resources in the Eastern Goldfields of Western Australia.

“La Mascotte is one of the few remaining outcropping gold deposits in the Eastern Goldfields. This initial JORC (2012) Mineral Resource Estimate highlights our cost-efficient approach to building a mineral resource base and strengthens KalGold’s credentials as a highly effective gold discovery company. For example, the incorporation of historic drill data into this JORC (2012) Mineral Resource Estimate has saved the Company $1.6 million in drilling-related costs, delivering a realised discovery cost of only $5/oz.

“With gold mineralisation remaining open at depth, KalGold will progress the La Mascotte mineral resource with additional work. We look forward to updating investors on our progress throughout CY2023.”

The La Mascotte Gold Deposit

The La Mascotte gold deposit is one of the few remaining outcropping gold deposits near Kalgoorlie- Boulder in the Eastern Goldfields of Western Australia. Located less than 35km east of the city on the sealed Bulong Road, the deposit can be accessed within 30 minutes’ drive from Kalgoorlie.

La Mascotte is located within the (historic gold rush era) Taurus Goldfield, immediately to the east of the Bulong Goldfield. Geologically, the deposit is hosted by a deformed, metamorphosed, felsic-intermediate volcanosedimentary sequence locally intruded by ultramafic to felsic porphyry pods and dykes. This sequence is juxtaposed against a nickel-mineralised ultramafic sequence to the west and north. Separating these sequences is the regionally extensive, deformed Goddard Fault. KalGold believes this fault to be the controlling structure for gold mineralisation throughout the Taurus Goldfield. Further south along strike, this hosts the high-grade Daisy Milano gold mine operations in the Mt Monger Goldfield.

Although outcrop at La Mascotte is poor, gold-mineralised quartz veining and altered felsic-intermediate volcaniclastic rocks are evident as subcrop and float over several hundred metres (Figure 3). Gold nuggets have also been recovered by our prospector partners over the area (Figure 4). Furthermore, shallow excavations in these areas exhibit a prevailing shallow westerly dip of strata, foliation, and veining.

Click here for the full ASX Release

This article includes content from Kalgoorlie Gold Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 May 2025

Kalgoorlie Gold Mining

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00