November 07, 2023

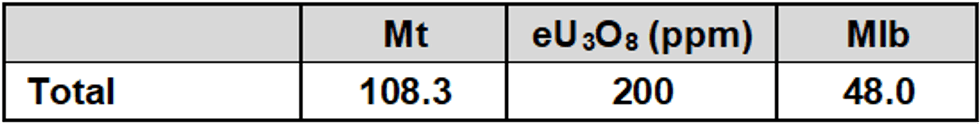

Elevate Uranium Limited (“Elevate Uranium”, or the “Company”) (ASX:EL8) (OTCQX:ELVUF) is pleased to announce an updated JORC Inferred Mineral Resource Estimate (“MRE”) of 48 Mlb eU3O8 for its Koppies Uranium Project in Namibia.

Key Highlights:

- Koppies JORC Mineral Resource Estimate (“MRE”) has been increased to 48.0 Mlb eU3O8.

- The MRE increase represents a 136% increase in the Koppies resources and a 42% increase in Elevate Uranium’s Namibian resources.

- Additional resource growth is targeted with 3 drill rigs currently progressing on resource drilling the mineralised zone south of Koppies 2 and at Koppies 4, to the south of the MRE envelope.

- Mineralisation remains open in multiple directions around the resource.

- Analysis of drilling results confirms the potential for additional mineralisation beneath earlier shallow drilling.

- Significant potential remains for resource expansion at Koppies and into the adjoining tenements.

Elevate Uranium’s Managing Director, Murray Hill, commented:

“Achieving the 48 Mlb eU3O8 resource is a milestone for the Koppies Uranium Project and the Company. The 136% increase in the resource substantially advances the status of the Koppies project, increasing our Namibian mineral resources by 42% to 94 Mlb eU3O8 and our global resources to 142 Mlb eU3O8.

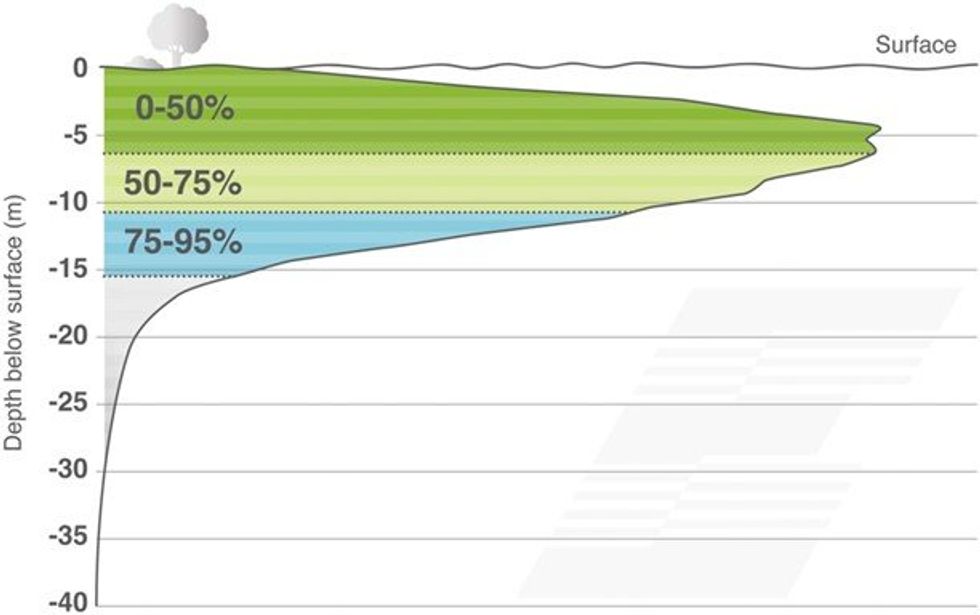

Koppies is one of the shallowest uranium resources globally, with 95% of the resource within approximately 15 metres of the surface and 50% of the resource within approximately 6 metres of the surface. These parameters are important for any potential low strip ratio, low-cost mining operation at Koppies.

Due to the large surface area of mineralisation at Koppies, drilling activities and resource updates are split into phases. The Company currently has three drill rigs operating to expand the resource reported here today. The next resource update will include the drilling currently in progress using three drill rigs to the south of Koppies 2 and into Koppies 4 and is expected to be completed during the March Quarter of 2024”.

This 48 Mlb eU3O8 MRE for the Koppies Uranium Project increases the Company’s total uranium resources to 142 Mlb, see Resource Table 3.

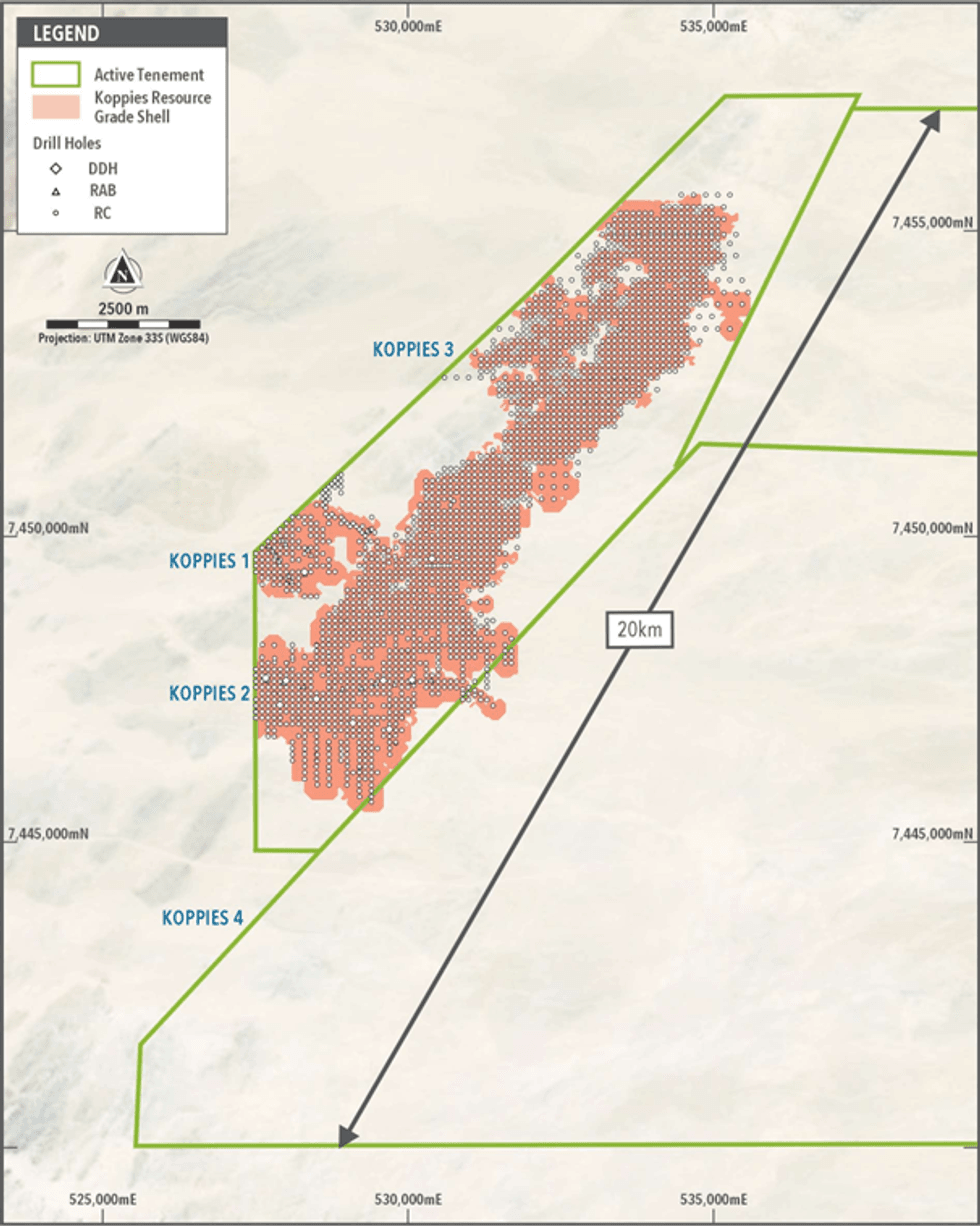

Figure 1 shows the surface extent of the mineral resource and the drilling completed for the resource upgrade.

Figure 2 indicates how the mineralisation is distributed by depth throughout the entire Koppies mineral resource. Koppies is one of the shallowest uranium resources globally and the diagram shows the near surface nature of the Koppies deposits, with 95% of the total mineral resource being within approximately 15 metres of the surface, and 50% of the resource within approximately 6 metres of the surface. These parameters are important for any potential low strip ratio, low-cost mining operation at Koppies.

Note – the scale on the left represents the cumulative depth, in metres, below surface. The diagram is not to scale.

Koppies Mineral Resource Estimate Summary

The Mineral Resource was estimated using Multi Indicator Kriging (“MIK”). The updated Inferred Mineral Resource Estimate (“MRE”) is reported at a number of cut-off grades from 50 ppm to 200 ppm eU3O8 and the MRE derived from these cut-off grades indicates that the mineralisation remains robust and consistent (see Table 2).

The MRE covers the Koppies deposit, between coordinates 527,500E, 7445500N to 535,600E, 7455600N, as shown on Figure 1. Mineral resources have been clipped to the Koppies tenement boundary to the west, where the deposit is contiguous with the Tumas 1E mineral resource (owned by Deep Yellow Ltd).

The maiden Koppies MRE was announced to the ASX on 4 May 2022 titled “22% Increase in Mineral Resources”. The results of drilling campaigns subsequent to the maiden MRE and included in this update were announced to the ASX on 30 October 2023, 31 July 2023, 27 April 2023, 22 November 2022, 28 September 2022 and 4 May 2022.

Click here for the full ASX Release

This article includes content from Elevate Uranium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EL8:AU

The Conversation (0)

13h

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00