April 04, 2022

Queensland Pacific Metals Ltd (ASX:QPM) (“QPM” or “the Company”) is pleased to announce conditional finance support from K-SURE for the provision of debt funding for QPM’s wholly owned TECH Project.

Highlights

- Conditional finance support received from Korea Trade Insurance Corporation (“K-SURE”) for the provision of debt funding for the TECH Project.

- The support from K-SURE follows on from the Memorandum of Understanding (“MOU”) on Cooperation in Critical Minerals Supply Chains signed between Republic of Korea and Australia in December 2021 and the MOU to undertake joint financings signed between K-SURE and Export Finance Australia (“EFA”) in February 2022.

- The support from K-SURE represents ongoing development of the potential lending syndicate for the TECH Project, with QPM having completed the Strategic Assessment phase of the Northern Australian Infrastructure Facility (“NAIF”) application process and having previously received a commitment letter for conditional debt funding for A$250m from EFA.

- Formal appointment of ANZ as Export Credit Agency (“ECA”) Co-ordinator, supporting KPMG in their role as Debt advisor

In December 2021, a MOU was entered into between the governments of the Republic of Korea and Australia regarding cooperation in Critical Minerals Supply Chains. Following this, the reciprocal Export Credit Agencies of both countries (K-SURE and EFA) entered into an MOU to strengthen their capacity to work together and undertake joint financings.

With Korean offtakers and shareholders, LG Energy Solution and POSCO, K-SURE is a logical target for QPM as part of its debt financing syndicate for the TECH Project. The formal receipt of an Expression of Interest Letter from K-SURE demonstrates their strong interest in providing debt funding for the TECH Project.

K-SURE has indicated that its partication in the debt funding of the TECH Project will be in line with the terms and conditions of EFA’s participation. The letter received from K-SURE does not constitute a commitment or an offer and any provision of debt funding will be subject to due diligence and typical terms and conditions.

QPM has also appointed ANZ as ECA Co-ordinator, working closely with existing debt advisor KPMG. ANZ has an excellent relationship with K-SURE and other ECAs around the world, in particular those which QPM are targeting and have received eligibility letters from. ANZ has also previously provided QPM with a letter of interest for the provision of debt funding.

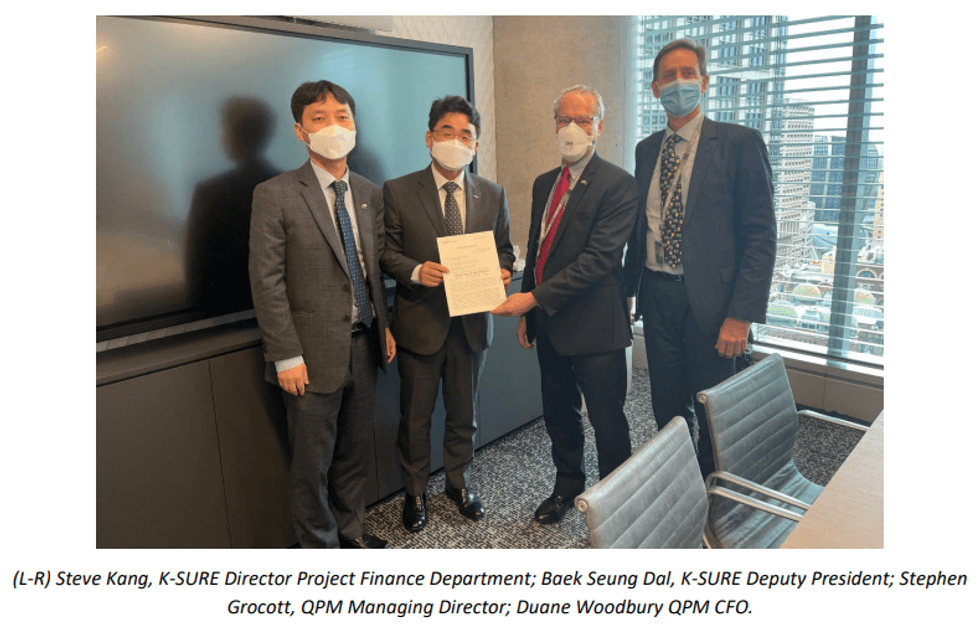

QPM Managing Director Dr Stephen Grocott commented,

“The increasing recognition from governments around the world, in particular the Korean and Australian governments, regarding the importance of critical minerals supply chains will be an important factor in QPM achieving its goal of becoming a sustainable producer of battery metals. The support we have received from government backed lenders to date has been tremendous.

I would like to express my sincere gratitude to Mr Baek Seung Dal and Mr Steve Kang for their formal expression of interest in the TECH Project and look forward to strengthening our relationship with K-SURE.”

About K-SURE

K-SURE is the official export credit agency of South Korea under the Ministry of Trade, Industry and Energy. K-SURE provides debt financing to international projects where there is participation from Korean companies.

This announcement has been authorised for release by Stephen Grocott

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00