- WORLD EDITIONAustraliaNorth AmericaWorld

May 27, 2024

Description

Touting Jindalee Lithium’s (ASX:JLL,OTCQX:JNDAF) huge lithium deposit and its strategic location in the US, market research firm MST Access believes the company is set to emerge as a notable producer of high-quality lithium carbonate responding to a US market highly in need of supply.

“(Jindalee) is perfectly positioned to take advantage of its location near US gigafactories, designed for mass production of Li-ion batteries and in need of quality supply from within the US,” wrote Michael Bentley, senior analyst at MST Access in a new report.

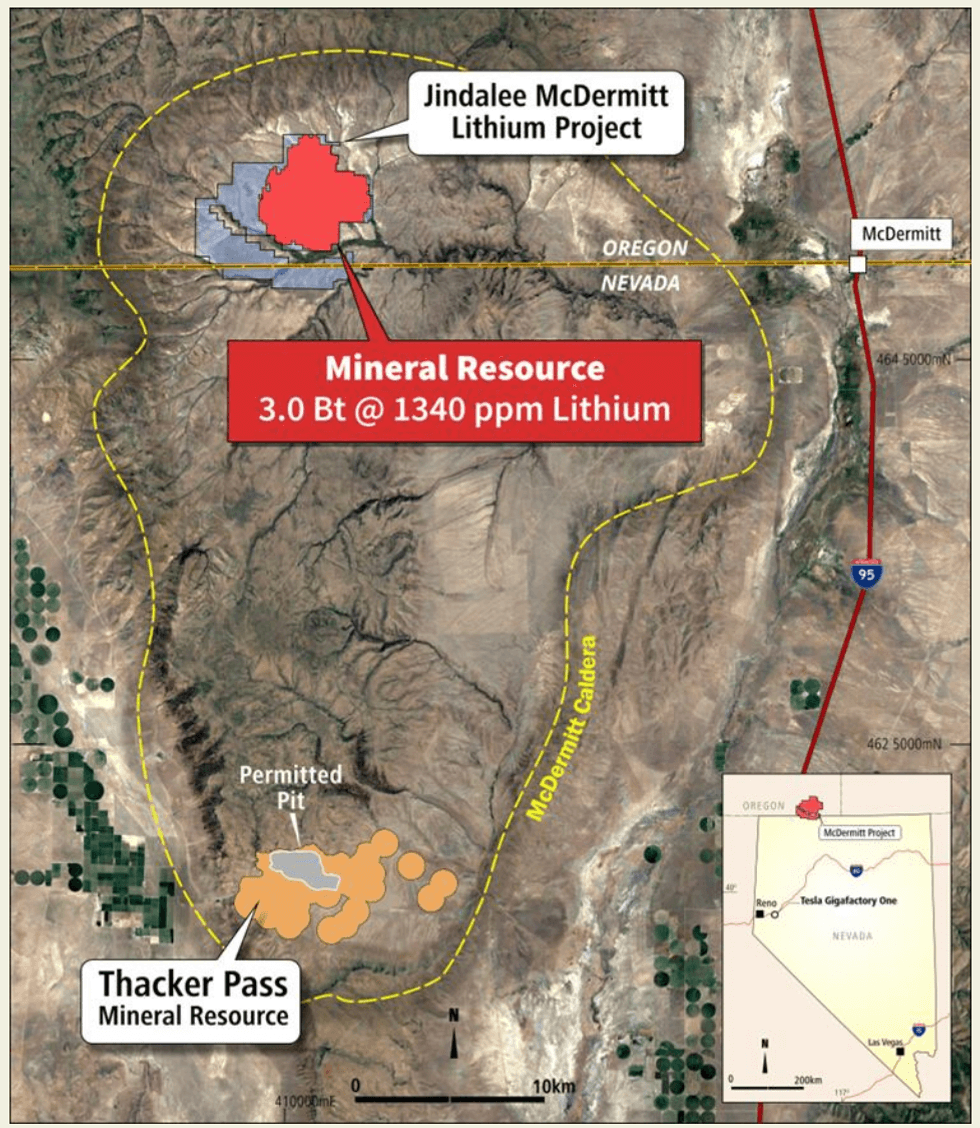

Jindalee owns 100 percent of the McDermitt lithium project, currently the largest lithium resource in the US, with a mineral inventory of 3 billion tons @ 1,340 parts per million for 21.5 million tons of lithium carbonate equivalent, and strategically located amongst US gigafactories. A prefeasibility study to determine the project’s economics is currently underway and expected to be completed within the second half of 2024.

The research firm has given Jindalee a valuation of AU$2.04, blending the EV/resource at 70 percent, and risked NPV at 30 percent.

“We consider JLL significantly undervalued given its large resource, strategically positioned project and the US Government’s determination to have a sustainable domestic supply of lithium to support the production of batteries in the USA,” the report said.

Report highlights:

- Large, strategically placed 100-percent-owned asset to deliver battery-grade product to a US market needing supply. The scalable McDermitt Project is strategically located and potentially a generational-scale development, producing a battery-grade end product for US domestic gigafactories.

- US government policy promoting domestic production incentivises new projects, driven by an inevitable increased lithium demand in the US. Neighbouring project Thacker Pass has attracted $2.26 billion in US government funding and US$650 million in strategic partner funding from General Motors, precedents that are crucial for McDermitt.

- Key risks include short-term funding, large capital requirements for project development, potential lack of funding from US government and/or strategic investors, approval delays and execution and construction risks

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

JLL:AU

Sign up to get your FREE

Jindalee Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

16 April 2025

Jindalee Lithium

Game-changing, economically significant lithium resource for North American battery supply chain

Game-changing, economically significant lithium resource for North American battery supply chain Keep Reading...

23 January

Quarterly Cashflow Report - December 2025

Jindalee Lithium (JLL:AU) has announced Quarterly Cashflow Report - December 2025Download the PDF here. Keep Reading...

23 January

Quarterly Activities Report - December 2025

Jindalee Lithium (JLL:AU) has announced Quarterly Activities Report - December 2025Download the PDF here. Keep Reading...

11 December 2025

US Government Approves Major Drilling Program at McDermitt

Jindalee Lithium (JLL:AU) has announced US Government Approves Major Drilling Program at McDermittDownload the PDF here. Keep Reading...

08 December 2025

Trading Halt

Jindalee Lithium (JLL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 November 2025

Drilling Underway at McDermitt Lithium Project

Jindalee Lithium (JLL:AU) has announced Drilling Underway at McDermitt Lithium ProjectDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Jindalee Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00