- WORLD EDITIONAustraliaNorth AmericaWorld

October 30, 2024

IODM Limited (ASX: IOD) (“IODM” or “the Company”), is pleased to release its Quarterly Activities Report and Appendix 4C for the period ended 30 September 2024 (“Q1 FY25” or “Quarter”).

Q1 FY25 highlights:

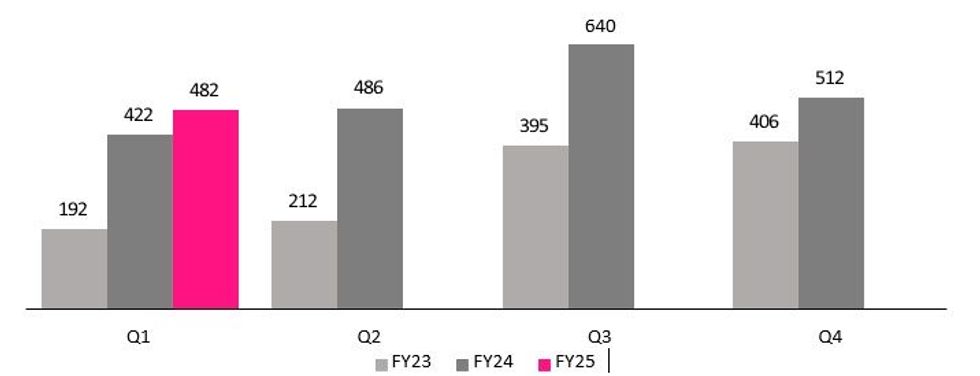

- Cash receipts of A$482k, +14.2% versus previous corresponding period (“pcp”);

- UK cash receipts +88% versus pcp to A$292k, driven by new commercial agreement with Convera for UK education business;

- Four additional universities implemented in the UK, making a total of nine

- Increasing number of USA and Canadian universities requesting and receiving formal presentations of the IODM solution;

- Continued engagement in respect of international licencing of the IODM solution;

- Fortification of the Australian and New Zealand business with the appointment of a new Head of Sales and complemented by an increase in sales team personnel; and

- Completed a $1.7m capital raising to institutional and sophisticated investors to enlarge sales teams both domestically and internationally.

Quarterly cash receipts in Q1 FY25 of A$482k represented an increase of 14.2% vs pcp. The revenue result accorded with Company budgeting for the Quarter given the seasonal decline in international revenues (as to which refer below).

Net cash operating outflows to $1.062m, 30.9% over pcp, driven by an increase in the Company’s sales division and supported by the successful capital raising ($1.7m).

UK Education Business

A strong contributor to cash receipts during the Quarter was the UK with and 88% increase on pcp to $292k. The result affirms that the re-negotiated UK educational licencing agreement (refer ASX Announcement 5 February 2024) procured an immediate positive impact on the Company in terms of revenue uplift as well as elevated recognition and speed of IODM solution rollout within the UK education sector.

At Quarter end the Company had a total of nine on-boarded universities with four implemented during the Quarter (refer 3 July 2024 ASX Announcement for further details).

Pleasingly, the IODM platform has been fully commissioned in all nine universities and the Company is primed to take advantage of the UK academic year billing cycle which commenced in September 2024. IODM’s revenue from the university sector is primarily derived from the student deposit, tuition and accommodation payments. Of the new universities on-boarded during the Quarter, the largest (in terms of international students and potential revenue to IODM) is the University of Sunderland, however – due to timing of on-boarding – provided minimal (three days) contribution to the Quarter.

As already detailed, the cash receipts and revenue observed during 1Q FY25 were both consistent with budgeting given the seasonal “quiet” period for student payments leading up to the commencement of the new academic year. Notwithstanding the forgoing, the 88% increase in cash receipts over pcp (to $282k) is a direct consequence of:

- The increased quantum of on-boarded universities; together with

- The renegotiated licencing arrangement with Convera which – amongst other advantages – is includes a guaranteed minimum payment regime.

Whereas the Convera revenue share arrangement in respect of the UK education sector has assisted the Company in both revenue and speed of university penetration, the benefits of the joint enterprise is equally attractive to Convera as evidenced by the University of Sutherland, previously a key customer of a Convera competitor, converting to the Convera payment platforms as a direct result of the IODM pipeline via a joint proposal.

Domestic Business

As previously disclosed to the market, the company raised funds, in part, to execute upon growth opportunities and initiatives which includes expanding the sales force globally.

As a result, the company has appointed Ashley (“Ash”) Clayton as head of domestic sales. Ash has over 18 years’ experience in software sales solutions and is a proven leader in his field. His experience includes enterprise software solution sales, presales and go to market across multiple regions. Mr Clayton has commenced expanding the sales desk with a recent key appointment.

As a result of the reinvigorated domestic sales team, the Company has witnessed an immediate increase in the number of enterprise companies seeking out the IODM solution and requesting presentations and contract proposals. The Company anticipates an elevated number and accelerated rate of domestic signings going forward.

Click here for the full ASX Release

This article includes content from IODM Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IOD:AU

Sign up to get your FREE

IODM Ltd Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

01 May 2025

IODM Ltd

Cloud-based cash flow optimisation solution for medium and large enterprises

Cloud-based cash flow optimisation solution for medium and large enterprises Keep Reading...

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

IODM Ltd (IOD:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

26 January

Material revenue event from the Convera Commercial Agreement

IODM Ltd (IOD:AU) has announced Material revenue event from the Convera Commercial AgreementDownload the PDF here. Keep Reading...

27 October 2025

Quarterly Activities/Appendix 4C Cash Flow Report

IODM Ltd (IOD:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

07 October 2025

IODM UK Revenue Update

IODM Ltd (IOD:AU) has announced IODM UK Revenue UpdateDownload the PDF here. Keep Reading...

10 September 2025

UK Revenue Update

IODM Ltd (IOD:AU) has announced UK Revenue UpdateDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

IODM Ltd Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00