March 19, 2025

Inca Minerals (ASX:ICG) is an Australian exploration company focused on uncovering high-grade gold and gold-antimony mineralization. The company recently acquired Stunalara Metals, a transformational deal that enhances its exploration assets.

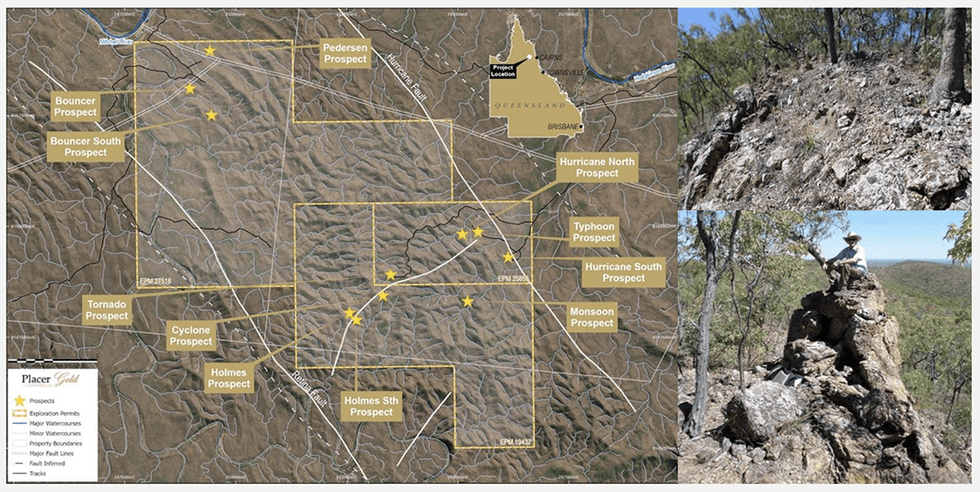

Inca Minerals' flagship Hurricane Project in Northern Queensland presents exceptional exploration potential, benefiting from a highly prospective geological setting. With record gold prices and rising demand for critical minerals, Inca is strategically positioned to seize this growing market opportunity.

Gold and antimony prospects at the Hurricane project

Gold and antimony prospects at the Hurricane projectInca Minerals is committed to advancing its flagship Hurricane Project through a high-impact exploration strategy. The company plans to launch a shallow drilling program in Q2 2025, targeting high-priority gold-antimony mineralization identified through rock chip sampling and structural mapping.

Company Highlights

- The flagship Hurricane project in Northern Queensland features exceptional gold and antimony grades, with assays returning up to 81.5 g/t gold and 35.1 percent antimony. Despite its strong potential, the project remains undrilled, offering a first-mover advantage in an underexplored high-grade system.

- A shallow, cost-effective drilling campaign in Q2 2025 aims to define a maiden gold-antimony resource at Hurricane, with the potential to deliver rapid upside for shareholders.

- Inca Minerals’ acquisition of Stunalara Metals significantly expands its footprint across Queensland, Tasmania and Western Australia, strengthening its exposure to high-value gold and critical minerals like antimony.

- With China restricting antimony exports and global supply tightening, Inca is well-positioned to benefit from rising demand across the energy storage, defense and high-tech sectors.

- Northern Queensland has seen limited modern exploration compared to Western Australia. Inca is leveraging advanced techniques to uncover new high-grade gold-antimony systems.

- Led by an experienced team with a track record of discovery success, Inca maintains a disciplined capital allocation strategy to maximize shareholder value

This Inca Minerals profile is part of a paid investor education campaign.*

Click here to connect with Inca Minerals (ASX:ICG) to receive an Investor Presentation

ICG:AU

The Conversation (0)

18 March 2025

Inca Minerals

Advancing high-grade gold-antimony project in Northern Queensland

Advancing high-grade gold-antimony project in Northern Queensland Keep Reading...

29 April 2025

March Quarterly Activities and Cash Flow Reports

Inca Minerals (ICG:AU) has announced March Quarterly Activities and Cash Flow ReportsDownload the PDF here. Keep Reading...

07 April 2025

Compulsory Acquisition Notice

Inca Minerals (ICG:AU) has announced Compulsory Acquisition NoticeDownload the PDF here. Keep Reading...

03 April 2025

Close of Takeover Offer

Inca Minerals (ICG:AU) has announced Close of Takeover OfferDownload the PDF here. Keep Reading...

31 March 2025

Inca to Raise $1.1M

Inca Minerals (ICG:AU) has announced Inca to Raise $1.1MDownload the PDF here. Keep Reading...

27 March 2025

Trading Halt

Inca Minerals (ICG:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

6h

Editor's Picks: Gold Price Breaks US$4,600, Silver Tops US$93 in Record-Setting Week

Gold and silver are wrapping up yet another record-setting week that's seen economic uncertainty and geopolitical tensions combine to push prices upward.The yellow metal moved decisively through US$4,600 per ounce on Monday (January 12), trading above that level for a decent amount of the... Keep Reading...

15 January

Will Rhind: Gold, Silver at Record Highs, Mania Phase Still to Come

Will Rhind, CEO of GraniteShares, outlines his thoughts on gold and silver heading into 2026, noting that historical precedents point to higher prices. "Clearly when you look back on some of those other periods for gold — and silver particularly — where they went to all-time highs, then we could... Keep Reading...

15 January

Sirios Adds $1.5 Million to the Treasury After Warrant and Option Exercises

Expanding investor outreach in Q1 by participating in key investor conferences and adding to its distribution network

Sirios Resources Inc. (TSXV: SOI) (OTCQB: SIREF) ("Sirios" or "the Company") has started the year with an infusion of capital, giving the Company additional financial flexibility for enhancing its exploration and investor programs in 2026.The exercise of 10,209,000 warrants and 1,750,000 options... Keep Reading...

15 January

American Eagle Continues to Expand South Zone near Surface Mineralization: Highlights Include 140 m of 0.74% Copper Eq. and 130 m of 0.62% Copper Eq.

American Eagle Gold Corp. (TSXV: AE) ("American Eagle" or the "Company") is pleased to announce drill results that further expand the South Zone at its NAK copper-gold project in British Columbia. Holes NAK25-55 and NAK25-62 extend shallow mineralization nearly 150 meters east-southeast, while... Keep Reading...

15 January

Positive Study Results - Kalahari Copperbelt

Aterian Plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce encouraging results from an independent geophysical study completed over Prospecting Licence PL265/2025 ("Licence") in the Kalahari Copperbelt ("KCB"), in the Republic of Botswana ("Botswana").... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00