July 27, 2022

Impact Minerals (ASX:IPT) has released its June 2022 quarterly report.

HIGHLIGHTS

1. Broken Hill, NSW (IPT 100%: IGO earning 75%)

- Deep-penetrating ground EM survey continues at the Broken Hill Joint venture with IGO.

2. Hopetoun, WA (Impact earning 80%)

- Diamond drill programme completed at Hopetoun: 25m wide sulphide bearing shear zone intersected at Silverstar.

- Assays due late July.

- First pass soil geochemistry surveys completed over other priority targets.

- Application for a new exploration licence lodged to cover part of the Jerdacuttup Fault and the southern extension of the Ravensthorpe greenstone belt.

3. Arkun-Beau, WA (IPT 100%)

- Follow-up work including field checking, and rock chip sampling

- and soil geochemistry survey’s completed.

- Land Access Negotiations are ongoing

- Airborne EM survey completed over priority targets.

4. Dinninup, WA (IPT 100%)

- New project acquired which covers 485 sq km located 60 km east of the world-class Greenbushes lithium-tantalum mine.

- No previous exploration except for bauxite.

- Project acquired for $20,000 cash and 3 million options exercisable at 2.4 cents.

- High-priority targets for nickel-copper-Platinum Group Elements (PGM), lithium-caesium-tantalum (LCT) pegmatites and Rare Earth Elements (REE) identified in a first-pass soil geochemistry survey that tested geophysical targets.

- Very high success rate of anomaly identification validates

- Impact’s targeting methodology.

5. Commonwealth, NSW (IPT 100%)

Negotiations in progress for a transaction on the project.

6. Blackridge, QLD (IPT 100%)

- Project sold to an unrelated private company.

- Terms of the sale are:

$30,000 cash for the outright sale of ML2386 (completed);

$50,000 cash as a non-refundable option fee to purchase three exploration licences EPM26806, EPM27410 and EPM27571 within two years for $350,000; and

- A 1% gross royalty for all gold produced after the first 5,000 ounces of production.

- 1 (one) for 4 (four) Renounceable Rights Issue at $0.011 per share completed to raise $3.2 million (before costs).

- With every two new Shares subscribed for, one free attaching Listed Option was issued with an Exercise Price of $0.02 and an Expiry Date of 2 June 2024 (ASX: IPTOB).

- All Directors took up their full entitlement.

OVERVIEW

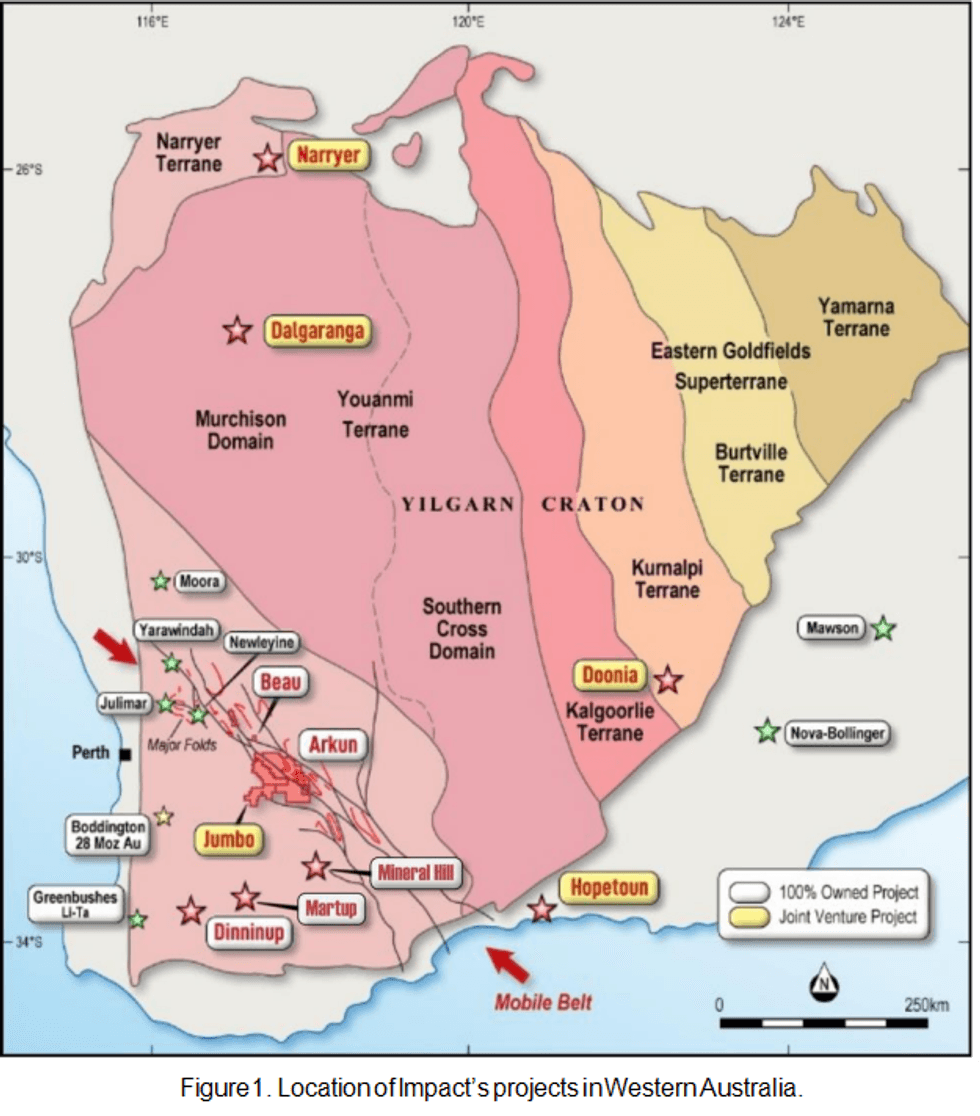

During the Quarter Impact continued work on its change in strategic focus from eastern Australia to the emerging mineral province of south west Western Australia following the recent Julimar PGE-Ni-Cu discovery (ASX:CHN) and also home to the world class Greenbushes lithium-tantalum mine (Figure 1).

Impact has assembled a significant number of projects in this highly prospective region, both 100% owned, (Arkun-Beau, Dinninup, Mineral Hill and Martup) and in joint venture (Hopetoun, Jumbo, Narryer and Dalgaranga). In addition, the Company is in a joint venture at the Doonia gold project near Kambalda where drill results are awaited (Figure 1). Drill results are also awaited at Hopetoun.

Current work programmes are aimed at defining drill targets at the flagship Arkun-Beau-Jumbo area and progressing interpretations of data at Doonia and Hopetoun. The other projects are also being progressed via compilations of previous work and preliminary interpretations of the surface and bedrock geology to identify areas of interest for follow up exploration.

Click here for the full ASX Release

This article includes content from Impact Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00