February 15, 2024

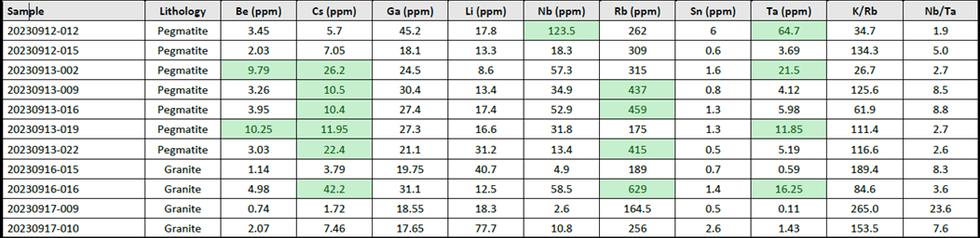

Eleven whole rock samples collected during the field work were sent to ALS Sudbury for analysis using the ME- MS61 package with four-acid digestion. This method analysed for 48 elements (Ag, Al, As, Be, Bi, Ca, Cd, Ce, Co, Cr, Cs, Cu, Fe, Ga, Ge, Hf, In, K, La, Li, Mg, Mn, Mo, Na, Nb, Ni, P, Pb, Rb, Re, S, Sb, Sc, Se, Sn, Sr, Ta, Te, Th, Ti, Tl, U, V, W, Y, Zn, and Zr).

- Assays received from the maiden Hornby Lake field program confirm the presence of fractionated LCT-type pegmatites with anomalism consistent with fertile granites in Ontario.

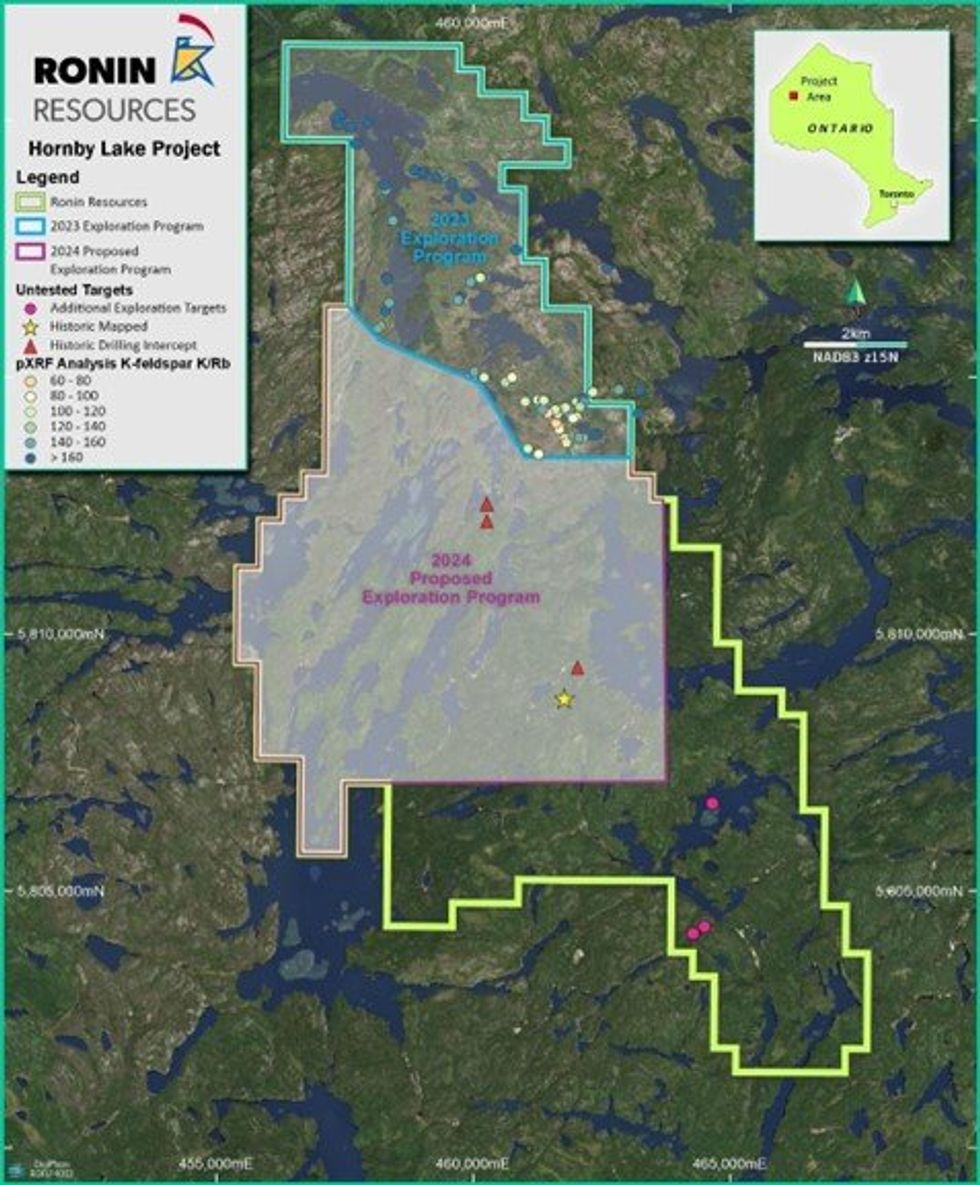

- The Company has commenced planning a 2024 field program to target the south-western portion of the Project area.

- Fieldwork will target the area south and southwest of the central region of the Project where fractionated pegmatites were encountered in the 2023 field program.

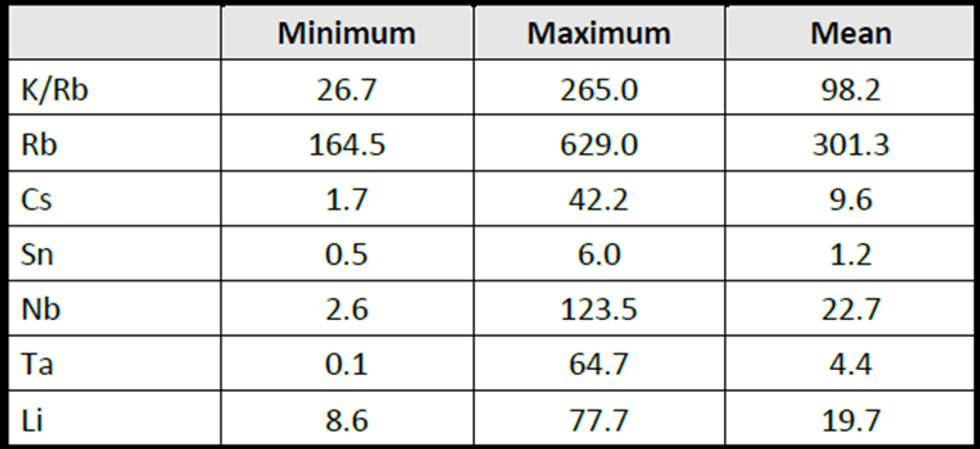

A summary of the results is shown below in Table 1:

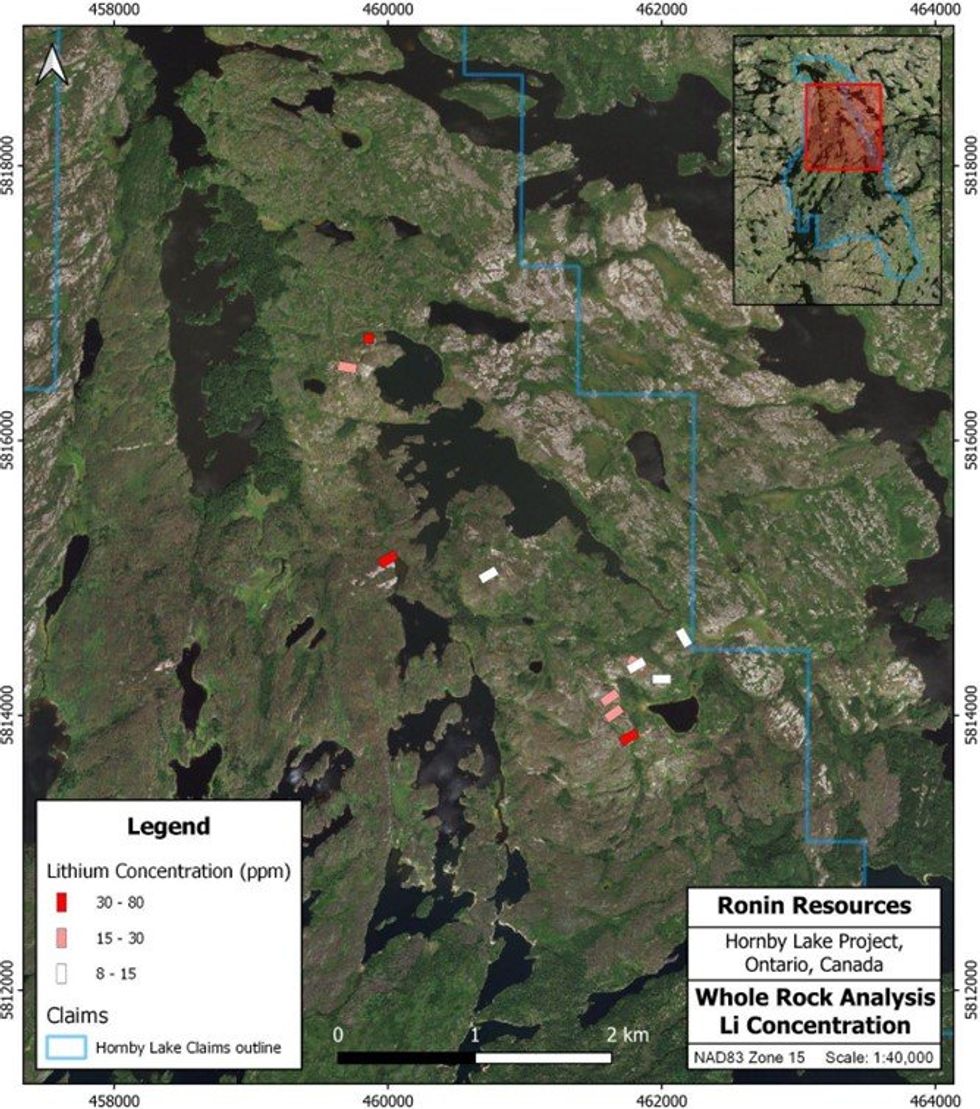

The assay results show overall low concentrations of LCT pegmatite suite elements (lithium, caesium, niobium, rubidium, tin, tantalum), with some low-level anomalism of caesium, niobium, rubidium, and tantalum (Table 2). The data confirm the pegmatites in the central part of the claims as being weak to moderately fractionated and that the granites are low-Ca and peraluminous. The highest concentration of lithium was 77.7 ppm (20230917- 010; Table 2), but is below levels considered anomalous (90 ppm, 3x crustal average) in whole-rock geochemistry samples.

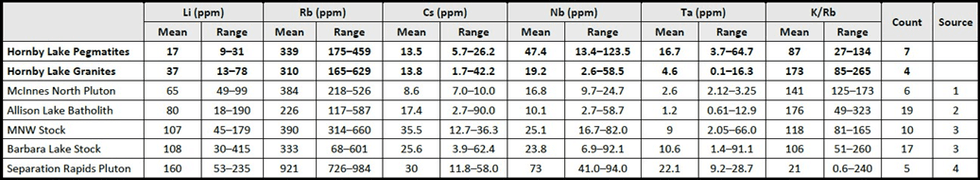

The samples show no clear mineralisation trends (Figure 2) and suggest that although there is low ranging lithium anomalism, it is too low to indicate potential economic mineralisation within the visited claim area. However, the whole-rock concentrations of LCT-suite elements in the pegmatites and one granite sample from the Hornby Lake area are within the range of fertile peraluminous granites elsewhere in Ontario (Table 3).

Analysis of Results

The 2023 exploration program undertaken by Ronin on the Hornby Lake project is the first program targeting LCT mineralization in the area. The primary focus of the first pass exploration was the central to northern segments of the project, targeting outcropping interpreted pegmatites from historical work and analysis of aerial photography.

The large granitic veins in the north of the project area were determined to be pegmatoidal biotite leucogranites, and not true pegmatites. The pegmatite-like outcrops within greenstones further south in the central east area were found to be complex pegmatite dykes with variations in crystal size from megacrystic to coarsely crystalline, garnet bearing aplitic phases, and rare patches containing muscovite.

The pXRF analysis of K-feldspar and whole rock assays determined the large pegmatoidal granite dykes in the north of the claim are unfractionated to very weakly fractionated. These are unlikely to be related to an LCT pegmatite system. The more complex garnet and muscovite bearing pegmatites in the central east of the area are weakly to moderately fractionated and show minor elevations of caesium and tantalum in some of the more fractionated pegmatites.

The fractionation data suggest that although the confirmed pegmatites contain no lithium mineralisation or favourable fractionation levels for lithium mineralisation, they do show a general trend of increasing fractionation from the unfractionated pegmatoidal granite dykes in the north to south. A westerly increase in fractionation was also observed from pegmatites east of the claims area into the claims.

The most fractionated pegmatites identified in the Project were some of the garnet and muscovite bearing pegmatites sampled in the central east area (Figure 1). White linear features apparent in Bing satellite/aerial imagery that appear similar to these confirmed pegmatites occur southwest (Figure 1). To the south, pegmatites have also been recorded in the historical mapping and recorded in drill hole logs (Figure 1; Mullan and Bell, 1968). Although these are recorded as being thin, they demonstrate that pegmatites occur further south in the claims where no features are apparent in the satellite and aerial imagery.

The Company believes based on fractionation trends, anomalous LCT indicator minerals from whole rock assaying, identified linear features in imagery similar to confirmed pegmatites, and historically recorded pegmatites, the south and southwest areas of the Hornby Lake Project remains prospective for potential lithium mineralisation.

Next Steps

The Company has commenced planning a 2024 field program targeting the south and southwestern extents of the Hornby Lake Project. The proposed program will follow closely with the procedures established in the 2023 program, including field reconnaissance, rock chip sampling and include potential channel sampling.

The program is expected to commence in H12024.

Assay data confirms the pegmatitic and pegmatoidal granite dykes in the northern section of the project are unlikely to be part of an LCT pegmatite system. The Company will discontinue its interest in this section of the Project.

Click here for the full ASX Release

This article includes content from Ronin Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00