- WORLD EDITIONAustraliaNorth AmericaWorld

June 24, 2024

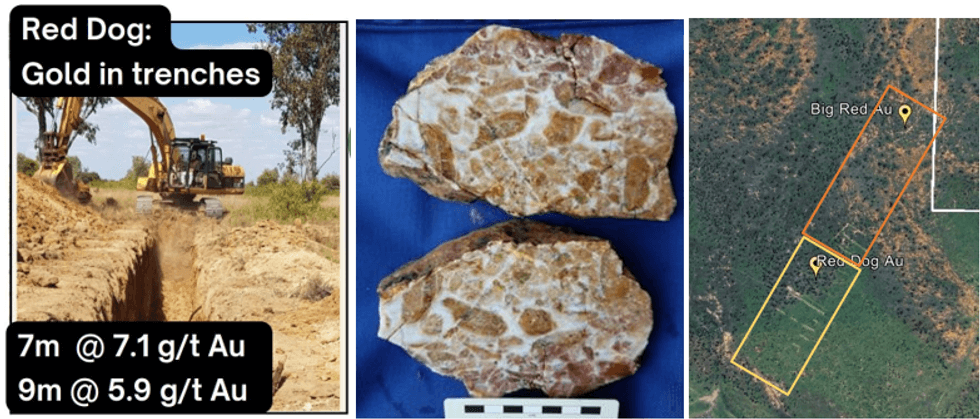

QX Resources Limited (ASX: QXR, ‘QXR’) announces a new program of trenching to extend known high grade gold mineralisation at Big Red Project, where prior trenching including mineralised widths of 9m @ 5.9g/t Au. The trenching is an initial phase, prior to drilling, as part of a plan of reassessment around potentially reopening closed open pit gold mines and further drill targets with the aim of future gold production scenarios.

- A follow-up trenching program has been planned at the Big Red Gold Project, Queensland.

- Previous trenching at Big Red returned high grade gold results including 9m @ 5.9g/t Au, with gold mineralisation remaining open along strike.

- Interpreted strike length over Big Red currently exceeds 450m with probable further concealed extensions beneath sandy loam surficial cover.

- The Company’s Gold projects are located in the Drummond Basin in central Queensland – an under- developed region with a long history of ongoing gold mining region with an endowment of over 8.5 million ounces.

- A reassessment of two shuttered open pit gold mines within QXRs ground has commenced as these mines were last operated when the gold price was less than A$500/oz.

- QXR has numerous gold and copper-gold targets which will be developed towards further drilling leading to potential production scenarios with updated permitting guidelines.

High Grade Gold in Trenches at Big Red Project

Gold trenching is planned to extend current high grade gold results in trenches at the Disney-Big Red Project (ASX announcement 1 Nov 2021). Two elongate gold anomalous zones were defined over 650m and may extend up to 1200m long. Best historic trench results from hard rock at the base of trenches at Big Red were:

- Trench 1 - 9m @ 5.9 g/t Au within a mineralised zone 35m wide. Large zone 80m @1.2 g/t Au

- Trench 2- 3m @ 2.2 g/t Au within a mineralised zone 13m wide. Large zone 28m @ 1.8 g/t Au

- Trench 4 - 2m @ 23 g/t Au with a mineralised zone 7m wide. Large zone 32m @ 1.7 g/t Au

These results produced a drill ready target, but that drill program was delayed twice due to weather and soft ground (ASX announcement 13 July 2021, 31 April 2022). Further trenching is planned to extend the current zone of high-grade gold mineralisation prior to a drilling program over a number of shallow targets. The Company believes the potential of Big Red may be similar to nearby Twin Hills deposit with 1.0Moz (23.1Mt@1.5g/t Au) incl 49m @5.2g/tAu and Lone Sister 0.48Moz (12.5Mt@1.2g/t Au) incl. 28m @45.2g/t Au (c.f. ASX:GBZ announcement 5 Dec 2022, 28 Apr 2023, 9 Jun 2023)

Reassessment of Open Pit Gold Mines

A reassessment of the potential of past open pit gold mines is underway. The two open cut mines, Belyando and Lucky Break, were closed when gold was less than A$500/oz. Drilling data by QXR and previous explorers shows potential exists for down dip extensions to known gold mineralised zones and parallel features, as well as extensions along strike.

QXR Managing Director, Stephen Promnitz, said: “QXR has excellent potential for a gold discovery at Big Red in Queensland, which will be followed-up in the planned trenching program and followed later by a drill program, previously delayed due to inclement weather. Nearby closed open pit gold mines were operating at much lower gold prices and show potential for future production as part of a reassessment of their potential.”

Next Steps

Trenching

A new program of trenching at Big Red Project (Disney) is an initial phase to extend two north-east trending elongate zones previously encountered in QXR trenches with high grade gold results occurring over a strike length of 650 metres. The zones may potentially be up to 1200m long based on past soil sampling and geophysics (magnetic low zones within magnetic highs). Mineralised widths included 9m @ 5.9 g/t Au in trenches (ASX announcement 1 Nov 2021, 16 Feb 2022). Quartz breccias show textures similar to gold producing zones elsewhere in the region.

Drill targets

Revised drill targets will be generated from the trenching results, merged with geophysical data. These results produced a drill ready target, but that drill program was delayed twice due to weather and soft ground (ASX announcement 13 July 2021, 31 April 2022).

Resource models

Updated resource modelling for Belyando and Lucky Break have been commissioned. Both mines show potential exists for down dip extensions to known gold mineralised zones and parallel features, as well as extensions along strike.

Background

QXR holds nearly 100,000 hectares of leases in the Drummond Basin of central Queensland – an under- developed region with a long history of ongoing gold mining region with an endowment of over 8.5 million ounces (1). Gold mineralisation is largely related to intrusives into the region with the largest producer – Pajingo (ex-Newmont) having produced 3.4 Moz since 1986 and was instrumental in the creation of gold miner Evolution when they purchased the mine from Newmont (Newcrest).

The QXR leases show potential for epithermal gold and porphyry related copper gold deposits and include two historical open pit gold mines, Belyando and Lucky Break, that were last producing when the gold price was under A$500/oz. QXR holds 85,800 Ha of exploration leases on a 100% basis and 11,500 Ha (70%QXR) in a JV with private company, Zamia Resources.

Click here for the full ASX Release

This article includes content from QX Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QXR:AU

The Conversation (0)

07 February 2024

QX Resources

Copper/Moly/Gold assets in Queensland

Copper/Moly/Gold assets in Queensland Keep Reading...

30 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

QX Resources (QXR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00