August 17, 2023

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) advises that significant high-grade assay results have been received for Abra after the data cut-off associated with the recent 2023 Mineral Resource Estimate (MRE) (refer ASX announcement dated 7 August 2023). Results reinforce confidence in the existing mine plan, mineral resource conversion and extension, and production guidance.

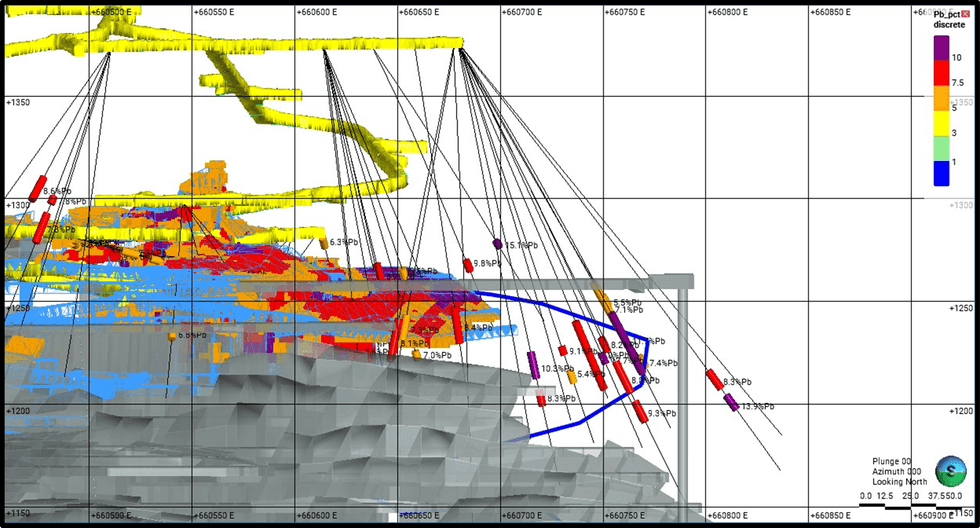

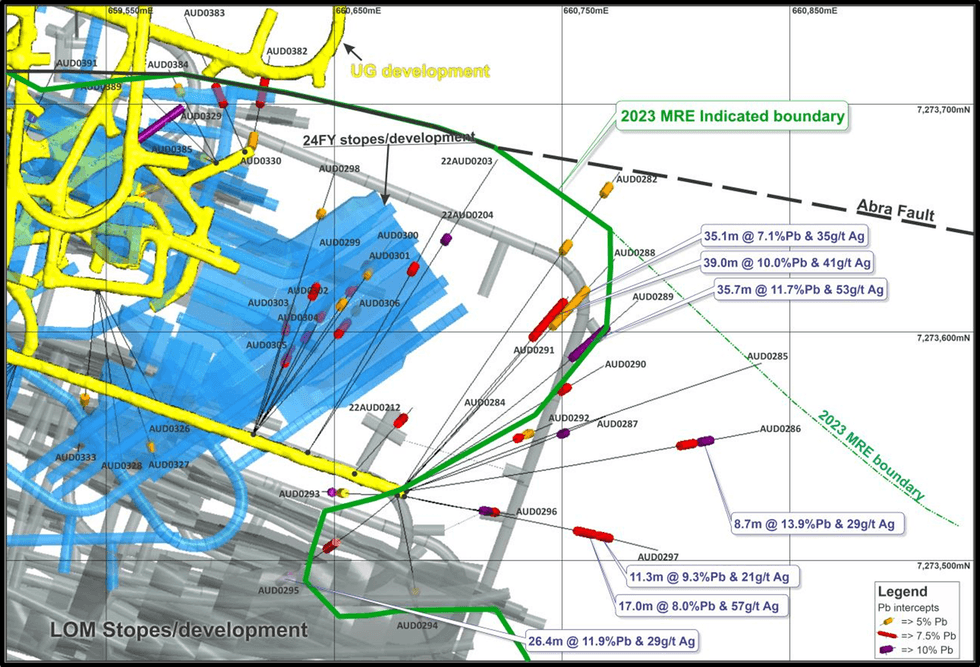

Significant results include:

- 18.9m @ 17.1% lead and 30g/t silver

- 38.3m @ 12.1% lead and 15.4g/t silver

- 26.4m @ 11.9% lead and 28.6 g/t silver

- 35.7m @ 11.7% lead and 53.4g/t silver

- 10.4m @ 11.4% lead 29.9g/t silver

- 38.9m @ 10.0% lead and 40.9g/t silver

Two underground drill rigs continue working at Abra and the recent MRE update included an additional 26,277m (163 holes) of underground diamond drilling. The updated MRE highlighted that after mining and the re-interpretation of the upper margin of the orebody following underground access and mapping, there was no material change in grade or tonnage for the MRE. Since the MRE update data cut-off date (5 May 2023) a further 13,336m (70 holes) of drilling has occurred and these results relate to that drilling. Table 1 below lists all the intercepts from that drilling.

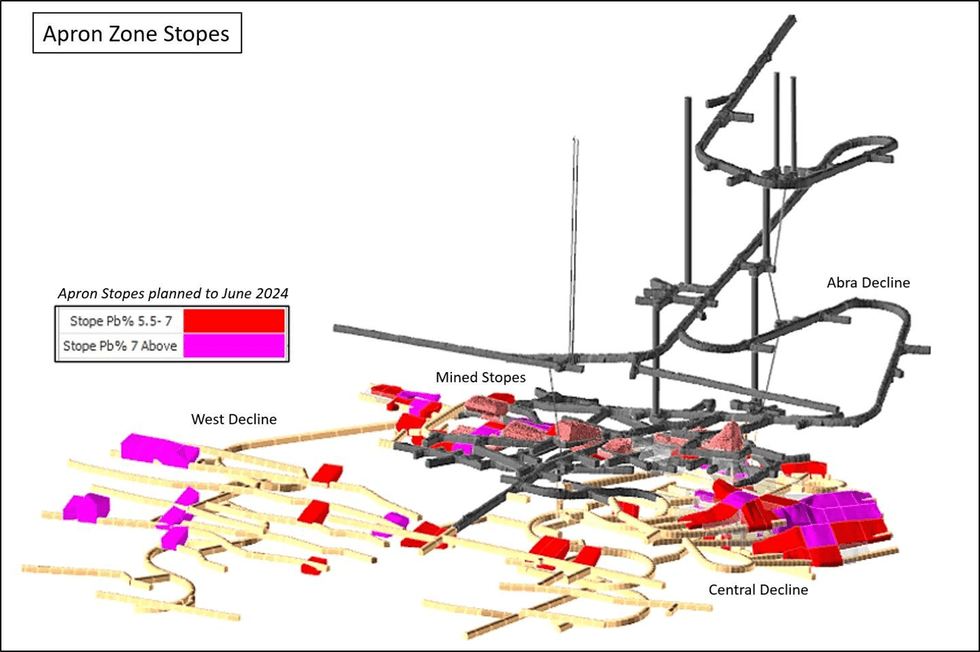

A significant portion of the mining plans over the next 12 months is now drilled to a 12m x 12m spacing and these results for areas within and adjacent to those work areas are expected to further improve the metal production during that time. The drilling is also confirming the extension of both Apron and Core mineralisation to the northeast of the deposit which is expected to increase the size of the MRE based on our current observations and understanding of the mineralisation in this area.

The increased confidence and understanding of the ore to be mined over the next 12 months will allow some drilling of the Abra North and Abra Copper-Gold targets below the existing mineralisation and planning has commenced for this drilling.

Managing Director, Tony James commented, “These strong results complement our mine plans over the next 12 months. Geologically they show the importance of the interface between the Core and Apron zones and the potential extension of the deposit to the Northeast. As mining progresses in these areas on multiple fronts and levels, it will generate enormous opportunity for us as we continue improving our production profile”.

The drilling results shown in Appendix 1 below are all the drilling intercepts received to date from underground drilling since 5 May 2023 (refer ASX announcement 7 August 2023). Pb assay results shaded in red are those results that are greater than 10% Pb.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00