November 20, 2023

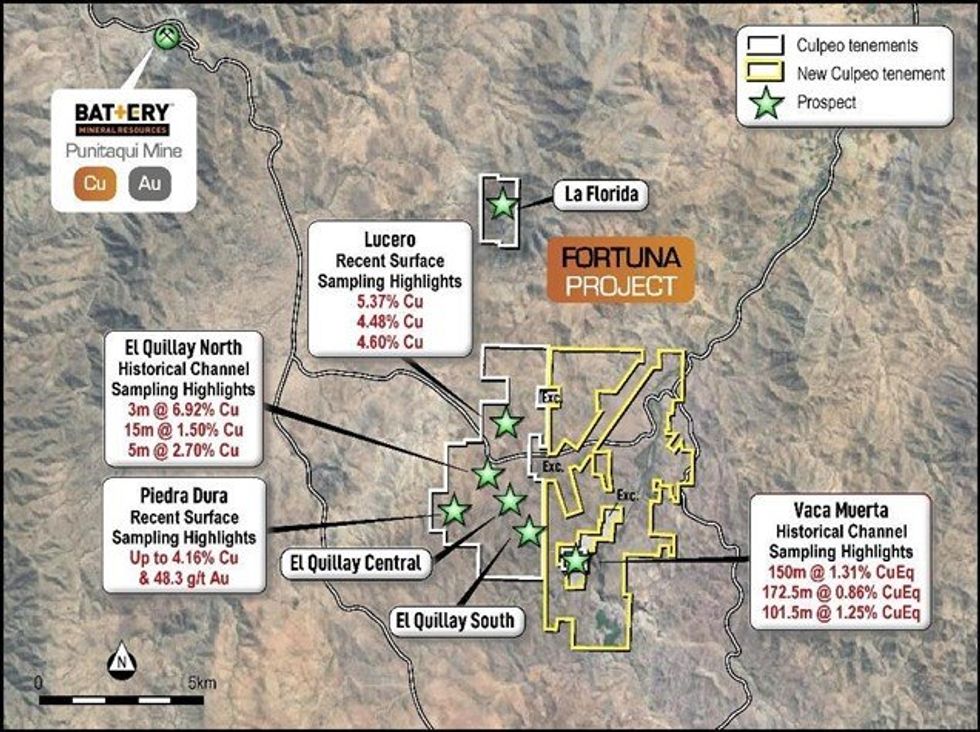

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce a new copper discovery at the Fortuna Project in Chile, with high-grade results of up to 5.37% Cu returned from rock chip samples taken from several newly defined parallel mineralised structures at the Lucero Prospect.

HIGHLIGHTS

- New Lucero Discovery at the Fortuna Project with high-grade copper returned at surface.

- Grades of up to 5.37% Cu returned from several newly defined parallel mineralised structures measuring approximately 950m by 60m.

- Total of 36 rock chip samples assayed, with 18 returning grades of greater than 2% Cu

- Significant results include:

- 5.37% Cu (sample #8615);

- 4.48% Cu (sample #8609); and

- 4.60% Cu (ample #8626).

- Four-hole diamond drilling program to commence at El Quillay north in November 2023.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“The discovery of outcropping high-grade copper mineralisation at Lucero is an exciting development for Culpeo. Lucero lies just 1.3km to the north of our high-priority El Quillay drill targets, where surface and channel sampling already suggest significant potential.

When combined with the Company’s highly encouraging exploration results at Piedra Dura and Vaca Muerta Prospects, we are quickly defining a series of high-potential copper and gold drill targets across the Fortuna Project area, the first of which will be tested in November 2023.

LUCERO PROSPECT

The newly discovered Lucero Prospect is located 1.3km north of El Quillay within the Fortuna Project. The structurally controlled outcropping copper mineralisation has been delineated over 950m of strike and has been observed to span up to 60m in width (Figure 2).

With grades of up to 5.37% Cu and 50% of samples returning above 2% Cu, this area of Fortuna shows potential for a significant metal endowment. Lucero represents the fifth key prospect Culpeo has identified at the Fortuna Project since its recent acquisition.

The discoveries present as two sub-parallel mineralised zones striking north-west and remain open in all directions. A total of 36 rock chip samples were collected (Table 1), three of which contained very high-grade malachite, bornite and chalcopyrite copper mineralisation assaying between 4 and 5% Cu (Figure 3).

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

1h

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

21h

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00