February 12, 2025

Heliostar Metals (TSXV:HSTR,OTCQX:HSTXF,FRA:RGG1) is an emerging mid-tier gold producer with a clear, execution-focused strategy. The company is on track to go from no gold production in 2023 to 150,000 ounces of annual gold production in just a couple of years. Aiming to unlock high-grade gold production in Mexico’s premier mining regions, Heliostar presents a compelling investment opportunity for investors looking to capitalize on a continued gold bull market.

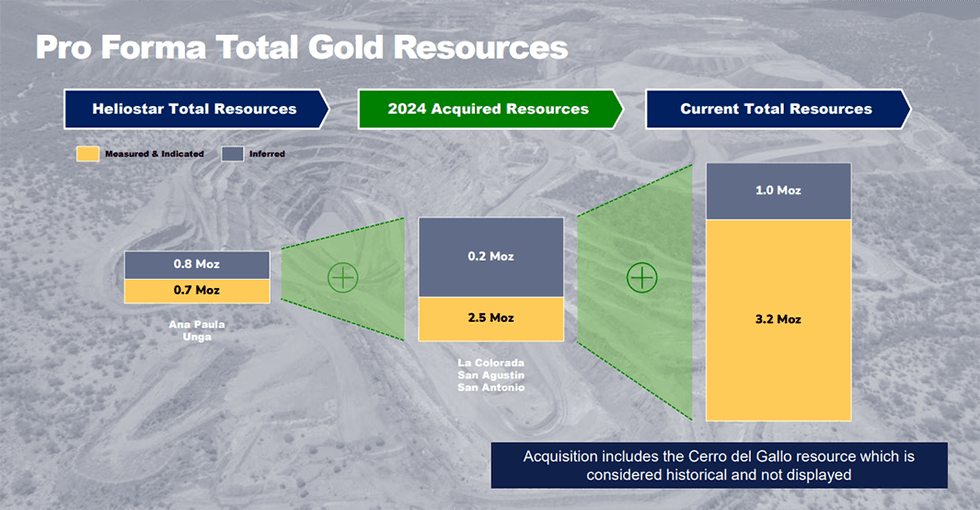

The company holds two operating mines (San Agustin and La Colorada), two advanced development projects (Ana Paula and Cerro del Gallo), and two additional growth assets (San Antonio and Unga in Alaska). Heliostar is strategically positioned to fund growth through internal cash flow while continuing to expand its resource base. Pro Forma Total Gold Resources

Pro Forma Total Gold ResourcesHeliostar Metals looks forward to scaling its gold production to 150,000 ounces per year in the near term by leveraging producing mines and development assets. San Agustin and La Colorada provide immediate cash flow and serve as the foundation for production growth. At La Colorada, a permitted expansion plan allows for low-cost increases in output, while the advancement of Ana Paula Phase 1 will significantly enhance production capacity.

Company Highlights

- Heliostar Metals is rapidly advancing from a junior explorer to a mid-tier gold producer, targeting 150,000 oz per year in the near term and 500,000 oz annually by 2030.

- Heliostar has rapidly expanded its portfolio with key acquisitions, now controlling two producing mines and four advanced-stage growth assets in Mexico. Added 3.5 million measured and indicated gold ounces for just US$15 million, reinforcing a capital-efficient growth model.

- The company prioritizes capital discipline and low-cost acquisitions to expand its asset base and maintain a lean financial structure. Unlike many juniors who dilute shareholders to grow, Heliostar leveraged gold production cash flows to drive project development.

- Its flagship project, Ana Paula, is one of Mexico’s highest-grade undeveloped gold projects. The Heliostar team took on the permitted open pit design and revised it to an underground operation. The current mine plan has potential to produce more than 100,000 gold ounces per year.

- In 2024, Heliostar acquired the La Colorada and San Agustin gold projects. Production at these two mines provide immediate cash flow. That funds Heliostar’s exploration and development without significant dilution.

- CEO Charles Funk leads a seasoned team of mine builders and exploration experts with a track record of developing world-class deposits.

- The company also features a favorable shareholder registry: 53 percent institutional investors, 42 percent high-net-worth and retail investors, and 5 percent held by the board and management.

This Heliostar Metals profile is part of a paid investor education campaign.*

Click here to connect with Heliostar (TSXV:HSTR) to receive an Investor Presentation

HSTR:CC

Sign up to get your FREE

Heliostar Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

27 November 2025

Heliostar Metals

Gold miner with a portfolio of producing and developing gold projects in Mexico

Gold miner with a portfolio of producing and developing gold projects in Mexico Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Heliostar Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00