February 06, 2025

Halcones Precious Metals Corp. (TSX – V: HPM) (the “Company” or “Halcones”) is pleased to announce results from the first field program completed by the Company at the Polaris gold project, Chile (“Polaris” or the “Project”). Halcones’ geologists recently initiated field work comprised of mapping and sampling in a portion of the Project area. The samples consisted of continuous 1m long chip samples to ensure representative sampling.

Highlights:

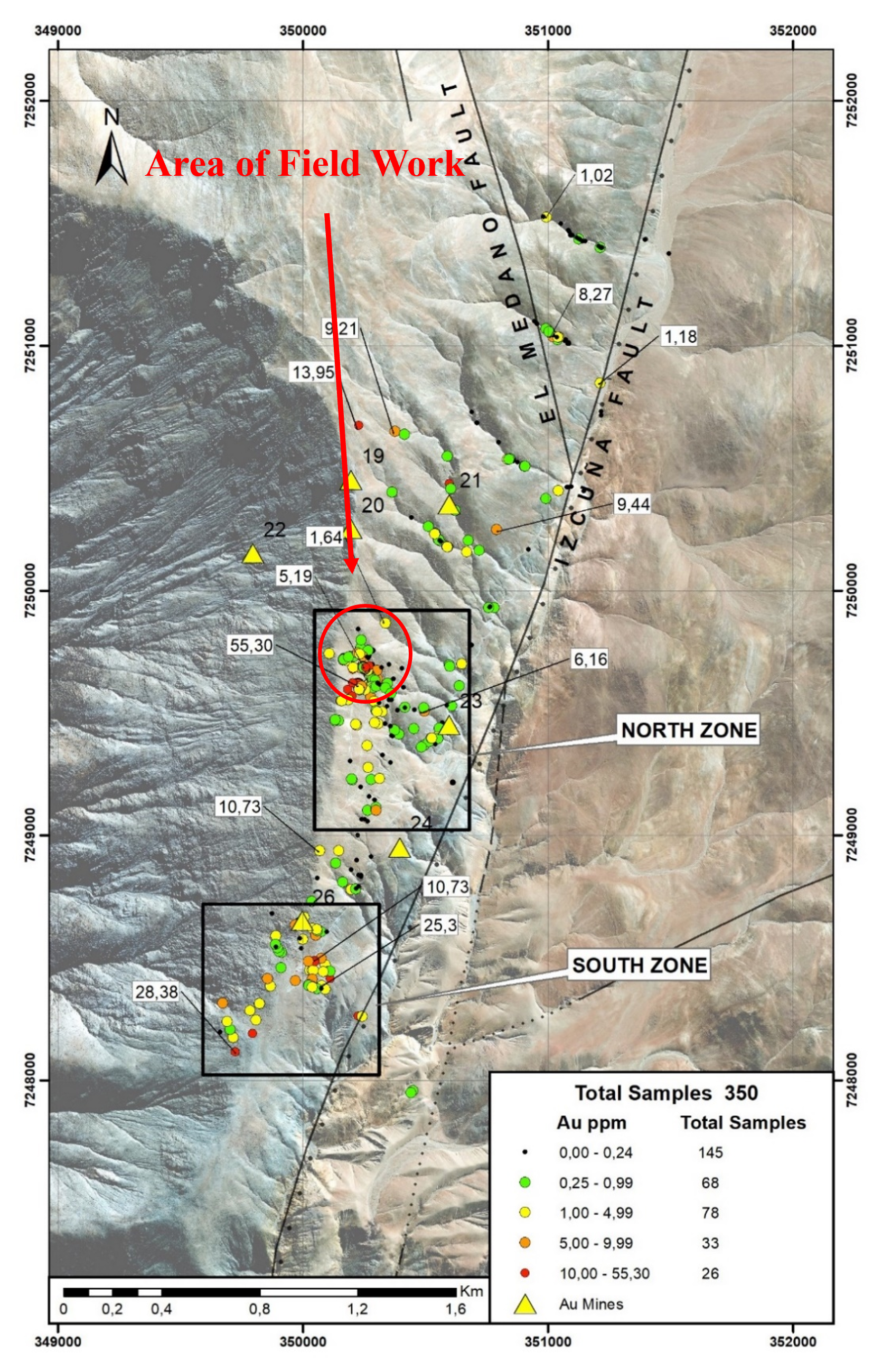

- The Polaris Project is a large, highly prospective gold project. 17 former artisanal, high-grade mines occur within the Project area. These bonanza grade operations were active approximately 130 years ago¹. Sampling of extensive zones of highly fractured and brecciated wall rocks was not carried out. Extensive gold mineralization has been identified by surface bedrock sampling over 2.7 km of strike length on the property to date. The full extent of this mineralization is presently unknown, however initial results demonstrate potential for mineralization occurring over wide areas at shallow depths (Figure 1). Large areas of the Project remain unsampled. Additional surface mapping and sampling is in progress and the results reported here are from the initial Halcones assays.

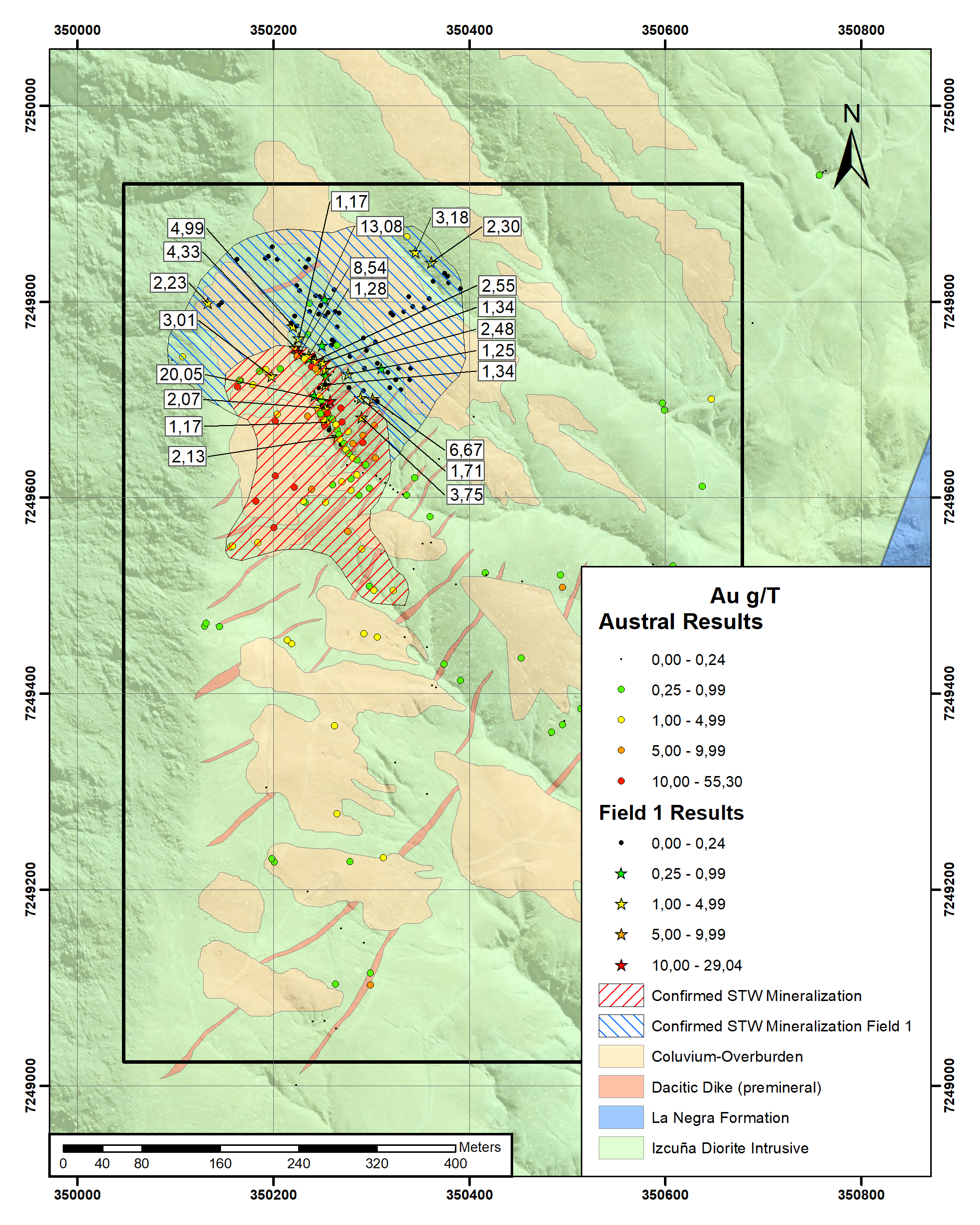

- Select highlights from this field programs include 20.05, 13.08, 8.54 and 6.67 g/t, hosted in veins and stockwork. See figure 2 for locations of samples.

- The initial sample area which contained multiple high grade surface samples has been expanded. Sampling by Halcones geologists returned values consistent with work done by the optionors of the Project and extended the known area of high grade mineralization to more than double that previously outlined.

- High grade mineralization exhibits a strong structural control and in the area of the reported sampling (Figure 2) high grade samples occur on the southwest side of a structural break.

- Gold bearing stockwork at surface has been sampled over approximately a 220m X 300m area and limits of this mineralized zone are not yet known. The average grade of the 20 samples collected by Halcones in this area was 4.26 g/t gold.

- Halcones believes there is potential for a larger tonnage surface deposit of vein and stockwork hosted mineralization hosted by the highly fractured rocks associated with fault splays associated with one of the major, continental scale, Atacama Fault Systems in the area.

- Northeast of the higher-grade sampling, there is an area extending approximately 150 meters further to the northeast of the structural break where samples are generally lower grade, however another parallel structure has been identified at the northeast edge of the low-grade sample area and grades appear to be stronger on the northeast side of the second structure there (Figure 2).

- Additional assays are expected to be released as they become available, and the Company is making plans to extend the sampling to a broader area.

Ian Parkinson, CEO and Director, of Halcones:

“We are extremely excited by the results from the first assays at Polaris. In just a few weeks in the field the team has significantly expanded one of the priority target areas in the North Zone. The extensive gold in stockwork is particularly encouraging as it demonstrates the potential for a large-scale bulk tonnage deposit at Polaris. Sampling and mapping continues with the goal to prioritize targets to be drilled later this year. It is rare to see such broad scale gold mineralization at surface. Many of the samples are not obviously mineralized other than the presence of fine stockwork fractures and veinlets that appear to carry the gold.”

About The Current Field Program

The were two main objectives of the current field program.

1) Expand the footprint of the known mineralization in the Northwest corner of the North Zone (see Figure 1)

2) Test and better define the extent of mineralized stockwork as a lower grade bulk tonnage opportunity adjacent to the known vein hosted mineralization.

This first phase of field work successfully expanded the surface area of mineralization (see Figure 2) and confirmed the presence of stockwork hosted gold mineralization at surface.

Sampling previously performed on Polaris identified the Northwest section of the North Zone as a priority area (see Figure 1). In recent field work, Halcones’ geologists increased the density of sampling and expanded the surface footprint of sampling in this priority area (see Figure 2). Halcones’ geologists took a total of 140 samples during the recent field campaign. 96 for which assays have been received, have been compiled in this release of which 22 returned values above 1g/t. The balance will be released shortly.

This sampling program has successfully expanded the surface expression of the work completed previously on Polaris. Additionally, stockwork mineralization has been confirmed over a broader area. The presence of mineralized stockwork over an extensive area supports Halcones’ geologist interpretation that bulk tonnage deposit potential exists at Polaris. Sampling has been limited in certain areas due to the presence of a thin layer of colluvial cover. Sampling programs are being planned to test bedrock below this this cover.

Halcones’ geologists have been working with a geological model that Polaris holds potential for a large scale bulk tonnage open pit operation. The presence of mineralization in stockworks in the wall rocks away from the historically mined, mineralized veins is a crucial component of this model that is present at Polaris. This stockwork is believed to have a similar genesis to the vein hosted mineralization previously exploited by artisanal miners but was never targeted. The stockwork mineralization is not visually obvious due to a general lack of associated sulfide minerals. The 17 known small scale mines in the Project area exploited very high-grade veins with no focus on the stockwork adjacent to the veins.

Figure 1. Polaris Project sampling has identified gold mineralization over a 2.7 km extent in an area that has never been drilled.

https://www.globenewswire.com/NewsRoom/AttachmentNg/1be344bb-8a68-4b8b-a723-214596b07455

Figure 2. Polaris Field Program Results with recent assays represented. The stars are Halcones samples, the dots are samples by the optionors.

https://www.globenewswire.com/NewsRoom/AttachmentNg/8fc24c11-51fd-4443-9b7f-94ed3e298e85

About The Sampling Process

Using a hammer and a rock chisel, a chip sample is carried out uniformly over at least 1 meter sections, ensuring complete collection and homogeneity in order to achieve proper representation of the sample. The sample is collected perpendicular to the dominant strike of the structures and the sample mass must be a minimum of 2 kg. In the event that the outcrop presents some mineralized structure, an independent sample will be taken only from the mineralized structure and an independent sample from the host rock on both sides of the structure. This process is designed to limit bias due to high grading sample collection.

All samples were bagged and sealed on site and delivered directly by the Project Geologist to ANDES ANALITYCAL ASSAY Laboratory in Copiapó, Chile. After sample preparation at ANDES ANALITYCAL ASSAY Laboratory in Copiapó, split pulp samples were shipped to ANDES ANALITYCAL ASSAY in Santiago, Chile for assaying gold by fire assay (AEF_AAS_1E42-FF), and for analyzing 34 other elements, including silver, by four acids (ICP_AES_AR34m1).

ANDES ANALITYCAL ASSAY is an independent laboratory certified with a global quality management system that meets all requirements of International Standards ISO/IEC 17025:2017, includes its own internal quality control samples comprising certified reference materials, blanks, and pulp duplicates.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. David Gower, P.Geo., as defined by National Instrument 43-101 of the Canadian Securities Administrators.

About Halcones Precious Metals Corp.

Halcones is focused on exploring for and developing gold-silver projects in Chile. The Company has a team with a strong background of exploration success in the region.

For further information, please contact:

Vincent Chen

Investor Relations

vincent.chen@halconespm.com

www.halconespreciousmetals.com

Cautionary Note Regarding Forward-looking Information

A qualified person, as defined in National Instrument 43-101, has not done sufficient work on behalf of Halcones to classify any historical grades, production or results reported above as current mineral resources or mineral reserves. The historical data should not be relied upon.

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, regarding the prospectivity of the Project, the mineralization of the Project, the Company’s exploration program, the Company’s ability to explore and develop the Project and the Company’s future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward- looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Halcones, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operation in foreign jurisdictions; ability to successfully integrate the purchased properties; foreign operations risks; and other risks inherent in the mining industry. Although Halcones has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Halcones does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

HPM:CA

Sign up to get your FREE

Halcones Precious Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

28 April 2025

Halcones Precious Metals

Advancing a significant high-grade gold project in Northern Chile

Advancing a significant high-grade gold project in Northern Chile Keep Reading...

9h

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

9h

Gold and Silver Stocks Dominate TSX Venture 50 List

This year's TSX Venture 50 list showcases a major shift in sentiment toward the mining sector. The TSX Venture 50 ranks the top 50 companies on the TSX Venture Exchange based on annual performance using three criteria: one year share price appreciation, market cap growth and Canadian... Keep Reading...

19 February

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

19 February

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

19 February

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Halcones Precious Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00