January 22, 2025

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to provide the results from the fourth aircore (AC) drill campaign at Guyer within the14 Mile Well Gold Project, located between Leonora and Laverton.

Highlights

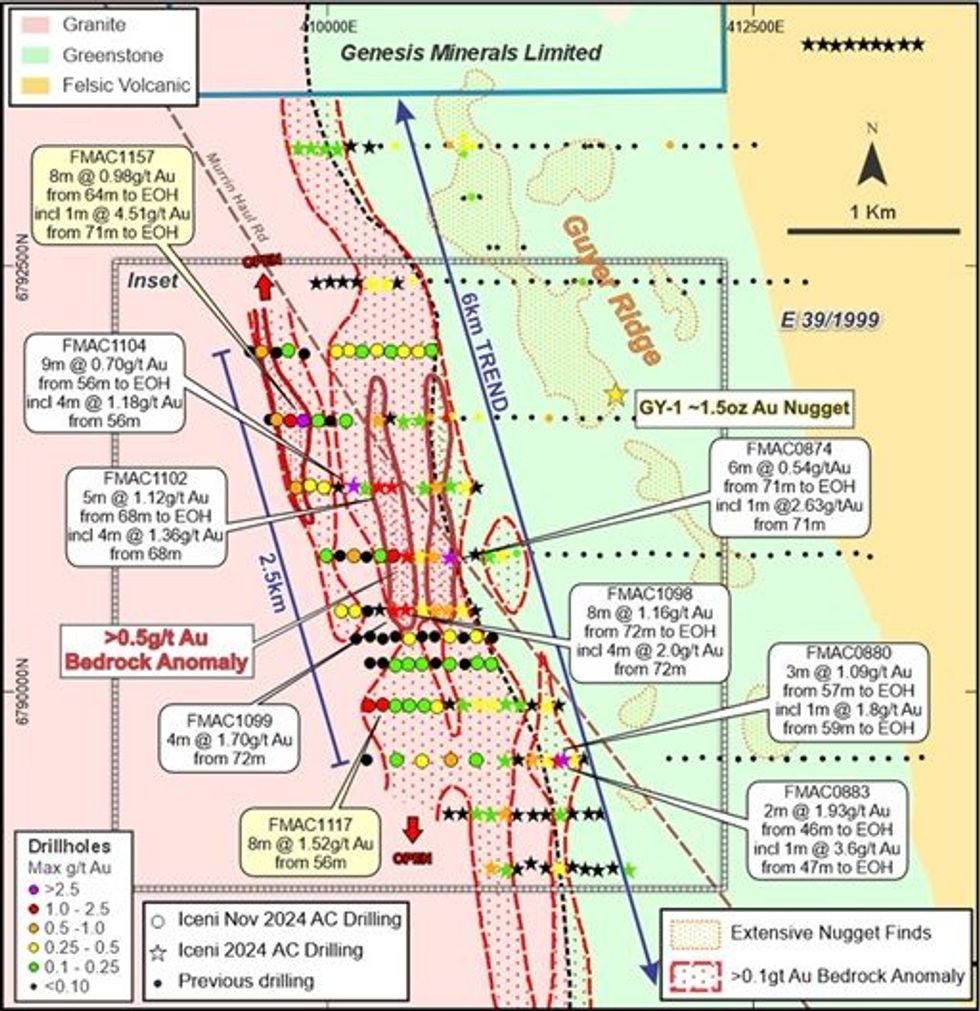

- Assay results from a fourth aircore (AC) drill campaign targeting extensions to the coherent 6km long bedrock gold anomaly at Guyer North, within the 15km long Guyer Trend, continue to enhance and grow the anomaly that is now up to 1100m wide.

- Broad downhole intervals of significant gold mineralisation were intersected in multiple vertical holes on nine infill and extensional drill traverses at Guyer North that has now outlined three robust 1500m long +0.5 g/t gold bedrock anomalies within the broader 6km long gold trend.

- More significant results from the latest drill campaign include:

- 8m @ 0.98 g/t Au from 64m to EOH in FMAC1157, including 1m @ 4.51 g/t Au from 56m to EOH

- 8m @ 1.52 g/t Au from 72m in FMAC1117

- 4m @ 2.07 g/t Au from 64m in FMAC1116

- 2m @ 0.92 g/t Au from 72m to EOH in FMAC1156, including 1m @ 1.47 g/t Au from 72m

- 5m @ 0.70 g/t Au from 60m to EOH in FMAC1151, including 1m @ 1.26 g/t Au from 64m to EOH

- Consistent with prior results, most new gold intercepts occur at the end of the drillholes (EOH), that combined, potentially represent a large footprint of a primary bedrock gold system.

- The Guyer Trend is part of the $35million exploration Farm-In agreement signed on 18 December 2024 with Gold Road Resources Limited (ASX: GOR).

- A major campaign of follow up RC drilling, to be managed by Iceni, to evaluate the primary zone beneath the large gold footprint at Guyer North, is scheduled to commence in early February as part of the initial $5 million minimum expenditure by GOR under the Farm-In agreement.

Commenting on the Guyer Well Results, Iceni Managing Director Wade Johnson said:

“The dimensions of the Guyer bedrock gold anomaly keep on expanding, with positive results from each successive aircore drilling campaign. At Guyer North we now have a large gold anomaly up to 1100m in width and at least 2500m long, that is part of a larger anomaly coincident with the granite greenstone contact that we have now outlined over 11kms. We are very pleased with the drill results from the fourth aircore drill program, which build upon previous results and now highlight three parallel stronger gold zones within the granitic bedrock west or near to the granite-greenstone contact. The large area of elevated gold in granite now provides a broad target for a maiden program of RC drilling to evaluate the primary zone that will commence shortly, backed and funded by Gold Road Resources. Our exploration in 2024 has laid the foundations for our focus in 2025 and we are gearing up for a big and successful year at the 14 Mile Well Project, with the immediate focus being Guyer.”

The board of Iceni Gold Limited (ASX: ICL) (“Iceni” or “the Company”) is pleased to announce results from a further early-stage AC drilling campaign along the 15km long Guyer Trend at its flagship 14 Mile Well Gold Project (“14MWGP” or “Project”) located midway between the gold mining towns of Leonora and Laverton. The Project (Figure 1) adjoins the recently recommenced Laverton Gold Operation, which contains the Jupiter and Westralia gold deposits owned by Genesis Minerals Limited (ASX: GMD).

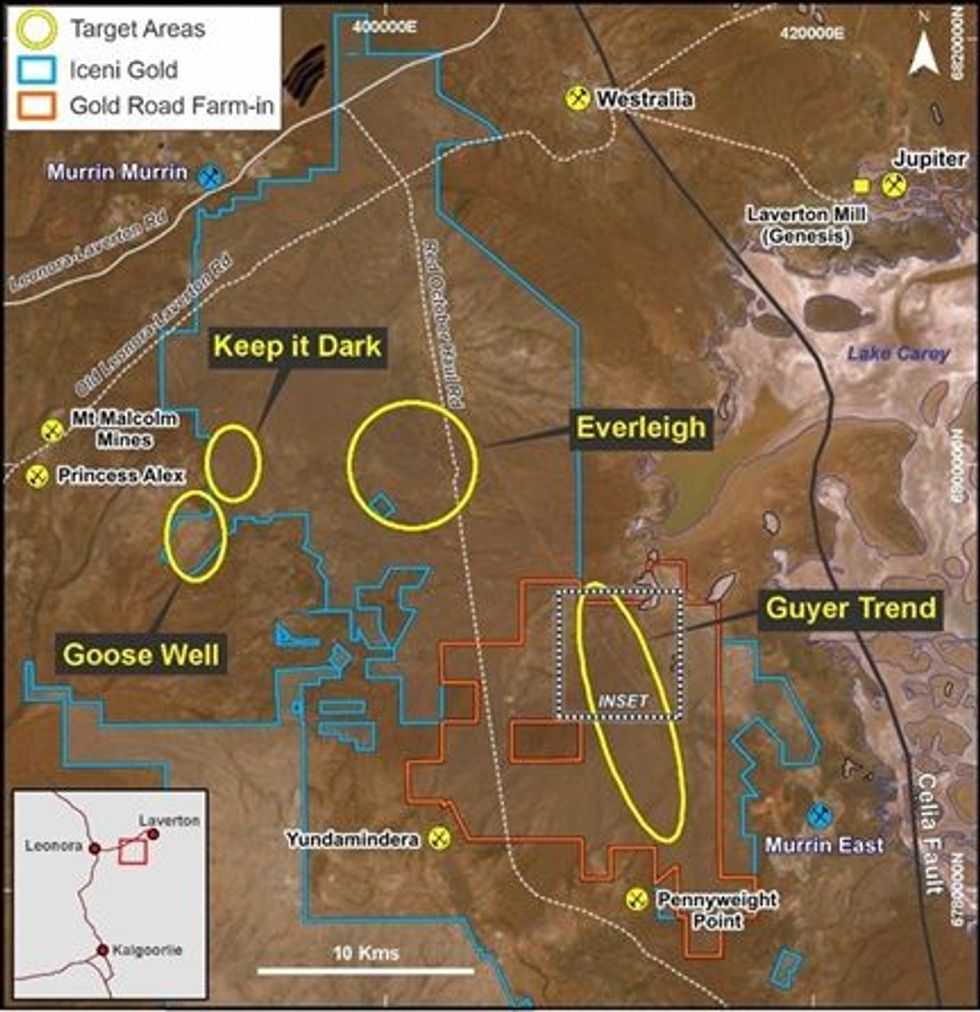

The Guyer Trend (“Guyer”) is located in the southeastern part of the 14MWGP. It was one of four key target areas identified from a targeting review in May 2024 that recognised priority areas to focus exploration on during CY2024 for a gold discovery (Figure 1). The trend lies over a northerly striking belt of mafic greenstone sequences, bounded by the Danjo Granite to the west and to the east by mafic to intermediate volcanic rocks (Figure 2).

Since June 2021, Guyer has been a focus of exploration by the Company, conducting extensive surface sampling, metal detecting and AC drilling (ICL ASX release 30 November 2022), primarily along a belt of sub-cropping mafic rocks along and to the south of the Guyer Ridge (refer Figures 2 and 3).

In August, September and October 2024, wide-spaced AC drilling revealed a broad, coherent bedrock gold anomaly along this granite-greenstone contact (Figure 2), spanning up to 950m in width and extending over 6kms in length (ICL ASX release 26 September 2024 and ICL ASX release 12 November 2024). The third aircore program completed in October 2024 identified a >0.5g/t Au 1500m long bedrock anomaly within the larger 6km >0.1g/t Au anomaly (ICL ASX release 12 November 2024). These two anomalies are hidden beneath up to 35m of transported overburden, masking any surface expression.

Whilst acknowledging the direction provided by the targeting appraisal in May 2024, Guyer has been a focal point for Iceni since 2021 (refer ICL prospectus), with extensive surface work, including Ultrafine Fraction (UFF) soil and rock-chip sampling yielding high-grade gold anomalies. This work was primarily concentrated along the Guyer Ridge (Figures 2 and 3), a sub-cropping basalt ridge east of the contact, where prospectors have made extensive gold nugget finds.

Geophysical gravity and magnetics data suggest that the Guyer Trend is part of a broader shear zone (Guyer Shear). Historical gold workings to the south (Refer ICL ASX release 12 November 2024) along strike, such as ‘Pennyweight’, which produced nearly 4200oz of gold from five tonnes of ore between 1897 and 1908 (Ref: Minedex), further underscore the area’s fertile signature and high prospectivity (ICL ASX release 15 October 2024). Combined with recent AC drilling results, these findings highlight the potential for significant gold mineralisation along the Guyer Trend.

Click here for the full ASX Release

This article includes content from Iceni Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ICL:AU

The Conversation (0)

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00