May 14, 2023

Maiden exploration drilling at the Twister Prospect has intersected significant zones of shallow, high-grade nickel sulphide mineralisation over an initial strike length of 900m

Centaurus Metals (ASX Code: CTM, OTCQX: CTTZF) is pleased to advise that greenfields exploration drilling at its 100%-owned Jaguar Nickel Sulphide Project (JNP) in the Carajás Mineral Province of northern Brazil has delivered a new nickel sulphide discovery at the Twister Prospect.

- Recent Reverse Circulation (RC) drilling has confirmed a new nickel discovery at the Twister Prospect, with multiple high-grade nickel sulphide intersections received over an initial strike length of 900m, including:

- 14.0m at 1.03% Ni from 163.0m in JAG-RC-23-190

- 11.0m at 1.06% Ni from 107.0m; including 5.0m at 1.70% Ni from 113.0m in JAG-RC-23-191

- 8.0m at 1.20% Ni, from 63.0m, including 3.0m at 2.67% Ni from 68.0m in JAG-RC-22-186

- 14.0m at 0.45% Ni from 85.0m in JAG-RC-23-196

- 4.0m at 1.57% Ni from 184.0m in JAG-RC-22-181

- 7.0m at 0.62% Ni from 173.0m in JAG-RC-23-189

- 8.0m at 0.46% Ni from 184.0m in JAG-RC-23-192

- The mineralisation outcrops at surface and remains open both at depth and along strike in both directions.

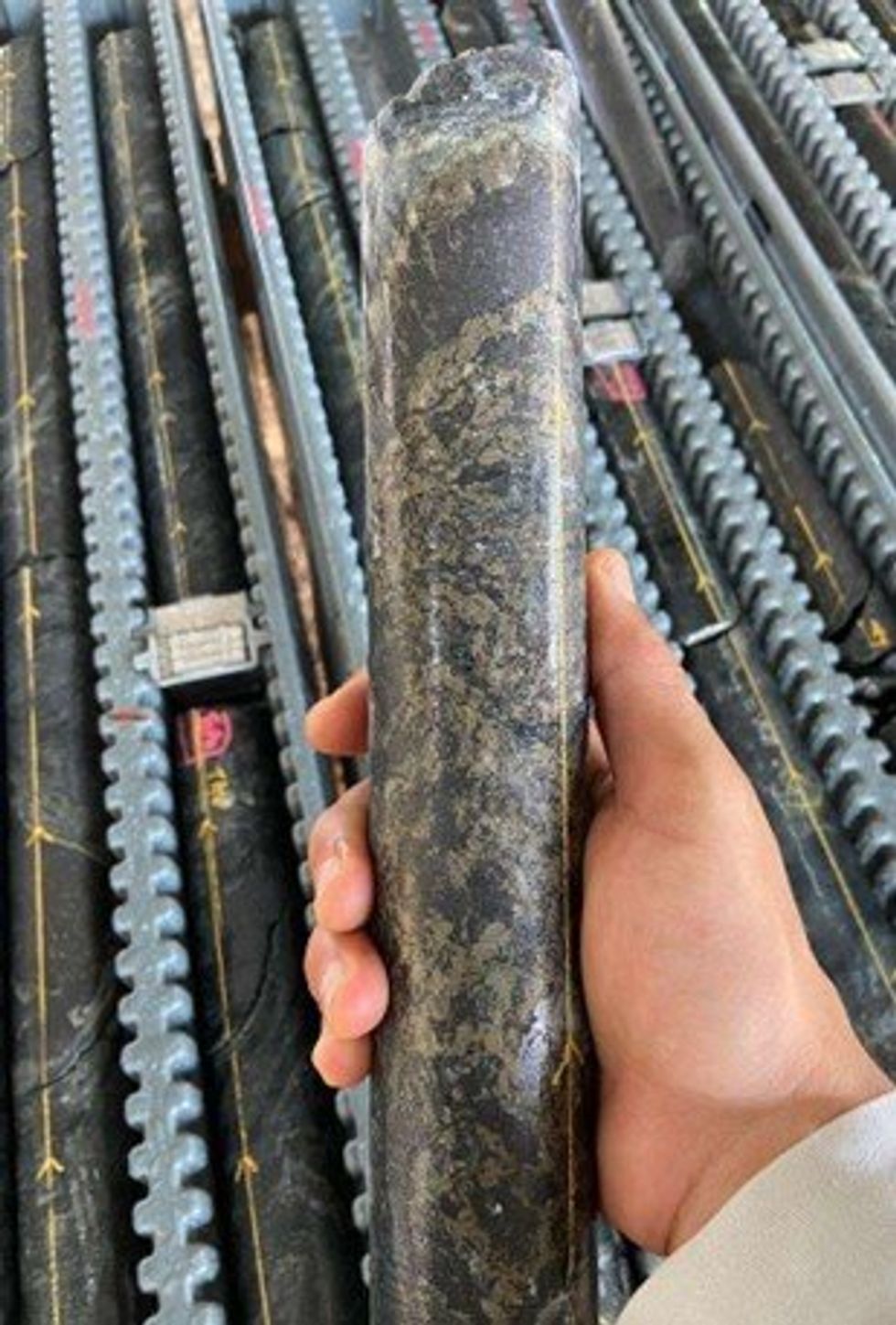

- Recently completed diamond drilling at Twister has confirmed +10m zones of stringer and net-textured nickel sulphides (millerite and pentlandite) in visual estimates from the first diamond holes drilled1.

- The new discovery at Twister is located only 5km from the proposed ROM pad for the Jaguar Nickel Project, presenting a new opportunity to build on the current Mineral Resource Estimate (MRE) of 109.2Mt at 0.87% Ni for 948,9002 tonnes of contained nickel metal.

- Near-surface nickel sulphide mineralisation has also been intersected at the Fliperama Prospect (12.0m at 0.92% Ni from 52.0m) and the Puma Contact Prospect (6.0m at 0.65% Ni from 81.0m) with further exploration planned.

- The RC rig is continuing to test greenfields targets at Twister, Dente de Sabre and Filhote. Diamond drilling is focused exclusively on step-out, extensional and greenfields drilling targeting resource growth, including the exciting Jaguar Deeps drilling – which is also set to commence this month.

- The Company remains well-funded, with $23 million in cash at the end of the March Quarter.

The shallow zone of nickel sulphide mineralisation – which has so far been delineated over a strike length of 900 metres – is located just 5km from the proposed mining and processing infrastructure at Jaguar and has the potential to grow the JNP’s Resource base and potentially extend mine life.

Centaurus’ Managing Director, Mr Darren Gordon, said the discovery of shallow nickel sulphide mineralisation at Twister represents the second greenfields discovery to be made on the property since it was acquired from Vale and shows the nickel prospectivity across the entire tenement.

“Our 2023 regional exploration focus has paid immediate dividends, with significant nickel sulphide intercepts returned in multiple holes over a significant strike extent at Twister. Over the past 18 months, the RC rig has been focused on project development and sterilisation drilling but has now been freed up this year to drill out the exciting greenfield targets on the tenement, and we are starting to see the results of this work.

“Drilling at Twister has intersected high-grade nickel sulphide mineralisation over 900m of strike which remains open in both directions and at depth. The mineralisation at Twister outcrops and, with initial RC results such as 8.0m at 1.20% Ni from 63.0m, we believe there is a good chance that, with some additional drilling, the Twister Prospect mineralisation will make it into the Resource base as part of the next MRE upgrade.

“Importantly, Twister is located less than 5km from the proposed ROM pad site and, as such, could be a future open pit satellite operation for the Jaguar Nickel Project.

“The continued delivery of outstanding results both from resource growth drilling and greenfields exploration drilling is consistent with the Company’s two-pronged strategy of continuing to grow and upgrade the Jaguar MRE, in parallel with key de-risking steps associated with Project permitting and the completion of the ongoing Definitive Feasibility Study.

“Jaguar is already a standout project in terms of scale and quality amongst undeveloped nickel sulphide projects worldwide and the Project’s extremely low emission footprint will be a key distinguishing feature in the market as OEM’s have to start reporting Scope 3 emissions and the location of where their nickel has been sourced.”

Twister Prospect

The Twister Prospect is located in the north-eastern corner of the Jaguar tenement and is interpreted to be a secondary splay of the Canaã Fault. Situated immediately south of the Puma Layered Mafic-Ultramafic Complex, the Prospect hosts multiple zones of magnetite alteration and nickel sulphide mineralisation within mafic- ultramafic rocks that have intruded into basement gneiss, suggesting that the mineralisation was emplaced during a stage of dilation similar to that seen at Onça Preta and Onça Rosa.

Twister has around 900m of prospective strike length identified by electromagnetic and ground magnetic anomalies, with Ni-Cr-As-V-Co and PGE soil geochemical support. A FLEM survey has identified a 500m long conductor plate, coincident with the soil anomaly.

Field mapping has identified multiple outcropping magnetite bodies coincident with the geophysical and soil anomalies along the structure (see Figure 2 below). There are no historical drill holes at the Twister Prospect.

Click here for the full ASX Release

This article includes content from Centaurus Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CTM:AU

The Conversation (0)

16 December 2021

Centaurus Metals

The World’s Next Green Nickel Project

The World’s Next Green Nickel Project Keep Reading...

1h

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00